The top performing ASX large-caps of FY23 (and 3 stock ideas for FY24)

The following article draws on the performance figures of ASX 200 companies as collated by Market Index, digging into those that ranked in the top five over the 2022-2023 financial year. And to get a sense of the useful insights these results might infer for FY2024, I also spoke with Henry Jennings , senior market analyst and media commentator at Marcus Today.

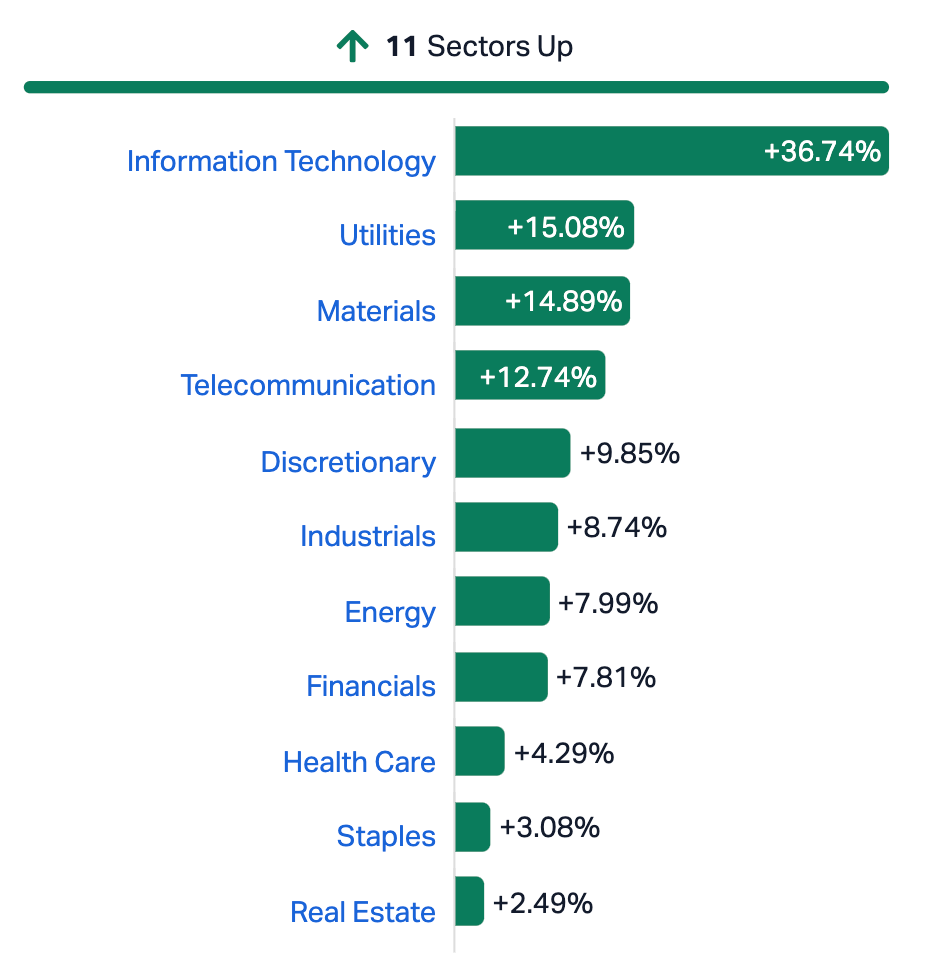

Starting at a higher level, these are how the various sectors fared in the 12 months up to 30 June 2023.

The table below shows the 10 ASX large-caps that delivered the highest returns in FY2023.

| Code | Company | Price | Market cap | 1-year return |

| ASX: NEU |

Neuren Pharmaceuticals Ltd

|

$12.25 | $1.6B | 222.37% |

| ASX: LTR |

Liontown Resources Ltd

|

$2.83 | $6.2B | 168.25% |

| ASX: TLX |

TELIX Pharmaceuticals Ltd

|

$11.22 | $3.6B | 147.68% |

| ASX: PLS |

Pilbara Minerals Ltd

|

$4.89 | $15B | 113.54% |

| ASX: WTC |

Wisetech Global Ltd

|

$79.81 | $26B | 110.86% |

| ASX: NST |

Northern Star Resources Ltd

|

$12.08 | $14B | 76.61% |

| ASX: DEG |

De Grey Mining Ltd

|

$1.35 | $2.1B | 67.08% |

| ASX: AUB |

AUB Group Ltd

|

$29.40 | $3.2B | 66.29% |

| ASX: CHN |

Chalice Mining Ltd

|

$6.26 | $2.4B | 65.61% |

| ASX: BLD |

Boral Ltd

|

$4.03 | $4.4B | 55.60% |

| ASX: AKE |

Allkem Ltd

|

$16.02 | $10B | 55.38% |

Top performing ASX 200 stocks of FY2023

Neuren Pharmaceutical (ASX: NEU)

Sector: Healthcare

Market cap: $1.6 billion

The drugmaker received US FDA approval for one of its treatments, DAYBUE, a couple of months ago – the drug is used to treat the rare neurological disorder Rett syndrome. Around the same time, the firm entered the ASX 200 index.

A non-executive director of the company, Trevor D. Scott, sold more than $15 million dollars worth of the biotech’s stock on 14 June.

Neuren was called out as “overhyped” by Yarra Capital’s Katie Hudson in a recent episode of Livewire’s Buy Hold Sell.

The firm is rated a BUY, according to Market Index’s Broker Consensus widget, where it is rated with 6 Buys, 2 Holds and 1 Sell, as of 1 June 2023.

Liontown Resources (ASX: LTR)

Sector: Basic Materials

Market cap: $6.2 billion

The lithium miner, which also produces nickel, copper and other metals used primarily in EV batteries, has been hot property in 2023. Liontown fielded no fewer than three takeover offers from Albemarle during the year, which was among topics addressed in my colleague Kerry Sun's recent interview with WILSONS analyst Sam Catalano.

Earlier this month, Liontown’s share price hit a 52-week high when it briefly traded at $3.15 on 16 June, as pointed out by David Thornton on Market Index.

TELIX Pharmaceuticals (ASX: TLX)

Sector: Healthcare

Market cap: $3.6 billion

Telix is a global biopharmaceutical company that develops diagnostic and therapeutic products for the use of targeted radiation to treat prostate, kidney, brain and other diseases.

Back in May, it featured in an episode of Livewire’s Buy Hold Sell, where Sage Capital’s Sean Fenton named the company as his “highest conviction call”.

“They've moved into a position of positive cash flow generation and there's a big pipeline to come,” Fenton said.

“So, we see that continuing to drive growth. And, at the end of the day, it's quite an attractive takeover target for big pharma globally.”

Telix is flagged as a STRONG BUY by Market Index’s Broker Consensus, where it receives 10 Buys, 1 Hold and 1 Sell.

Pilbara Minerals (ASX: PLS)

Sector: Basic Materials

Market cap: $15 billion

Another lithium producer, Pilbara has also attracted plenty of attention this year. Market Matters’ James Gerrish says he likes the lithium story but is also more cautious than some because of an outlook of “ample supply down the track.”

“We are holders of Pilbara Minerals but are not planning to increase this exposure,” he writes, noting that he would consider taking profits on the stock if the price heads beyond $5 a share.

WILSONS’ Sam Catalano recently told Kerry Sun that domestic names including PLS are “fully priced” at current levels.

Market Index’s Broker Consensus rates the stock as a BUY at current levels, with 13 Buy ratings, 4 Holds and 3 Sells.

WiseTech Global (ASX: WTC)

Sector: Information Technology

Market cap: $26 billion

The only technology firm among the top five performing stocks in FY2022-2023, WiseTech is the local sector’s biggest.

Shares in the company were trading at record highs of more than $79 as of Friday's market close and the price has gained 32% in the last six months.

Sage Capital’s Sean Fenton named the company as his “bottom drawer stock” in a recent Buy Hold Sell episode.

“They've been gradually taking share, acquiring companies, pushing in there with those big contracts to the point where you can't really do business without them, and that gives them enormous pricing power,” he said.

It was also named alongside one of several companies that provide exposure to the cybersecurity mega-trend called out last month by Livewire’s Sara Allen.

.png)

Market Index's Broker Consensus rates the stock a BUY, with 11 Buys, 7 Hold and 1 Sell.

A view from the sell-side

Of the five stocks mentioned above, Marcus Today’s Henry Jennings notes he’s largely unsurprised – especially given three of them are companies his team has been recommending – but describes Neuren as “an absolute stonking winner.”

“The CEO previously told the market that on 12 March it would get the decision on the new drug for Rett syndrome…and that day came, they got the approvals, the milestone payments were triggered, and the stock price went from languishing around the eights and pushed through to $12 and $13 and hasn’t looked back,” says Jennings.

He says the presence of WiseTech Global in the list is somewhat surprising, given how much we’ve all heard by now about the global growth slowdown and the software company’s heavy exposure to international logistics supply chains.

“I think part of that performance is that they’re emerging as the premier player in that space but also the buzz around AI and technology in the US. And we just don’t have that many tech companies here, so the market tends to gravitate to the successful ones we do have – and that’s WTC and Xero (ASX: XRO),” Jennings says.

What’s ahead in FY2023-24?

Jennings thinks it will continue to be a stock pickers' market and also expects we will continue to see conflicting signals.

“Many analysts suggest a big recession is coming and that equities are completely mis-priced – and earnings season is going to show that. But we do tend to muddle through, and I expect that will continue,” Jennings says.

“I think we’re going to have probably six months where we continue to push sideways…until we get a slightly clearer picture. But I don’t think we’re going to have that precipitous fall some are expecting.”

And ahead of the FY2023 reporting season, he expects caution will prevail in the messaging from management teams until then but doesn’t anticipate a massive drop-off in earnings.

“Many businesses have used inflation as a cover to push prices up and when customers don’t squeal too much and there are no alternatives, the prices have stayed there,” Jennings says.

“I think margin expansion will offset, to some extent, revenue falling slightly and will mean we’re in relatively good stead. But I suspect companies will be relatively cautious and probably won’t crow too much about margin expansion.”

Henry Jennings' 3 stocks to watch

Leo Lithium (ASX: LLL)

The Australian battery metal mining company’s flagship operation is its Goulamina Lithium Project in Mali, West Africa. Leo Lithium’s share price has more than doubled since late May, when management inked a $100 million strategic partnership with China’s largest lithium producer, Ganfeng.

Latin Resources (ASX: LRS)

Jennings mentions another lithium explorer, Latin Resources, whose two largest operations are the Catamarca Lithium Project in Argentina and the Colina Deposit in Brazil, where LRS recently announced a 240% upgrade to its mineral resource estimate.

The company was also named by Marcus Padley himself back in January, when it had a market cap of around $250 million – a figure that has now headed north of $820 million.

Jennings says some of his recent “back of the envelope” calculations on lithium projects and comparisons of mineral reserves versus stock valuations reflect very favourably on both Leo Lithium and Latin Resources.

“They look very cheap when you can see the trajectory of those two. And if we’re talking about FY24 stock returns in a year’s time, I wouldn’t be surprised to see either of them replacing Liontown as the winners of the year,” he says.

Lovisa Holdings (ASX: LOV)

Jennings compares the fast fashion jewellery retailer with the likes of Domino’s Pizza, which has also surprised to the downside since the economic decline hit.

“Retailers have been completely decimated in some respects this year, where we’ve seen some big falls as they’ve now been downgrading their outlooks…some things we thought would do well in a recession, or a slower environment, haven’t,” Jennings says.

“The narrative has always been that Lovisa was somewhat immune to the economic impacts because it was feel-good $14 jewellery for 14-year-olds, which has again not proven to be the case.”

But Jennings believes the company has been oversold and looks interesting at current valuations – also anticipating the stock could see a “big jump up” from Taylor Swift in next year’s results. That’s because several of Lovisa’s most popular jewellery designs mimic styles worn by the pop singer, who has broken online ticket sales records ahead of her 2024 tour dates.

3 topics

15 stocks mentioned

8 contributors mentioned