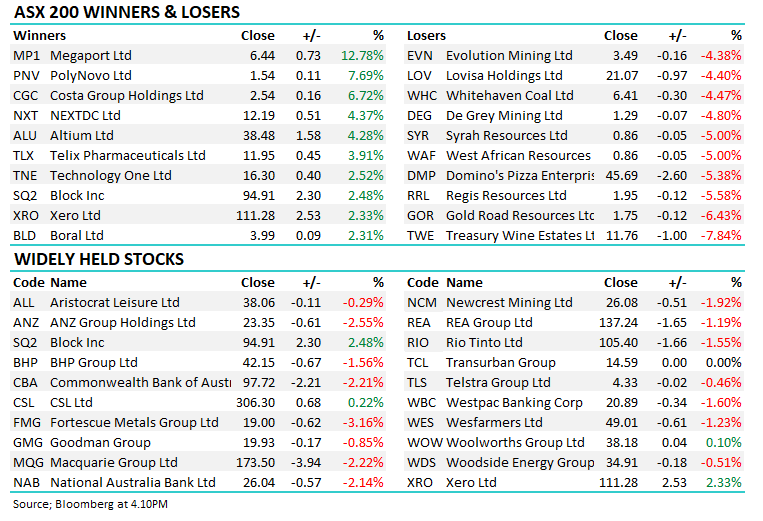

The Match Out: ASX slides on global growth fears, Resources hit but tech rallies

A tough day for stocks with the heavy-weight sectors of Financials & Materials causing most of the pain. Despite the index finishing down ~1%, only 65% of stocks actually closed lower with the technology sector enjoying a phenomenal update from global chipmaker Nvidia (NVDA US) after the US close this morning – a stock we discussed this week here. That pushed Nasdaq Futures up +1.5% underpinning a 2.4% move higher from the Aussie tech sector.

- The ASX 200 finished down -75pts/ -1.05% at 7138

- The IT sector was best on ground (+2.42%) while Healthcare (+0.33%) & Utilities (+0.14%) were also positive.

- Financials (-1.88%) and Materials (-1.76%) the weakest links.

- Iron Ore fell below $US100/t while Copper hit the lowest level in over a year. The concern is that a debt default in the US will crimp economic growth which is hurting commodity prices.

- We think this is a move to fade in the first instance and sharpened our pencil this morning in a note talking about our targets – Read Here

- Treasury Wines (ASX: TWE) -7.84% said strength in their premium brands was not enough to offset deteriorating trends in their entry-level (premium) categories, which have struggled, hitting earnings.

- Costa Group (ASX: CGC) +6.72% held their AGM today and provided a positive trading update, these have been few and far between in recent years.

- Megaport (ASX: MP1) +12.78%, NEXTDC (ASX: NXT) +4.37%, Altium +4.28% and Xero (ASX: XRO) 2.33% all standouts in the tech sector.

- Sandfire (ASX: SFR) -2.31%, Whitehaven Coal (ASX: WHC) -4.47% & BHP Group (ASX: BHP) -1.56% traded down on growth concerns.

- A few of the more defensive names caught our eye today – APA Group (ASX: APA) which we discussed (here) and Metcash (ASX: MTS) both up on the day after having a tough time of late – we like both.

- Retailers have had a very tough week, the worm has turned there, however some of the higher quality names are also getting kicked to the curb. We’ll write a note on the sector at some point soon as we have very limited exposure (for now).

- Gold was down overnight before adding +US$2 today settling at ~US$1960

- Asian stocks were lower, Hong Kong down -2.19% while China was off -0.52%

- US Futures are mixed, Nasdaq +1.61%, S&P Futures +0.64% while Dow Futures are flat.

ASX 200 Chart

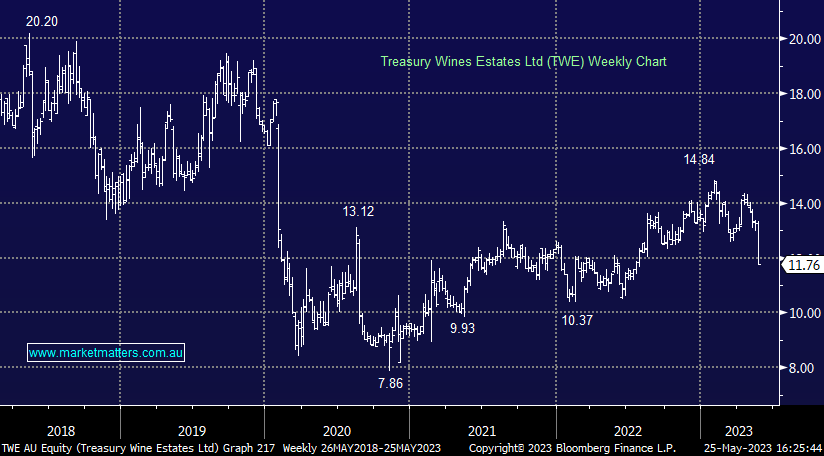

Treasury Wines (ASX: TWE) $11.76

TWE -7.84%: Not a great day for a downgrade with TWE saying that strength in their premium brands was not enough to offset deteriorating trends in their entry-level (premium) categories, which have struggled. They recut FY23 guidance and now expect earnings (EBITS) of $580m-$590m, which represents growth of 11% to 13% on FY22 however it’s around 3% below consensus ($602m). They continue to re-jig their business to focus on the premium segments that achieve better margins while they highlighted continued challenges in the lower margin commercial wines. As a result, they are looking to reduce costs and it seemed like the tone of the upside was a more cautious one.

- A weaker update from TWE downgrading by ~3% , not good but not a disaster.

Costa Group (ASX: CGC) $2.54

CGC +6.72%: Held their AGM today and provided a positive trading update, which have been few and far between in recent years. They talked to improving trends across their business with recent investments into new production capacity, namely in Mushrooms and Tomatoes paying dividends. Their international operations are doing best, with very strong profit results emerging from both China and Morocco. They saw evidence that the increased input cost pressures of 2021-22 are slowly easing while an improvement in labour availability was also a plus. We have held Costa (CGC) in the past and lost money, however, this is a leveraged business, and when times are good, they can generate very strong earnings.

Broker Moves

- Allkem Rated New Buy at Barclay Pearce Capital; PT A$21.37

- Nib Cut to Neutral at Jarden Securities; PT A$8

- Webjet Cut to Neutral at Goldman; PT A$7.90

- Accent Group Cut to Neutral at Citi; PT A$2.14

- Dalrymple Bay Raised to Add at Morgans Financial Limited

Major Movers Today

Have a great night

The Market Matters Team

1 topic

10 stocks mentioned