The pendulum of opportunity: 4 small caps poised to deliver in 2024 and beyond

As a kid in the 1980s, I would memorise the statistics for the Australian test cricket team. While this might be akin to watching paint dry for most, I found reviewing the numbers for the likes of David Boon, Allan Border and Dean Jones both fun and insightful. The 8 year old kid in me didn’t see it at the time but it also helped shape my expectations for each player, the probability of each player contributing to the outcome. And from my armchair, whether or not they deserved to be in the team, based purely on the numbers.

While the cricket stats of my childhood heroes are now a distant memory, fast forward to today and the detailed review of the numbers is critical to all that we do with our investing. Curiously, however, it’s not the only thing that matters. In many respects, successful investing requires participants to determine the probabilities of certain events occurring, while also considering to what degree these factors are ‘in the price’ of the stock being analysed.

A high quality company with a durable economic moat, strong balance sheet and aligned management team has a higher probability of sustainable success when compared to another company with none of these characteristics. But then again, chances are that the qualities of the former company are well reflected in the price of the stock. Thankfully, this isn’t always the case and from time to time, attractive windows of opportunity open up.

But why is this so? Investing legend Howard Marks goes a long way to answering this question, in his excellent book ‘Mastering the market cycle: Getting the odds on your side’. Marks dedicates a whole chapter to the impact of investor psychology on investment markets, suitably titled ‘The pendulum of investor psychology’. The following excerpt perhaps best details why understanding this concept is so important:

The mood swings of the securities markets resemble the movement of a pendulum. Although the midpoint of its arc best describes the location of the pendulum ‘on average’, it actually spends very little of its time there. Instead, it is almost always swinging toward or away from the extremes of its arc.

But whenever the pendulum is near either extreme, it is inevitable that it will move back toward the midpoint sooner or later. In fact, it is the movement toward an extreme itself that supplies the energy for the swing back. This oscillation is one of the most dependable features of the investment world, and investor psychology seems to spend much more time at the extremes than it does at a happy medium.

Marks’ metaphorical pendulum has been on full display since the turn of the century, especially for ASX listed stocks. Wild swings have punctuated the dot com bubble, Global Financial Crisis (GFC) and the Covid pandemic.

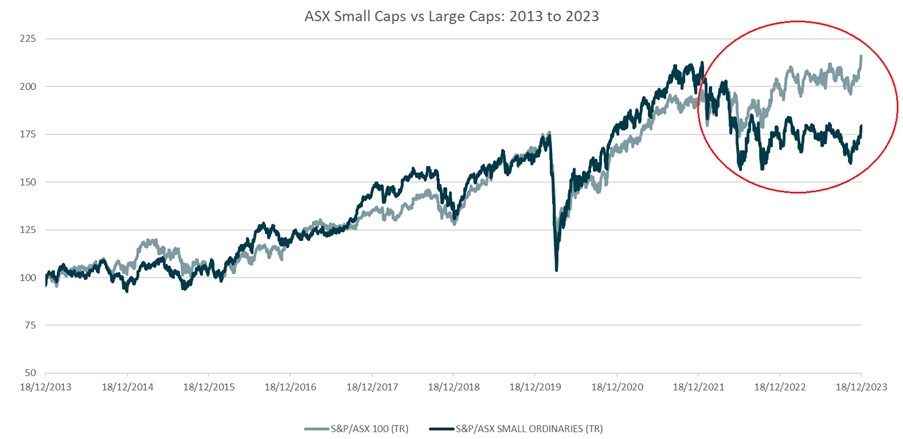

For many years, the pendulum for both large and small caps swung largely in tandem (illustrated below from 2013 to 2021). That is, until the end of 2021. The underperformance of small caps since then has been stunning, and rarely has the disparity between small and large cap performance been greater. But is the tide starting to turn?

Surging inflation pushed Central Banks to take decisive action, who have collectively enacted one of the swiftest rate hike cycles in modern history. The 40 year bond rally that kicked off in 1980 therefore came to an abrupt end in 2020, with the resetting of risk free rates becoming the most dominant macroeconomic trend in recent times. In turn, the relative safety and liquidity of Australia’s largest 100 companies provided appeal for investors seeking refuge during the storm of inflation and aggressive rate hikes.

The above sets the scene for pockets of the ASX market right now. In contrast to the dominant 2023 performance of the ‘Magnificent 7’ US mega-cap cohort, small caps have been left in the dust.

With only a few exceptions, small cap stocks have been hit relatively hard, receding from the nosebleed heights induced by the near zero interest rates of 2020. But when it comes to quality and growth prospects, not all have been created equal. Some emerging gems have been tossed out alongside the overpriced speculators, and despite the snap back since 30 October 2023, we still see clear value on offer in a range of ASX small caps.

With the end of 2023 now just days away, we start turning our attention to what 2024 may have in store for investors. Rather than prognosticate on the macro possibilities, as fundamental investors seeking to own a part share of established emerging leaders, in today’s note we focus on some stock specific opportunities.

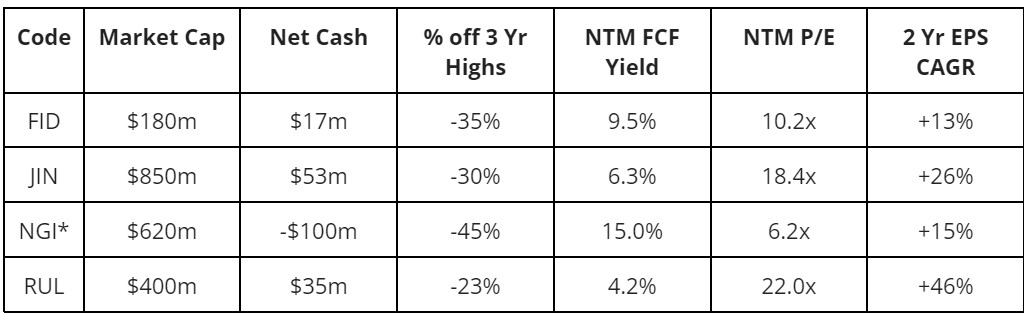

All stocks listed below are trading well off multi-year highs at sound free cash flow yields and discounts to fair values. All are founder-led or owner managed, have strong balance sheets, are cash generative and offer attractive growth profiles in their respective niches. And while the near term environment may remain volatile, we view the opportunity for solid long term gains from these entry points as constructive. Finally, the pendulum may just be starting to swing back our way.

Fiducian Group (ASX: FID)

We first introduced FID to Livewire readers in a previous article ‘The small cap stairway to Heaven’. For the uninitiated, FID is an integrated financial services provider with three key operating divisions; Financial Planning, Platform Administration and Funds Management. It was founded in 1996 by Indy Singh, who remains today as a substantial shareholder and Executive Chairman.

To the more casual observer, FID is most commonly and broadly categorised as a financial planning group. However, we see this as an oversimplification that sells the investment proposition short.

As we have previously detailed, Fiducian’s financial planning business unit acts as an enabler of flows to its high margin Platform Administration and multi-manager Funds Management divisions. It’s a powerful model that combines a strongly performing, diversified funds management group with a high margin platform business, all within the one operating structure. The efficient operating model has delivered positive long term outcomes for Fiducian’s clients, its advisers and shareholders for many years.

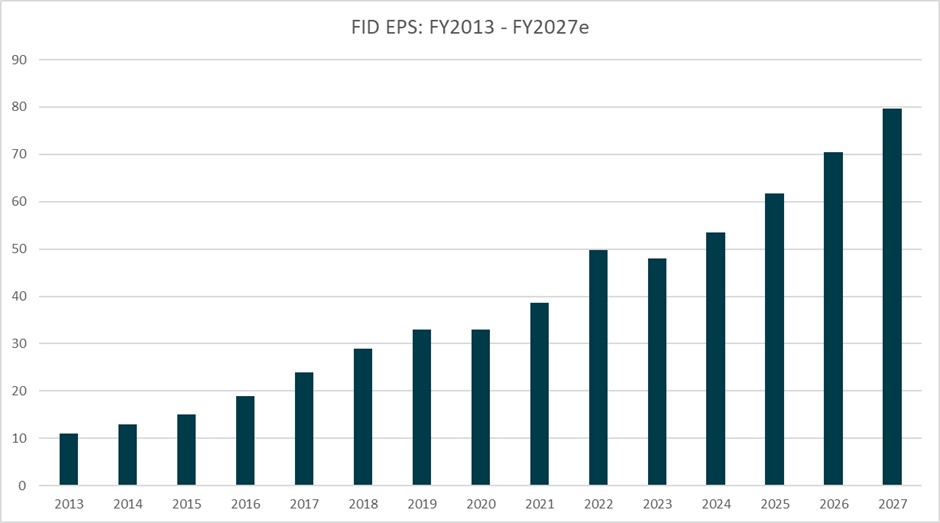

As illustrated in the below chart, leverage to markets adversely impacted FY2023 results, especially when coupled with the inflationary environment evident during the year (wage cost inflation). But therein lies some of the opportunity. A rebounding market in the year/s to come will likely provide ample opportunity for growth across the FID ecosystem of businesses. None of this is in today’s price, with FID trading a substantial discount to our assessment of fair value.

So while forecasting too far out into the future is fraught with danger, we see enough cause for optimism with this quiet achiever at current prices. FID management would appear to concur, with over a dozen on market Director buys announced over the past 12 months. In the meantime, we all get paid reasonably well to wait, with a forecast dividend yield of 6.4% (fully franked) currently on offer.

Jumbo Interactive (ASX: JIN)

Initially founded as Squirrel Software Technologies in 1995, Jumbo listed on the ASX in 1999 as an e-commerce business before pivoting to online lotteries shortly thereafter. Today, JIN is a leading digital lottery specialist, providing best in class lottery software platform and lottery management expertise to the charity and government lottery sectors in Australia, Canada and the UK.

Reviewing the story of JIN from its inception makes for interesting reading. From our meetings with Founder and CEO Mike Veverka over the years, one of the insights that stands out is why he chose online lotteries. After trial and error in the broader e-commerce sector, he landed on the niche of online lotteries, for a few reasons.

There was little competition in the space, but importantly it doesn’t require inventory, and it has weekly draws providing a regular source of repeat business. So it results in highly consistent and profitable revenue and avoids many of the pitfalls of traditional e-commerce. But over time, it also became apparent that building customer databases to scale, inclusive of identification and payment details, was a significant challenge. This now presents as a near-impossible barrier for new entrants.

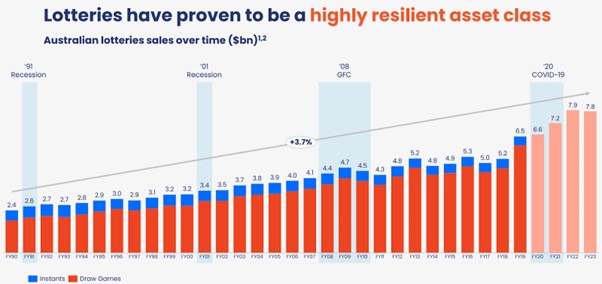

Two further factors have acted to provide significant tailwinds for JIN over the years. Firstly, as illustrated below, lotteries have proven to be a highly resilient asset class. Total market growth has been metronomic for decades, providing greater year-on-year breadth in addressable opportunity. Secondly, and a more recent phenomenon, has been the transition from physical to online ticket sales. Since 2017, online’s share of Australian lottery sales almost tripled from 15% to 40%. Only two players, JIN (via ozlotteries.com) and The Lottery Corp (TLC, via the Lott), have benefitted from this structural trend, though JIN more so as the online pure play.

Looking ahead, specifically to FY2025 and beyond, we forecast improving operating leverage as further increases in online penetration, lottery ticket price rises and flat TLC fees all combine to generate strong growth in Australian earnings.

Equally as promising is JIN’s sharpened global expansion strategy, this time as a software vendor rather than a retailer in offshore markets. Having honed their expertise in digital lotteries, JIN sees opportunities for outsourcing its best-in-class lottery management software to charities and governments around the world, starting with charities in Australia, the UK and Canada. Based on recent data, JIN’s software platform significantly improves the growth and profitability of charity operators, providing an exciting new runway for JIN in what is a multi-billion dollar market.

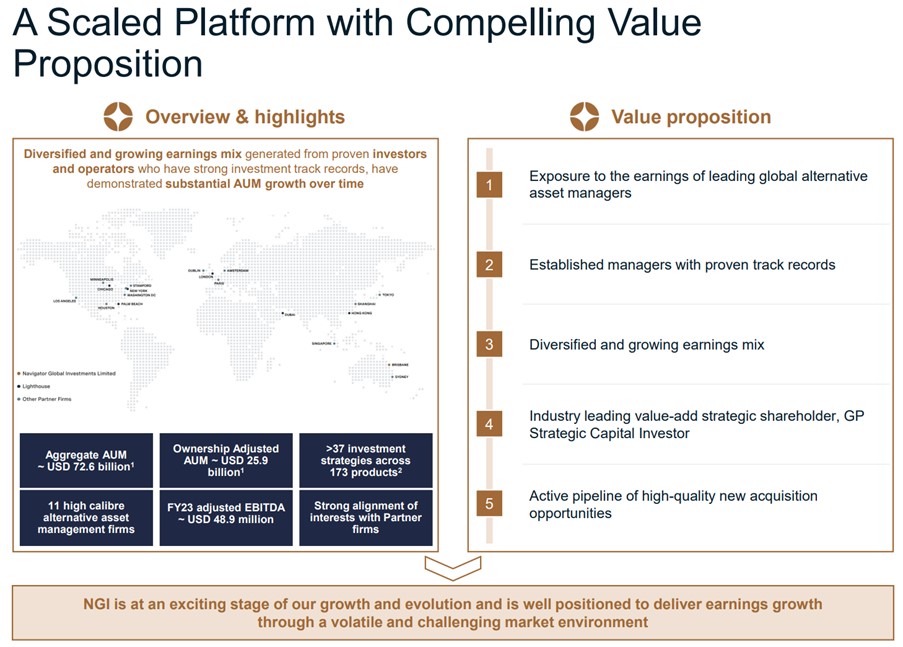

Navigator Global Investments (ASX: NGI)

The historic core of the NGI business, US-based Lighthouse Investment Partners, was established in 1999 and has provided hedge fund solutions ever since. Lighthouse was acquired by ASX-listed HFA Holdings (later rebadged to Navigator) via a mix of cash and scrip back in 2008, and after a long period of post-GFC balance sheet repair, has been the driver of steady progress since then.

The most significant step in diversifying the business came in February 2021, when NGI completed the acquisition of a strategic portfolio of assets from Dyal Capital (since renamed GP Strategic). The initial portfolio comprised passive minority stakes in six boutique alternative asset managers, and formed the basis of what is now the NGI Strategic Division.

NGI’s Strategic Division has since grown to encompass 10 affiliate firms and US$55.3bn of assets under management (NGI ownership adjusted of US$9.8bn). Inclusive of Lighthouse and other ownership stakes, Group AUM has thus swelled to US$25.9bn as at 30 September 2023, spread across 37 alternative investment strategies and 173 products.

Given the above, the NGI of today is vastly different to the NGI of a few years ago. The group is on a reinvigorated growth trajectory, has a highly diversified earnings stream without any key person risk, and yet ostensibly remains completely off the radar.

The catalyst for change may well be on the doorstep. Once perceived as an overhang on the stock, NGI management sensibly negotiated the expedited settlement of the outstanding redemption payment owing to GP Strategic. With shareholder approval now in the bag and completion of the transaction imminent, 2024 is shaping up as an exciting year for the company.

The transaction has several benefits, including the simplification of NGI’s balance sheet and group structure, and means NGI will now receive 100% of the distributions coming from the strategic portfolio (previously shared with GP Strategic). For context, the initial six boutiques acquired have alone delivered average annual distributions of US$54m over the past three years, meaning group earnings have the potential to approximately double post deal completion.

Finalising this transaction required a large equity raise from NGI, though the deal was structured to reward existing shareholders. Under the deal terms, GP Strategic will shortly receive total consideration of US$200m, funded via a $120m placement to GP at $1.40 per share, and an $80m entitlement offer to all NGI shareholders at $1.00 per share.

While the above may sound a little convoluted, when completed in the next fortnight, NGI will emerge from the transaction a larger, more diversified business with a stronger balance sheet and an attractive growth profile. On Elvest’s numbers, NGI offers a free cash flow yield of 15%+, which compares favourably to a multi-boutique peer set trading on two or three times its multiple.

All of this is occurring at a time when the spectre of corporate activity across the financial services sector is gaining pace. NGI may prove tempting for one or more of these types of multi-affiliate investment houses, particularly any group seeking a strong North American asset base.

RPMGlobal (ASX: RUL)

With origins dating back to 1968, RUL is a company with a long and storied history. That said, much of its history - through to about 2012 - was focused on advisory and consulting. Over the past decade especially, the company has transformed to now be a leading provider of software solutions to the global mining industry.

This transition largely coincided with the arrival of CEO Richard Mathews, who acquired a ~4% stake and went about developing and bolting on a raft of industry leading solutions. Ten years on and RUL is riding an accelerating wave of software adoption across the mining industry, which has traditionally lagged other sectors.

Looking ahead, RUL’s key growth engine is its software division specialising in mining operations and equipment maintenance, while its Advisory division continues to provide project assessment and due diligence for resource companies globally.

As verified to us by third party mining software consultants, one of RUL’s key advantages is its breadth of offering, which enables the business to pursue a ‘land and expand’ strategy to good effect. The jewel in the crown, however, is the AMT mobile equipment maintenance software suite. Heavy machinery is the largest cost item for miners and AMT is essential for budgeting and maintenance. Most of the world’s yellow kit Original Equipment Manufacturers (OEMs) have adopted AMT, cementing RUL as the leader in this vertical.

Flat earnings from FY17 to FY22 masked significant progress within the software division, reflecting a transition from upfront licence sales to software subscriptions, which meant contracted software revenues were spread over several years rather than received upfront. With this transition recently completed, earnings strongly inflected in FY23, and we expect the trajectory to continue in earnest for the foreseeable future.

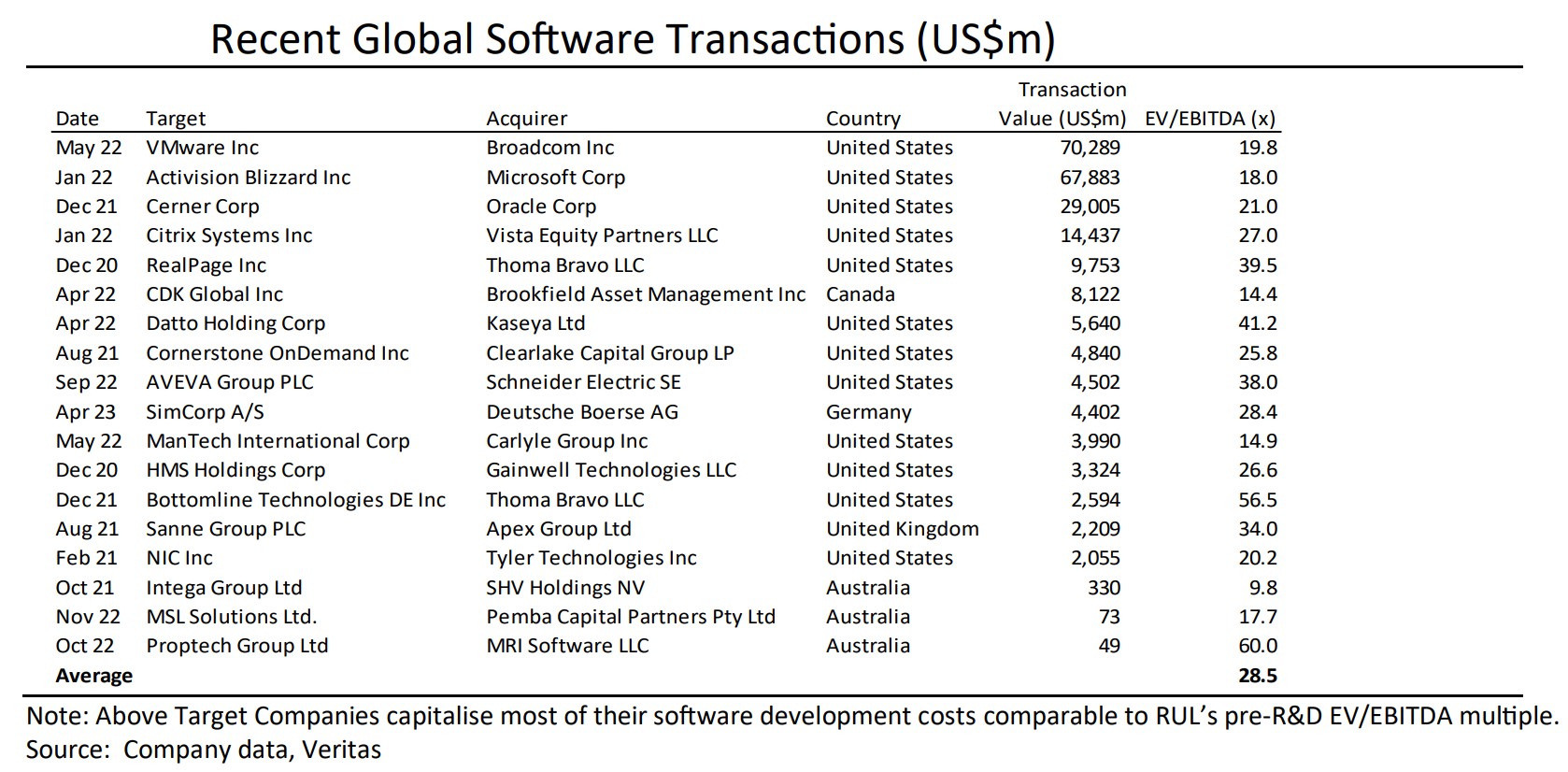

Cash conversion from earnings before interest, tax, depreciation and amortisation (EBITDA) is also very strong because RUL expenses all of its software development. In fact, as Veritas securities notes, ‘RUL is one of the few listed software companies to expense all of its R&D. If all such costs were capitalised (to be consistent with most peers) it would trade on a pre-R&D EV/EBITDA forecast multiple of 8.3x in FY24. Assessing recent large global and Australian software transactions indicates an average transaction EV/EBITDA of 28.5x.’

Recent announcements suggest the company is on track for another positive financial year. FY24 EBITDA guidance provided in August was incrementally upgraded in October, and then again in November, to now sit at $21.5m to $23.5m (vs FY23 underlying EBITDA of $15.0m). On our numbers, shares trade on a FY25 free cash flow yield of close to 6%, which represents tremendous value for a company growing so swiftly.

As we close out what was another eventful calendar year, we'd like to take the opportunity to wish everyone a safe and happy festive season. May markets be kind to you in 2024!

---

Adrian Ezquerro and Jonathan Wilson are Principals of Elvest Co Pty Limited (ABN 65 657 018 614, AFSL No. 547 262) and Portfolio Managers of The Elvest Fund.

Disclosure: Adrian is exclusively invested in The Elvest Fund. Elvest holds shares in FID, JIN, NGI and RUL.

5 topics

4 stocks mentioned