ASX 200 logs modest rebound, always believe in gold - the ASX gold rally is indestructible!

Today in Review

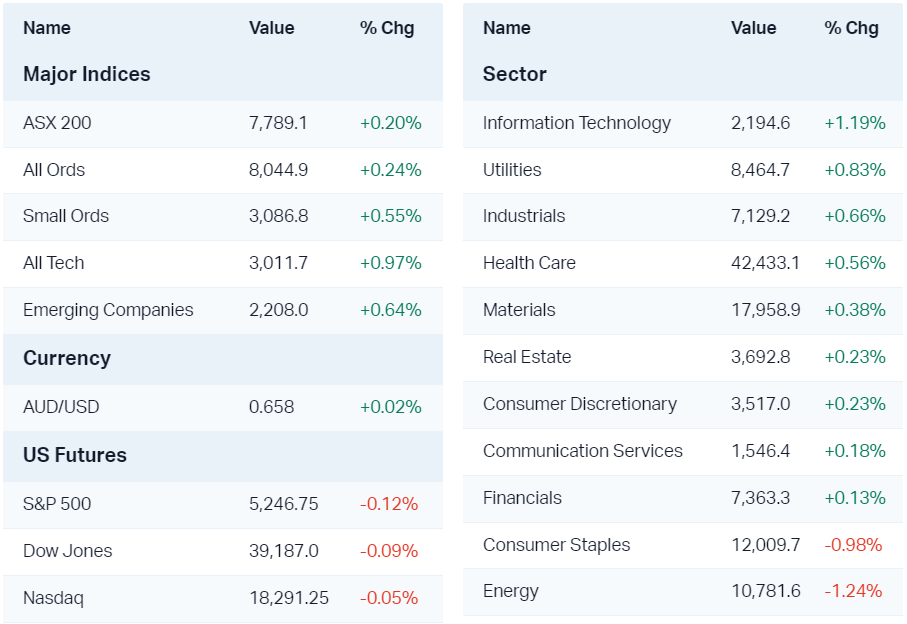

Markets

%20Intraday%20Chart%208%20Apr%202024.png)

The S&P/ASX 200 (XJO) finished 15.8 points higher at 7,789.1, 0.25% from its session low and 0.16% from its high. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by 168 to 106.

The Gold (XGD) (+2.7%) sub-index was again the best performing sector today, likely in response to yet another record high set over the weekend. It's a case of extending winning ways for most of the stocks in the sector best performers table below.

Also doing well today was the Information Technology (XIJ) (+1.2%) sector, but this was partly due to a surge in Life360 (ASX: 360) (+16.8%) which provided a better than expected market update, and partly due to a rebound in US tech stocks on Friday. One could also argue it was due to the sector getting a bit belted last week, and therefore it was due for a bounce.

Doing it tough today was the Energy (XEJ) (-1.2%) sector. Mainly stock-specific moves here, although crude oil prices are trading a little lower in Asia. Beach Energy (ASX: BPT) solidified its longstanding position as a serial underperformer, reporting "quality issues" during pre-commissioning of systems at its Waitsia Gas Plant. Read this as: At least a 6-month delay to get underway at the plant, and a cost blowout of around $150 million.

CEO Brett Woods described the issues his company is encountering at Waitsia as "extremely disappointing". I guess, Brett, investors will have to Wait-sia a while to get their money back after today's 15% plunge in the share price...

ChartWatch

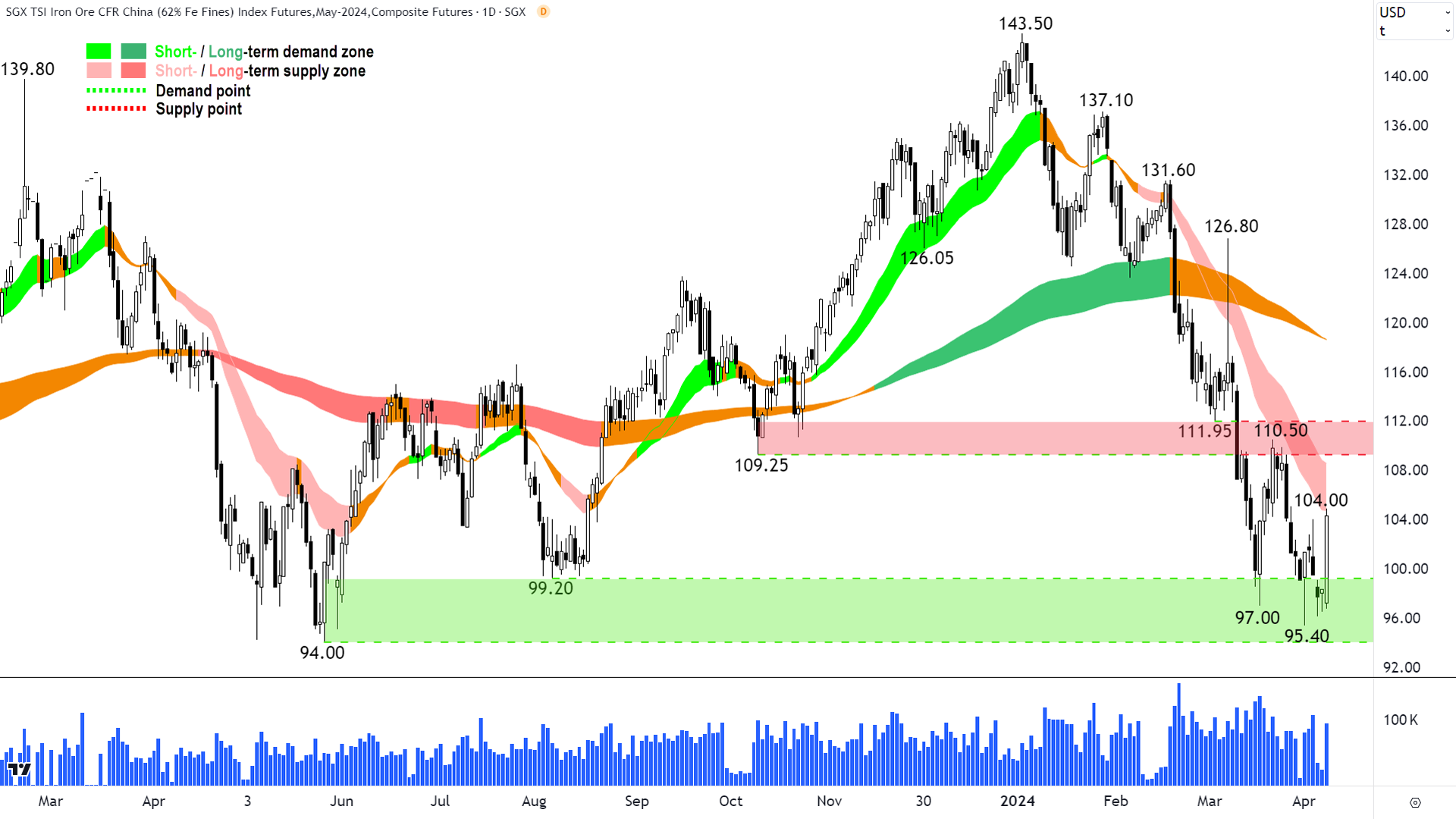

Iron Ore SGX

The iron ore futures price surged today in Singapore delivering a long white candle with a close very near the high of the trading session. Importantly, the candle is occurring at an important historical point of demand between 94 and 99.20.

This is the third, and by far the strongest in terms of demand-side showing, attempt to rally from this zone. It's made even more emphatic by the fact the close has eclipsed a key historical point of supply at 104.

Generally, one would assume now that as long as the price does not close below 95.40, at least an intermediate low is in.

The demand-side is still going to have to contend with several other key points of supply to push the price back into a new short term uptrend. Here, I point out what will likely be a particularly tough zone of supply to breach between 109.25 and 111.95. Before we get there, though, I also note the potential for dynamic supply from the short term downtrend ribbon.

At best only cautious optimism is warranted from the bulls, at least until the price action and candles can demonstrate the demand-side has enough renewed power to close the price above the aforementioned key supply levels.

Economy

Today

There weren't any major data releases in our time zone today

Later this week

-

Tuesday

10:30 Westpac Consumer Sentiment (-1.8% previous)

11:20 NAB Business Confidence (0 previous)

-

Wednesday

10:30 USA Core CPI March (+0.3% forecast vs +0.4% February)

-

Thursday

04:00 USA Federal Reserve FOMC Meeting Minutes

10:15pm EU ECB Main Financing Rate (4.5% no change forecast)

10:30pm USA Core PPI March (+0.2% forecast vs +0.3% February)

-

Friday

03:00 USA 30-year Government T-Bond Auction

11:00 CHN Trade Balance

-

Saturday

00:00 USA University of Michigan Consumer Sentiment (79.0 forecast vs 79.4 previous)

Latest News

The 10 most overbought and oversold ASX 200 stocks – Week 15

ASX 200 stocks hit with the biggest broker downgrades last week: Orora, Champion Iron

Have a spare $10,000? This investor says these 3 ASX small caps are worth a closer look

The stocks headed for the ASX 20 (and 2 on the way out)

ASX 200 stocks hitting fresh 52-week highs and lows – Week 15

Interesting Movers

Trading higher

+33.3% Qoria (QOR) - Qoria rejects unsolicited non-binding proposal from K1, rise is consistent with prevailing short term uptrend, long term uptrend is transitioning from down to up 🔎📈

+16.8% Life360 (360) - Market Update, rise is consistent with prevailing short and long term uptrends 🔎📈

+10.1% Alpha HPA (A4N) - No news, rise is consistent with prevailing short and long term uptrends, bouncing off long term uptrend ribbon 🔎📈

+8.1% Silver Mines (SVL) - Investor Presentation - Gold Forum Europe, rising silver price

+6.9% Mesoblast (MSB) - Continued positive response to 26 March FDA Notifies Clinical Data Sufficient for Refiling aGVHD BLA, rise is consistent with prevailing short term uptrend, long term uptrend is transitioning from down to up 🔎📈

+6.7% Paladin Energy (PDN) - No news, initiated at overweight at Morgan Stanley with a price target of $1.75, rise is consistent with prevailing short and long term uptrends 🔎📈

+6.6% Newmont Corporation (NEM) - No news, continued rally in gold price to record highs is translating into broad ASX gold sector strength

+6.6% GQG Partners (GQG) - Continued positive response to 5 April FUM as at 31 March 2024, several brokers retained positive ratings and increased price targets (see Broker Moves), rise is consistent with prevailing short and long term uptrends 🔎📈

Trading lower

-29.4% APM Human Services International (APM) - Non-Binding Acquisition Proposal and Business Update

-24.4% Elders (ELD) - FY24 Trading Update

-15.0% Beach Energy (BPT) - Waitsia Stage 2 update

-6.0% Strike Energy (STX) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-5.0% Redox (RDX) - No news 🤔

-5.0% Chalice Mining (CHN) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.3% Botanix Pharmaceuticals (BOT) - No news, minor pullback after strong rally 🔎📉

-3.7% Infomedia (IFM) - No news, minor pullback after strong rally 🔎📉

-3.6% Nufarm (NUF) - No news, suspect didn't like the Elders news 🤔, fall is consistent with prevailing short term downtrend, falling peaks and falling troughs, closed below long term downtrend ribbon 🔎📉

Broker Notes

Life360 (360) retained at buy at Goldman Sachs; Price Target: $14.20

Adore Beauty Group (ABY) retained at buy at Citi; Price Target: $1.70

Ampol (ALD) retained at equal-weight at Morgan Stanley; Price Target: $40.00

Eagers Automotive (APE) retained at neutral at Macquarie; Price Target: $14.00

APM Human Services International (APM) retained at buy at Bell Potter; Price Target: $1.93

ARB Corporation (ARB) retained at underperform at Macquarie; Price Target: $32.30

Arafura Rare Earths (ARU) downgraded to underweight from neutral at JP Morgan; Price Target: $0.14 from $0.21

Autosports Group (ASG) retained at outperform at Macquarie; Price Target: $3.10

ASX (ASX) retained at neutral at Macquarie; Price Target: $63.00

Bapcor (BAP) retained at outperform at Macquarie; Price Target: $6.90

BHP Group (BHP) retained at hold at Ord Minnett; Price Target: $40.50 from $42.20

Boss Energy (BOE) initiated at equal-weight at Morgan Stanley; Price Target: $4.60

Beach Energy (BPT) downgraded to sell from hold at Canaccord Genuity; Price Target: $1.61 from $1.65

Cobram Estate Olives (CBO) retained at buy at Shaw and Partners; Price Target: $2.05 from $1.80

Charter Hall Group (CHC) retained at overweight at Morgan Stanley; Price Target: $13.35

Capricorn Metals (CMM) downgraded to underweight from neutral at Macquarie; Price Target: $4.80

CSL (CSL) retained at outperform at Macquarie; Price Target: $300.00 from $310.00

Deterra Royalties (DRR) retained at lighten at Ord Minnett; Price Target: $4.20 from $4.40

Dexus (DXS) retained at underweight at Morgan Stanley; Price Target: $7.75

-

Endeavour Group (EDV)

Initiated at neutral at Citi; Price Target: $5.94

Retained at equal-weight at Morgan Stanley; Price Target: $5.80

Fortescue (FMG) retained at lighten at Ord Minnett; Price Target: $16.20 from $17.20

Fleetpartners Group (FPR) retained at outperform at Macquarie; Price Target: $3.01

-

GQG Partners (GQG)

Retained at buy at Goldman Sachs; Price Target: $2.73 from $2.40

Retained at outperform at Macquarie; Price Target: $2.80 from $2.40

Retained at buy at Ord Minnett; Price Target: $2.80 from $2.60

G.U.D. Holdings (GUD) upgraded to positive from neutral at E&P; Price Target: $13.42 from $10.94

Gullewa (GUP) retained at outperform at Macquarie; Price Target: $12.85

Hub24 (HUB) upgraded to overweight from market-weight at Wilsons; Price Target: $45.32 from $42.63

IGO (IGO) retained at neutral at Macquarie; Price Target: $7.70 from 7.90.

Iluka Resources (ILU) retained at accumulate at Ord Minnett; Price Target: $9.50

Kogan.Com (KGN) retained at sell at Citi; Price Target: $5.50

Arcadium Lithium (LTM) retained at outperform at Macquarie; Price Target: $10.00

Lynas Rare Earths (LYC) downgraded to underweight from neutral at JP Morgan; Price Target: $5.00 from $6.90

-

Magellan Financial Group (MFG)

Retained at neutral at Goldman Sachs; Price Target: $9.10

Retained at underweight at Macquarie; Price Target: $8.40 from $8.00

-

Mineral Resources (MIN)

Downgraded to neutral from overweight at JP Morgan; Price Target: $74.00 from $70.00

Retained at outperform at Macquarie; Price Target: $79.00

McMillan Shakespeare (MMS) retained at outperform at Macquarie; Price Target: $22.63

Macquarie Group (MQG) downgraded to sell from neutral at Citi; Price Target: $161.00

Mesoblast (MSB) retained at buy at Bell Potter; Price Target: $1.40 from $0.58

Newmont Corporation (NEM) retained at accumulate at Ord Minnett; Price Target: $78.00 from $76.50

New Hope Corporation (NHC) retained at accumulate at Ord Minnett; Price Target: $4.90 from $4.70

Orica (ORI) retained at overweight at JP Morgan; Price Target: $19.00 from $17.00

Paladin Energy (PDN) initiated at overweight at Morgan Stanley; Price Target: $1.75

Pilbara Minerals (PLS) retained at neutral at Macquarie; Price Target: $4.20

Perseus Mining (PRU) retained at hold at Ord Minnett; Price Target: $2.05

Rio Tinto (RIO) retained at hold at Ord Minnett; Price Target: $112.00 from $115.50

-

Regis Resources (RRL)

Retained at sell at Citi; Price Target: $1.30

Retained at overweight at Morgan Stanley; Price Target: $2.45 from $2.40

South32 (S32) retained at hold at Ord Minnett; Price Target: $3.50

St Barbara (SBM) retained at neutral at Macquarie; Price Target: $0.21 from $0.17

SG Fleet Group (SGF) retained at outperform at Macquarie; Price Target: $3.21

Smartgroup Corporation (SIQ) retained at neutral at Macquarie; Price Target: $9.51

Temple & Webster Group (TPW) retained at buy at Citi; Price Target: $13.00

Viva Energy Group (VEA) retained at equal-weight at Morgan Stanley; Price Target: $3.34

West African Resources (WAF) retained at outperform at Macquarie; Price Target: $1.60 from $1.50

Scans

This article first appeared on Market Index on Monday 8 April 2024.

5 topics

13 stocks mentioned