Time to cash out

The market had risen 33.06% from December 2018 to the high last Thursday. That’s over 1.2 years. The average annual return from the stock market is 5.7% pa. So in 1.2 years we have seen 5.8 years worth of average annual returns. This year alone the market had gone up 15% in 28 days from early January to the all time high last Thursday. That’s almost three years of average returns in a month. If the market kept going up at this rate (works out at 26.9% pa) it would double in three years and go up 10x in 10 years (compounding 26.9% pa for ten years)….and all this is before dividends. In other words the market momentum has been extreme - price is the problem more so than the coronavirus.

Something was always going to come along and knock it off its perch - coronavirus happens to be it. Chinese cases apparently plateaued yesterday but the market has got its knickers in a twist over new cases in Iran, Italy and S.Korea. The air is thin at high altitude making it a lot easier to pass out. It wasn’t going to take much.

Will we crash?

Tomorrow we could wake up to the market down 5% or 10% or it could be up 1000 points. No-one knows. Our reaction (using decades of experience) is that corrections start fast and then trend. So this could be the top for some time. We reacted to a similar move in September last year and got it wrong. This time we perceive that precipitous risk again but are not going to cash out completely, but we are raising cash levels, just in case. We will be selling up some of our high growth stocks today and our 'stock market stocks' today just in case this becomes precipitous. The technical (charts) ingredients suggest a bigger fall.

In the 2018 correction which saw our market down 15% in three months and the US down 20% and some of our high-quality growth stocks like ALL, CSL, COH, TWE, APT and others fell 25% plus. In a correction the market doesn’t care for quality it cares about high PEs and risk. Growth stocks will underperform in a sell off, possibly precipitously. Ultimately it will prove to be a wonderful opportunity, but not yet.

The main reason to cash up is not because the market darlings have become disasters overnight, its because you want to be able to take advantage of any correction, to buy stocks like CSL and APT on their lows not their highs. We are ‘hoping’ for that opportunity.

If you are long term, at worst this is a “regular” correction that happens once every three years or so. The market has regular 20% corrections. Then recovers. This might be the start of one of those, maybe not, but the point is that the ingredients for a GFC 2 are not here (unless coronavirus really catches on). There is no systemic problem. We have a sentiment problem and possibly a ‘price’ problem. The US has $27.7 trillion of S&P 500 stocks trading on a PE of 23.5x. Its ridiculous. No-one would pay 23x this years profit for a private company. So nothing major is amiss. In which case it is only the people who duck and weave in the stock market on a shorter timeframe that will do anything, not because the market is a sell, but because they want to take advantage of the sentiment change.

SECTORS IN A CORRECTION

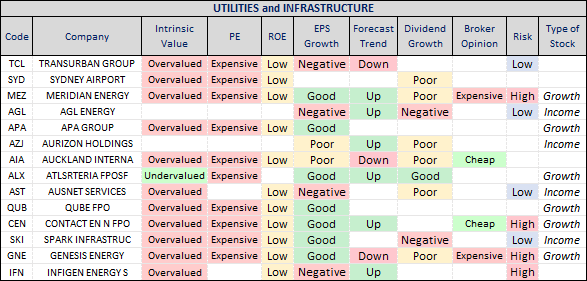

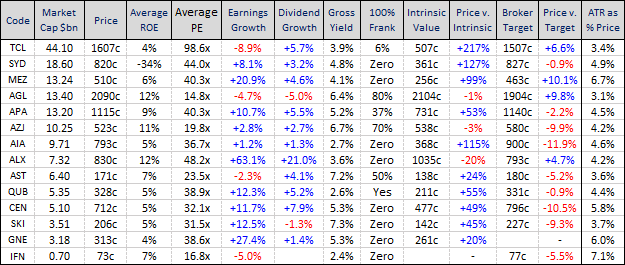

- The winners will be the boring defensive interest rate sensitive stocks. They will still fall, but less than the market. These are the stocks that benefit from the fall in interest rates that accompanies (coronavirus inspired) GDP growth fears. For REITs, utilities and infrastructure stocks, with high debt levels, a fall in interest rates (on growth fears) is as good as a profit upgrade. Interest rates will trend down again as growth fears return. Much as they did last year during the trade war fears that also threatened global growth.

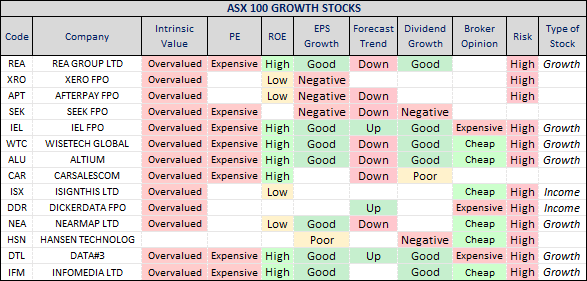

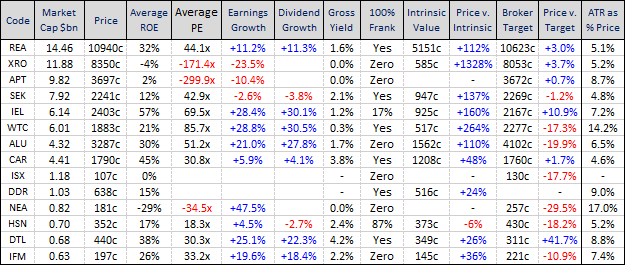

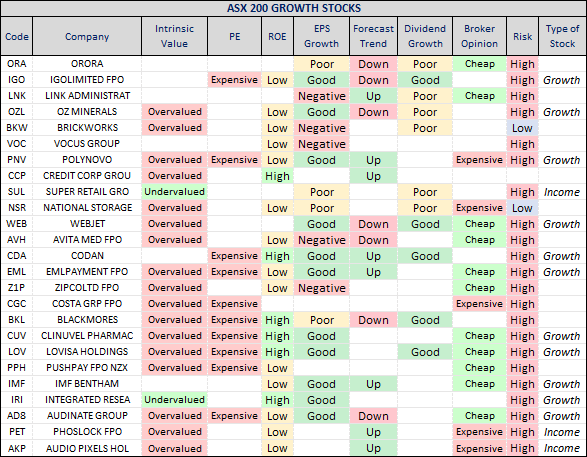

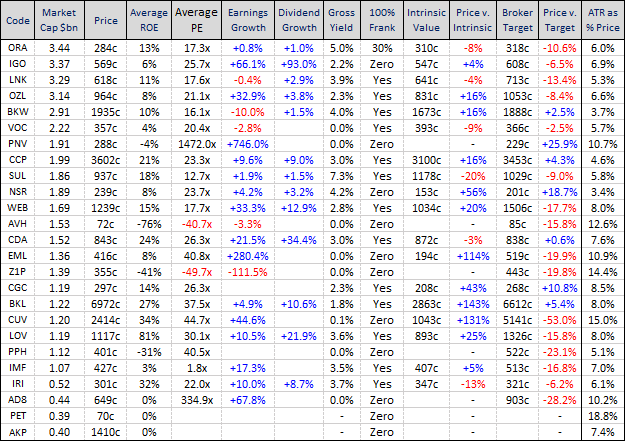

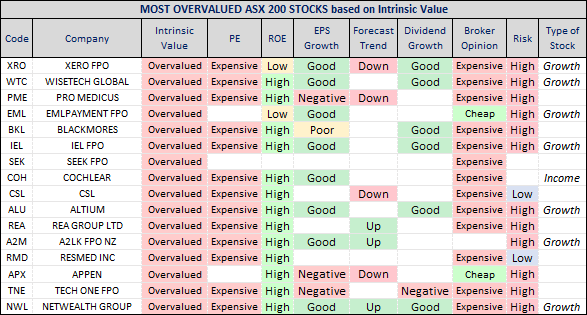

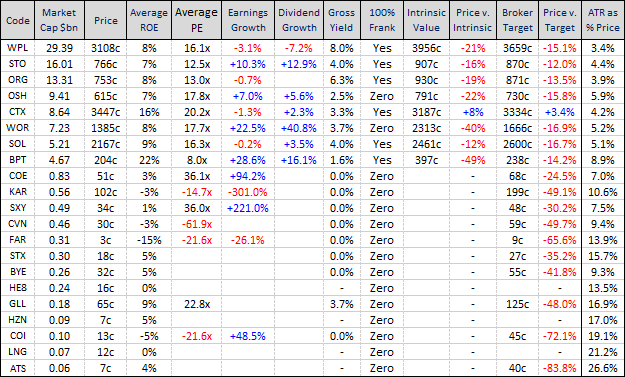

- Stocks that suffer most in a correction will include cyclicals (linked to GDP growth), high PE stocks, 'stock market stocks', loss-making growth stocks, stocks that require ‘faith’, and stocks that are well above intrinsic value. Here are a selection of what we might call ASX 100 growth stocks. The key to the tables is down below.

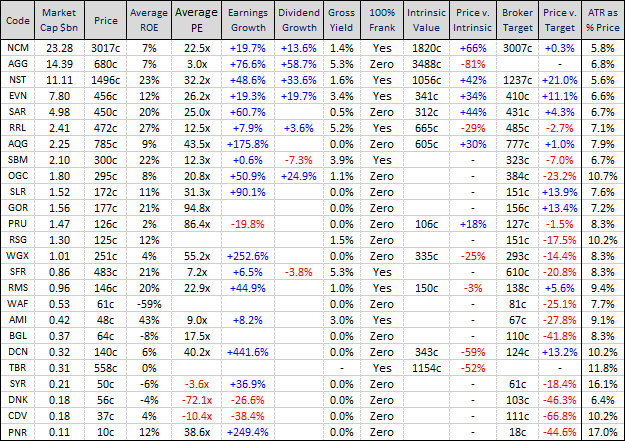

- And here are some smaller growth stocks – some are actually outside the ASX 200 despite the title:

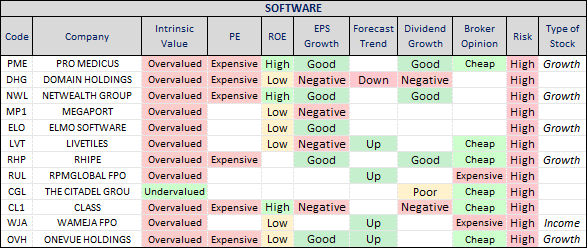

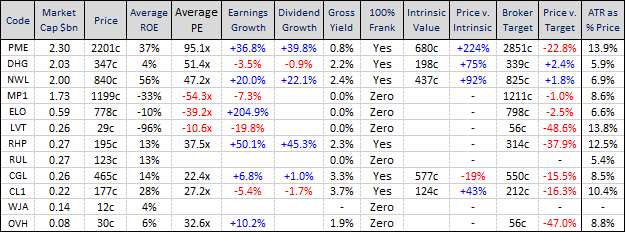

- And there are some overvalued smaller IT stocks:

- Here is a list of the most overvalued stocks (relative to intrinsic value) in the ASX 100:

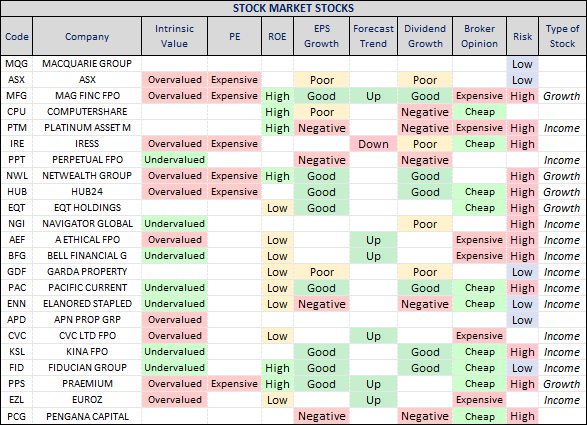

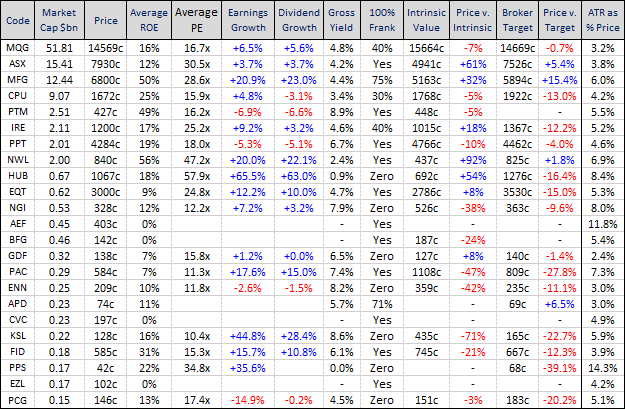

- 'Stock market stocks' as I call them will also struggle with a falling market:

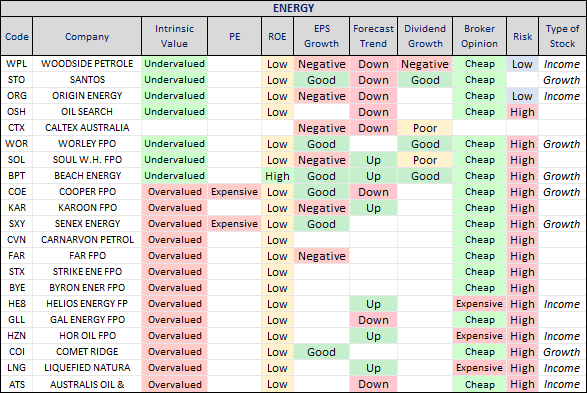

- Oil stocks will struggle – the oil price falls when the market starts worrying about GDP growth

- Gold will be the standout sector if this develops. In 2018 when the market fell 15% the gold sector went UP 20%.

In the end we’ll probably wake up to the Dow Jones up a 1000 points tonight and we’ll all look ‘silly’.

But maybe not….

Key:

Read more from Marcus

Marcus Padley is the author of the Marcus Today stock market newsletter. To sign up for a 14-day free trial please click here.

3 topics

5 stocks mentioned