10-Year anniversary of the Forager International Shares Fund: Reflections and plans for the future

Last week we passed an important milestone: the 10-year anniversary of the Forager International Shares Fund.

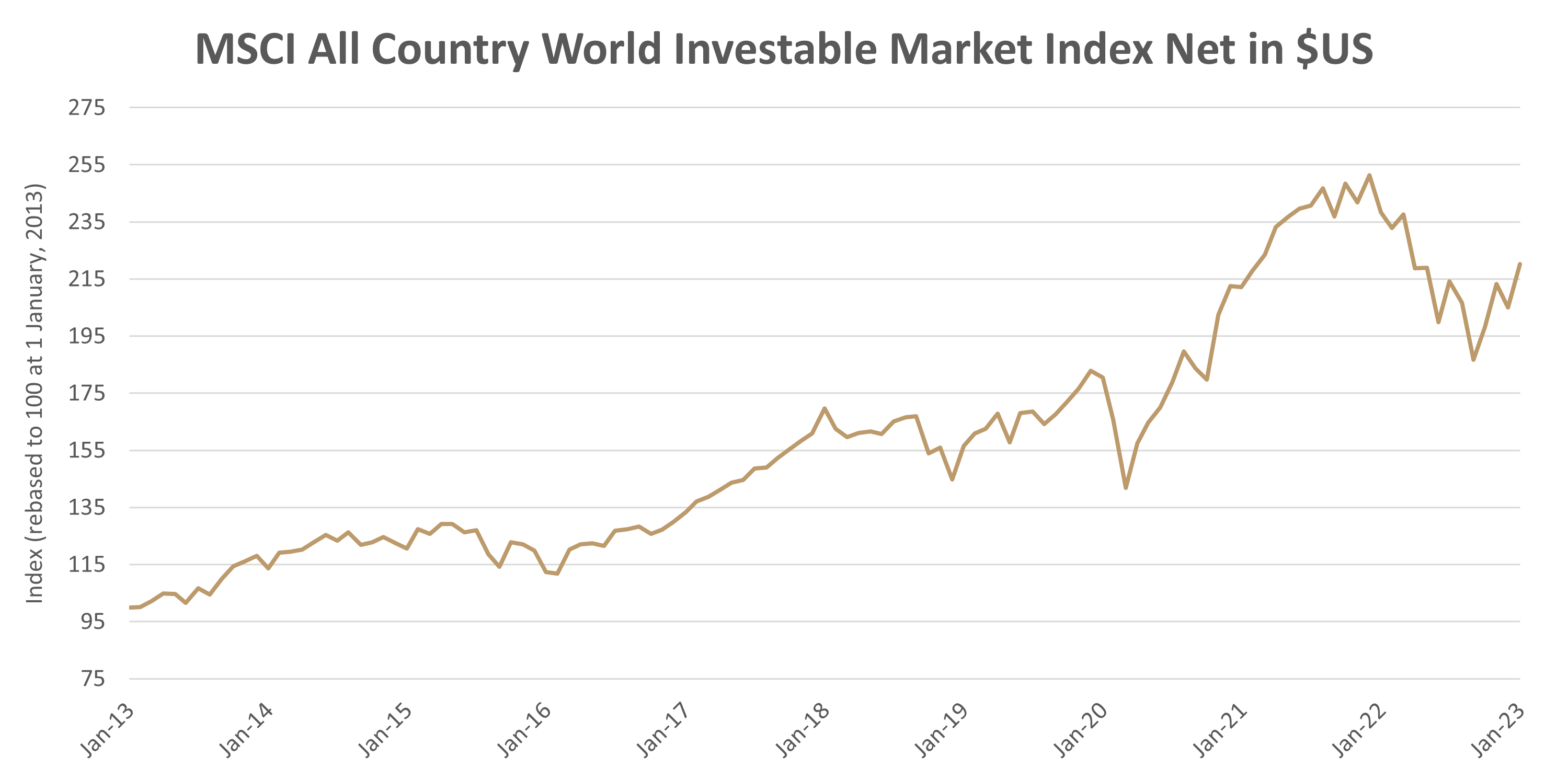

It has been an eventful first decade for our foray into international shares, marked by multiple significant market contractions. Measured in US dollars, the MSCI All Country World Investable Market Index, against which we measure ourselves, suffered peak to trough falls of 14% in 2015/16, 15% in 2018, 22% in early 2020 and 26% in 2022.

We saw Donald Trump come and go, Britain leave the European Union, Western governments issue bonds at negative rates of interest and most of the world locked inside their homes to mitigate the spread of a coronavirus.

A perfectly normal decade of returns

For all of the turmoil, the end result has been pretty close to what investors could have expected a decade ago. When measured in local currency, the index has returned a touch under 10% per annum over the period. Index investors in Australian dollars have done better, 12.4% per annum, thanks to currency depreciation over the period (The Aussie was buying more than one US dollar when we launched the fund, the main reason we were in a hurry).

These are perfectly normal returns from investing in equities - long-term returns average 8-10% per annum in Australia and the US. And the power of compounding is really starting to work. A decade of returns of 11% per annum means you have more than tripled your money.

You could have achieved all of that in a low-cost index fund, though. Our job is to make our clients more than the index. A decade in, we haven’t quite achieved that. As of the end of January 2023, $100k invested with us at inception was worth $290k, thanks to a compound annual return of 11.3% per annum. That’s about 1.1% per annum worse than the index.

While it’s far from a disaster - Forager’s stock performance has been a bit better than the index, offset by base and performance fees - the next decade needs to be better. That comes down to a few key tweaks.

The DNA of a funds management business

Forager started with me and my investment approach. Most of which was in my head. That deep contrarian approach had benefits (huge winners from deeply unloved stocks like RHG and Service Stream) and shortcomings (deeply unloved stocks that went bust, like Freedom Insurance).

I recognised this fairly early and knew, especially as we grew and started running more than one fund, that we needed different skills and experience on the team. This could compensate for some of the shortcomings and give us better portfolio returns.

But I didn't realise early enough that we really needed to get the philosophy out of my head and make it a part of our organisational DNA. You can have lots of different strengths in the boat, but you all need to be rowing in the same direction, especially in times of stress.

We have had our research process written down for a long time. It contains everything you need to understand to value a business. Process, though, is different to philosophy.

I’ve always said the why is more important than the what. The work needs to get done to deeply understand as many businesses as possible. But the money gets made by buying them when everyone else is panicking. Understanding when to pull the trigger and why was something I was doing intuitively.

I've spent much of the past 12 months getting that intuition into a written form. What should a great opportunity feel like? How do we position ourselves to best take advantage of them? I want to see us more conservative in buoyant times and more patient when things start to unravel. Consistently, across the whole organisation.

It’s easier said than done, of course. But if we are going to succeed, it needs to be this coming decade. I'm turning 45 years old in a few weeks' time and will be 55 when reflecting on the 20-year anniversary. It took some time to settle on the right team, but the four of us working on this fund are close to four years together. We are managing a relatively small amount of money. This is the no-excuses decade, or else index funds it is.

Access a unique portfolio of global shares

If you share our passion for unloved bargains and have a long-term focus, Forager could be the right investment for you. Click 'FOLLOW' below for more of our insights.

For all of Forager's latest content, videos, podcasts and fund reports, register here.

4 topics

.jpg)

.jpg)