What are franking credits and how to use them for income

Franking credits are a well-loved institution for Australian investors, but they are also poorly understood. With more than half of Australian companies on the ASX200 paying either partially or fully franked dividends, the idea of franking credits and how to use them is something that investors will need to know at some point of their investment journey (or their advisers and accountants will know for them).

Franking credits are not uniquely Australian but we do offer an added bonus unlike other countries – the ability for certain investors to use them for a tax refund.

Between tax return season and reporting season coming up in a matter of weeks, it never hurts to have a refresher on franking credits. So, in this wire, I’ll go through the basics and give you some examples of what level of franking some of the top ASX companies offer.

What are franking credits?

If you receive a franked dividend or distribution, it means the company has paid out its after-tax income to investors with a tax credit. That tax credit is also known as a franking credit.

That tax credit means that you only need to pay tax on that dividend to the extent that your marginal tax rate exceeds the rate of tax the company has already paid on that dividend income. If your marginal tax rate is less than the company rate, you may be entitled to a refund of tax paid.

The aim of franking credits is to prevent double taxation and has become a popular part of income strategies in Australia.

If you invest in a managed fund, ETF or similar, you may still receive franking credits as the structure can allocate the credits out to investors from the underlying assets.

Some companies, such as Telstra, offer fully franked dividends because their revenue streams are generated within Australia. Others might offer partially franked dividends, for example, Macquarie Group, which has revenue streams outside of Australia that require it to pay foreign tax where Australian franking doesn’t apply. Many companies don’t offer franked dividends – it is an individual company decision.

How do franking credits work?

The easiest way to think of how franking credits work is that you don’t have to pay the tax already paid on the dividend by the company, just any excess you would normally owe.

Or, for those who don’t need to pay tax or have a marginal rate lower than the company rate, you might instead think of it as tax has been paid on your behalf, your marginal rate means you wouldn’t have to pay that much, so you might receive some back from the ATO.

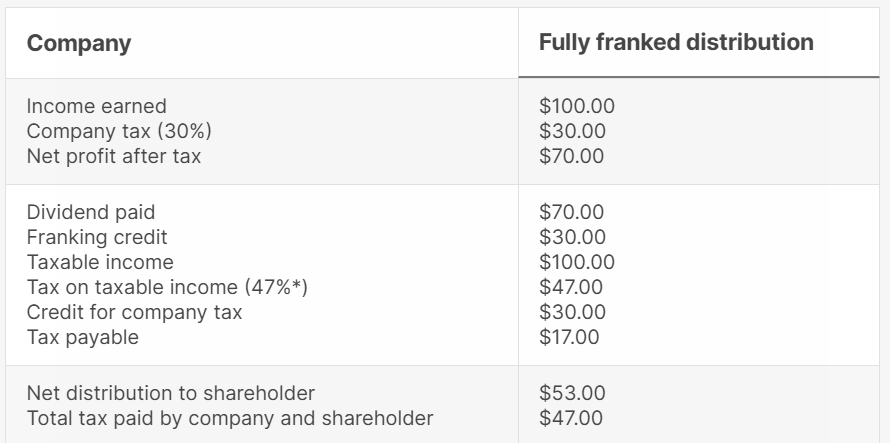

Here is a basic example from the ATO of how it might look in practice for an individual with a marginal tax rate of 47%.

Now, reimagine the above for an entity that is not-for-profit, or a retiree who doesn’t pay tax. Instead, they might be entitled to receive a refund of the $30 paid by the company in tax. This would mean that the total income received by that entity or retiree would come to $100. This is a popular income strategy used by retirees in Australia to help maximise their income streams from their investments.

Now let’s consider a live example, say Commonwealth Bank (ASX: CBA), which is a portfolio staple.

Commonwealth Bank pays 100% franked dividends.

The last dividend it paid from its after-tax income was $2.25/share. It has a corporate tax rate of 30% for the half year ended 31 December 2024.

This means the franked amount is $2.25 and the franking credit per share (aka the tax Commonwealth Bank already paid for the income before you received it) would therefore be $0.964.

You don’t need to calculate the franking credits yourself, your tax statement from the company or fund will include it for you to use in your tax return.

Where to find franked dividends

With many of the ASX200 already offering partially or fully franked dividends, you already have franking credits within your investment strategy – at least in your superannuation if not your own personal portfolio.

You can find a list of upcoming company dividends with the level of franking available at Market Index here.

Those focused on dividend yield can also use this screen to sift through yield and franking credits.

Investors should bear in mind that having the highest yield and offering 100% franking doesn’t necessarily mean a high-quality investment, or an investment that is suitable for your strategy, so it is worthwhile taking the time to truly analyse an investment.

Another way to start your research might be via looking into recent income picks from experts on Livewire.

For example, Reece Birtles from Martin Currie Australia is competing against ChatGPT for an income portfolio in the new round of the AI v Fundie series. Read more here.

His picks and the level of franking available follow:

- Medibank Private (ASX: MPL) – 100% franked

- Nine Entertainment (ASX: NEC) – 100% franked

- Telstra (ASX: TLS) – 100% franked

- APA Group (ASX: APA) – 13% franked

- Downer EDI (ASX: DOW) – 32% franked

Or, Morgan Stanley’s high-quality picks as outlined here, highlight a range of higher-yielding stocks (all bar one above 4.35% pa) and nearly all are fully franked.

If you choose to focus on franking credits strategies, keep on top of tax rules and keep your records up to date. As always, consider speaking to an expert to make sure a strategy and investment suits your portfolio, needs and goals.

4 topics

6 stocks mentioned

1 contributor mentioned