A rock-solid global small cap stock that’s flying under the radar

You might not think twice about the cement under your feet or the drywall in your home — but behind those essential materials is a surprisingly impressive business with deep roots and high returns.

Eagle Materials Inc. (NYSE: EXP) began life in 1963 as part of homebuilding giant Centex Corporation, originally going by the name Centex Construction Products. But in 2004, it spread its wings: Centex spun off the division, it rebranded to Eagle Materials, and it’s been flying solo on the NYSE under the ticker “EXP” ever since.

From its base in Dallas, Texas, Eagle now manufactures two of the most important inputs in America’s built environment: cement and gypsum wallboard. Whether it’s roads, bridges, homes, or high-rises, chances are something Eagle made is holding it together. The company operates more than 70 facilities across 21 states — so it’s safe to say it’s built for scale.

“Commodities? Must Be a Tough Gig…” Think Again

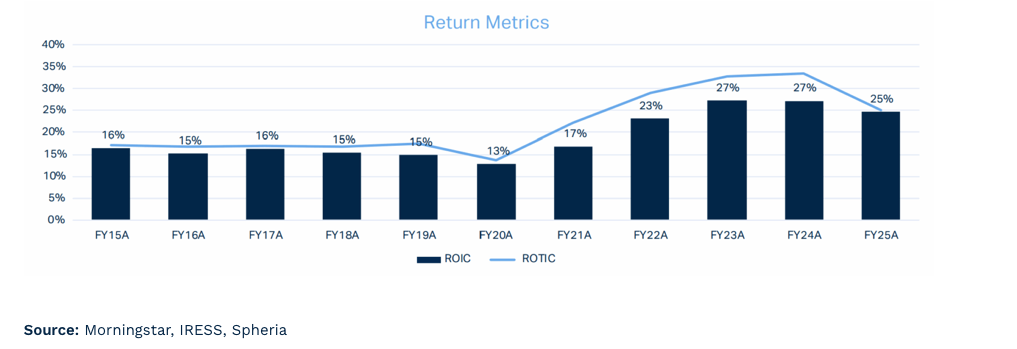

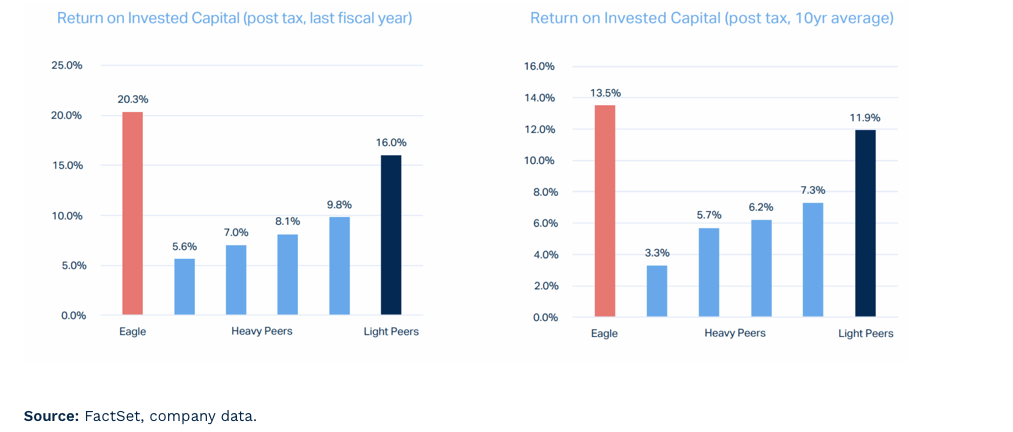

On the surface, you’d expect a business like this — making raw materials for construction — to be competitive, low-margin, and, let’s be honest, a little boring. But Eagle’s financials tell a different story: operating margins and returns consistently above 20%. That’s more Apple than asphalt.

So what’s their secret?

Industry Structure: Built-in Barriers and Rational Competition

One of the most attractive — and often underappreciated — features of Eagle’s business is the structure of the industries it operates in, which are characterised by high barriers to entry, limited competition, and pricing discipline.

In cement, the product’s heavy weight and low value density make it uneconomical to transport long distances. As a result, the U.S. cement market functions as a collection of regional oligopolies — often duopolies or monopolies — where each producer serves a geographically captive customer base. This leads to rational pricing behaviour, high asset utilization, and protection from new entrants, particularly in markets where Eagle has a well-established footprint and strong distribution networks.

In gypsum wallboard, while the product is more transportable than cement, the industry remains highly consolidated: the top four producers account for approximately 80% of U.S. volume, with Eagle Materials among this leading group. Such concentration supports some level of pricing stability and enables the leading manufacturers to pass on input cost increases with less risk of undercutting from smaller players.

Combined, these industry structures create a supportive backdrop for margins and returns, reinforcing the competitive moats around Eagle’s operations.

The Beauty of Being Close to the Dirt

Unlike many of its competitors, Eagle owns the raw materials. They’re vertically integrated into mining their own limestone and gypsum, with reserves that will last them 25+ years. That’s a massive advantage — kind of like owning the farm instead of buying from the market. Their low-cost reserves feed into nearby manufacturing plants, which are also close to end-customers. That setup helps keep input and freight costs low, while giving them flexibility to shift supply between regions.

All this underpins Eagle’s long-standing strategy: be the low-cost producer in every market they serve. In commodity-style industries like this, price is king — but consistent product quality and service matter too. If you can make good stuff for less and deliver it fast, you’re well placed to win.

Cement: Hard to Make, Harder to Permit

One of the most overlooked advantages Eagle enjoys is just how hard it is to build new cement capacity. Why? Two reasons: regulation and NIMBYs (“Not In My Backyard”). Cement production is energy-intensive and not exactly a neighbour’s dream, so getting permits involves navigating a thicket of environmental rules at every level of government — plus pushback from nearby communities.

As a result, almost no new U.S. cement plants have been built in recent years, with demand gaps filled by imports brought in by Eagle and its peers. The upshot? Cement supply is tight — and has been for a while. In fact, Eagle hasn’t experienced a price decline for 15 years straight.

Gypsum: A Market Shaped by the Energy Transition

Eagle’s other main product, gypsum wallboard, has a quirky supply story. For decades, power plants that burned coal helped supply the market by producing synthetic gypsum as a byproduct (you can thank chemistry: sulfur dioxide meets limestone = gypsum). But as the U.S. moves away from coal, synthetic gypsum supply peaked in 2018 and has been falling ever since — down over 50% in a decade.

That tightening supply — combined with ongoing demand from residential construction — means pricing power is likely to return to wallboard makers like Eagle. Fewer power plants = less synthetic gypsum = more reliance on natural gypsum (which Eagle owns in spades).

Supply Tight. Demand Rising. What’s Not to Like?

With supply constrained across both cement and gypsum, any increase in demand flows straight through to higher prices and margins. And there are real tailwinds building:

- Bipartisan infrastructure spending is set to drive heavy construction activity for years.

- Easing interest rates should eventually support a rebound in single-family home construction — great news for gypsum demand.

Environmental Risks and Sustainability Considerations

Cement manufacturing is widely recognized as one of the more carbon-intensive industrial processes, accounting for approximately 7–8% of global CO₂ emissions. The emissions arise from two sources:

- Process emissions, which result from the chemical decomposition of limestone (calcium carbonate) into clinker (calcium oxide) — an unavoidable part of traditional cement production.

- Combustion emissions, due to the high-temperature kilns typically powered by fossil fuels.

Given these factors, the environmental risk profile of cement is material, particularly as regulatory scrutiny, investor expectations, and carbon pricing regimes continue to evolve globally.

That said, cement is also a “hard-to-abate” sector, meaning that viable low-emission alternatives are still in development and not yet commercially scalable. Commercially viable decarbonisation technologies — such as carbon capture, utilization and storage (CCUS), or alternative chemistries — remain 10 to 15 years away from broad adoption.

Eagle Materials is not passive in the face of these risks. The company has taken steps to reduce its carbon footprint by:

- Improving energy efficiency at its cement plants through modernized kiln technology and upgraded fuel systems.

- Utilising alternative fuels where viable, such as non-recyclable waste materials.

- Lowering clinker factors, which reduces the proportion of emissions-intensive clinker used in finished cement products.

- Increasing use of blended cements, which substitute materials like fly ash or slag to displace clinker.

Eagle has operational flexibility which should enable it to adopt emerging technologies as they become commercially viable. Importantly, Eagle’s focus on being a low-cost producer in each market means it is structurally better positioned to absorb and respond to future compliance costs or carbon-pricing mechanisms than higher-cost peers.

In gypsum, Eagle faces a far more benign emissions profile, but has similarly focused on resource efficiency and responsible quarry management, including site reclamation efforts and dust mitigation

Valuation That Doesn’t Make Sense (In a Good Way)

Eagle has built a high quality portfolio in the U.S. building materials sector — low cost, well-located, and incredibly hard to replicate. And yet, it trades at just 11x EBIT. For a business with this kind of margin profile and structural tailwinds, that feels like a steal.

We’re not just optimistic — we’re confident. In a market full of flashy tech and speculative growth stories, Eagle’s story is refreshingly grounded. Quite literally.

Invest in a portfolio of global small caps with Spheria Asset Management

The Spheria Global Opportunities Fund is a carefully constructed portfolio of solid businesses listed globally, with strong cash flow generation and good balance sheets.

As a 31 May 2025, the Fund has delivered 11.7% p.a. after fees since inception in March 2019.

Click here to visit the Spheria website to learn more about the Fund.

2 topics

1 stock mentioned

1 fund mentioned