Why Rudi is hoarding 18% cash as reporting season fires up

Six months can feel like a long time in markets. Cast your mind back to August 2022... The RBA was in the midst of an aggressive rate hiking cycle having delivered its third consecutive 50 basis point hike. Inflation hit an annualised rate of 7% in Australia and the ASX200 bounced around 10% after a painful and volatile first half of the calendar year.

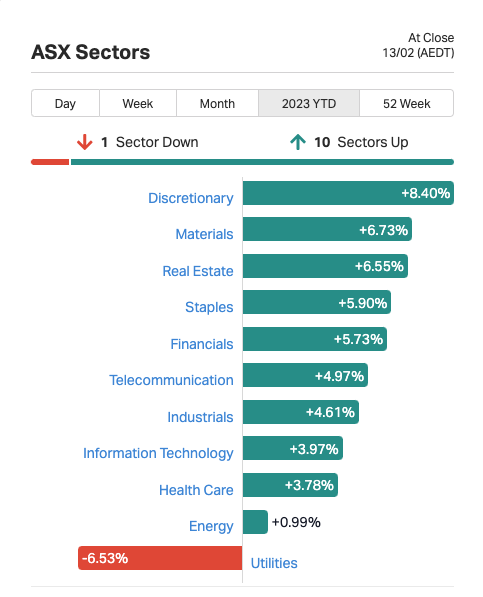

Since then, things seem to have gotten a bit better. The pace of interest rate hikes and inflation has eased, with the yield on US 10-year treasuries peaking in late October. The ASX200 gave up nearly all of the gains mentioned above before staging a 17% rally from the lows of October 2022 to the recent highs in early February.

The strength in local equities was initially fuelled by buoyant commodity and financial sectors - both of which are well-owned by local investors. More recently the laggards of 2022, basically everything bar utilities, have joined the good times.

While it appears that markets are looking through some of the big issues of 2022, that doesn’t mean things are about to get easier for investors in the local share market, according to FNArena’s Rudi Filapek-Vandyck.

Early reports from the February reporting season indicate that market expectations for company results are high and there is an early trend to sell stocks even if the results are good. Rudi’s analysis of the first round of reports found that the vast majority of stocks finished lower on the day of reporting. The common denominator has been cost inflation, according to Rudi.

It is because of this early trend and a belief that the inflation story of 2022 is not fully resolved that Rudi is hoarding an 18% cash position heading into the February reporting season.

“I expect the reporting season will be brutal at times and that means you can jump on opportunities as well,” Rudi said

As I have done for the past few years, I sat down with Rudi to get his views on some of the big trends in markets that are playing out right now. Specifically, we touch on the rally in speculative sectors, the strength in commodities and how he is positioning his portfolio.

I also asked Rudi to share some of the stocks he is following closely and what it would take for him to put that cash balance to work.

Topics discussed

- 0:00 - Introduction

- 0:45 - Is this a bear market rally or the start of a longer trend?

- 3:09 - A look at the buoyant commodities sector

- 7:42 - Rudi’s current cash levels

- 8:45 - Why Rudi remains sceptical on markets

- 10:39 - Explaining the rally in the laggards of 2022

- 12:40 - Early trends in reporting season

- 15:33 - The stocks Rudi is following closely

- 21:14 - What will it take for Rudi to turn bullish?

Note: This video was recorded on Wednesday the 8th of February 2022.

Stay up to date with Rudi's analysis this reporting season

Rudi will be publishing FNArena's Reporting Season Monitor each Friday during reporting season. The Monitor reports ratings, consensus price target changes, and brief summaries of the collective responses from FNArena's database of brokers for each of the stocks covered.

Follow Rudi's profile and set your alerts to be notified when new updates are available.

1 topic

3 stocks mentioned

1 contributor mentioned