Weekly S&P500 ChartStorm - 5 June 2022

The Weekly S&P500 ChartStorm is a selection of 10 charts that I handpicked from around the web and post on Twitter. The purpose of this post is to add extra colour and commentary around the charts.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective...

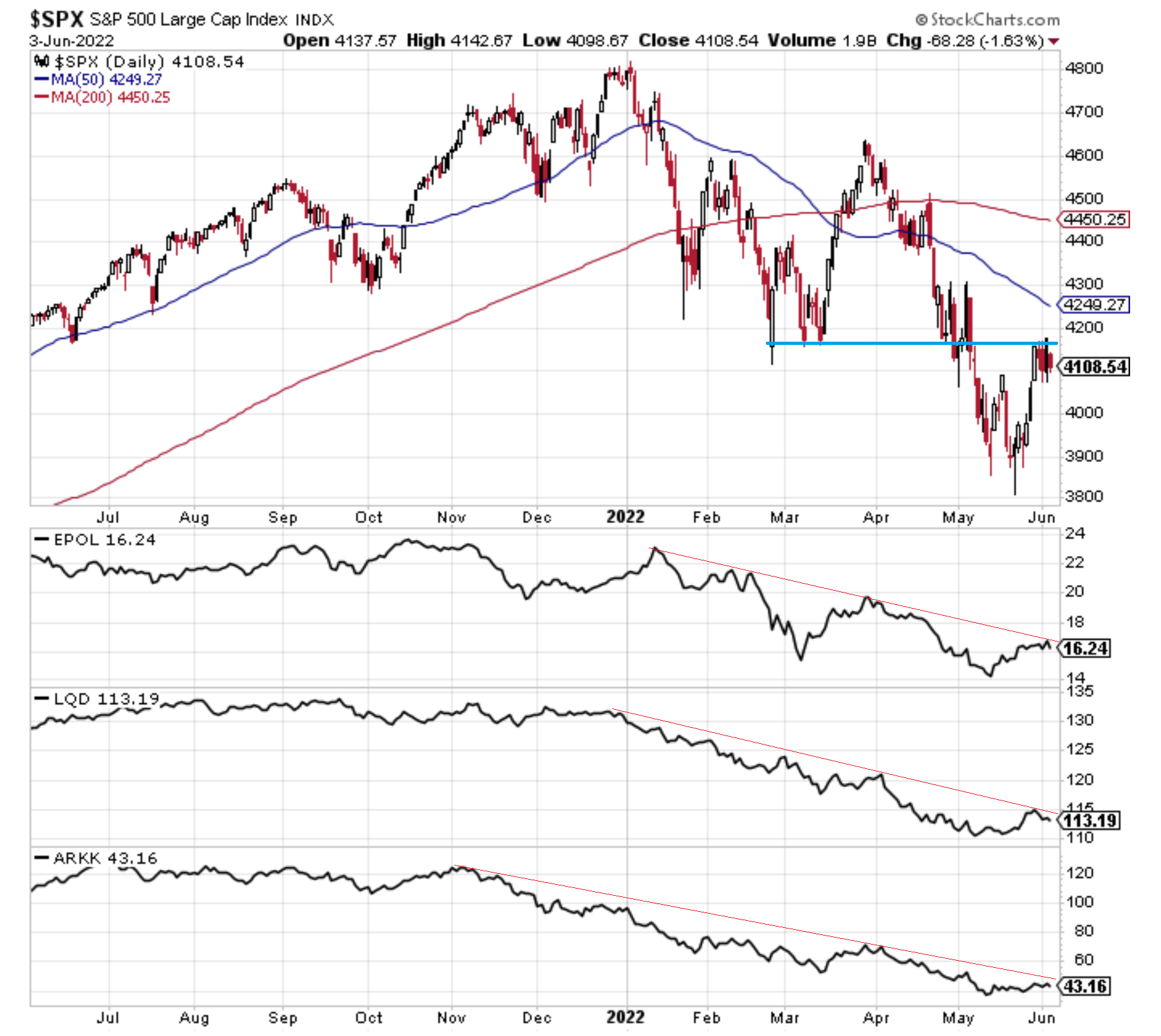

1. Lines in the sand

The S&P 500 appears to be stalling at resistance after a short sharp rebound. Looking at the “correction risk drivers“ I’ve mentioned previously:

- EPOL (geopolitics) also stalling

- LQD (rates/credit) turning down again

- ARKK (tech bust) bouncing along the bottom

Overall, fairly unconvincing.

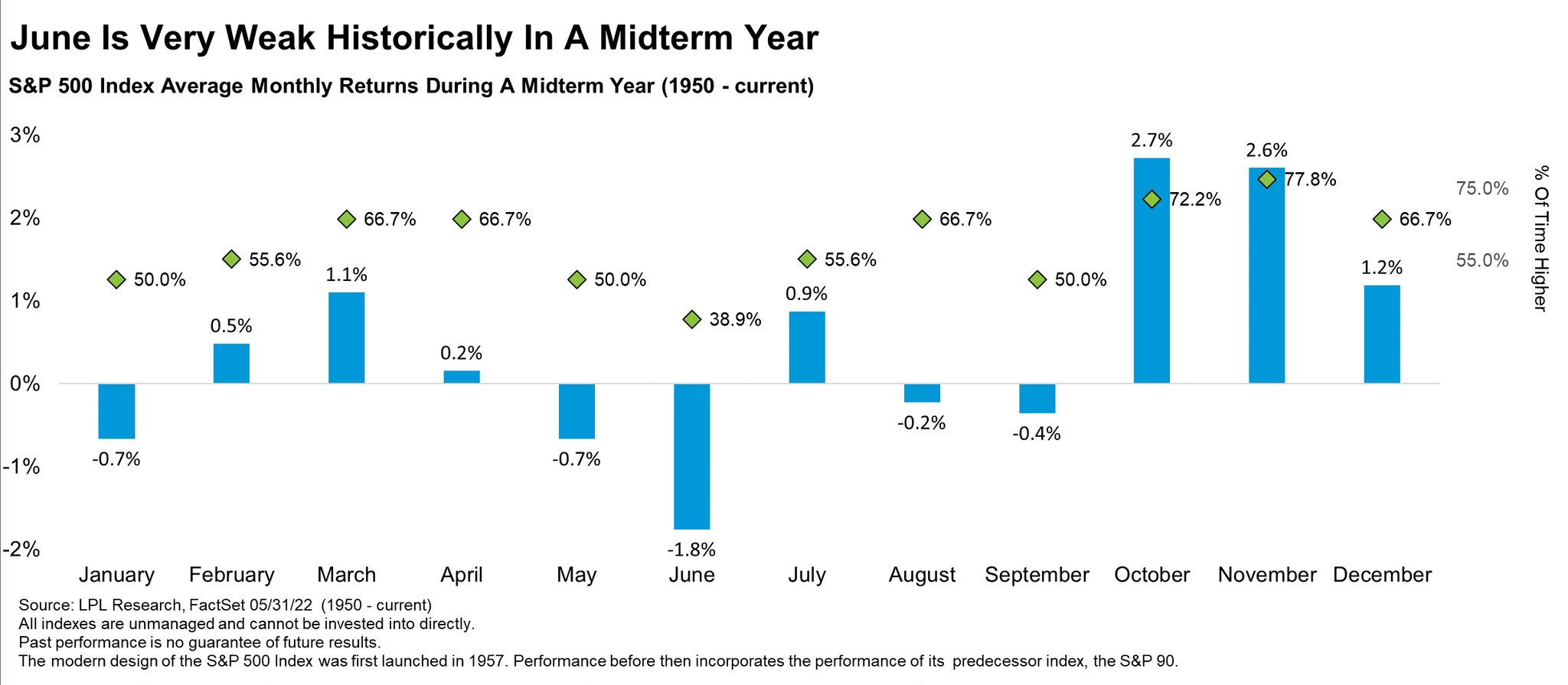

2. Seasonality check

June is historically the worst month of the year for stocks during a midterm year. There are always exceptions to the average, but it's interesting to note.

Source: @RyanDetrick

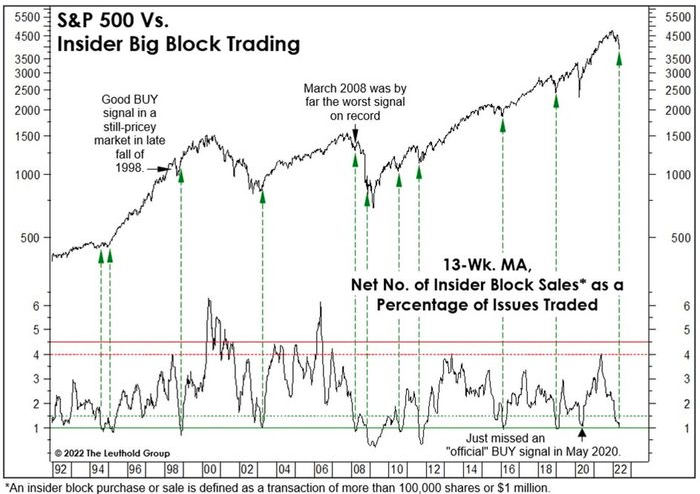

3. Insider timing

This “Insider Big Block Trading indicator” looks to be at or close to a buy signal... as always, note the exceptions (beware of early buy signals).

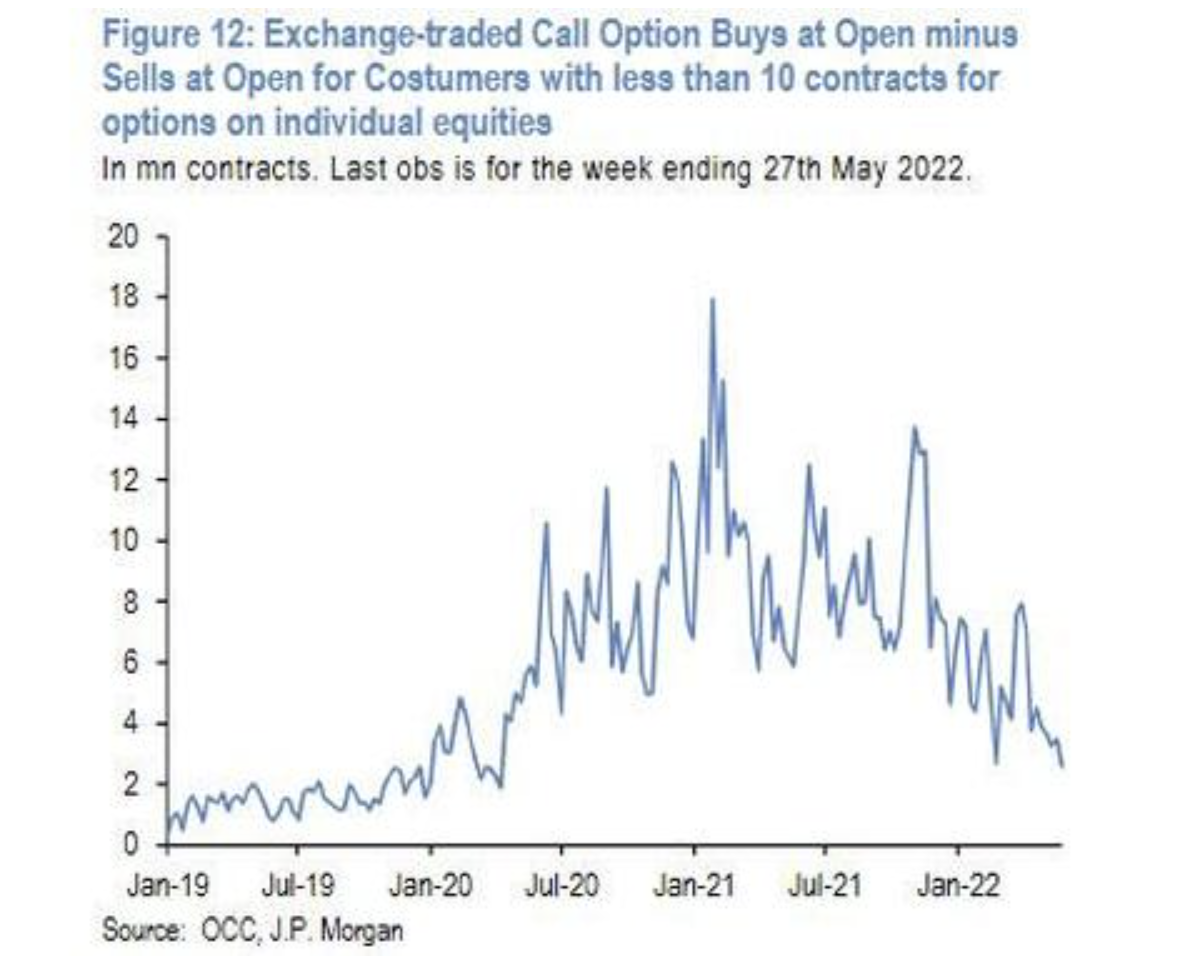

4. Giving up on calls

Small trader buying of call options has near evaporated – a stark contrast to the frenzy of 2020/21.

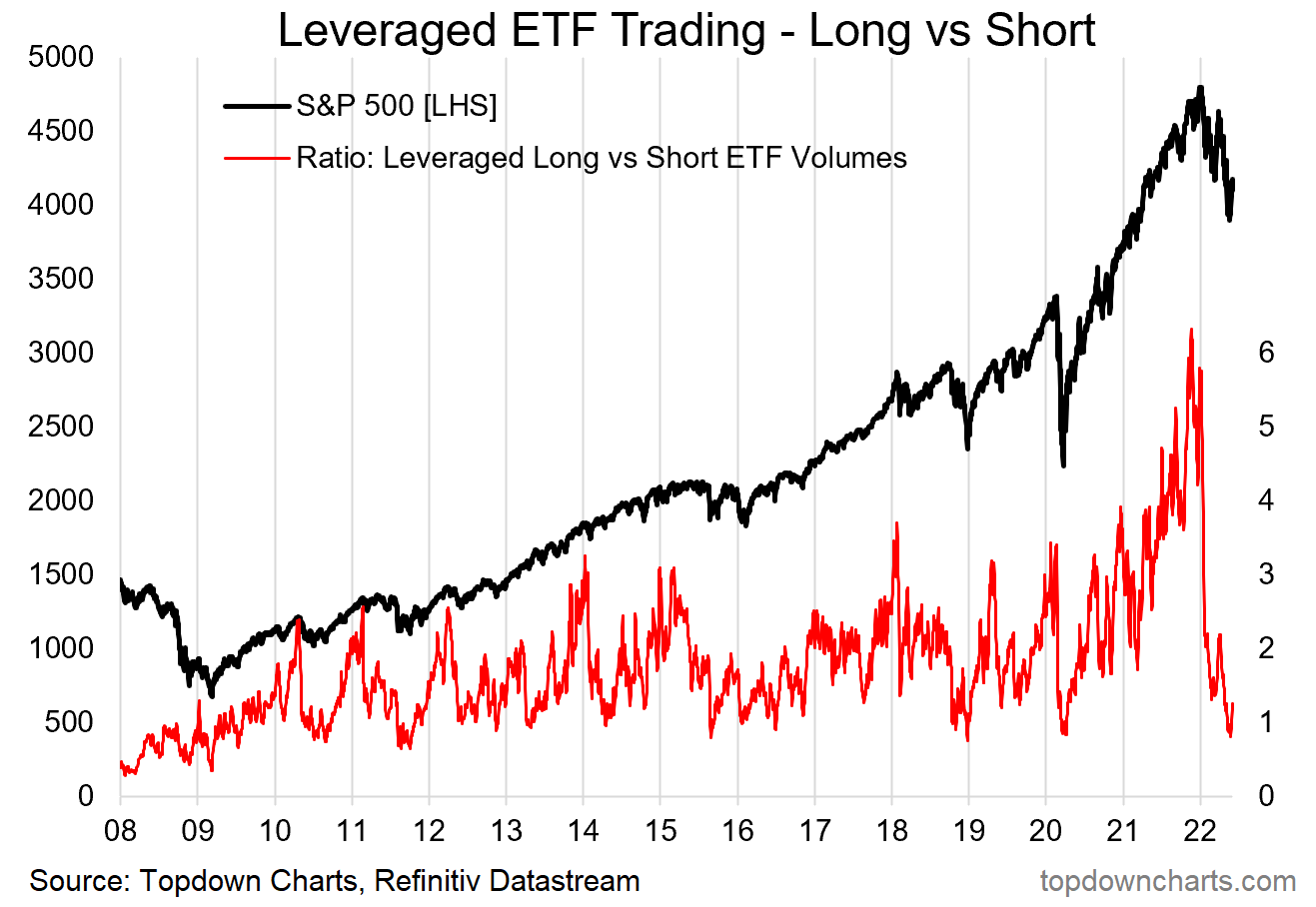

5. Bullish speculation evaporation

Similarly, the degree of trading in leveraged long versus short US equity ETFs puts on clear display the bullish speculation evaporation. Looks like a buying/bouncing signal recently though...

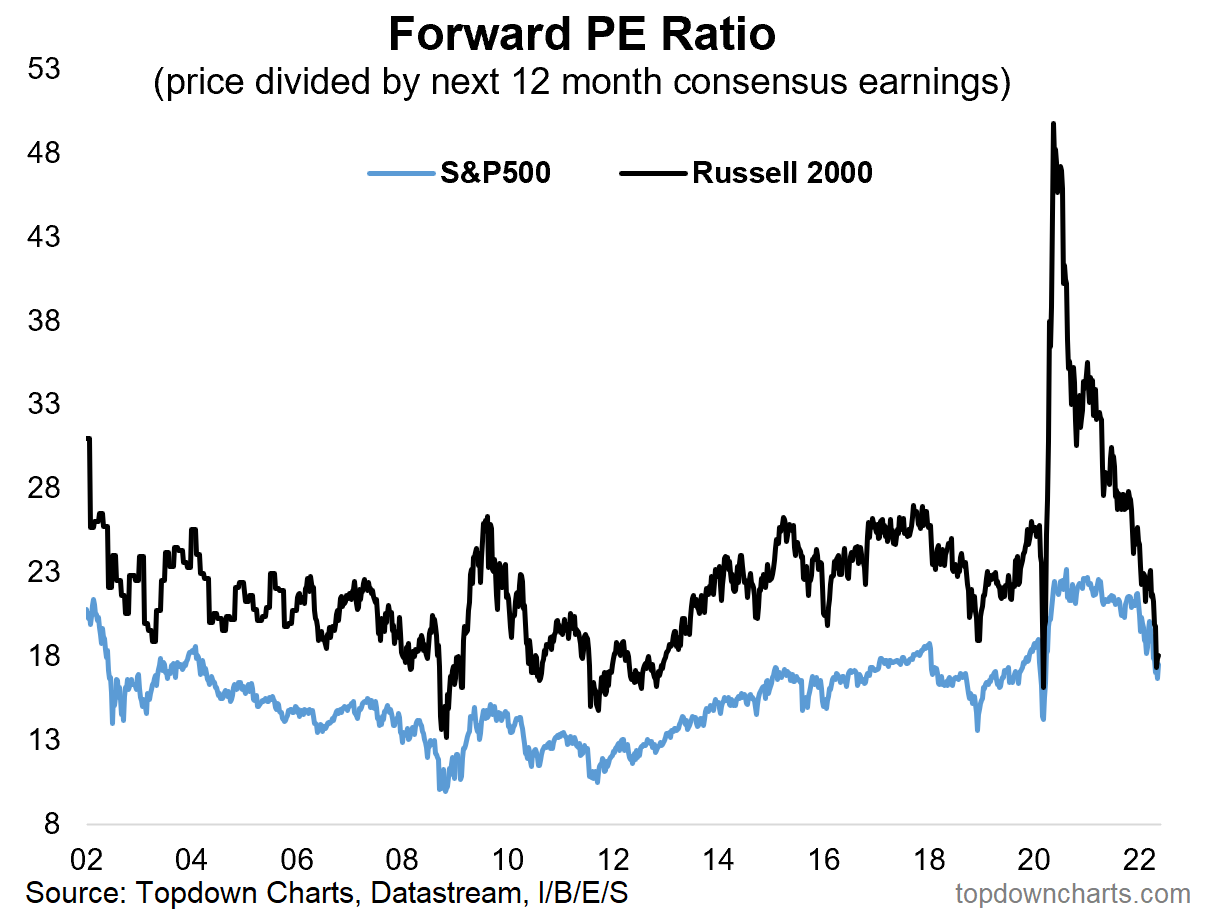

6. Forward PE ratio

The small-Cap forward PE ratio falls back down to earth (albeit, note carefully that small cap consensus forward EPS crashed -57% in 2020, and have surged +15% this year, and up around 250% off the low point. That's all good if EPS deliver on analyst expectations — and assuming earnings are sustainable in the face of a potential global recession... )

7. Price to sales ratio

Good news everyone!

After a big reset, the S&P 500 price to sales ratio is now only as expensive as during the peak of the dot com bubble!

(albeit, margins are also higher, rates lower, etc)

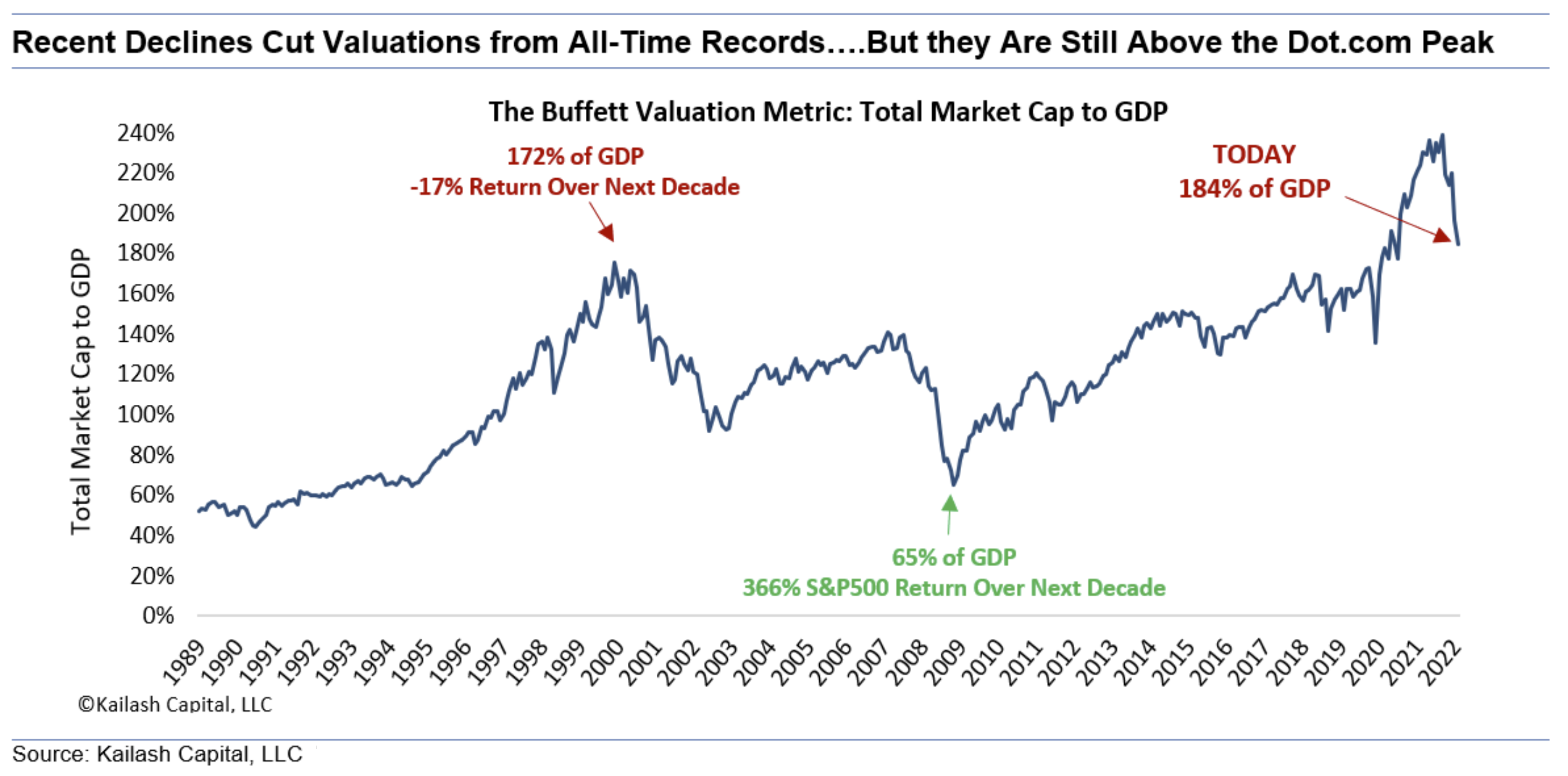

8. Value?

The "Buffett Indicator" is also now all the way down to dot-com bubble levels.

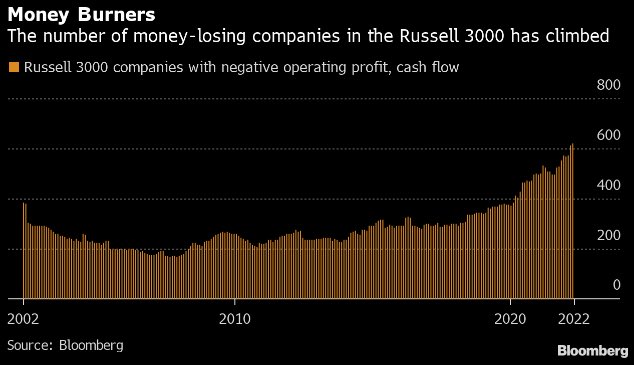

9. The number of money-losing companies

No profits, no problem?

(or: no profits, no, problem!)

10. The cost of recency bias

"If 2008 hit again" (you always hear some attention seekers claiming this is going to be the next 2008 every time markets get a bit volatile… be careful who you listen to!!)

Thanks for reading!

Callum Thomas, founder and head of research at Topdown Charts.

Any feedback, questions and views are welcome in the comment section below.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics