Uranium bull run continues: US$100/lb down, where to next?

As a technical analyst, and a trend-following technical analyst more specifically, I’ve naturally followed the fortunes of the uranium price and ASX uranium stocks very closely over the last 12 months. The trend in the uranium price is shaping up as one of the potentially “great trends” of the last few years.

As always, just because an asset is in a strong trend, it doesn’t guarantee the trend will continue. Technical analysis is 100% backward-looking and any technical analyst who proclaims to be able to use it to predict the future should be treated with great scepticism (I am a trend follower, not a trend prognosticator!).

When discussing my technical analysis techniques, I prefer to deal in language no stronger than “more likely to occur”. As in, assets that exhibit strong price trends are more likely to continue in those trends. The stronger the trend, the greater the likelihood of its continuance. With this disclaimer aside, let’s take a gander at the uranium price.

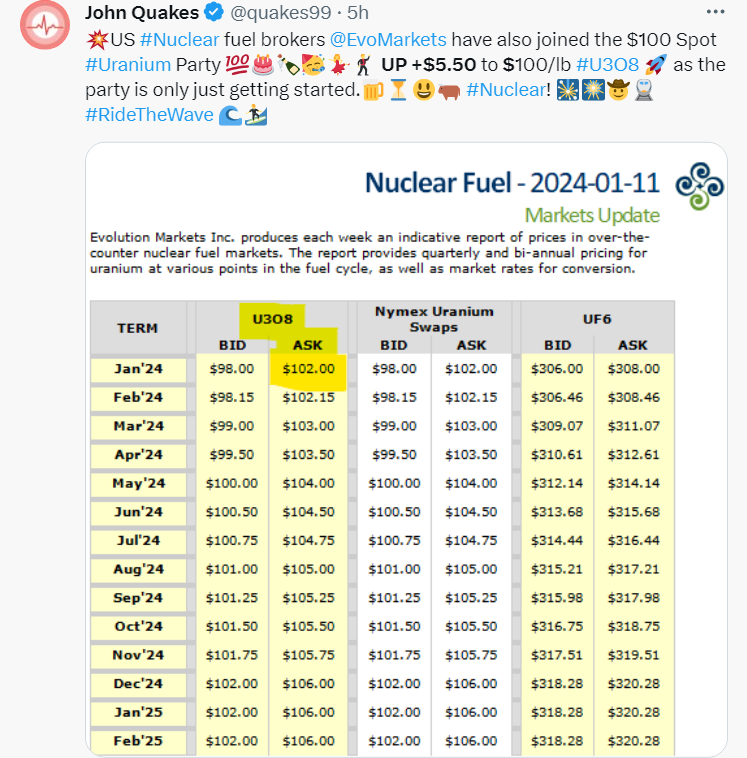

You can see why I’ve chosen my words very carefully up to this point. Uranium appears to be in a very strong trend indeed, and I don’t want to get anyone too excited! And there’s been plenty of excitement in social media today, given a certain uranium price provider reported the uranium price tipped US$100/lb – see this tweet by popular uranium blogger John Quakes (@quakes99).

The trend really is your friend

Trends speak to the underlying demand-supply environment. My experience suggests trends like the one now being experienced in uranium are consistent with a substantial imbalance between demand and supply – in this case, demand is substantially greater than supply. Let’s just call this a state of “excess demand”.

Here’s some pointers on how to determine if a state of excess demand is more or less likely to continue:

Indicators of excess demand

Trend ribbons are pointing up and are broadening

Higher peaks and higher troughs (higher peaks equals supply removal, whereas high troughs equals demand reinforcement)

White candles, and or downward-pointing shadows (indicates intra-session accumulation)

Support levels are respected, resistance levels are broken, and once broken previous resistance levels tend to act as future support levels

Indicators the market is moving back towards equilibrium

Trend ribbons begin to flatten, contract

Lower peaks and or lower troughs (lower peaks equals supply reinforcement, and lower troughs equals demand removal)

Black candles, and or upward-pointing shadows (indicates intra-session distribution)

Support levels are broken, resistance levels are respected, and once broken previous support levels tend to act as future resistance levels

The long and short of trend following

As a trend follower, my objective is to seek out charts that show the strongest signals of excess demand, and these become the pool of opportunities I may consider to buy (i.e., for “long” positions). I have no idea what will happen after a buy into a stock in a strong uptrend as I cannot tell the future (surprise!). This is why I will carefully watch how the technicals develop, and I will have a plan for how to exit my position based upon signals the market dynamics are moving away from excess demand.

Most importantly, I will have a clear point where if the price closes below that point, signals the market is most likely in a state of excess supply, and therefore I must exit. You could say this is a “stop loss” point – but this assumes the trade is in a loss. Often, this point could be a profit if the trade has gone my way for some time.

Using this methodology, I can never buy into a stock in a downtrend. I never try to buy stocks on the basis that their fundamental valuation might be “cheap”, or simply because it may have fallen a long way, and therefore they might bounce. I have no notion of “cheap” or “expensive”, simply what my plan compels me to do based upon the state of a stock’s trend.

I plan my trade carefully. I monitor my plan carefully. And I always follow my plan!

Probability versus profitability

Trend followers understand they are probably going to be wrong at the top and bottom of a trend. You never know when a trend is going to come to an end. It might end literally the moment you get in (no – I am not specifically referring to you!). This does not phase the trend follower! A disciplined trend follower takes their medicine and moves on to the next strong trend. Their goal is not to be right or wrong, but simply to follow their plan and do their best to play the probabilities.

Probability, in my experience, typically falls in favour of the prevailing strong trend. I always say: “If I can get the probability part of it right, the profitability part of it will take care of itself!”. I should add here, this philosophy is vastly assisted if, on average, you make more on your winners bigger than on your losers – but that’s perhaps a topic from another ChartWatch!

Where does the chart say the uranium price is headed next?

The short answer is: I don’t know! I can’t predict the future, remember!

I do consider historical resistance and support levels as potential future resistance levels, though. Unfortunately, there are few clues here as the uranium chart doesn’t have any major levels to contend with until the 2007 highs around US$153/lb. So, in the absence of any of the indicators the market is moving back towards equilibrium discussed above, I can only assume probability lies with the prevailing uranium uptrend continuing.

In the next edition of ChartWatch, I’ll use the foundational concepts of technical analysis and my trading philosophy discussed here to review the key stocks in the ASX uranium sector. Spoiler alert! Many are showing fantastic signs of excess demand!

This article first appeared on Market Index on 12 January 2024.

5 topics

9 stocks mentioned