The Match Out: Shares move higher following record CBA result

Shares started slowly today but found their mojo into the afternoon, finishing near highs on the back of strength in the banks. There was little change ahead of inflation data coming out of China mid-morning, but when that passed without concern, the focus returned to CBA’s record result.

- The ASX 200 finished up +26pts/ +0.37% at 7338

- The Financials sector was best on ground (+.21%) while Telcos (+0.94%) & Tech (+0.87%) were also strong.

- Healthcare (-0.89%) continued to lag. Real Estate (-0.72%) and Utilities (-0.27%) were the remaining sectors to close lower.

- China CPI figure came in at -0.3% YoY, broadly in line with expectations. The market is looking for additional stimulus measures now which would support the miners, though timing is more difficult to predict.

- Commonwealth Bank (ASX: CBA) +2.58% delivered a strong FY23 result, a small beat to expectations and a surprise $1b buyback. More on that below.

- Lead Portfolio Manager James Gerrish was on Ausbiz this morning covering the result from CBA - Click here to watch

- Suncorp (ASX: SUN) -1.53% saw a broadly inline headline result with profit of $1.25b, though a strong Aus Insurance performance was offset by weaker bank and NZ result.

- Bowen Coking Coal (ASX: BCB) +10.71% found some form with an improved shipping update + a resource increase.

- InvoCare (ASX: IVC) +5.94% has accepted a revised $12.70/sh bid from TPG Capital, valuing the company at $2.2b.

- Syrah Resources (ASX: SYR) +1.56% signed an agreement with Samsung to provide graphite for their Batteries.

- Iron Ore was flat in Asia today with BHP (ASX: BHP) and Fortescue (ASX: FMG) slightly higher, though RIO fell.

- Gold was trading around $US1930 in Asian trade today, marginally higher on the day.

- Asian stocks were soft, Hong Kong down -0.25% and Japan & China down around -0.50% each

- US Futures are all up, around +0.10%

- July Performance for the Market Matters Portfolios – Click Here to Watch

- We have a close eye on AGL Energy (ASX: AGL) reporting earnings tomorrow as well as AMP, Megaport (ASX: MP1), QBE Insurance (ASX: QBE) and Boral (ASX: BLD) among others. Download the Market Matters Reporting Calendar Here

- Stocks we own in the International Equities Portfolio with results this week: Barrick Gold (NYSE: GOLD), Alibaba (NASDAQ: BABA), The Trade Desk (NYSE: TTD) & Yeti Holdings (NYSE: YETI).

ASX200

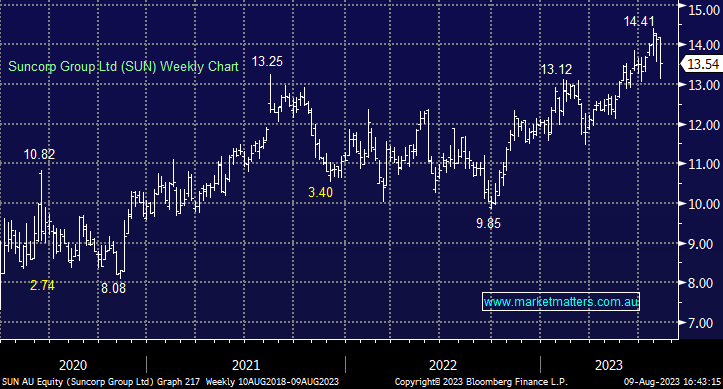

Suncorp (ASX: SUN) $13.54

SUN -1.53%: Fell today despite announcing cash earnings of $1,254m in line with consensus, however, the composition of the result was soft and their guidance was a touch light, particularly within their banking division which had a tougher period, which is likely to continue. The 27c final dividend was also a long way below consensus (40c). Insurance earnings were strong, at $755m and above $687m expected, however, guidance was less upbeat than current market expectations sit. Within the banking division, net interest margins (NIMs) were 1.96% while they’ve guided to the bottom end of the 1.85-1.95% range for FY24 as costs increase.

A mixed result from SUN, okay from insurance, soft from the bank

Suncorp (ASX: SUN)

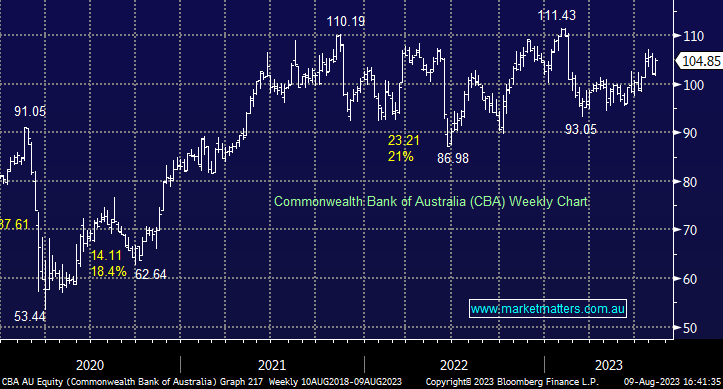

Commonwealth Bank (ASX: CBA) $104.85

Earnings per share (EPS) of $6.015 was pleasing and a slight beat while the FY dividend of $4.50 was ahead of the $4.33 consensus (2H dividend of $2.40), and is based on a 74% payout ratio. Capital levels are strong and above expectations while they did experience a reasonable uplift in provisioning for bad loans. We were not expecting any new buy-backs, however, they did announce an additional $1bn on-market program which reflects their strong capital position.

The commentary was cautious, with CEO Matt Comyn saying….We are seeing consumer demand moderate and economic growth slow and we are closely monitoring the impact of reduced discretionary spending, particularly on our small and medium-sized business customers.

A very good result from CBA.

Commonwealth Bank (ASX: CBA)

Bowen Coking Coal (ASX: BCB) 9.3c

Bowen Coking Coal (ASX: BCB)

Broker moves

- Woodside Energy Cut to Underweight at Jarden Securities

- Lovisa Cut to Neutral at Macquarie; PT A$22

- Charter Hall Long WALE Raised to Neutral at Macquarie; PT A$3.56

- HMC Capital Cut to Hold at Jefferies; PT A$5.20

- Dexus Cut to Hold at Jefferies; PT A$8.78

- James Hardie GDRs Raised to Hold at Jefferies; PT A$43.30

- Woodside Energy Cut to Neutral at Evans & Partners Pty Ltd

- Pilbara Minerals Raised to Add at Morgans Financial Limited

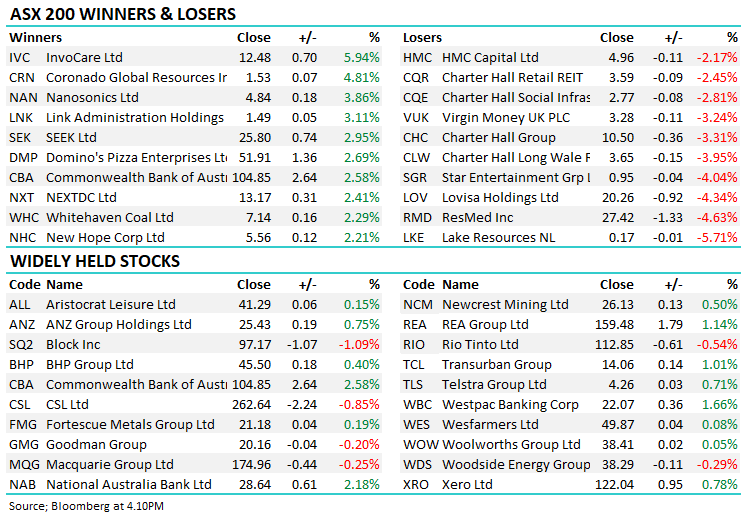

Major movers today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

15 stocks mentioned