Why do you pay attention to financial forecasts?

It’s that time of year when inboxes get flooded with 2019 economic and financial market forecasts. As the CFA institute points out, at the beginning of 2018 the median analyst forecast for the S&P 500 calendar year return was +10.3%. The actual result ended up being -6.2%.

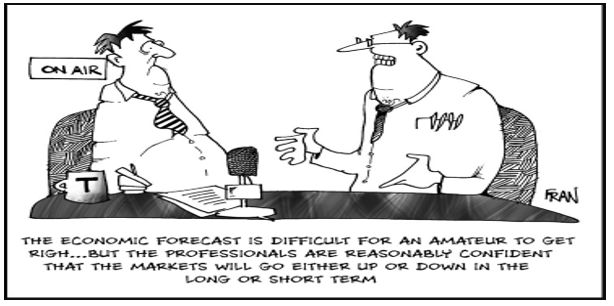

Forecast errors of this magnitude are not an outlier, they are very much the norm.

The institute notes the median analyst forecast for S&P 500 returns has been wrong by over 10% in 13 of the last 20 years. Even when just forecasting whether the market would be up or down, they were only right in 9 out of 20 years. A coin toss would, on average, have produced better results.

The fact that equally well qualified forecasters, with access to the same information, can come up with very different forecasts is an obvious warning of the inherent UNpredictability of what they are trying to predict.

What’s particularly strange is the amount of attention given to the release of every new economic statistic, such as GDP or employment data. The financial media and even some of the market experts (who should know better), react to every new economic release even though there are large margins of error in their measurement and they are often revised significantly in subsequent months.

For example, one of the closely followed and widely forecast economic indicators is the employment data released by the Australian Bureau of Statistics (ABS). Every month the financial press asks experts for their forecasts ahead of the numbers and then follow with breaking news headlines as soon as the number is released.

The December ABS employment report showed the economy adding 37,000 new jobs between October and November, and was followed by headlines like this – “Employment jumped by 37,000, nearly double the level expected …” – which imply a noteworthy deviation from forecasts.

What they don’t report is the fine print in the ABS release, which basically says the reported number is just the ABS’ best guess and there is a 95% chance that the true number lies somewhere between a loss of 23k jobs and a gain of 98k jobs.

This margin of error is so wide that they don’t even know for sure whether the economy added or lost jobs. Yet so much attention is still given to forecasting things like this, that can’t even be measured with precision today.

To give some context on how subjective the data measurement is, in 2015 the former head of the ABS said this in relation to the ABS labour force report;

“The results of the last six months aren’t worth the paper they’re written on …”

This demonstrates how hard it is to even measure what’s already happened, let alone to try and predict it in the future.

There is a long history of evidence showing there’s no point paying attention to financial forecasts, other than purely for entertainment purposes – like visiting a fortune teller. Yet, we still have entire industries of well-paid experts who put lots of time and effort into carefully constructing forecasts … and stranger still, people still pay attention to them despite their consistently bad track records.

So how can forecasters keep getting away with churning out a dubious product? For the same reason reality TV and gossip magazines still, exist … because there is demand. People keep asking for them.

And, why is there persistent demand? Perhaps our evolutionary past is to blame, having hard-wired us to fear uncertainty.

Imagine your ancestors wandering around in the wild just trying to survive. In that world, uncertainty correlates highly with danger and that hard wiring has carried through in most of us to the modern day.

A 2016 study published in the journal Nature found our aversion to uncertainty is so strong, it causes even more stress than knowing for sure that something bad is going to happen.

We crave certainty so much that even the illusion of certainty makes us feel better.

Forecasts of all kinds act as a kind of security blanket, offering psychological protection against our innate fear of uncertainty. As the author Nassim Nicholas Taleb says;

“Forecasting by bureaucrats tends to be used for anxiety relief rather than for adequate policy making”

That evolutionary instinct served our ancestors well, but in our modern context often leads to sub-optimal decisions.

From our experience, trying to predict market direction or whether interest rates are going up or down is not a reliable source of returns … which is why we don’t bother.

Instead we focus on relative value opportunities arising from market inefficiency, which have a high probability of positive returns, irrespective of the future direction of markets.

Sometimes these opportunities arise precisely because market participants, emboldened by a strong consensus of expert forecasts, cause pricing in a particular segment of the market to become highly skewed in one direction, at the expense of severely under-pricing all the other possible scenarios that could play out.

For example, through most of 2018 the consensus view of the forecasters was heavily skewed towards US interest rates continuing to rise, and this was reflected in market pricing. But in just the last few weeks that abruptly changed, with markets now pricing US rate cuts.

These types of situations create favourably asymmetric investment opportunities that take advantage of future uncertainty being underestimated and therefore under-priced.

In other cases, consensus forecasts just extrapolate current conditions far into the future due to the prevalence of recency bias, which also creates attractively asymmetric opportunities, irrespective of market direction.

Examples of these can be seen in the pricing of interest rate volatility.

So, the next time you hear an ‘expert’ forecasting stock market returns, interest rates, house prices, or anything else, fight your evolutionary instincts and take it with a giant grain of salt. Regular salt will do … no need for the fancy pink Himalayan umami essence cold smoked variety.

Never miss an update

Stay up to date with the latest news from Ardea by hitting the 'follow' button below and you'll be notified every time I post a wire.

Want to learn more about Ardea's expertise? Hit the 'contact' button to get in touch with us or visit our website for further infomation.

3 topics