The Match Out: Stocks more bullish than an 8-year-old hunting Easter eggs, Newcrest (ASX: NCM) gets bid again

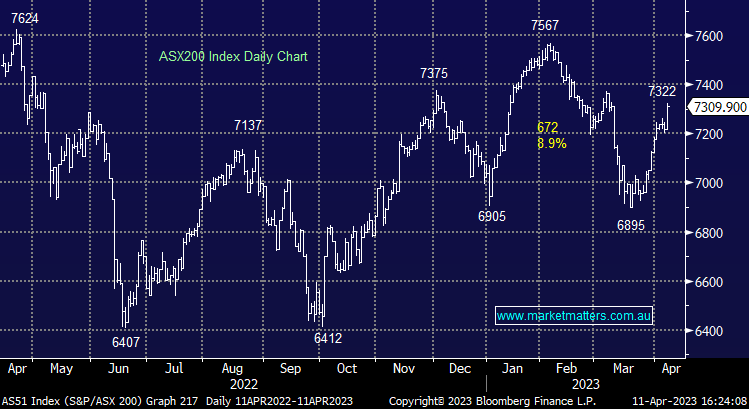

A few scratching their head on the desk around what’s driving the advance, perhaps traders took risk-off ahead of the 4-day break and the rare occurrence of important U.S. economic data being released on a public holiday, or perhaps corporate activity (Newcrest getting bid again) was the catalyst, whatever the case our view has been a more bullish one suggesting that surprises are more likely on the upside – today’s result certainly fit that view nicely!

- The ASX 200 finished up +90pts/ +1.26% at 7309

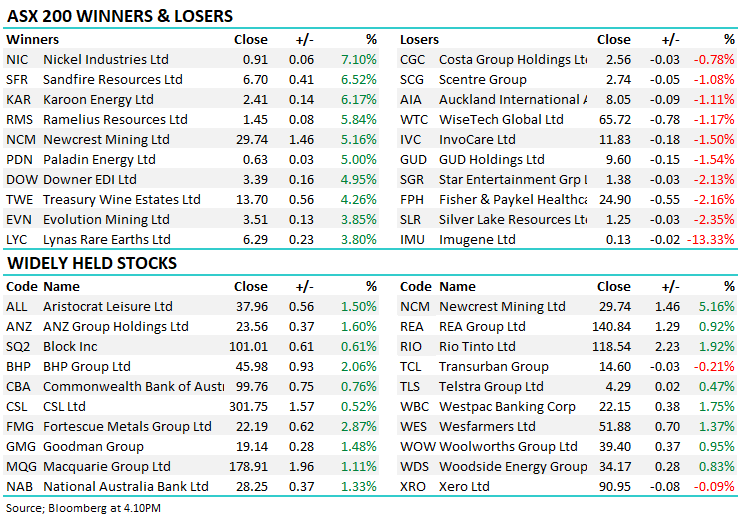

- The Materials sector was best on ground (+2.24%) and the only sector that really outperformed, while Consumer Discretionary (+1.27%) & Staples (+1.19%) were also solid.

- IT (-0.07%) the only sector that fell while Healthcare (+0.42%) & Communications (+0.45%) underperformed a strong market.

- Research Lead Shawn Hickman on Ausbiz today discussing the all-important macro-economic environment - Click here to watch

- Newcrest (ASX: NCM) +5.16% received a 3rd (and apparently final) takeover bid from Newmont worth $32.87 based on the last close for NEM US. We are long Newcrest in the Flagship Growth Portfolio and will discuss how we’ll play this in tomorrow’s Portfolio Positioning Report. Take a free 14-day to Market Matters HERE to see our take.

- Westpac Consumer Confidence surged in April after the RBA left interest rates unchanged for the first time in almost a year.

- We took profits on Transurban (ASX: TCL) -0.21% believing it’s more than fully valued for the risks involved – more on this tomorrow for our Income focussed investors. We allocated funds elsewhere.

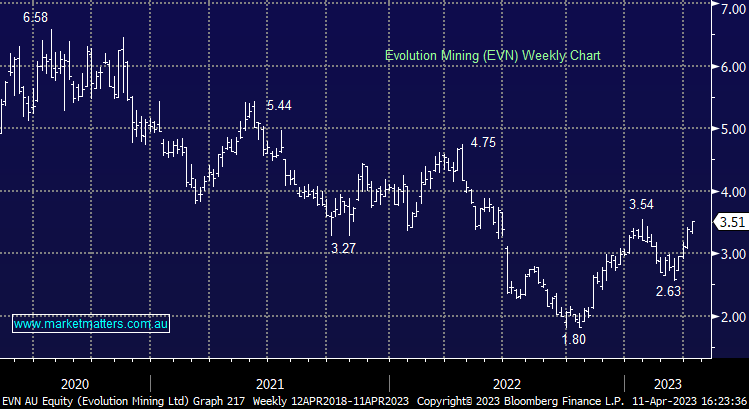

- Evolution (ASX: EVN) +3.85% chose a good day to push through a production downgrade, although it was not a huge surprise – more on that below from Harry.

- AGL Energy (ASX: AGL) +2.64% enjoyed another strong session, the stock up ~25% in 6 weeks showing there is money to be made in beaten-up large caps…

- APA Group (ASX: APA) +0.48% is on our radar below $10 – it dipped below recently, but we’ll be patient.

- Sandfire Resources (ASX: SFR) +6.52% had a day in the sun, a topic of conversation on the desk as we look to optimise our resource holdings, we’re long from sub $4, it closed today at new 52-week highs of $6.70

- Some of the fund managers enjoyed a good session, Perpetual (ASX: PPT) +2.98%, Platinum (ASX: PTM) +3.23%, but Magellan (ASX: MFG) could only muster a gain of +0.88%. PPT remains our preferred pick here.

- China-facing stocks enjoyed a Penny Wong bump today, with the first Chinese official in ages set to visit – Treasury Wines (ASX: TWE) our pick in the China/Oz thaw trade!

- Iron Ore was up a touch in Asia today, Futures at $US119.10 supporting Fortescue (ASX: FMG) +2.87%

- Gold is back around~US$2000 as the $US moved higher overnight – the Gold stocks more interested in the bid for NCM and what it means for relative valuation.

- Asian stocks were okay but not as bullish as our own, Hong Kong up +0.21%, Japan +0.94% while China fell -0.33%

- US Futures are all up, around +0.10%

ASX200

Evolution Mining (ASX: EVN) $3.51

Evolution Mining

Broker moves

- Newcrest Raised to Buy at Citi; PT A$31.22

- Janus Henderson GDRs Raised to Neutral at Citi; PT A$37.80

- Alcidion Group Reinstated Speculative Buy at Bell Potter

Major movers today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

11 stocks mentioned