The two most important charts in markets right now

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,967 (+0.30%)

- NASDAQ - 11,785 (-0.26%)

- CBOE VIX - 25.56

- FTSE 100 - 7,148 (-1.86%)

- STOXX 600 - 407.42 (-1.85%)

- SPI FUTURES - 6,820 (+0.33%)

- US 10YR - 3.262%

- USD INDEX - 109.68

- GOLD - US$1,706/oz

- WTI CRUDE - US$86.44/bbl

- DALIAN IRON ORE - US$104.76/T

US JOBS PREVIEW

The great lottery that is US jobs day is upon us. The figure will be very important for the all-surging US Dollar, not least because a bearish print might allow some traders to take their money and run.

For the Federal Reserve, it's not so much about the exact number but the trend. If there's a big print this evening, then you know the score. The Fed will get another cue before its mid-September meeting to hike rates by 75 basis points. The markets are happy because their hawkish biases of late will be rewarded. A smaller number may put that theory in jeopardy, perhaps even affecting rate expectations.

The forecast for this month is 300,000 jobs to have been added with the unemployment rate expected to stay stagnant at near-50-year lows. Average hourly earnings should still remain above 5% year-on-year but of course, inflation far eclipses that. So workers are still effectively earning a negative wage.

THE QUOTE

We are confident that the Board will decide to raise the cash rate by a further 50 basis points to 2.35%.

The all-seeing, all-knowing (supposedly) Bill Evans has made his call for next Tuesday's RBA decision. Another 50 is what he's predicting, as is Janus Henderson's Frank Uhlenbruch and CBA's Gareth Aird. It's not over yet, folks.

THE CHART

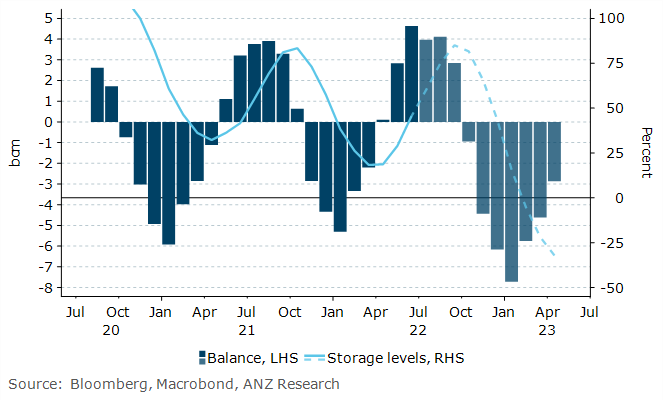

This isn't a comfortable chart to look at but if you care about the war in Ukraine and how it affects your investments, this is a chart you will need to watch closely. Germany could run out of natural gas by early next year at this rate.

The essence is that Europe has made the most of a seasonal lull in demand to fill gas storage facilities well ahead of schedule. However, that's not necessarily an even case across the continent. In Germany, gas inventories can, at present, cover two months of peak demand. As temperatures fall through Autumn, demand for heating fuels will rise significantly above the current supply. ANZ's forecast, led by commodities czar Daniel Hynes, suggests the country could run out of gas by early next year.

While we're on the subject of energy, next week sees the latest OPEC meeting. Saudi leader bin Salman has already hinted that a cut to the cartel's daily output might be on the way. Just what the world needs right now, right?

THE STATS

80%: The proportion of ASX 200 tech stocks that beat FY22 consensus estimates in its August earnings report. That contrasts to the 50% figure in energy and industrials, which ranked among the lowest. (Source: WILSONS Advisory)

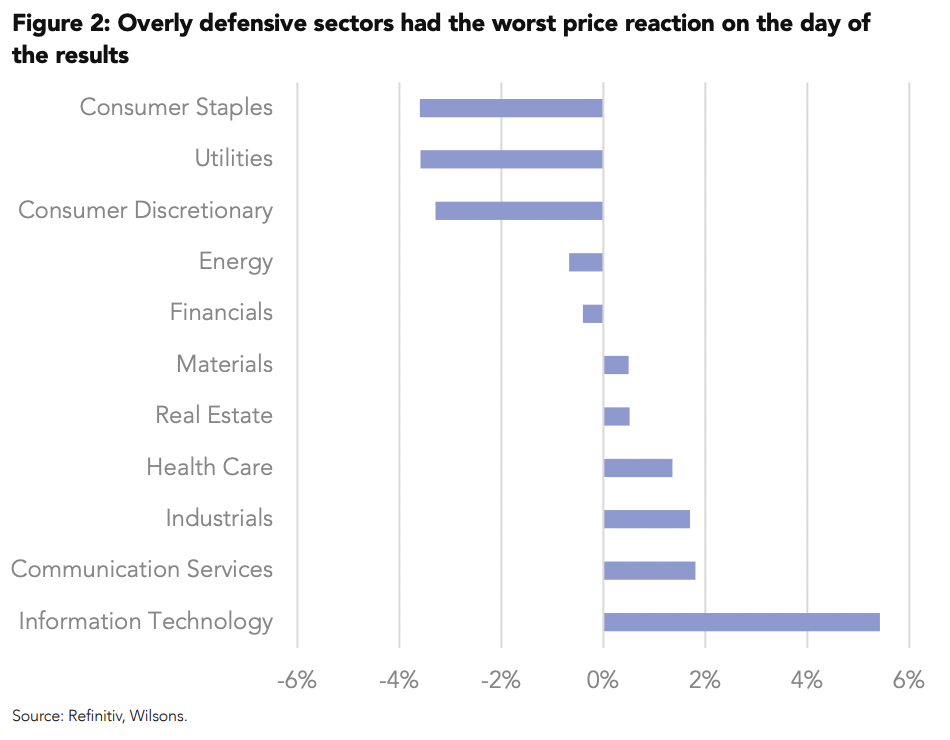

Shock! Sectors and stocks where sentiment was overly bearish before reporting season outperformed others in the wake of their results. Think of such names as Altium ASX: ALU and Wisetech ASX: WTC which both beat every expectation in the book. That explains this stat. But that doesn't mean shareholders reacted kindly, as this chart from that same paper shows.

STOCKS TO WATCH

This section's going to be quick today as three of these four upgrades to outperform from neutral are valuation-based. And the awards go to...

Then, there's Webjet ASX: WEB - and this is where Macquarie has some hard, qualitative analysis at their back. The guidance provided at Webjet's AGM suggests FY24 earnings will exceed those of the pre-COVID era.

But can they keep those costs down? Analysts certainly think so, with the medium-term growth outlook for travel demand looking favourable. The new price target is $6.50 (up from $6.15). Incidentally, Morgans and UBS didn't change their ratings but they felt the same way in regards to the travel outlook.

Does anyone need a holiday?

CHART OF THE WEEK

I'll leave that to you to work out what that means for consumer stocks.

Today's report was written by Hans Lee.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

6 stocks mentioned

1 contributor mentioned