They won’t fear it until they understand it

There were three entertainment blockbusters in Australia through July. The release of Barbie, and Oppenheimer; and the final instalment of the ‘Who will be the new RBA Governor?’ franchise, which has played out through the mass media through the past year. Indeed, I can’t recall whether it was Einstein telling Oppenheimer, or Philip Lowe telling Jim Chalmers “…They won’t fear it until they understand it. And they won’t understand it until they have used it…”. Both fiscal and monetary policy, and government policy more broadly, have been used to great effect in Australia through the past year, and continue to impact upon equity market returns.

Energy

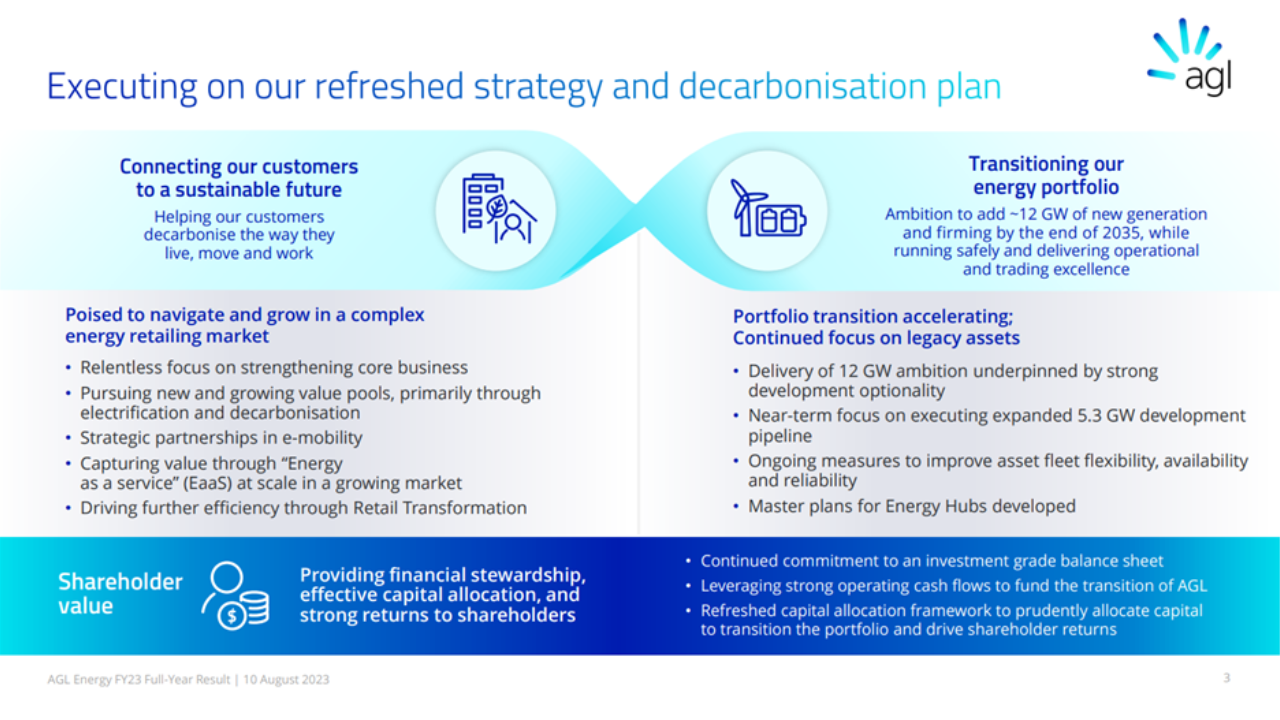

Globally, no stocks have been more impacted by the great spend by governments through the past year than those impacted by the energy transition. That trend continued apace through July with Energy being the best performing sector. While the debate over the pace and scope of the energy transition remains live, the magnitude of the investment required, and hence the potential call upon investors, becomes clearer. For example, AGL (ASX: AGL) proposes to add 12 GW of new generation and firming by the end of 2035, without clarity as to the level of required investment. For context, Snowy Hydro 2.0 is aiming to deliver 2 GW of pumped hydro storage by 2029 at a cost of $5.9b – three times the initial budget. The Sun Cable project in the Northern Territory, the world’s largest solar and battery proposal, is currently costed at $30b for 17 to 20 GW of solar production and 36 to 42 GW of energy storage. We remain wary of AGL’s ability to finance its investment, and suggest any excess returns generated from higher prices and capacity availability will likely be more than absorbed through time by internal needs for capital, or government policy changes redirecting excess returns from aged, carbon intensive energy generation towards renewable energy sources.

Source: AGL FY23 Full-Year Result,10 August 2023

As is the intent with the US Inflation Reduction Act, which has fuelled market leading performance by the lithium stocks. Through July they underperformed the market, aiding the portfolio’s relative performance. Just as the infusion of monetary supply ultimately unleashed inflationary forces, it is still unclear what the supply surge fuelled by the massive stimulus and geopolitical intent behind the Inflation Reduction Act, will ultimately mean for shareholders in lithium producers.

Banking

The Banking sector continues to be our largest underweight. In our commentary for May this year we noted that “…The prospect for higher taxes upon the sector, as has recently been introduced in Canada and before that in the UK, for example, cannot be dismissed as a real and present danger for shareholders…”. In our eyes, that risk has only increased; Italy, for example, has just issued a 40% windfall tax on excess profits generated by its banking sector for 2023. Despite being capped at 0.1% of risk weighted assets (which in Australia equates to $2tn for the major banks; or a tax of $2b), the capital market’s reaction was aggressive, with bank share prices down between 5% and 10% on the day of the announcement.

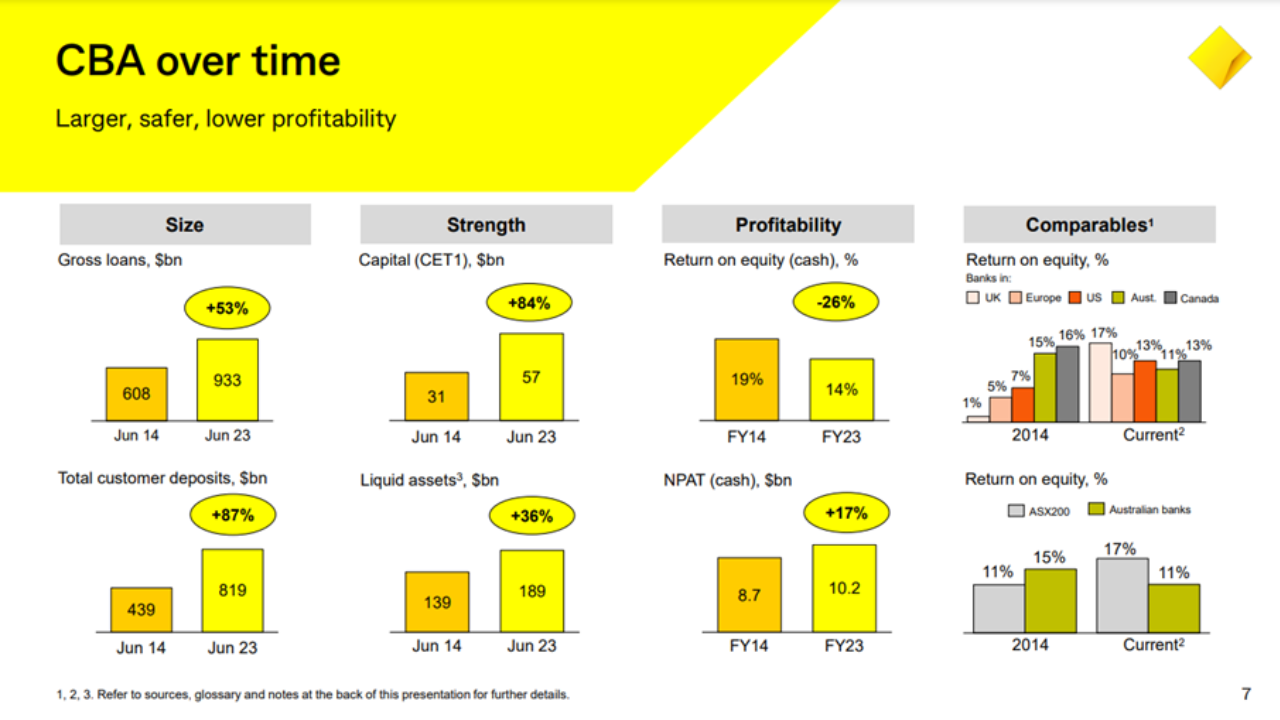

To that end, the sector is alert and CBA (ASX: CBA) highlighted in their most recent results presentation that the Australian banking sector today looks lacklustre relative to global peers on a returns basis.

Source: CBA FY23 Results Presentation For the full year ended 30 June 2023

The dilemma for investors remains that those fair returns are priced by equity markets at a much higher multiple than is the case in other countries, especially for CBA. There is little scope for downwards pressure on returns, whether that arises from regulatory changes or from competitive pressures or bad debts increasing.

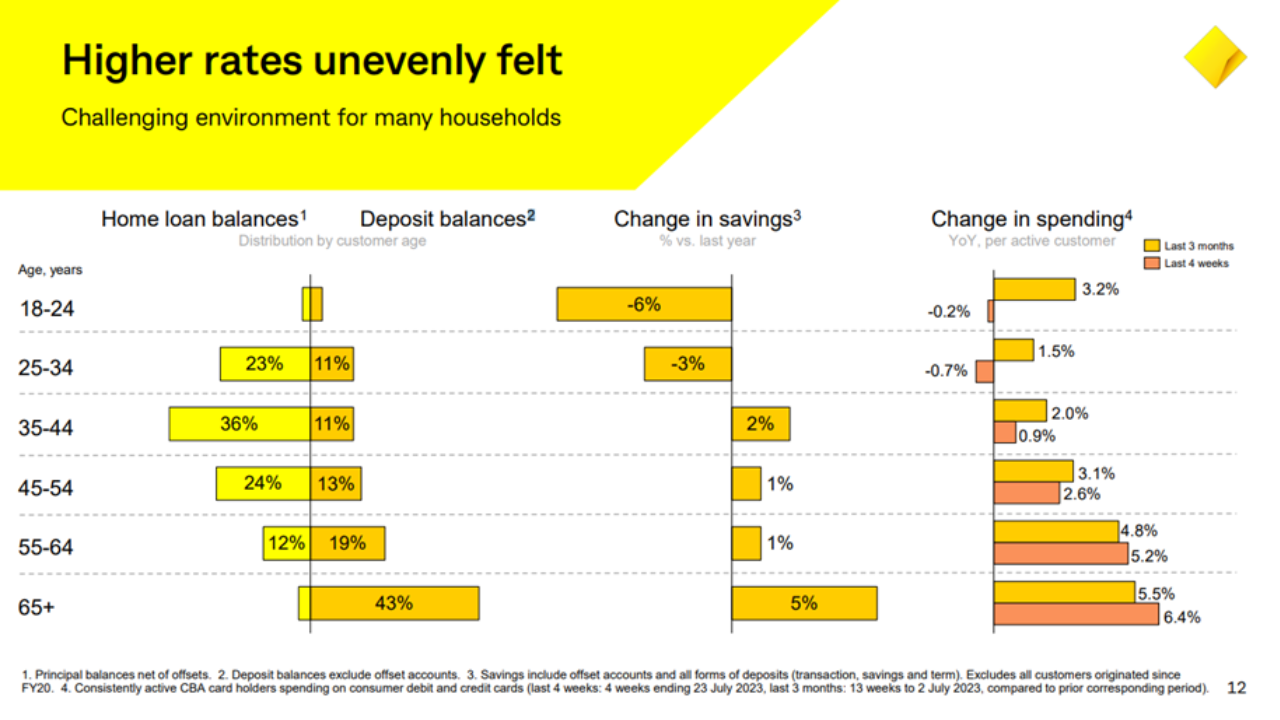

Source: CBA FY23 Results Presentation For the full year ended 30 June 2023

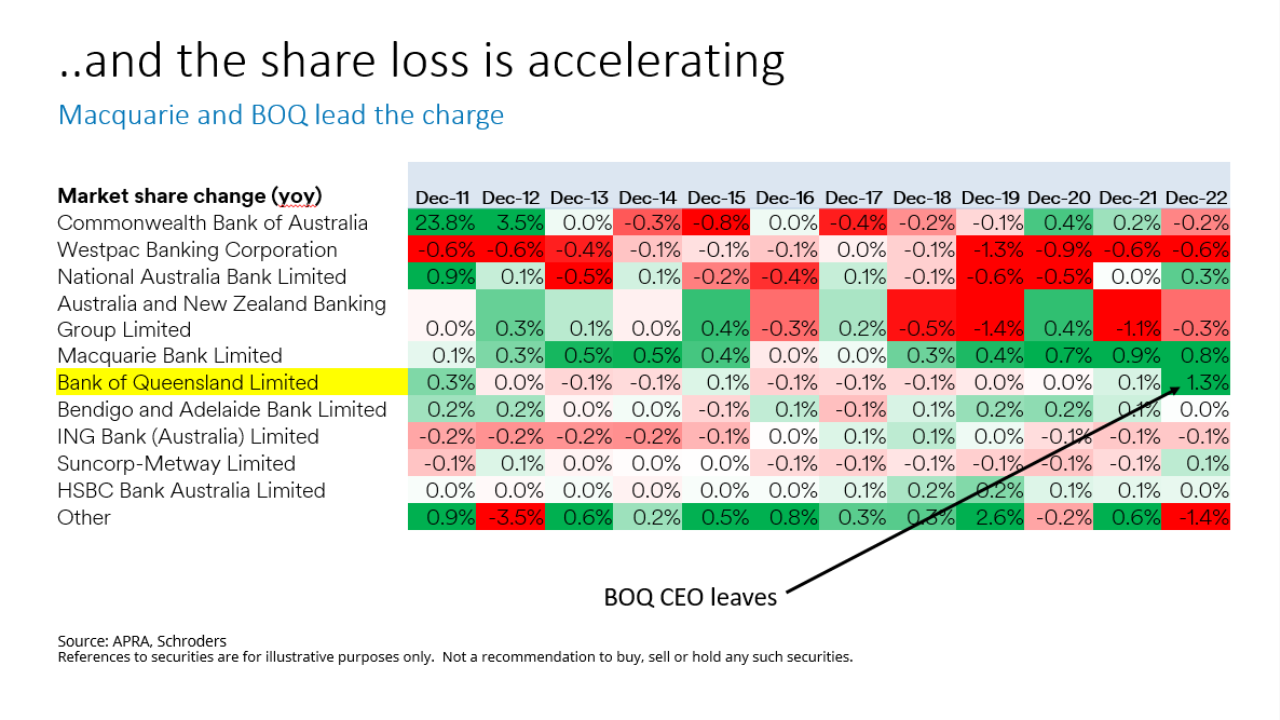

The above slides set a challenging context for the Banking sector, and yet we feel the underperformance may still be nascent. On every important line in the profit and loss account, we see more challenge than opportunity to mid cycle. Credit growth has been well above GDP and population growth for several decades, driven by housing lending, which in turn has been fuelled by more lax lending standards (on a loan to income basis) than is the case in other major economies. Market share shifts have been consistently adverse for the major banks through the past decade; but this has progressively accelerated to an unprecedented level through the past two years, as the chart below highlights;

Source: APRA, Schroders

The following are alarming facts to arise from this study of market share shifts in the Australian mortgage market through the past decade:

- There is no single year where the major banks combined have won market share.

- There is no single year where Westpac has grown market share.

- There is no single year where Macquarie lost market share.

- There is no instance of a major bank or even Macquarie organically winning more than 1% market share in a given year. Last year, Bank of Queensland (ASX: BOQ) won 1.3% market share. Following the departure of the then CEO at the end of the year, the Chairman spoke of the need for an “…uplift in our risk culture, frameworks, processes and control…” in his AGM presentation.

Given all of this, we find the decision by the ACCC to deny authorisation for ANZ (ASX: ANZ) to acquire the bank within Suncorp, as bewildering as we find the decision by ANZ to want to acquire it in the first place. In our view a focus upon organic growth, effectively utilising the large resource base already at the disposal of each major Australian bank by running their existing business well, would clearly be the best path for each of them to create shareholder value. Of the cohort, CBA has long done this best and NAB (ASX: NAB) has pursued this strategy since Ross McEwen arrived as CEO and it has outperformed accordingly. As with its peers, from a shareholder’s perspective, ANZ’s strategic imperative is to be better, not bigger.

To be fair to Suncorp, being better and not bigger was exactly what it was trying to achieve in divesting its banking business. After a poor decade, Suncorp (ASX: SUN), IAG (ASX: IAG) and QBE (ASX: QBE) have all taken advantage of a cyclical upturn in prices through the past two years to restore profitability to more acceptable levels. The cycle continues to be supportive and hence premium increases continue to be strong, although as with the banks, from here operational efficiency will likely be a challenge for all the major competitors in the sector for shareholder returns to be able to be maintained.

Materials

Apart from insurers, building materials is another sector that has focused on being better, not bigger, through the past decade and market performance has followed. James Hardie (ASX: JHX) has continued to perform strongly as its fibre cement product continues to win market acceptance in the US (mostly) and Australia. CSR (ASX: CSR) led the charge domestically, as it pursued a narrow strategic focus on energy efficient, lightweight building products. In the past two years, Boral (ASX: BLD) has simplified its strategy to be focused purely upon Australian construction materials, which has been rewarded by the market before the operational results have been delivered. The exception to the rule is Fletcher Building (ASX: FBU), which continues to diversify what we see as an already too wide business base and both invest capital into lower returning businesses and realise further write downs on a small number of poorly performing NZ construction contracts. It is possible that the Chemical stocks, Orica (ASX: ORI) and IPL (ASX: IPL) are at the nascent stage of a similar upswing in returns through a cycle.

While pressure upon consumers continues to mount, with rents, mortgage rates and general living expenses all continuing to increase materially year on year, it is only starting to impact upon consumption, and the impact is aggressively demographically skewed, with the lower income and wealth cohort (notably the young) being impacted to a greater extent than others (notably, the not so young). While EPS revisions for F23 have been negative, they have not been as aggressive as we anticipated, as commodity prices have remained high, and employment has remained strong, supporting industrial and bank earnings. While market F24 earnings growth is expected to be relatively strong at 11% despite commodity prices reverting, to date it is only the Healthcare sector that has shown any weakness.

Learn more about investing in Australian Equities with Schroders by visiting our website or fund profile below

14 stocks mentioned

1 fund mentioned