The recession we have to have... again

We’re in the midst of a war – and not the type that normally springs to mind. A war played out in terms of growing costs of living, an energy crisis and a range of geopolitical risks. The missiles of choice? Interest rate hikes. It’s the war against inflation.

While the war itself is largely being waged by central banks, the very nature of their arsenal means that civilians and investments are feeling the pinch. There has been 6,700 rate hikes this year – more likely in the next few weeks, let alone the next year.

This theme is key to Deutsche Bank’s outlook for 2023 – and it’s not looking pretty.

“2023 will be the third-worst year for global growth so far in the 21st century, behind only the pandemic year in 2020 and the aftermath of the financial crisis in 2009,” says David Folkerts-Landau, Group Chief Economist Global Head of Research for Deutsche Bank.

All signs are pointing to a recession – is this the new "recession we had to have"? It’s certainly one way of looking at it.

.png)

All roads lead to a recession

Deutsche Bank were one of the first banks to tip a 2023 US recession earlier in April this year – their stance hasn’t changed.

They anticipate this hitting around mid-next year, while there are some suggestions Europe has already entered one.

It comes back to the story of inflation.

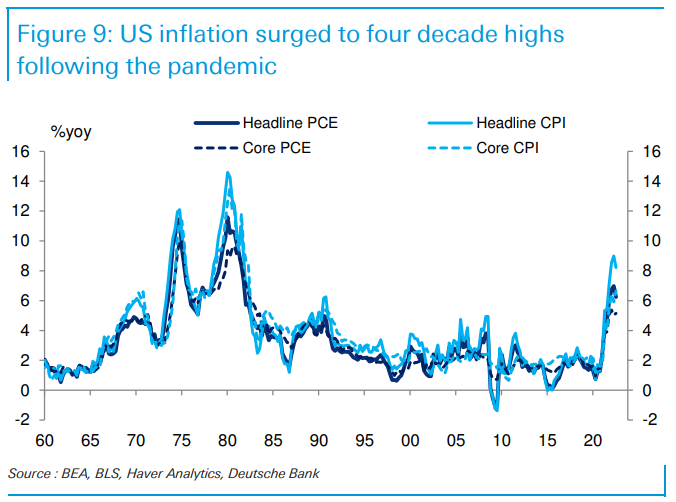

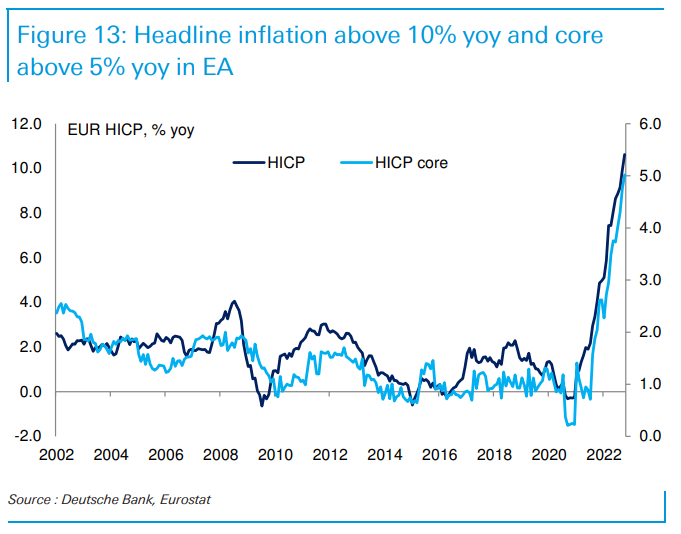

Inflation in the US moved to four-decade highs, while the eurozone sits even higher. Labour markets are tight courtesy of the pandemic. Demand is high. Through in a few geopolitical risks, such as the Russian invasion of Ukraine and you have the recipe for persistent high inflation. Central banks have no choice but to act. And act they have.

Deutche Bank believe that there are some indications the US inflation may be starting to peak, while Europe isn’t far off but central banks won’t slow on hikes until they see a stable movement down in inflation.

The alliance of interest rates and recession

The pattern of rate hikes and their historic impact says a lot about what is coming.

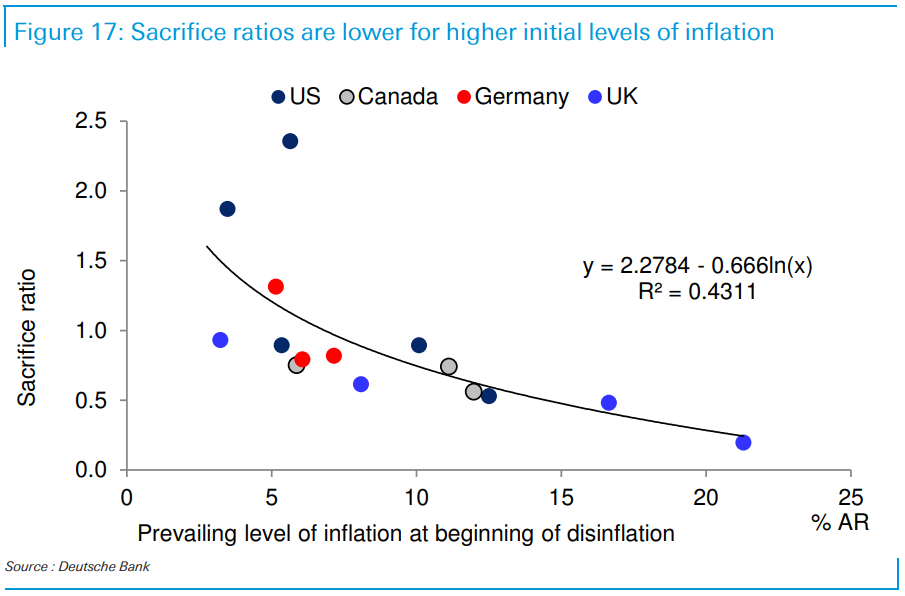

“Successful disinflation does not occur on the cheap. It generally comes at a substantial cost in terms of jobs lost and output foregone,” says Folkerts-Landau.

It is also typically more costly, the closer you get to target inflation and the tighter the labour market was to begin with.

You can see this in the below chart showing sacrifice ratios. These ratios represent the ratio between the cumulative rise in inflation to the decline in trend inflation recorded in a deflation episode.

How bad will it get?

If there’s good news to be had about a recession, it’s that Deutche Bank tip the US recession to be mild and last into 2024.

The Eurozone may already be entering a recession at the moment, with Deutche Bank suggesting the risk for this zone would be to start to emerge from recession in 2023, only to be hit with the impact of the US recession and face a double-dip recession.

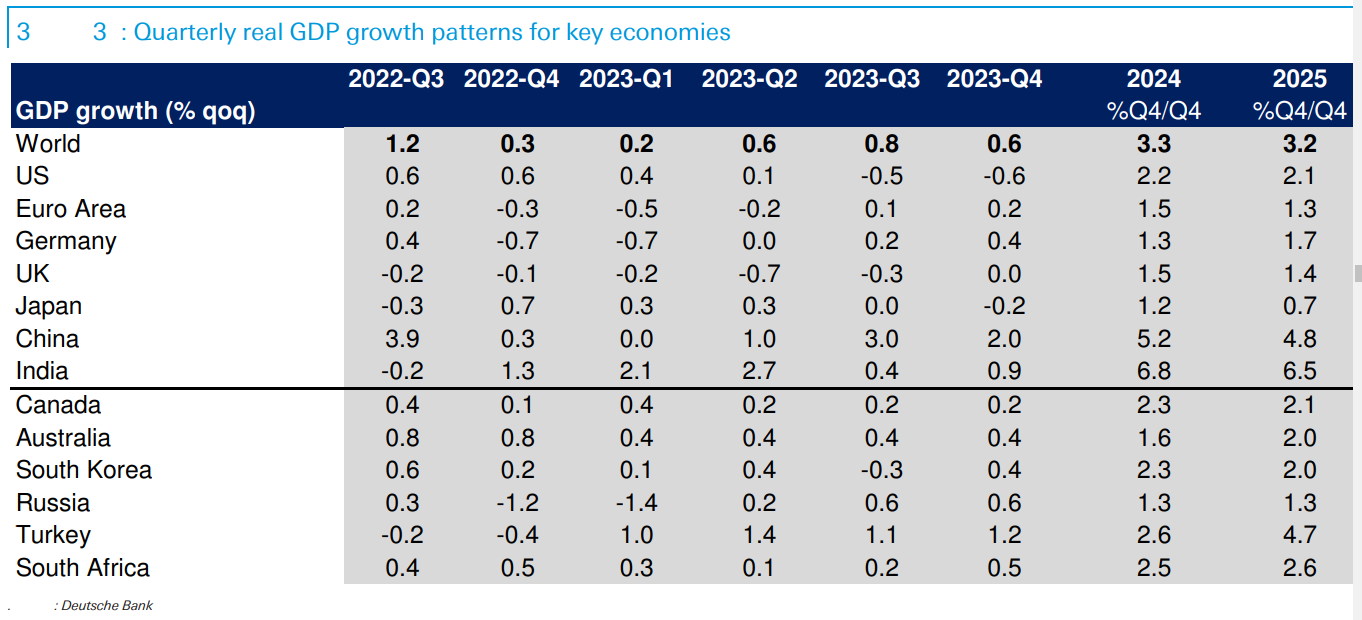

You can see Deutche Bank’s growth forecasts in the table below.

Looking at the chart, you might assume Australia will miss a recession, but Deutsche Bank believe the technical definitions of recession are not helpful to the Australian situation. They argue that employment figures are a better indication of welfare, and we will enter a recession next year based on a 1% rise in the unemployment rate. Their forecast is for 4.5% unemployment in Australia by the end of 2023.

GDP growth in Australia is set to be supported by a strong outlook for business investment, ongoing demand for commodities exports (gas and coal) and predictions that consumer spending won’t see heavy dips.

Beyond the recession we have to have?

While 2024 is expected to be a more promising year across the globe, Deutsche Bank are not expecting any strong gains in recovery.

“The pace of recovery in 2024 and beyond is likely to be moderate, not a strong bounce as has been seen in the past. Factors that are likely to weigh on global growth for some time to come include uncertainties relating to both the Russia-Ukraine conflict and the growing US-China strategic competition,” says Folkerts-Landau.

Either way, it’s worth noting that these forecasts reinforce that a recession is not permanent – though we might feel some pain in 2023 – and this is all part of economic and investment cycles.

Thinking of how to position for recessionary times? These recent articles might trigger some ideas.

.png)

.png)

.jpg)

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics