A misbehaving bond-substitute

For much of the last decade, many investors were lured to a particular class of equities which, as they believed, would deliver yields greater than what could be achieved in the bond markets but without taking significantly more risk. This was the environment of ultra-low interest rates which forced investors up the risk spectrum. Characterised by many as the “hunt for yield”, investors who would have otherwise preferred to own fixed income securities would instead find themselves owning equities that, in theory, would behave like bonds.

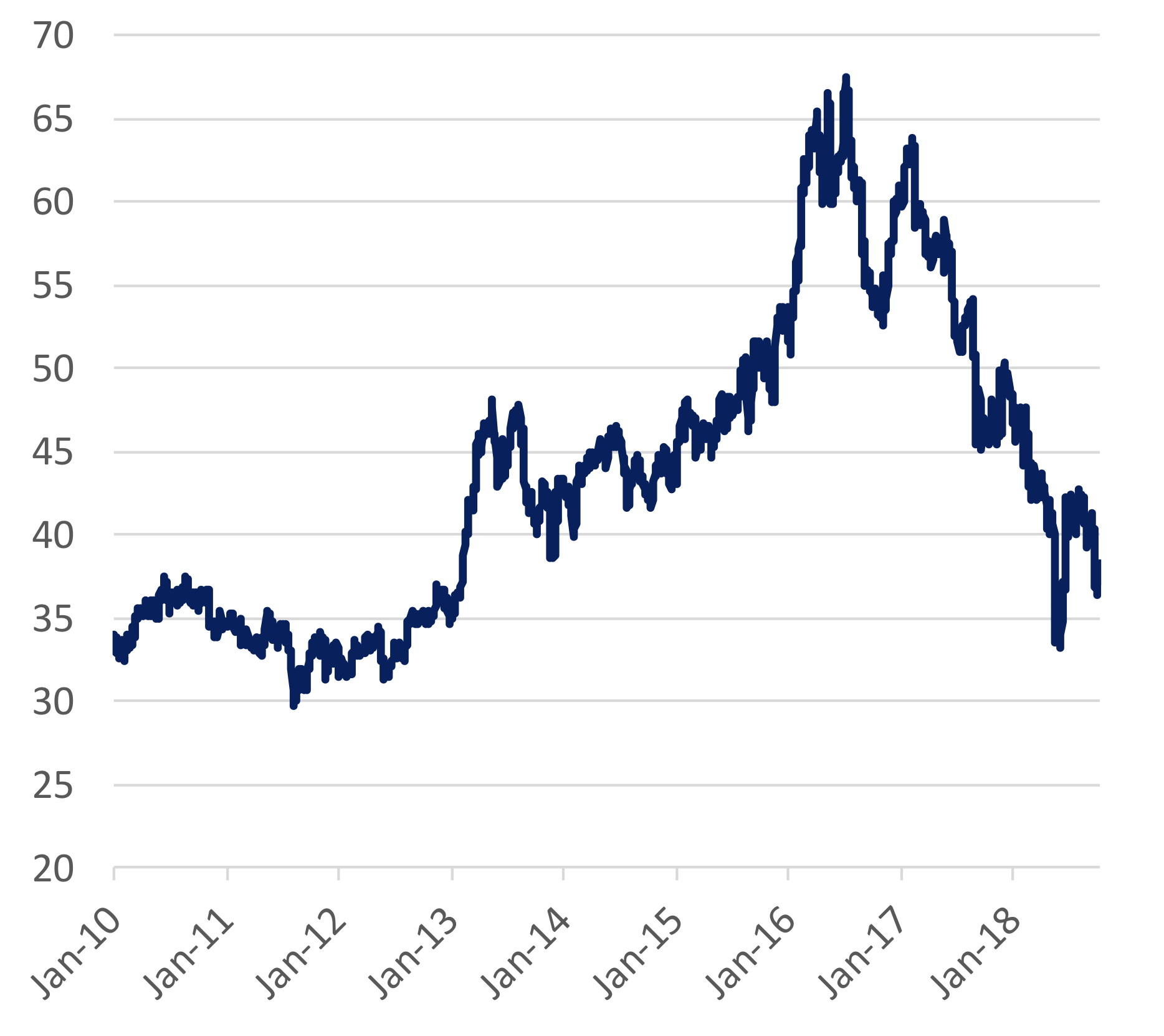

Take a defensive consumer staples business like, say, Campbell Soup (NYSE: CPB). It has spent much of the last decade with a P/E ratio of about 17x. Inverting this ratio gives you a sense of the “earnings yield” of the business, let’s say around 5.9 per cent per annum. Now, at nearly six per cent, this yield was materially higher than most bond yields over the same period. Remember, the Fed Funds Target Rate was essentially zero until late 2015; and the US 10YR government bond yield averaged approximately 2.4 per cent per annum over the same 10-year period.

So the logic was simple: buy a stable, defensive business at a 5.9 per cent yield and you are earning approximately double the US 10YR by taking little additional risk. This logic was found to be compelling by many investors, so much so that CPB’s stock price nearly doubled by 2016, driven by an expansion in the stock’s P/E multiple to 22x. In bond-speak, this is equivalent to the earnings yield tightening to approximately 4.5 per cent as this bond-substitute became more popular with investors.

Campbell Soup Stock Price (US$/share)

Source: Bloomberg

Source: Bloomberg

Now, you will note the subsequent decline in the stock price over the last two years. There are a number of reasons for this decline which we have documented in detail in our recent whitepaper.

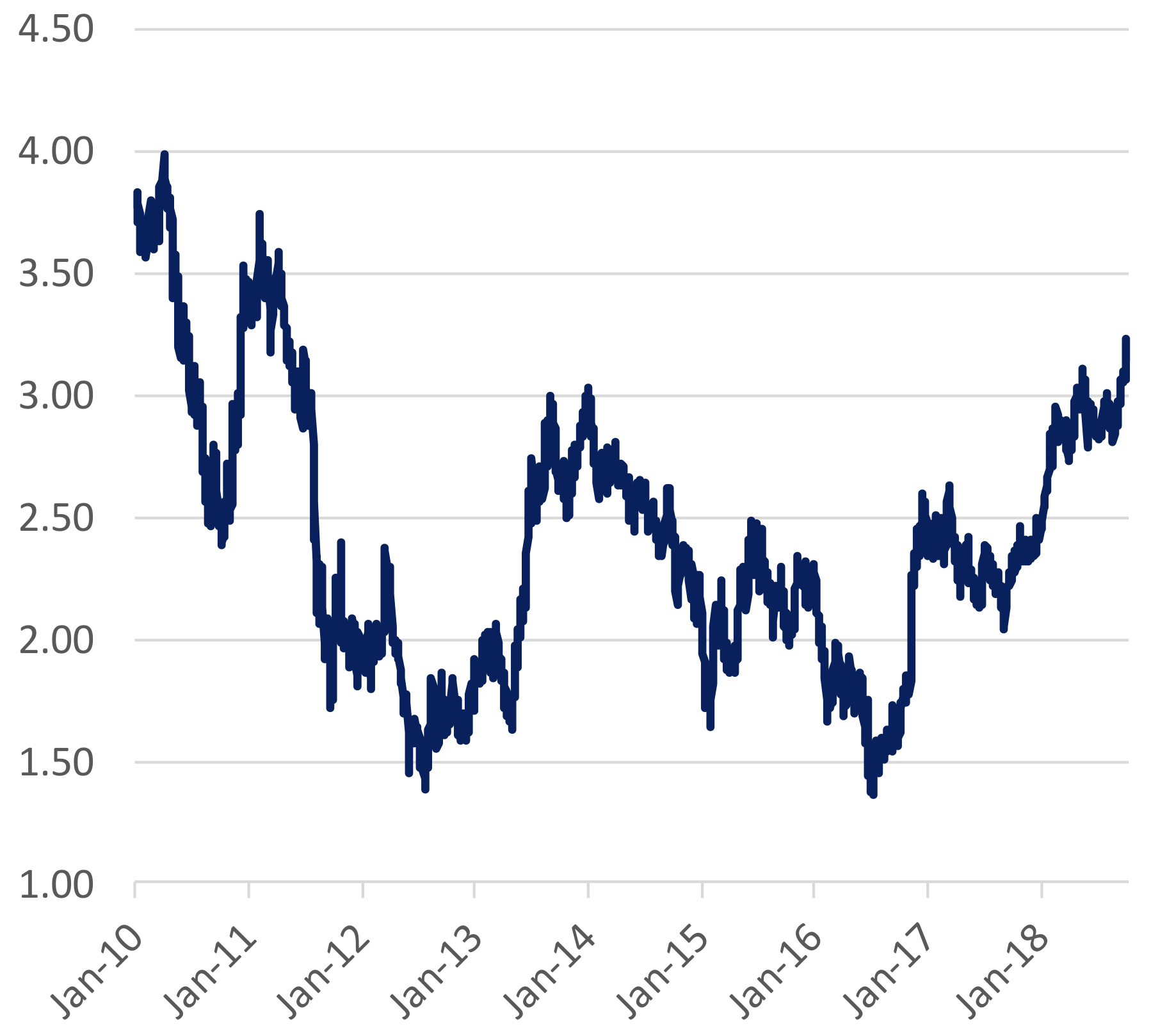

For this note, however, our focus is on the behaviour of CPB as a bond-substitute in what has become a rising interest rate environment. At the time of writing, the US 10YR government bond yield has hit a seven-year high.

US 10YR Government Bond Yield

Source: Bloomberg

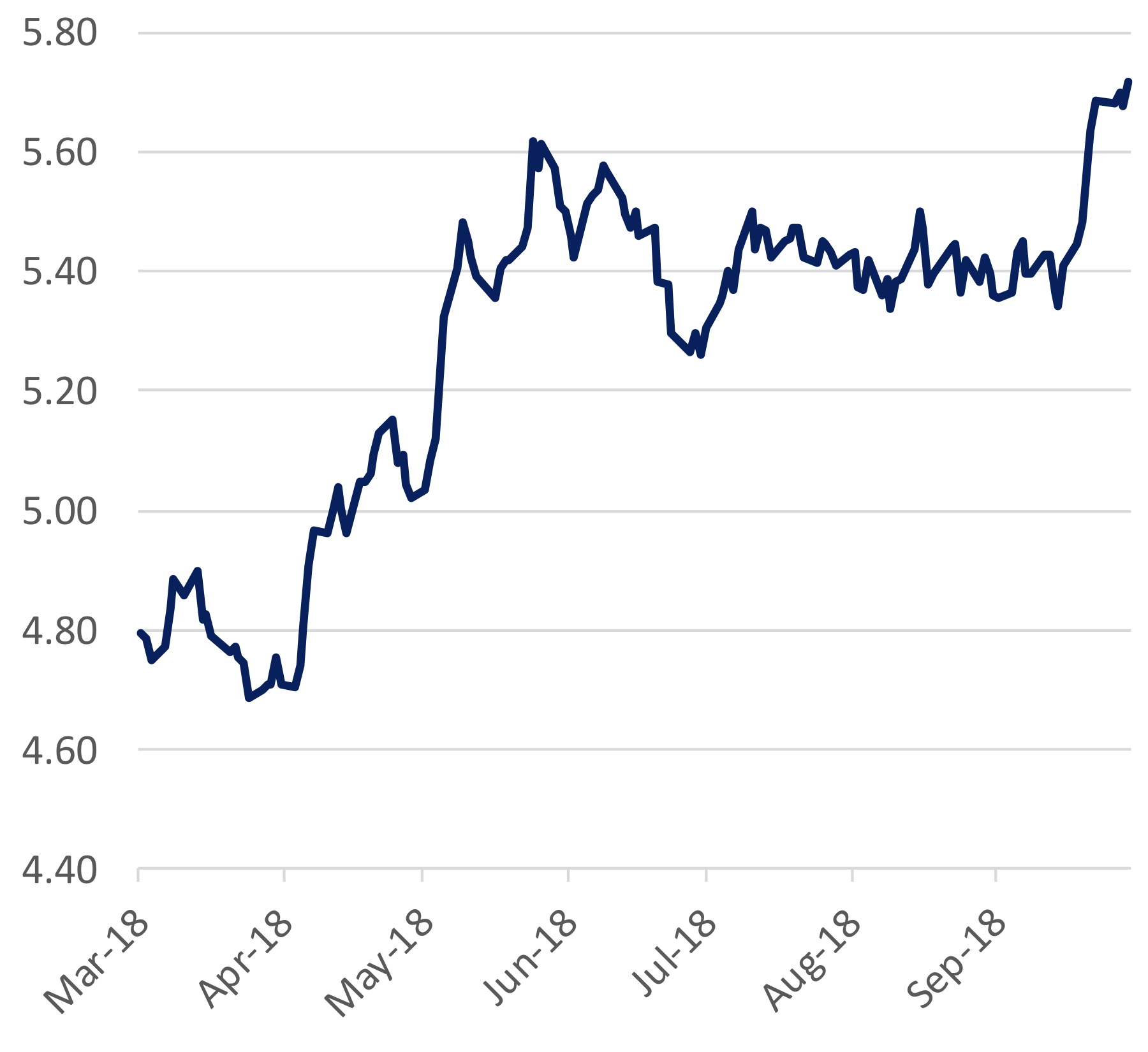

Many of the same drivers that have pushed the 10YR higher are naturally pushing corporate bond yields higher as well. For example, consider the market yield on Campbell Soup’s Senior Unsecured 4.80 per cent coupon bonds expiring March 2048. Over the last six months, it has risen by approximately 100 basis points. Now, of course, for the bonds already issued by the company, the coupon paid to investors is fixed. But as and when the company needs to refinance its bonds (much of which will occur over the coming three years for CPB), they will become this much more expensive in today’s interest rate environment.

CPB March 2048 4.80 per cent Coupon Senior Unsecured Bond Yield

Source: Bloomberg

Source: Bloomberg

Now, to give you some sense of the average interest expense paid by Campbell Soup over the last year, it was US$201 million. The average gross debt level of the company over the same period was US$6,715 million. The ratio of the two gives us an approximation of the company’s average cost of debt, at 3.0 per cent per annum. It’s fair to say, in light of the current interest rate environment, the days of Campbell Soup paying only 3.0 per cent per annum on its debt are surely numbered.

Now, at the time of writing, Campbell Soup was carrying US$9,668 million in net debt on its balance sheet. This implies that, for every 100 basis points of increased debt cost, earnings would be compressed by US$97 million. As a proportion of Campbell Soup’s trailing 12-month earnings, this equates to 8.1 per cent.

And this is the problem with bond-substitutes – especially those with significant borrowings, as so often is the case. As interest rates rise, not only does the market valuation multiple (a P/E ratio, for example) compress; but the earnings power of the business is also impaired as interest expenses increase. It’s a double whammy for the equity holders and one that is remains underappreciated today.

Investors in shares of businesses classed as bond-substitutes often believe they are taking bond-like risk for equity-like returns. Time and time again, reality shows that these investors are often taking equity-like risk for bond-like returns – and often, much worse.

1 topic

1 stock mentioned