3 charts (and 4 investments) to help navigate a new market era

Inflation poses a real risk to investors, chipping away at both the cash in their pockets as well as their investment returns. Worse still, for investors to outperform in an inflationary environment, their returns need to be higher than the rate of inflation.

That might be hard, particularly when you consider that over the 12 months to June, Australia's consumer price index rose 6.1%. Meanwhile, US CPI data for the 12 months to August is currently sitting at a whopping 8.3%.

For some context, the S&P/ASX 200 has fallen more than 11% and the S&P/ASX 200 A-REIT Index is currently more than 26% in the red year to date. In that same time period, the yield on a 10 Year Australian Government bond has lifted by more than 105%.

So how do you outperform inflation? And which charts are fund managers watching to keep them on the straight and narrow?

In part two of this special Income Series panel, Livewire's Ally Selby was joined by Plato Investment Management's Dr Don Hamson, Dexus Asset Management's Pete Morrissey and Realm Investment House's Robert Camilleri for a look at the headwinds that have been missed by the market, as well as the charts, stocks and investments they have in their back pockets to navigate the challenging market environment ahead.

Note: This interview was recorded on Wednesday 31 August 2022. You can watch the video or read a written summary below.

Related investment products

The funds below are managed by the guests in this panel session. Click on the fund name to learn more about performance, process and fees.

Dr Don Hamson: "Don't forget the franking!"

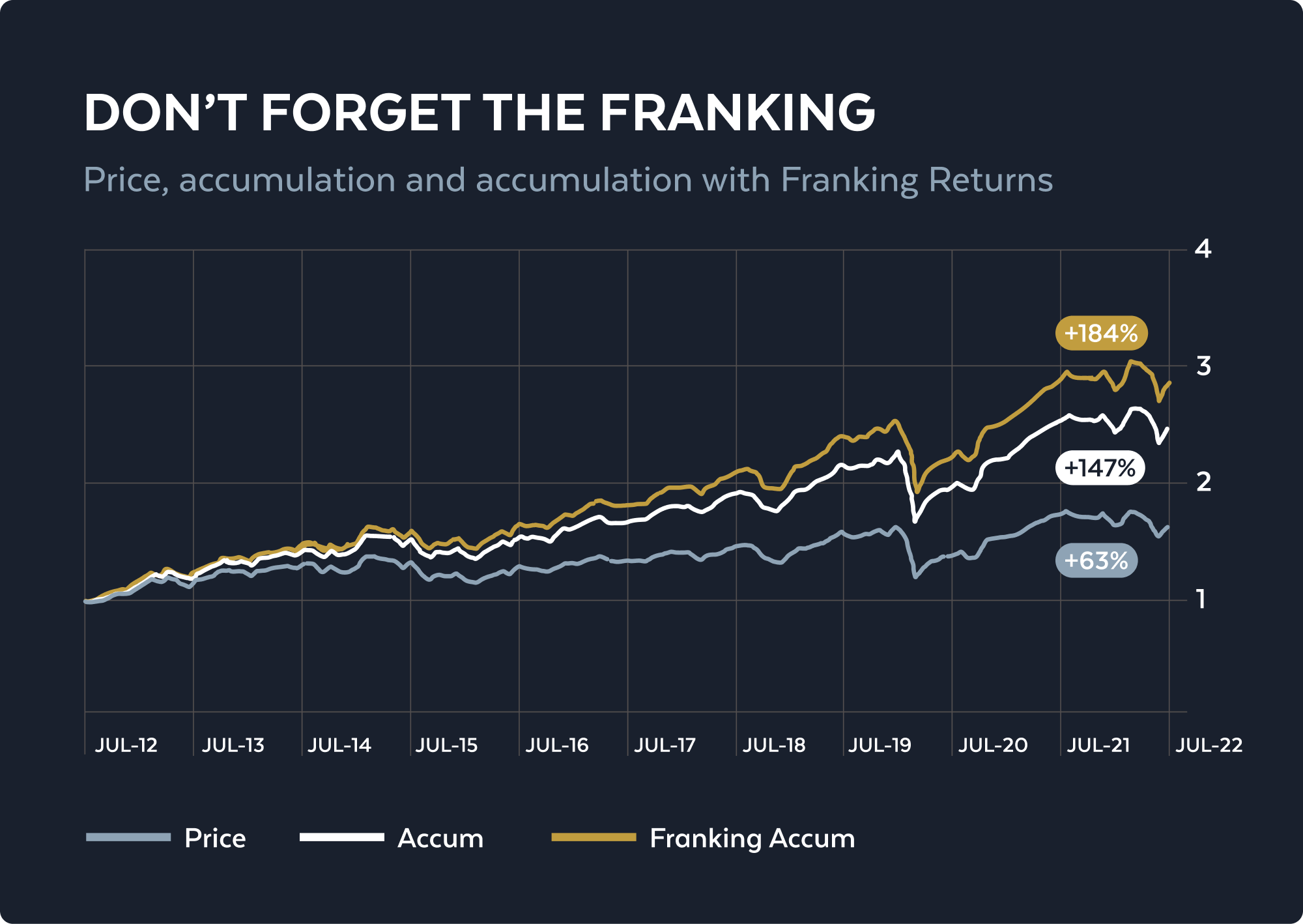

Plato's Hamson brought along the chart below, and his message is loud and clear: franking credits have delivered in droves for Australian investors over the past decade.

"The accumulated return in the price of Australian equities over 10 years is 63%, which is not that exciting over 10 years - it's actually only 5% per annum when you look at compounding," he said.

"When you add the income on, it actually comes out to a 147% return accumulated, which sounds a hell of a lot better over 10 years, but it's actually only 9.5% per annum."

Luckily, for Australian investors, there's a little thing called franking, Hamson said.

"It actually adds another 1.5% per annum return, which brings it up to 11% per annum or 184% over 10 years. I think that's a pretty good number," he said.

"So my message is: Don't forget the franking -and if you just look at the cash yield, actually most Australian investors are getting a lot more than that."

Pete Morrissey: Why REITs are in for a turnaround

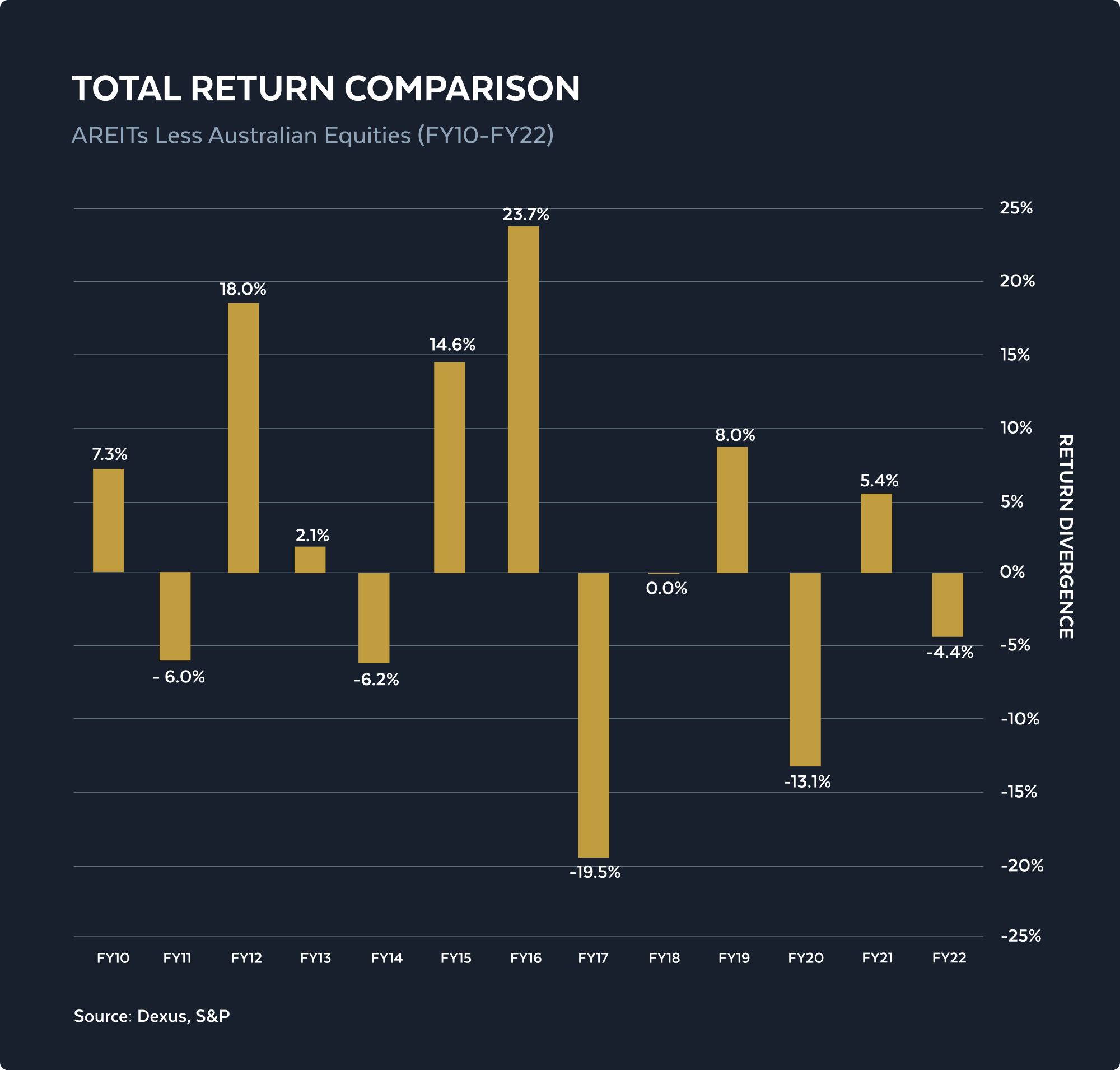

Dexus Asset Management's Morrissey believes that REITs are set to outperform the overall Australian equity market over the year ahead, and he's brought along the below chart to prove it.

"As you can see in the chart, REITs have outperformed slightly more often, only 54%, but if you're looking under those numbers, you'll see that REITs have delivered an additional return of 2% per annum compound over that period, and that's underpinned by a 1.2% high distribution yield coming through," he said.

Right now, the opportunity is particularly compelling, he added.

"Looking at the chart, you can see that every year where REITs underperform, they tend to come back and compete very well with equities the following years," Morrissey said.

Rob Camilleri: Why governments bonds should be your satellite

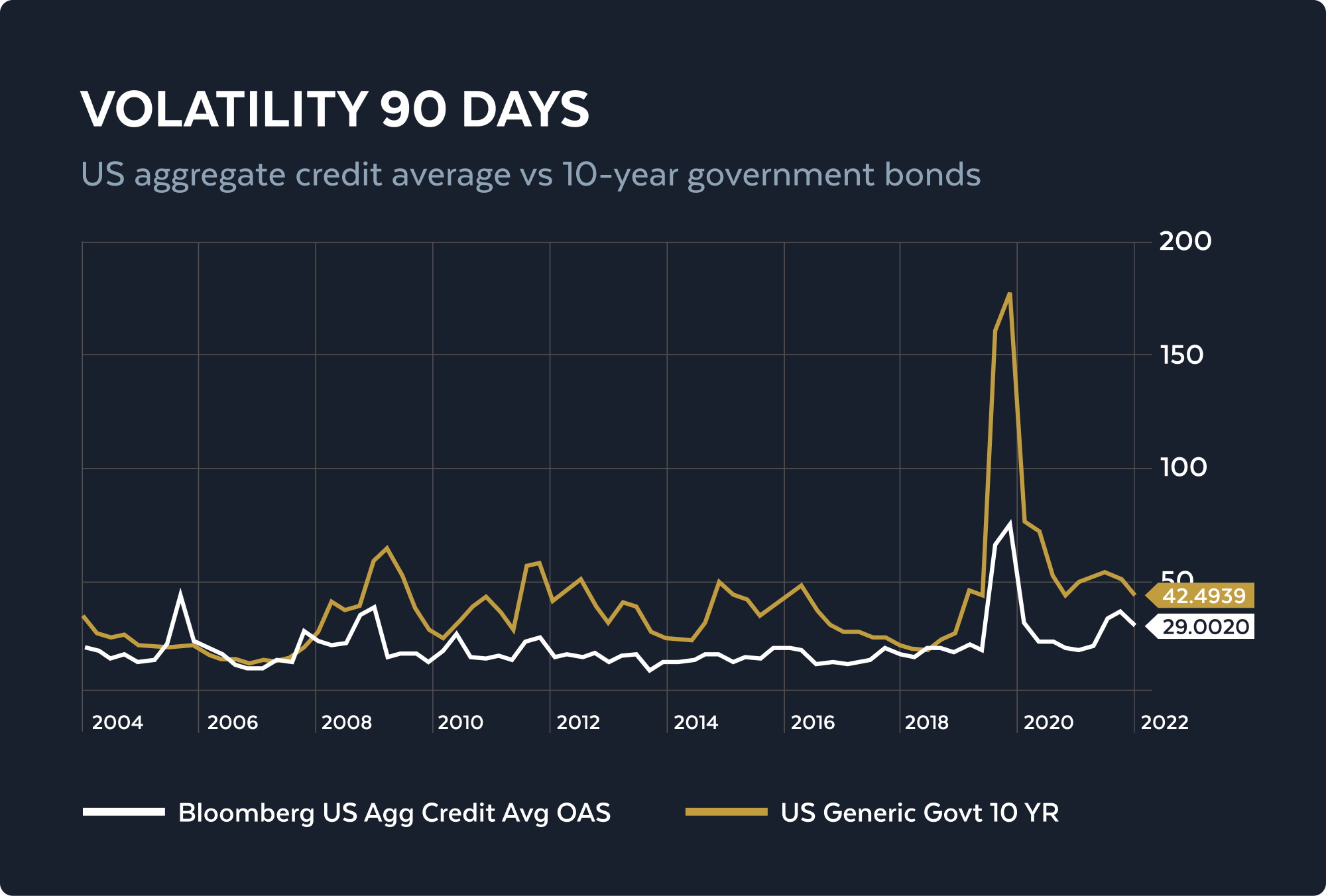

Realm Investment House's Camilleri believes there's a case for government bonds no longer being a core component of investors' portfolios, and he has brought along the below chart to prove it.

"For traditional asset allocators, they would generally build a bond portfolio, which is AAA, it's got some interest rate duration versus a satellite approach to adding credit to that portfolio, which would be around about that BBB rating attachment point and much shorter," he explained.

"So, when you actually break all that down, what you actually find is that the volatility of bonds versus credit spreads is actually almost two times."

In volatile periods like what we have seen in recent times, credit portfolios have actually performed really well, he added, proving themselves to be a "very stable asset class from a credit spread perspective."

"The challenge for traditional thinkers is to actually flip that around," Camilleri said.

"Maybe there's a movement now to make a credit portfolio your core offering because of the stability of the credit spread return and make government bonds your satellite."

2 headwinds the market is missing (and why we're not going to face a recession)

Camilleri believes the collateralised loan obligation (CLO) market is currently a major headwind that the market seems to be missing.

"We're seeing a reluctance from US banks to add CLO exposures to their balance sheet. Obviously, there's a regulatory impact to that and the additional capital required to be a net buyer of that market is about 1%," he said.

"What that is doing is it's forcing that risk to the street. We're seeing AAA CLO spreads reprice higher, and some of them are trading around about that 5% mark. So, that's a headwind that I think not a lot of people are talking about."

Currently, Camilleri and his team are trying to figure out how spreads in Australia have been impacted, particularly in structured finance markets. And he believes this headwind will take some time to play out.

Meanwhile, Morrissey points to the economic distress across the ditch as his biggest concern right now.

"They've been in the environment of rising rates a little bit longer than us and are seen as an economy to watch to see how they come through this. There's a fair bit more pain there going on right now," he said.

"My biggest concern is that we can go down that path and it's going to be tougher the longer this goes on."

The Dexus team has been assessing how retail, office and property have been impacted by rising rates in New Zealand - and are keeping across these trends to see if something similar could occur in Australia.

"I just think economically, people's necks are getting squeezed pretty hard over there right now," Morrissey said.

"Australia's in a better position, that's one thing for sure, but how much further we go down that path is yet to be determined."

That said, Hamson believes it's unlikely we are going to see a recession in Australia, or stagflation for that matter.

"I think central banks are going to be smarter this time and they'll get to about 3.5% and then they'll take the foot off," he said.

"In fact, we may even see interest rates falling within a year or two. We're starting from a very, very strong position: full employment, balance sheets are very strong in terms of listed companies. So companies are full of cash, and so is the individual."

Camilleri agrees, noting that consumers remain flush with cash and employment is strong, as are corporates' balance sheets.

"A recession is generally around capacity destruction, which we don't seem to have," he said.

"There's a lot of stats that say that the borrower is actually in a much stronger position this time around, so they can absorb these rate rises."

However, this is a very different environment that we're dealing with, Morrissey adds. After all, "a lot of investors out there have never seen these types of conditions."

"I think there has been a 'throwing the baby out with the bath water'-type response from some people, but we'll get through this," he said.

The highest conviction calls from our 3 income experts

Hamson is bullish on energy despite its already incredible run and believes Woodside (ASX: WDS) can continue to spew out cash over the coming years.

"I know it's a bad thing, but it's benefiting from the war in Ukraine because there's a gas shortage and that's going to continue," he said.

"But even if you look out through those dynamics, we do think decarbonisation is going to be a big thing for the next 30 years, and gas is the interim step. And they're very well placed with that."

Woodside boasts great cash flows, assets, and fairly low debt, he added.

"I think after they pay their dividend, it's going to be 13% geared. So, it's actually very, very low," Hamson said.

"And it has a great yield - it's on a yield of 9% gross dividends. So that's one of our favourites."

Meanwhile, Morrissey points to the retail sector - which was perhaps the most badly burnt during the COVID-19 pandemic - as an area of opportunity as we return to normal.

"Looking at the large mall operator Scentre Group (ASX: SCG). It's trading at a big discount to NTA, and yet it's a company that's got a 50-year track record of developing fantastic assets," he said.

"So people aren't paying anything for that. And it offers close to a 6% yield."

Tailwinds for Scentre Group include immigration and tourism slowly returning back to pre-COVID levels. However, headwinds remain in terms of an increasingly economically sensitive consumer, he added.

"Hopefully, the outlook is a little more positive there," he added.

He also named HomeCo Daily Needs REIT (ASX: HDN) as another high-yielding opportunity.

"It's on a 6.5% yield. It's also trading at close to a 20% discount to NDA," Morrissey said.

"It's got 4% earnings growth underpinned by predominantly supermarkets and it's got some exposure to CPI growth as well. So, I think those types of names are going to do pretty well, and retail isn't dead, obviously, and nor is the large mall."

And while doomsayers predict a 20-30% fall in Aussie property prices over the coming months, Camilleri is adamant that the residential mortgage-backed security market won't suffer from a similar fate.

"You look at the fundamentals. We've got full employment, so are borrowers going to struggle? Will arrears rise? Are we building enough houses? Is there going to be net immigration?" He asked.

"We don't see a servicing problem because everybody has a job and you can have more if you want. Banks have learned a lot about forbearance. So, we feel like the banks will work with their borrowers because they've done it for the pandemic, they've done it for the floods."

Banks are not going to push borrowers over just because they've missed a payment, he added. In fact, he's betting that they will actually work with borrowers to get through the other side.

"When we think about that as a fundamental outlook for residential mortgage-backed securities, the AAA part of the market, which is essentially the very top of the capital structure and by its very rating, very safe and stable, has repriced not because of those fundamentals per se, but they're repriced because of that CLO problem that we spoke about," he said.

"So, you can get AAA returns anywhere from 170-200bps over. It doesn't sound like a lot, but for our market, that's a great risk-adjusted return profile."

Watch part one of this panel

Click on the wire card below to access part one of this panel session.

3 stocks mentioned

3 funds mentioned

3 contributors mentioned