When coronavirus passes, EU solvency issues will emerge (again)

Earlier this week I published a wire in which one of Australia’s most experienced investors, Robert Millner, Chairman of Washington H Soul Pattinson, raised an important concern regarding the amount of debt corporates and governments will accumulate due to COVID-19.

“How do we repay all the massive amount of debt that’s going to build up? A lot of companies, a lot of governments have had far too much debt before this situation has arrived. To me that’s a great concern.”

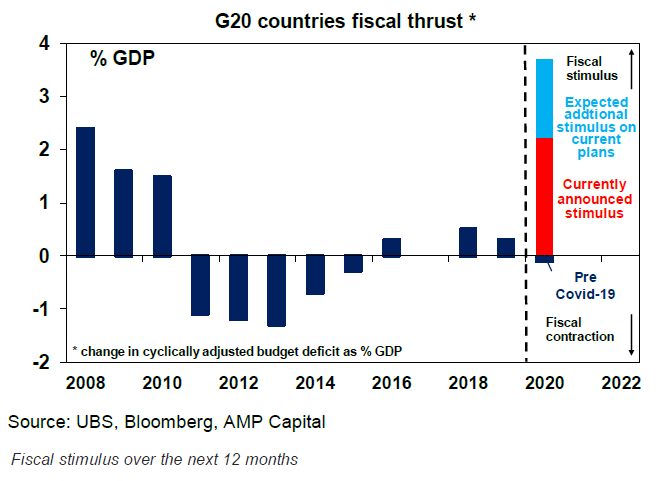

Robert's views struck with Livewire Markets readers, with several commenting that this is a real concern following on from the pandemic. To quantify, the chart below shows that fiscal stimulus spending is expected to be worth nearly 4% of the G20’s output this year alone, compared to ~2.5% in 2008. Schroders meanwhile observed that fiscal deficits in Australia, the UK and the US are set to reach World War 2 levels.

Fortunately, Australia entered the crisis from a position of fiscal strength. But even Treasurer Josh Frydenberg says taxpayers will be "paying for years to come" for the $213.7 billion worth of spending announced across the three stimulus packages so far, which will cause the national debt to swell to more than half-a-trillion dollars.

Remember the PIIGS?

Those invested in markets back in the early 2010s would remember the dreadful headlines and concerns around the ‘PIIGS’ - debt issues that were brewing in the economies of Portugal, Italy, Ireland, Greece and Spain – which threatened to shatter the euro, spark financial contagion in Europe and rupture global debt markets.

A series of IMF and EU bailouts - as well as forced restructures for the weakest economies and a pledge by the ECB to do “whatever it takes” to fix the problem - had seemingly put those issues to rest. But they were not permanently resolved.

So, what happens to those economies after coronavirus? Hamish Douglass, Chief Investment Officer at Magellan Asset Management, agrees that this is the “big question”. While it’s not a short-term concern, it’s something he's keeping an eagle eye on.

“Firstly, I'd say that this isn't today's issue. This isn't what we're grappling with today. We're very likely to be in a very prolonged period of near-zero interest rates.”

As he outlined here, most developed nations are taking on debt to compensate workers and businesses for the economic fallout resulting from COVID-19. Still, the demand shock would lead to a recession and substantial excess capacity in many economies and accordingly, interest rates and inflation would stay low for years.

“But on the other side of this equation, the debt burdens that many countries will be facing and you could think of some countries in Europe that already have high debt burdens … this could put very substantial market pressures on long term interest rates as well as market participants. Investors worry about the solvency of countries. This issue could again place very substantial pressures on the EU and on the euro. So in the short term to the medium term, inflation in many of our economies probably isn't the issue, but the debt burdens and the solvency of countries is becoming an emerging issue.”

What does it mean when bond rates rise?

Hamish says the only way to overcome a spike in longer-term interest rates is to “transfer the debt burdens to central banks via quantitative easing and maybe to specifically target longer-term interest rates”, pointing to Japan as an example.

From an investing perspective, Hamish prefers to stay in “safe-haven status” countries like the US, Switzerland, Denmark, UK, Singapore and “even possibly Australia” and avoid many others. (Note: Hamish made these remarks and covered more topics at a Magellan webcast on 1 April).

“Be very wary of emerging market currencies. And, you know, I think we do have caution around Europe in this situation. So it isn't the first issue on our agenda today. But as we think about portfolio positioning of where we want to be exposed, it is a relevant issue about which currencies you want to be in. As I mentioned, we've got pretty limited exposure to emerging markets outside of China and we may even take action to further reduce that risk through portfolio management.”

Mother of bear markets yet to come

Robert and Hamish's sentiments were echoed by the famous American investor Jim Rogers, Chairman of Rogers Holdings. But Jim, who co-founded the Quantum Fund with George Soros in the 1970s, expressed an even more drastic view in a recent Bloomberg interview.

“I expect in the next couple of years we’re going to have the worst bear market in my lifetime.”

While he believes the current rebound in markets may continue for a while following a bout of extreme pessimism, another bear market is around the corner because of a triple whammy of economic damage caused by COVID-19, substantial debt levels and interest rates that are low, which will cause indebted economies pain when they rise.

In such an environment Jim reckons quality stocks, especially those with low debt, are the ones that “people love the most because they don’t have to worry about bankruptcy". That's the approach that Magellan and WHSP have taken in their portfolio construction as well, a strategy worth taking note of given the potential trouble in debt markets down the track.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

5 topics

1 contributor mentioned