Why the ASX is actually outperforming its global peers in 2023

All is not what it appears to be, in particular not in financial markets today.

At face value, it seems US equities are well and truly on their way to wiping out last year's negative performance with the S&P500 gaining 7.7% and the Nasdaq recovering by nearly 17% since January 1st.

Both strong numbers suggest US equities are back on track to seemingly doing what they do best: outperforming most of the rest of the world, including the Australian share market, while climbing the proverbial Wall of Worry.

But look under the hood and virtually all those gains stem from a small group of index heavyweights only. Unless investors own an index tracking ETF, missing out on one or two of the world's largest companies means the year-to-date experience probably looks a whole lot less positive.

Which opens up the logical debate: is the US really outperforming when it's done through a handful of megacaps only? With large swathes of US equities deep under water still, it can just as easily be argued last year's bear market is still alive and rolling on.

To add a little more juice to that latter argument, consider small caps in the US are still trading in negative territory year-to-date, as well as from twelve months ago, and so are all kinds of micro-cap measurements as published by index provider Dow Jones.

In contrast, the situation in Australia has been a lot easier to navigate for investors. Small caps and micro-cap stocks in Australia are equally still waiting for liquidity to return, but at least most large caps on the ASX are participating in this year's positive trend.

It's not difficult to back up those observations with some real-life stats: since January 1, the ASX200 is up 2.5% (week ending May 5), but those gains stand despite banks losing -7% and the energy sector trading more than -5% lower.

Admittedly, most income-hungry investors do own bank shares, likely more than they should, which makes these observations rather subjective, I agree.

One tool that is available to avoid your typical index-related shenanigans is to look at equal-weighted indices. S&P Dow Jones has one each for the US and the Australian market. The first one is up 1.19% year-to-date and down -3.64% over twelve months. The second one is only down -2.62% from a year ago and up 4.84% since the start of 2023.

Take away the "perception" and it can just as easily be argued Australia is winning the race thus far in 2023.

Equally worth highlighting: if it wasn't for a solid rally on Friday, US equities without the skew of a few megacaps wouldn't even be up for the year to date.

Just goes to show the all-importance of face value appearances, and how they guide our views and conclusions.

Head Up/Head Down

As is typical at these market junctures, human eyes are inclined to see what they want to see.

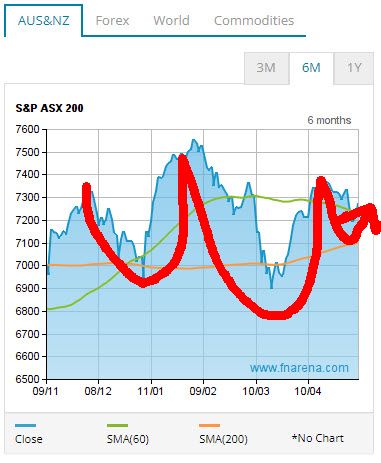

With uncertainty dominating and markets in general showing more resilience than many had expected, one of the popular chartist views on equities is that indices are forming a so-called Head-and-Shoulders formation, which, if confirmed, serves as a precursor to the next wave of selling, taking indices possibly down to last year's low.

Of course, that is one possibility and those who pay religious attention remain on alert. The other possibility is indices can equally still carve out a so-called inverse Head-and-Shoulders, which is the same formation but upside down, and this would be a very positive signal, if it comes to pass.

Take your pick, which is not unusual given the time of the year, the many opposing narratives and market forces, and the variety in scenarios that still lay on the table for the quarters ahead.

A Crisis To Bank On?

One thing that has had me puzzled recently is the resilience shown by US markets.

Not only has the prospect of economic recession not suddenly evaporated (I still see quite the number of economists insisting their modeling continues to point towards negative GDP growth) but the USA is also, yet again, facing another nasty banking crisis.

According to some expert insights on the sector, nearly half of the country's 4800 banks have by now burnt through their capital buffers and are running on negative equity.

Under US accounting rules, the banks are not required to mark to market and reveal to the outside world the extent of their capital losses, but somebody, somewhere, sometime will have to compensate for the mismatch between capital and liabilities. As this is predominantly caused by negative movements in US bonds, lower interest rates might just be what the doctor ordered in the not too far out distance.

A Hoover Institution report recently stated more than 2315 US banks now have assets worth less than their liabilities. Total market value of these banks' loan portfolios is -US$2trn below the published book value.

These are not just small-cap, regional lenders only. According to the Hoover report, that troubled basket includes one globally systemic entity with assets of over US$1trn, plus three other large-sized banks.

The Federal Reserve just added 25bp in extra burden for its domestic banks. All this once again confirms my view that forecasting what is likely to occur is difficult, but forecasting what the response from financial markets will be is a completely different matter.

I think institutional investors in the US are all too aware of the depth and the complications of this year's emerging banking crisis. They also expect the Fed and the US government to stand ready and be the cavalry once again that comes rallying over the hill when defence walls are about to break.

This, I believe, is why US bond futures are suggesting the Fed will be cutting interest rates and reverting back to stimulating the economy in a few months from now.

US bonds are suggesting three rate cuts before year-end. Meanwhile, very unsurprisingly, the S&P500 Regional Bank index has sunk to its lowest level since March 2020, when covid panic was all the rage.

US banks and commercial property also received a mentioning from Charlie Munger and Warren Buffett at Berkshire Hathaway's annual Omaha gathering over the weekend.

I think everyone's aware of the problems, but nobody knows what follows next or how the next crisis will be prevented or dealt with.

Under different circumstances, in a different context, this level of uncertainty, with real prospects for calamity, would be sufficient to start selling stocks. Not this time. Today we trust the authorities will act swiftly and decisively, and on time.

Other positives supporting this year's resilience are the peak in official interest rates is near, with inflation on the way south, and a net positive performance from US companies this quarterly reporting season (circa 85% has reported).

While the end of central bank tightening can be a positive for equities -with the emphasis on 'can'- the all-important factor that is still missing is whether there follows an economic recession or not. The positive thesis is built on the premise there won't be a recession. If this is false, any rally post the Fed pausing will be short-lived.

For obvious reason. History suggests the second condition is non-negotiable.

As far as US corporate results are concerned, performances have on balance beaten forecasts, with the market average EPS growth improving to -2.9% from -6.7% at the start of the current quarterly season.

While this is noticeably better-than-expected, the more appropriate definition might be better-than-feared. The outcome is still negative, leaving the choice to investors: half-full or half-empty?

The US government approaching its debt ceiling over the weeks to follow is a clear and present danger to markets, but given history shows there's always a deal agreed upon at the very last moment, markets might just take this in their stride this time. Unless things really run out of control. (One would hope not).

Other factors that are potentially making a contribution too include:

-Market positioning; multiple indicators are suggesting investors are already lightly positioned on equities, with a defensive skew and lots of cash on the sidelines

-Economic data are still relatively resilient

-Short covering; last week's rally in regional banks is one prime example, but surely megacap profits beating forecasts has been a positive factor this season

-Bond markets; lower bond yields are now treated as a positive for valuations for technology companies and so-called long duration assets (think REA Group in Australia)

-Liquidity: the Federal Reserve has been providing additional liquidity when the downside was beckoning

Ultimately, none of these positives will matter much if authorities will not be able to contain the US banking crisis or prevent the US economy from slowing into negative growth in the quarters ahead.

Australia's Confession Season Can Hurt

Over in Australia, where the chances for banking calamity and economic recession are notably lower, the irony is corporate profits seem more vulnerable. See profit warnings from AdBri (ASX: ABC), Amcor (ASX: AMC), Ramsay Health Care (ASX: RHC) and Synlait Milk (ASX: SM1) recently, while margin vulnerability is also the key word that dominates the local bank results.

Here the notable observation is that both AdBri and Amcor shares seem to have encountered solid buying interest once the bad news was out in the open and the share price punishment in the past, but not for the latter two.

Close to half of ASX-listed companies worth following need a solid second half to meet forecasts in August. This almost by definition means there will be more downward guidances and confessions in the weeks ahead.

Which is one major reason as to why the FNArena All-Weather Model Portfolio is still happily sitting on 23% in cash, with no urge to allocate it in a hurry.

Even Jun Bei Liu, lead portfolio manager for the Tribeca Alpha Plus Fund, in a column for the Australian Financial Review on Monday titled 'Why Australian equities are set for a strong rally', anticipates the coming months will see ASX-listed companies fessing up that sales and momentum have slowed down.

Her advice to investors, however, is not dissimilar from what has been written down in these Weekly Insights on numerous occasions: look for good-quality businesses at cheaper prices in the volatility that may well continue for longer.

Bei Liu specifically mentions a2 Milk (ASX: A2M) and Xero (ASX: XRO).

Stock pickers at Wilsons like Aristocrat Leisure (ASX: ALL), CSL (ASX: CSL) IDP Education (ASX: IEL), Qantas Airways (ASX: QAN) and Worley (ASX: WOR).

One thing I agree with Bei Liu & Co is that further weakness in the months ahead should provide investors with great buying opportunities on a medium-to-long-term horizon.

FNArena offers impartial, independent and ahead-of-the-curve market commentary and analysis, on top of proprietary tools and applications for self-managing and self-researching investors. The service can be trialed at (VIEW LINK)

5 topics

11 stocks mentioned