Why Baidu is undervalued and three more stocks ripe for picking

Livewire Markets

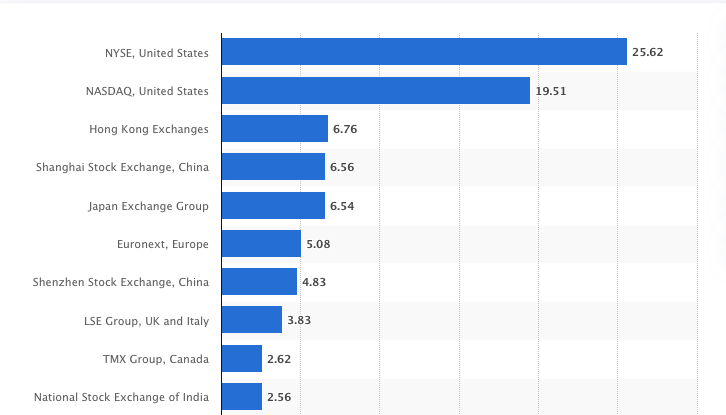

The Hong Kong exchange (Hang Seng) is the third largest in the world by market cap, which stands at a whopping US$6.76 trillion. This is behind only the New York Stock Exchange (NYSE) and the NASDAQ. China's two mainland stock exchanges Shanghai and Shenzen are also listed in the top 10 with market caps of US$6.56 trillion and US$4.83 trillion respectively.

Top 10 stock exchanges in the world by market cap (US$ trillion); February 2021

In the past two years, China has overtaken Japan as the leading Asian exchanges. Source: Statista.

While this makes for a bountiful territory for stock pickers, the tyranny of having too much to choose from means you might miss a golden opportunity. For the final part of this series, we asked Stephen Kam Investment Director, Asia ex-Japan equities, Schroders, Hong Kong, Nicholas Yeo director and head of equities - China from Aberdeen and the Ellerston Asia Team from Ellerston Capital for the most under-researched, under-valued or contrarian opportunities on the Chinese exchanges.

Trend-setters: the industrial revolution and decarbonisation in China

"In terms of strategy, we like industrials and upstream material names, as we believe these companies will benefit from multiple drivers," said Stephen Kam.

These drivers include:

- increased localisation

- international trade friction

- abundance of engineering talent for research and development

- increasing automation

- focus on climate change

"Green energy is a key growth theme," said Nicholas Yeo, "China needs to invest huge sums to meet its commitment to achieving carbon neutrality by 2060. Estimates range from US$6 trillion to US$16 trillion."

Yeo points to Nari Technology as the key examples of Beijing's move to greener pastures. Nari produces hardware and software for renewable energy sources.

"It's more of a solutions provider than equipment maker ... to uninitiated investors (Nari Tech) usually serves as a lightbulb moment in their realisation of its strategic importance in China," said Yeo.

"Strategic planners in Beijing have ensured that many of these companies - those in the 'value chain' of green industries - are located within China. That's why the country is already a world leader in the production of wind, battery and solar power," he said.

Kam also backs the green-trend, noting that electric vehicles (EVs) are going to benefit from China's focus on climate change and a greener economy.

"On the other hand," adds Kam, "banks remain our major funding source."

He notes Schroders has chosen to be underweight consumer staples and health care sector stocks due to stretched valuations.

Ellerston Asia: stock picks

Under-researched stock: By far the highest conviction in an under-researched stock is Contemporary Amerpex Technology Ltd (CATL).

CATL is the largest lithium-ion battery companies in the world with a market cap of $130 billion and $14 billion of total sales. It's listed as an A-share.

"The stock is trading at 64 times PE, which appears high in absolute terms, but earnings are growing at a CAGR of 40%, so the PEG ratio is still very reasonable," said Ellerston Asia.

Undervalued stock: Baidu is China's own version of Google, including a search engine and mapping platform. It also has a stake in a number of related businesses, including social app iQiYi, online travel company Ctrip, and rideshare platform Didi Chuxing.

Ellerston said it's only undervalued now because of the hit it took from fund manager Archegos' collapse back in March, when the stock price fell 23% and has since fallen nearly 50% off its high.

"At this level, Baidu is significantly undervalued. ... On a PE basis, the stock is trading at attractive 15 times 2022 PE with a forward earnings growth of over 20%. To get a large-cap tech company (market cap $65 billion)," they wrote.

"Finally, we use a forward SOTP (sum of the parts) methodology to ascribe value to Baidu's three major growth engines: Apollo (ADAS), EV and Cloud. These businesses are all loss making at the current time but have a significant long term potential."

With these factors in mind, Ellerston Asia puts the average price target for Baidu at $300.

Contrarian pick: The Hong Kong Exchange is one of the largest overweights in the Ellerston Asia Fund and they believe this is somewhat contrarian given the current political climate.

"The Hong Kong Exchange is trading at 32 times PE with EPS growth of over 30% for 2021. The company has excess capital and the is scope for a dividend increase. The new CEO Nicholas Aguzin starts soon, which could be a positive catalyst for the stock. The stock has fallen from high of almost HK$600 in February to its current price of HK$442, presenting a good entry point," they wrote.

The conviction comes from the high levels of IPO activity and a strong pipeline for future listings on the Hang Seng.

"The pipeline for 2021/22 is robust with multiple mega-cap listings on the cards, including Bytedance (owner of TikTok), Didi and the much anticipated resurrection of the Ant Financial IPO."

In 2020, there were 1,415 IPOs globally, of which 52% were Asia-Pacific IPOs compared to 36% from the US.

Related articles:

All responses for this series were provided in May 2021.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Four reasons to register for Livewire’s 100 Top-Rated Fund Series

Livewire’s 100 Top-Rated Fund Series goes live on 1 June 2021. Register now if you want:

- To get first access to a list of Australia’s 100 top-rated funds

- Detailed fund profile pages to help you compare performance, fees, and philosophy

- Exclusive in-depth interviews with expert researchers from Lonsec, Morningstar and Zenith.

- One-on-one videos and articles with 16 of Australia’s best fund managers

3 topics

3 contributors mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...

Expertise

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...