What Mattered Today; Santos - whats it worth now?

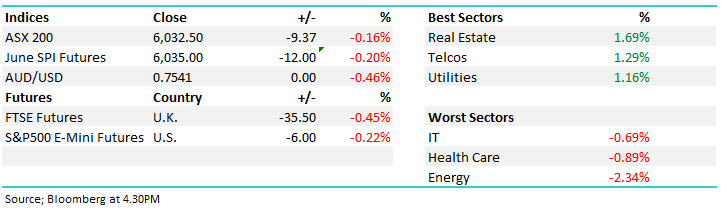

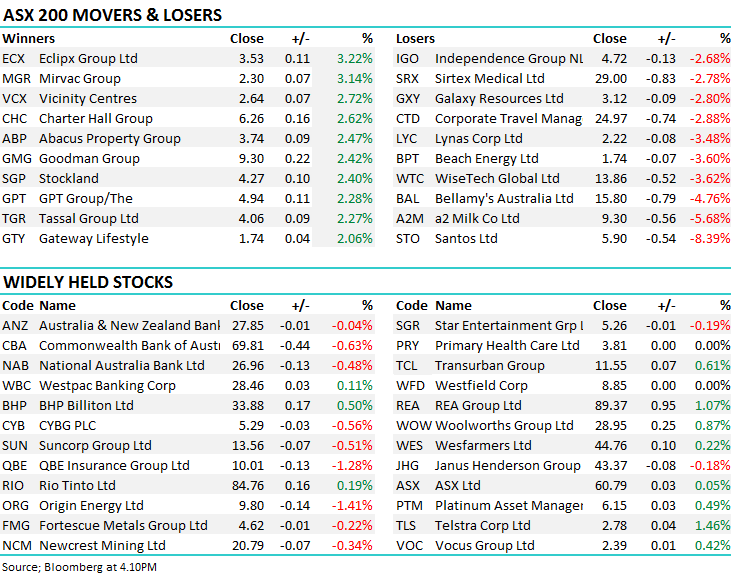

The index was choppy early, edging higher in the first hour before heading lower from at around 11am onwards which coincided with Santos resuming trade after snubbing the harbour bid. It was the real estate names that supported the market once again today with 7 of the top 8 performers in the ASX200 being REITs – Eclipx took out the top spot, catching a bid after we discussed it in today’s income report – click here to read. Along with the REITs, it was the other defensive sectors that were in favour today – even the Telcos lead by Telstra had a rare day in the sun! Energy was weak, driven lower mainly by Santos rejecting the Harbour Energy takeover over.

Overall, the market closed 9 points lower, -0.16% to 6035 points.

ASX200 Chart

ASX200 Chart

A quick rundown of today’s trade from James Gerrish – Direct From The Desk after market close today - CLICK HERE to VIEW

CATCHING OUR EYE

Broker Moves; Wilsons turned neutral on CSL as brokers continue to chase the stock higher. BWX downgraded to a hold at Shaw & Partners – likely pre-empting a move that hasn’t occurred yet closer to the $6.60 takeover offer – the offer/price target is now 13% higher than the stock price.

- Bapcor (BAP AU): Rated New Buy at William O’Neil & Co Incorporated

- BWX (BWX AU): Downgraded to Hold at Shaw and Partners; PT A$6.60

- CSL (CSL AU): Downgraded to Hold at Wilsons; PT A$181.34

- Growthpoint (GOZ AU): Rated New Neutral at JPMorgan; PT A$3.20

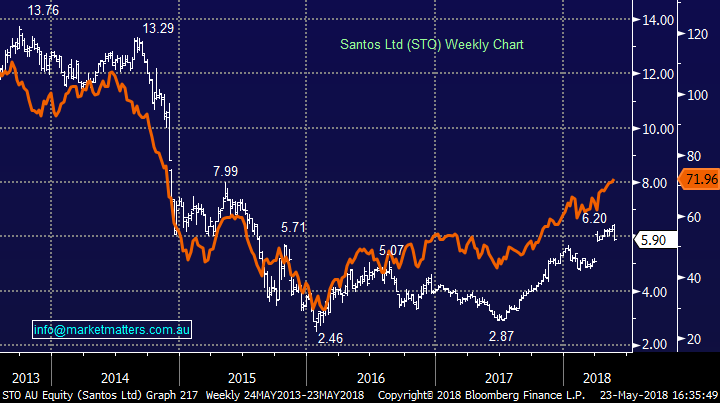

Santos (STO) $5.90 / -8.39%; last night the Santos board walked away from the Harbour Energy takeover offer of $7 and the stock got hit today fairly hard, although it could have been worse if not for a strong Oil price - the stock tumbling more than 8% in early trade and failing to recover throughout the session. The bid from US based group is said to be their final offer and the end of a lengthy process that started with a $5.30 bid back in November – the final bid was ~60% higher than the Santos price before the original bid and Harbour probably have every right to be peeved. Some will sight the last time Santos copped a bid in 2015, the price was at a similar level, $6.88, and after they rebuked it the stock traded to a low of $2.46 in 2016. The difference at this stage being a buoyant Oil price that has allowed STO to print more cash and pay off more debt than they thought possible.

Harbour also wanted a greater level of hedging while Santos wanted less. Seems like Santos might be bullish the oil price at current levels and that’s the reason why they stayed firm. It’s always dangerous to extrapolate current conditions out into the future – let’s hope STO have not just called the TOP!

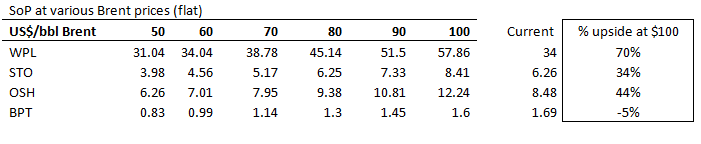

Oil price sensitivities

The above gives some idea around sensitivities to the Oil price and where STO should trade while the chart below overlays STO with the Crude Price .

Santos v Crude Oil Chart

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

1 stock mentioned