The Match Out: Surprise rate hike puts the Kibosh on Stocks

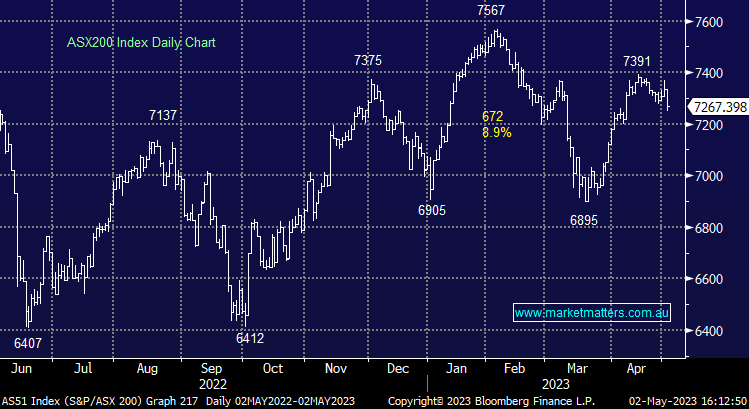

- The ASX 200 finished down -67pts/ -0.92% at 7267, which was -60pts below where it was trading before the rate decision, although it was +24pts above the session lows.

- The IT sector was best on ground (+0.02%) and the only sector to finish higher – go figure – rate-sensitive IT the only one up on the day they raised rates!

- Property (-2.12%) and Communications (-1.82%) the weakest links.

- The RBA surprised us and many others today by raising rates by 0.25% to 3.85% - markets had priced only a ~10% chance of this happening.

- The AUD spiked more than 1% to 67.11c, Aussie 2-year yields put on 0.23% in a heartbeat to settle at 3.28% triggering a short sharp ~70pt drop for the ASX200.

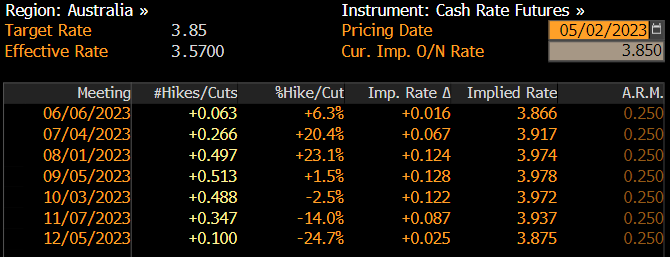

- The RBA stressed the importance of its inflation-fighting priorities, and this leaves the door open for more hikes – Futures now pricing a high chance of a 4% cash rate.

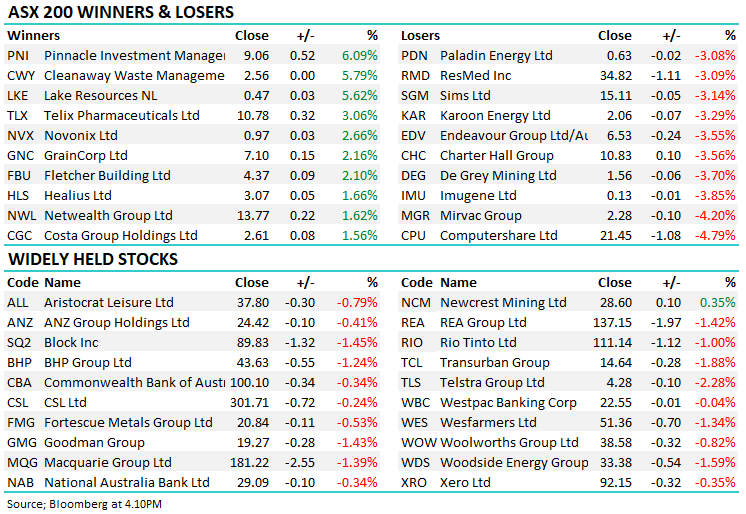

- Cleanaway (ASX: CWY) +5.79% was strong today after reaffirming 2H guidance while presenting at the Macquarie conference – a stock we’re warming to and will cover in more detail tomorrow morning.

- Computershare (ASX: CPU) -4.79% was hit on lower FY24 margin income guidance – the supposed beneficiary of higher cash rates remains elusive.

- Centuria Capital (ASX: CNI) -0.58% said they have reduced gearing from 17.3% as at 31 December to 14.6%, along with refinancing existing debt to reduce their interest burden which was a headwind at their HY result. The RBA hike put a halt to proceedings though, with shares ending marginally lower, having been higher before the RBA’s move

- Woolworths (ASX: WOW) -0.82% released a 3Q update which was broadly in line with food LFL sales up 6.6%. Big W momentum continues hitting $1b in sales in the quarter, while they said inflation continues to moderate and 4Q has started largely in line with the 3rd.

- Qantas (ASX: QAN) -2.97% will have a new CEO in 6 months after Alan Joyce announced he was stepping down, with current CFO Vanessa Hudson getting the gig ahead of Olivia Wirth (Head of Loyalty), having been with the flying Kangaroo for 28 years. They’ve gone for safety & continuity here.

- Telstra (ASX: TLS) -2.28%, Aussie Broadband (ASX: ABB) & TPG Telecom (ASX: TPG) -2% took a hit today after the ACCC rejected a new NBN wholesale pricing plan which would’ve reduced the cost burden on internet service providers

- Iron Ore was closed, Fortescue (ASX: FMG) -0.53% & RIO (ASX: RIO) -1% - the bearish Iron Ore calls are starting to do the rounds again. Iron Ore Futures are at $US103.61.

- Gold was up a touch at ~US$1984.

- Asian stocks were mixed Hong Kong up +0.25%, Japan was flat while China was closed

- US Futures are largely flat.

ASX200

Surprise RBA Move

The RBA surprised us and many others in the market today by raising rates by 0.25% to 3.85%. We’d held the out-of-consensus view that 3.60% would be the peak of official cash rates and in the last week or so (post CPI data), that view became consensus with markets pricing a 90% probability of no action, while only 9 out of 30 economists surveyed by Bloomberg predicted a hike. It’s a big call by the RBA and we fail to see the rationale for pausing for a month (following 10 consecutive hikes) to see how data evolved given the lag effect, only to jump again 4-weeks later saying that inflation was their primary battle (when inflation data had moved in their favour), plus there are potentially more hikes on the way.

Markets are now pricing a high chance we’ll see a cash rate of 4%.

Cash Rate Futures – Source Bloomberg

Aussie Broadband (ASX: ABB) $3.20

ABB -3.90%: the telco market took a hit today after the ACCC rejected a new NBN wholesale pricing plan which would’ve reduced the cost burden on internet service providers. The sticking point related to the reduction in charges for high-speed 50mbps plans where the Government has legislated cost recovery requirements that the NBN’s plans would’ve challenged. Overall though, there is a trend to improve the pricing of the NBN, and there was no challenge to the ultra-high speed tiers where ABB has a significant skew of customers relative to their overall market share. While this further delays a potential margin improvement for Aussie Broadband, we now suspect the NBN will focus on pushing through reduced costs for ultra-fast speed access, or a push from legislators to amend the cost recovery requirements on the back of industry pressure.

Aussie Broadband (ASX: ABB)

Broker Moves

- GUD Holdings Raised to Buy at UBS; PT A$10.50

- Pinnacle Investment Raised to Neutral at UBS; PT A$8.80

- Platinum Asset Raised to Reduce at CLSA; PT A$1.80

- Megaport Raised to Buy at Canaccord; PT A$7.10

- Little Green Pharma Raised to Speculative Buy at Canaccord

- Qube Raised to Outperform at Credit Suisse; PT A$3.40

- Flight Centre Raised to Overweight at JPMorgan; PT A$22.60

- GrainCorp Raised to Buy at Bell Potter; PT A$8

Major Movers Today

Have a good night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

10 stocks mentioned