Are these 13 "High Quality" stocks the perfect ASX portfolio?

Each month the team at Morgan Stanley crunch the numbers on hundreds of ASX listed stocks, conducting what is known in the industry as “quantitative analysis”. Quantitative analysis uses mathematical and statistical models to understand, measure, and evaluate financial and investment data. It focuses on trends and patterns in the data to inform investing decisions.

Quantitative analysis allows an investor to rank stocks in their universe in various categories, e.g., return, value, quality, momentum, etc. Stocks can then be sorted/filtered by the investor's preferred attributes and hurdle rates – for example, to show only stocks in the top 10% of the universe with respect to certain value and momentum criteria.

Morgan Stanley’s proprietary quantitative model is called “MOST” and it has been shooting the lights out so far this year, returning 10.9% to the end of April compared to the benchmark ASX 200’s paltry 0.2%. MOST impressive!

While reading Morgan Stanley's April report on MOST's performance (Stock Ideas - A "Quantamental Approach", 7 May), one particular quantitative screen caught my attention. It consisted of a 13-stock cohort of ASX stocks described as “High Quality Stocks Preferred by MOST and Morgan Stanley Fundamental Analysts", where each stock is also rated “Overweight” by the firm.

The 13 stocks in alphabetical (ticker) order are:

- Eagers Automotive (APE)

- Accent Group (AX1)

- Coles Group (COL)

- Dicker Data (DDR)

- Data#3 (DTL)

- Endeavour Group (EDV)

- Fortescue (FMG)

- IPH (IPH)

- Pro Medicus (PME)

- Premier Investments (PMV)

- Redox (RDX)

- Telstra Group (TLS)

- Woolworths Group (WOW)

Most of the 13 in the list are household names, like Coles, Fortescue, Telstra, and Woolworths, but there may be a few you're not familiar with. To this end, I have compiled a ready reckoner of information on each of the companies below, including the area of the economy they operate in, a very broad overview of their business, as well as detailed 5-year financials including metrics on profitability, value, and dividends.

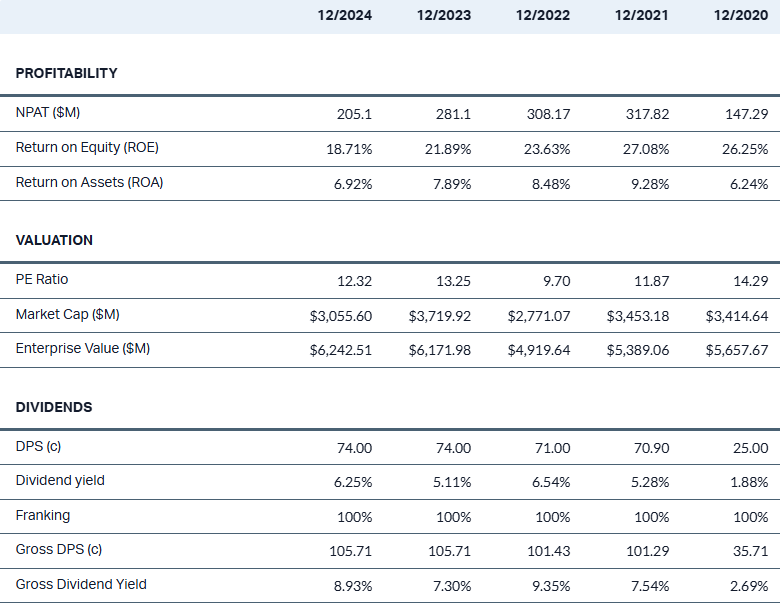

1. Eagers Automotive Ltd (ASX: APE)

Industry: Consumer Discretionary (Automotive Retail)

Operations: Operates a network of new and used car dealerships across Australia and New Zealand, representing various automotive brands.

5-year Financials:

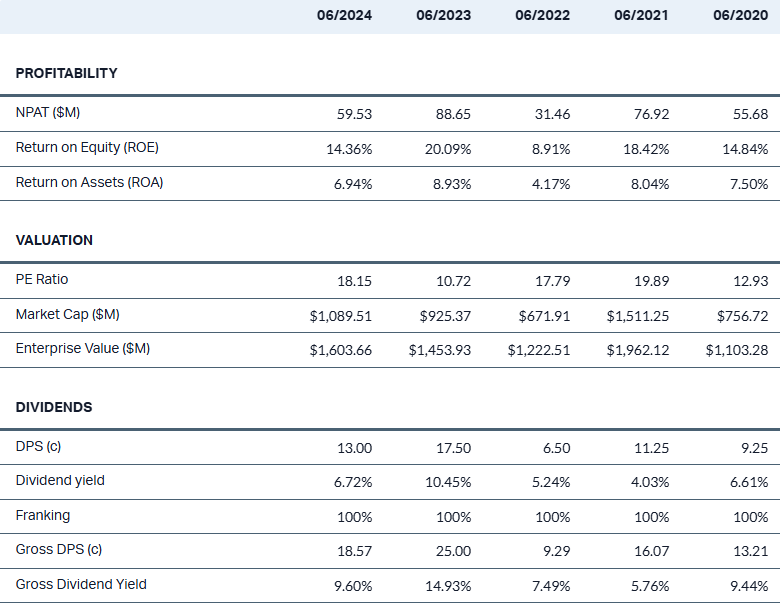

2. Accent Group Ltd (ASX: AX1)

Industry: Consumer Discretionary (Footwear and Apparel Retail)

Operations: Manages a portfolio of retail brands including The Athlete's Foot, Platypus, and Hype DC, with stores across Australia and New Zealand.

5-year Financials:

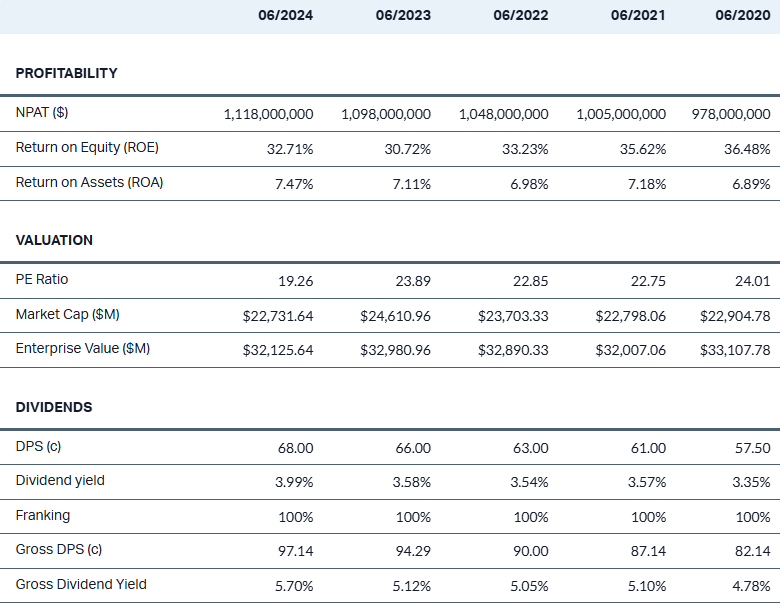

3. Coles Group Ltd (ASX: COL)

Industry: Consumer Staples (Supermarket Retail)

Operations: Operates over 800 supermarkets, Coles Express fuel and convenience outlets, and liquor stores across Australia.

5-year Financials:

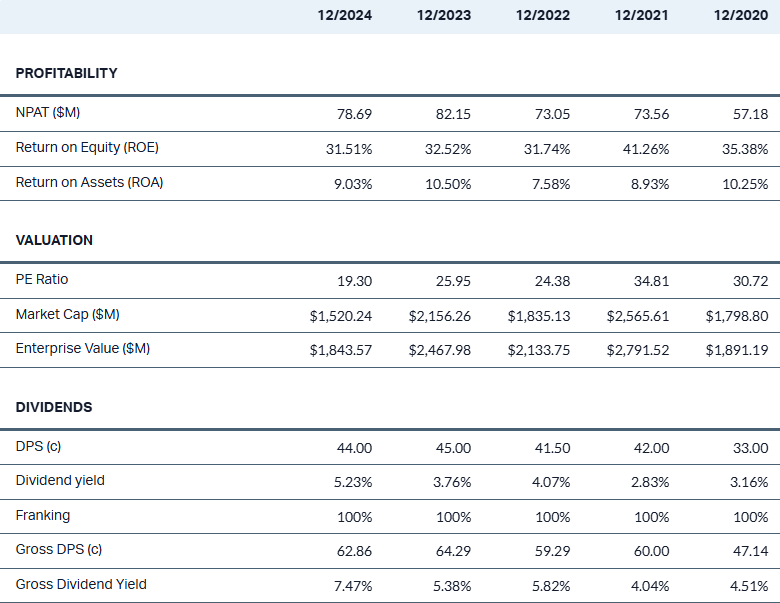

4. Dicker Data Limited (ASX: DDR)

Industry: Information Technology (Hardware, Enterprise Software Distribution)

Operations: Distributes hardware, software, and cloud solutions to IT resellers in Australia and New Zealand.

5-year Financials:

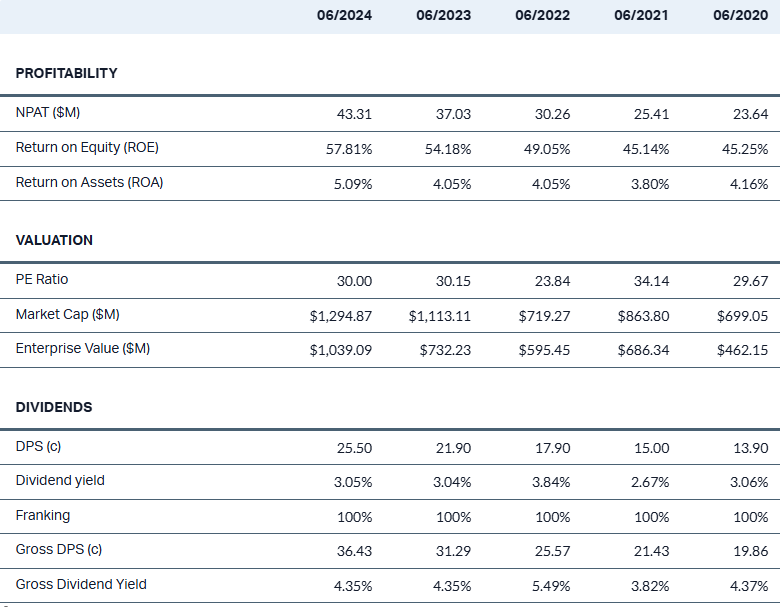

5. Data#3 Limited (ASX: DTL)

Industry: Information Technology (IT Services)

Operations: Provides IT solutions including cloud services, software licensing, and managed services across Australia.

5-year Financials:

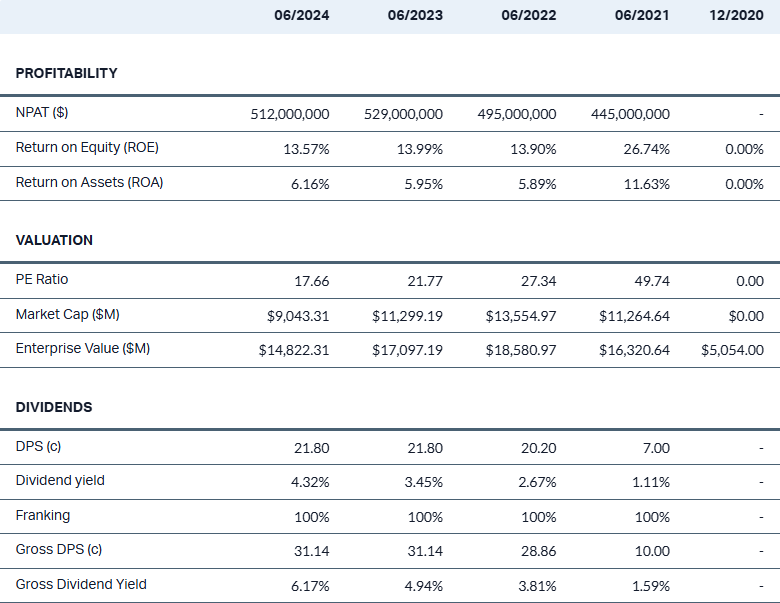

6. Endeavour Group Ltd (ASX: EDV)

Industry: Consumer Staples (Retail and Hospitality)

Operations: Operates liquor stores (Dan Murphy's, BWS) and hotels across Australia.

5-year Financials:

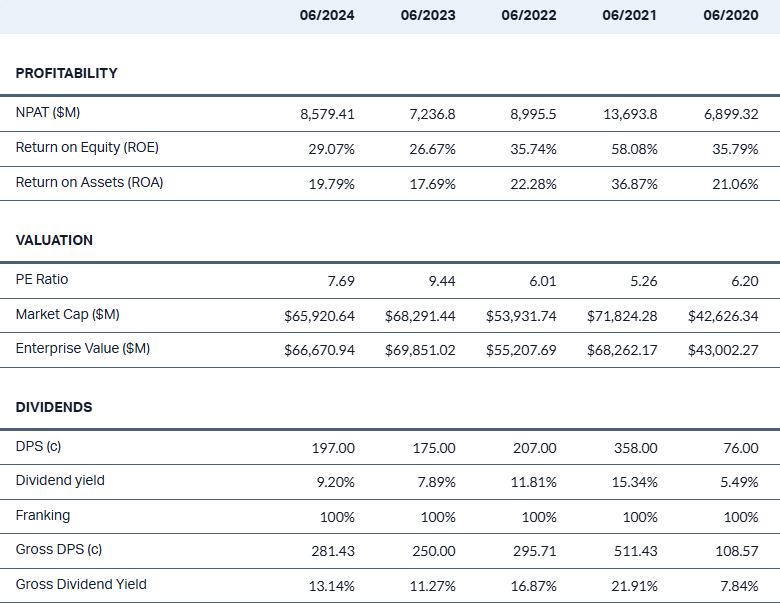

7. Fortescue Ltd (ASX: FMG)

Industry: Materials (Mining and Energy)

Operations: Engages in iron ore mining in Western Australia's Pilbara region and invests in green energy projects globally.

5-year Financials:

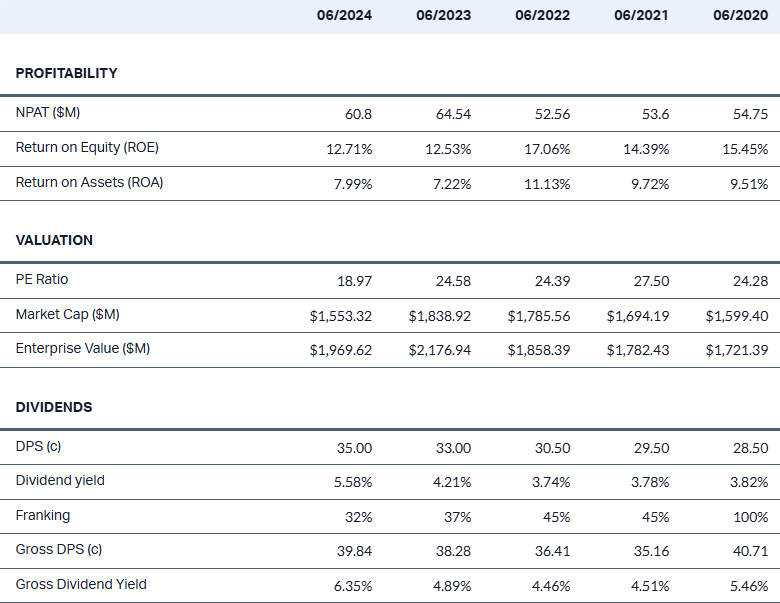

8. IPH Limited (ASX: IPH)

Industry: Industrials (Intellectual Property Services)

Operations: Provides IP services including patent and trademark filings across Australia, New Zealand, and Asia.

5-year Financials:

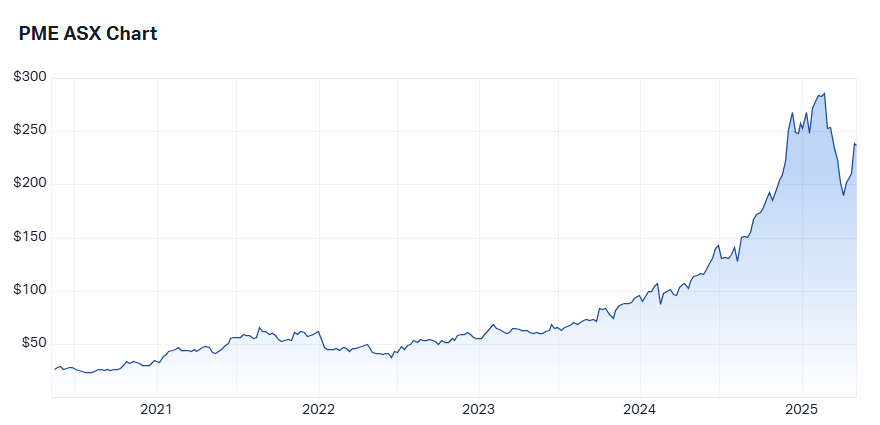

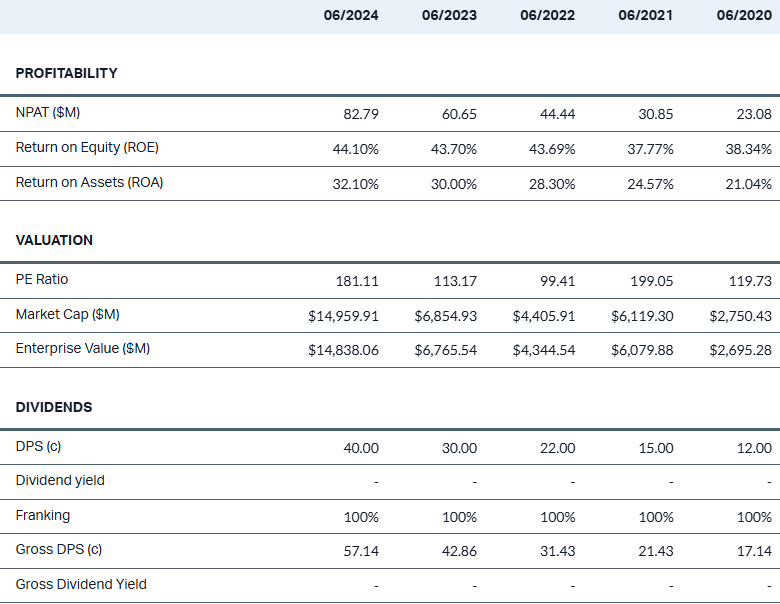

9. Pro Medicus Limited (ASX: PME)

Industry: Healthcare (IT, Software Solutions)

Operations: Develops and supplies radiology imaging software solutions, primarily in the US and Australia.

5-year Financials:

10. Premier Investments Ltd (ASX: PMV)

Industry: Consumer Discretionary (Retail Investment)

Operations: Owns retail brands including Smiggle, Peter Alexander, and Just Jeans, operating stores across Australia and internationally.

5-year Financials:

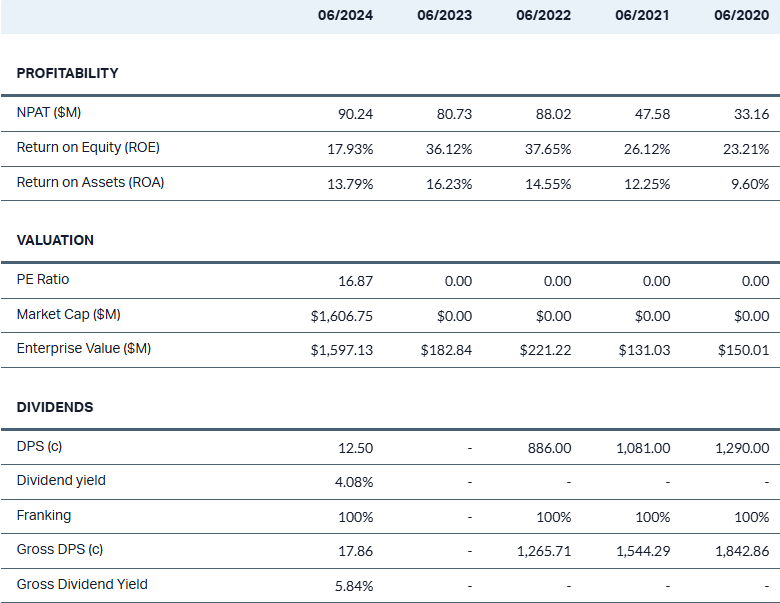

11. Redox Ltd (ASX: RDX)

Industry: Industrials (Chemical Distribution)

Operations: Supplies chemicals and ingredients to various industries across Australia, New Zealand, and the USA.

5-year Financials:

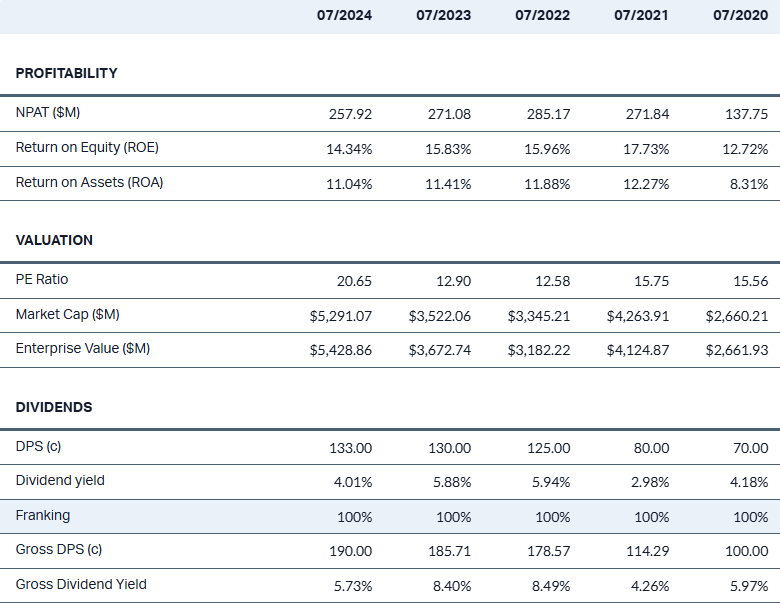

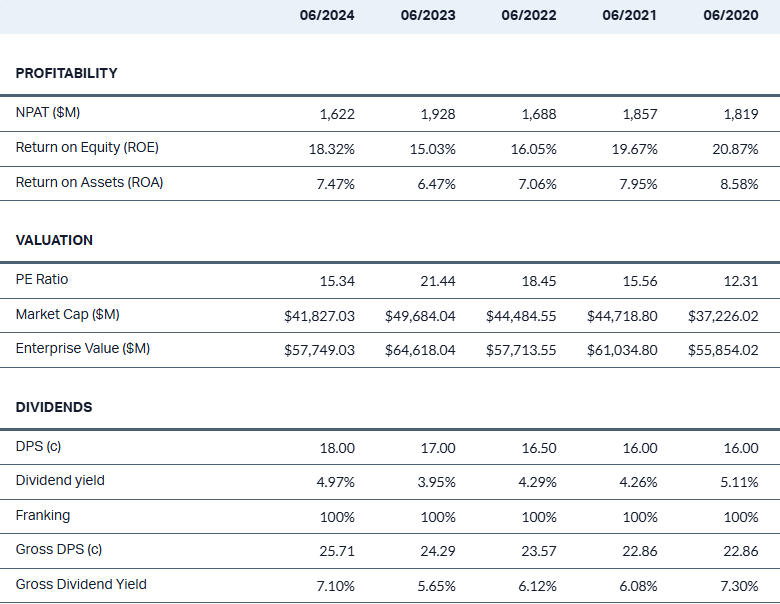

12. Telstra Group Ltd (ASX: TLS)

Industry: Telecommunications (Integrated Telecommunication Services)

Operations: Provides telecommunications and technology services across Australia and internationally.

5-year Financials:

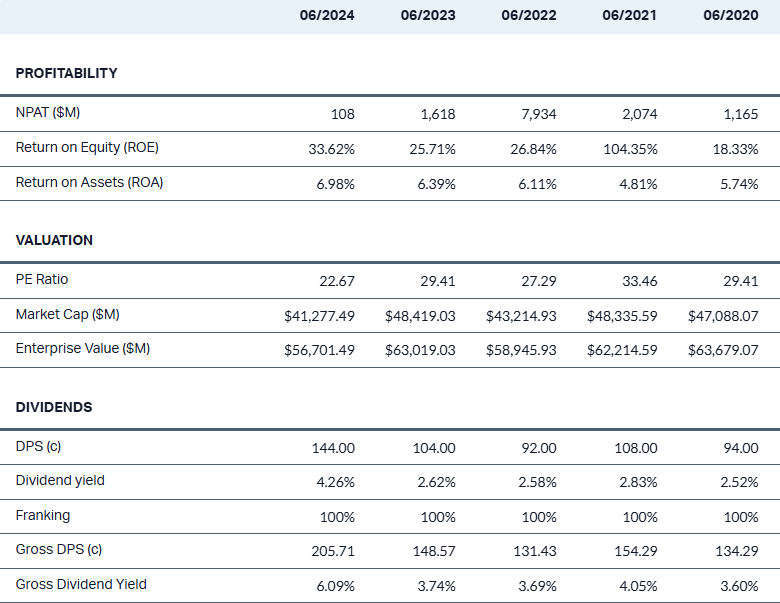

13. Woolworths Group Ltd (ASX: WOW)

Industry: Consumer Staples (Retail)

Operations: Operates supermarkets, liquor stores, and general merchandise stores across Australia and New Zealand.

5-year Financials:

Observations on the hypothetical portfolio

Is this the perfect starter portfolio for someone looking to commence investing today? The answer to that question is best found with your financial advisor, but we can make some very basic observations about it's suitability based on broad themes like diversification, style, and momentum.

The first thing I notice about this hypothetical portfolio, is that only seven out of the eleven major ASX Sectors Indices are represented, with no selections from the Energy, Financials, Real Estate, and Utilities sectors. So, it's possible you may wish to use this hypothetical portfolio as a starting point from which to add selections from these other areas of the market.

Of the sectors that are represented, there are three stocks from Consumer Discretionary and three from Consumer Staples – so nearly half of the hypothetical portfolio's exposure is tilted towards retail stocks in general – something to consider. The rest are roughly evenly spread across the remaining five sectors that are represented.

As for style, i.e., income, growth, or balanced, the portfolio seems to be fairly balanced with a mix of both mature, higher yielding companies, and higher growth, lower yielding companies. Certainly, with both major supermarkets COL and WOW, and TLS in the mix, there's a solid whack of stability. One could also add EDV here, but it's mix of liquor retailing and hospitality probably has it sitting more on the fence between defensive and cyclical.

On that point, companies like APE, AX1, and PMV are indeed highly cyclical, while possibly only DTL and PME could be classified as your typical high growth stocks. Industrial stocks like IPH and RDX generally also tend to be more cyclical rather than defensive in nature.

If we focus specifically on the income derived by the hypothetical portfolio, this is potentially where it really shines. All but one of the stocks pays a grossed up dividend yield in excess of 4.35% p.a. (this is the typical after-tax yield for an Australian resident tax payer). PME is the only non-dividend paying exception, but this is typical of high growth stocks of its nature. The trailing 12-month average grossed up yield of the hypothetical portfolio (assuming an equal allocation to each stock) is an impressive 6.65% p.a.

Finally, as a technical analyst, I would prefer that each stock in the hypothetical portfolio also shows a strong, but at least a developing, uptrend. In this regard, I have reservations about AX1, DDR, EDV, FMG, IPH, PMV, and RDX, although the short term trends appear to have stabilised for each except RDX. The strongest trends are shown by APE, COL, PME, TLS and WOW, and each of these meets my trend following criteria.

Is this the perfect ASX portfolio?

What's the perfect portfolio? That's easy: The one that not only beats the market but also exceeds your required return over the next 12-months. I am joking, of course. We can't know in advance what the perfect portfolio is going to be, but we can take advice from the experts, as well as conduct our own analysis of fundamental, style, and technical factors.

I'll let you decide where this hypothetical "perfect portfolio" sits based on the analysis presented here. Ultimately, however, the value you ascribe to this potentially ready made portfolio largely depends on how much stock you place in Morgan Stanley's quantitative analysis!

This article first appeared on Market Index on Friday 9 May, 2025.

5 topics

13 stocks mentioned