The Match Out: Market recovers from an early decline, Coal stocks rally, ResMed struggles with the supply chain

There was every opportunity for the market to pullback today, the ASX 200 is up approximately 6% on the most recent drive from the ~7000 handle, US markets were down around 1.3% overnight, Asian markets were mostly lower and while US Futures were up, it wasn’t by a big margin, but still the ASX recovered from the early lows, supported mainly by Energy & Materials to actually finish up on the day – a good effort.

- The ASX 200 finished up +9pts/ +0.13% at 7387

- The Utilities sector was best on ground (+2.56%) while Energy (+1.95%) & Materials (+0.97%) were also strong.

- Financials fell (-0.38%) however it was IT that reacquainted itself with the loser’s corner, down (-0.76%).

- National Bank (NAB) +0.22% has completed its $2.5bn on-market share buyback and announced it will start a further on-market buyback of up to $2.5bn following its 2022 half-year results on 5 May.

- Resmed (RMD) -4.22% was weak today following downbeat comments from the CEO at a conference overnight, supply chain issues starting to hurt. More below.

- Praemium (PPS) -4.17% fell today following an announcement after close yesterday outlining senior management changes, including a new CFO and CCO

- JB Hi-Fi (JBH) +4.34% provided a sales and buy-back update, reporting solid sales growth in the third quarter. Management said it continues to see heightened customer demand and strong sales growth. Cost control and inventory management helping gross margins, particularly in The Good Guys.

- Brickworks (BKW) +4.96%: Released half-year results today, generating $581 million in after-tax profits for six months to the end of January, its largest first-half result on record

- Whitehaven Coal (WHC) +6.51% broke out today and looks very strong, the rest of the Coal sector following suit. Always hard to watch when you’ve sold out of a stock and your thesis continues to play out (without you!)

- AGL Energy (AGL) +2.89% rallied and now looks good technically for another assault on $8 at least, Barrenjoey initiated today with a neutral and $8.10 PT

- Iron Ore was ~2.4% higher in Asia, Coal Futures rallied ~8%

- Gold was down $US4 at ~US$1939

- Asian stocks were mixed today, Hong Kong up +0.40%, Japan slipped -0.3% after a strong session yesterday while China was off -0.75%

- US Futures are all up, Dow +0.27%, Nasdaq +0.67%.

ASX200

Resmed (RMD) $31.98

RMD -4.22%: At a conference overnight, the CEO of RMD Rob Douglas has painted a fairly challenging picture around supply chains, more or less reiterating what F&P Healthcare (FPH) said yesterday. He said rising freight costs and semiconductor chip shortages are curbing its ability to meet surging global demand for its devices. Rob went onto say that RMD was seeing almost "unlimited demand" for its products as a major recall from its competitor Philips continues, but they are having trouble keeping up. "We're pulling out all stops there as to what we can. But unfortunately, there still will be a shortfall of treatment," Mr Douglas said. To put some numbers around this, US based research house KebBanc now think it will be very challenging for RMD to reach the expected $300-350m benefit from the recall. Resmed was down ~8% overnight and opened sharply lower this morning before partially recovering.

Broker Moves

- Seek Cut to Neutral at Macquarie; PT A$32

- Austal Cut to Neutral at Macquarie; PT A$1.91

- Mineral Resources Raised to Overweight at Morgan Stanley

- Northern Star Rated New Hold at Barclay Pearce Capital

- Vita Group Raised to Speculative Buy at Ord Minnett

- Origin Energy Rated New Neutral at Barrenjoey; PT A$7.09

- AGL Energy Rated New Neutral at Barrenjoey; PT A$8.10

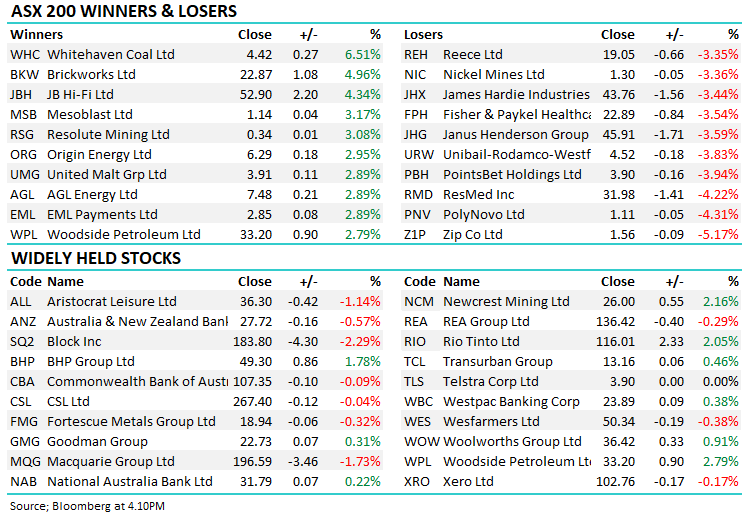

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

12 stocks mentioned