Aussie house price crash about to pass through all-time record of an 11% peak-to-trough loss...

In October 2021 we projected that Aussie house prices would fall by a total of 15-25% as a result of this RBA hiking cycle. This was partly based on applying a refined and upgraded version of the RBA's Saunders/Tulip housing model. We revealed in June 2022 that we arrived at similar predicted losses if we assumed a 100 basis point permanent increase in the RBA's cash rate or a temporary jump from 0.1% to 4.25% followed by interest rate cuts.

As this started to play-out after the RBA commenced its tightening cycle in May 2022, we forecast that the first 10 percentage points of house price losses would likely materialise by February/March 2023.

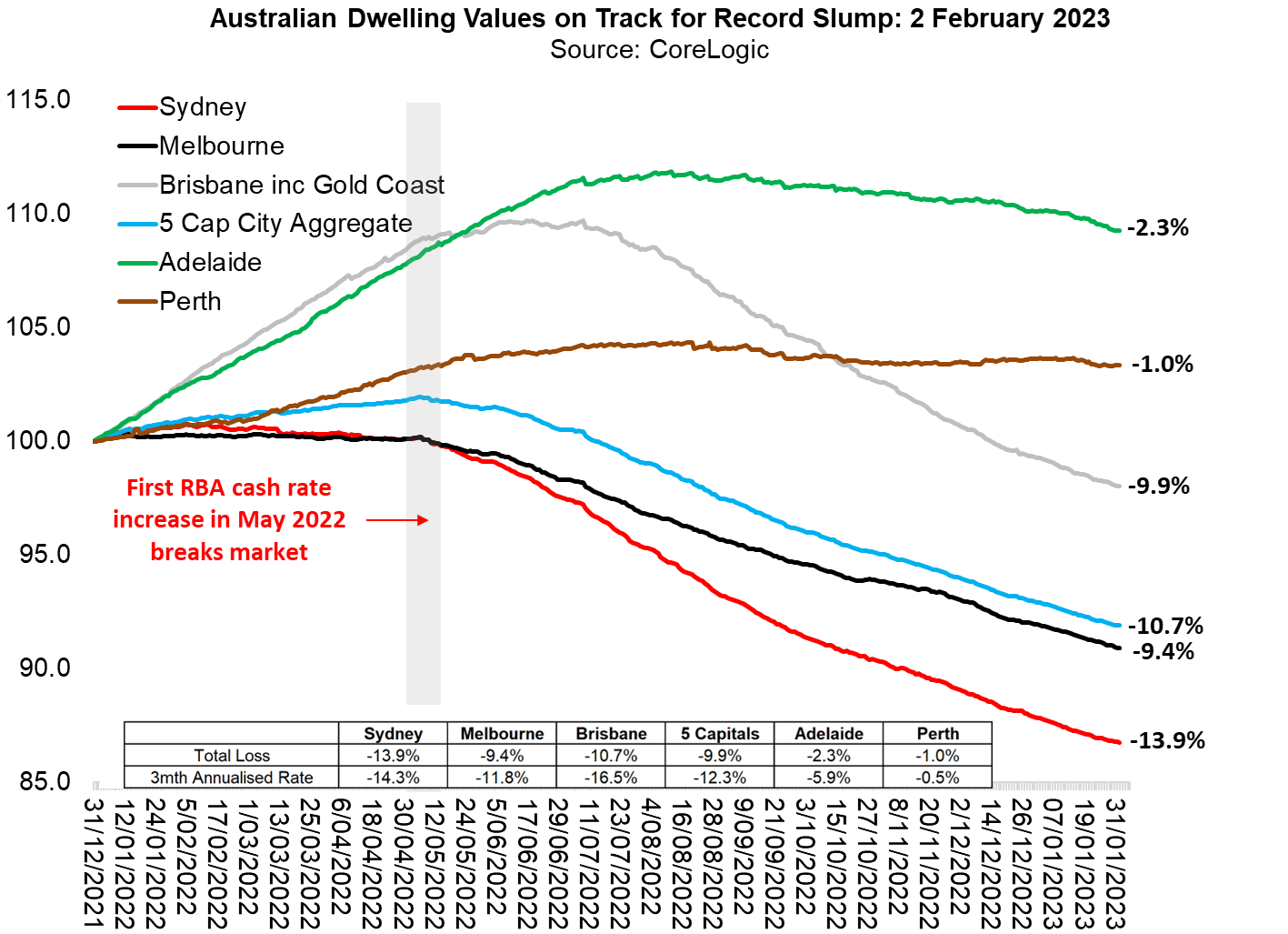

It appears that this central case is on track: CoreLogic's 5 capital city index has now lost 9.9% from its May 2022 peak through to 2 February 2023 care of the RBA's interest rate increases (with more hikes expected in February and March).

We should, therefore, pass through the crucial 10% draw-down threshold this month. And by the end of March 2023, we would expect the Aussie capital city market to record its worst-ever loss---exceeding 11%---since CoreLogic began collecting data in 1980.

Home values in Sydney and Melbourne are now off by almost 14% and 11%, respectively, from their peaks in 2022. Dwelling prices in Melbourne are not far behind with a 9.4% correction. Canberra is faring similarly to the other east coast cities. While Adelaide and Perth remain the outperformers with cumulative retrenchments of only 2.3% and 1.0%, respectively, there is evidence that the house price declines in Adelaide have been accelerating over the last few months (see second chart below).

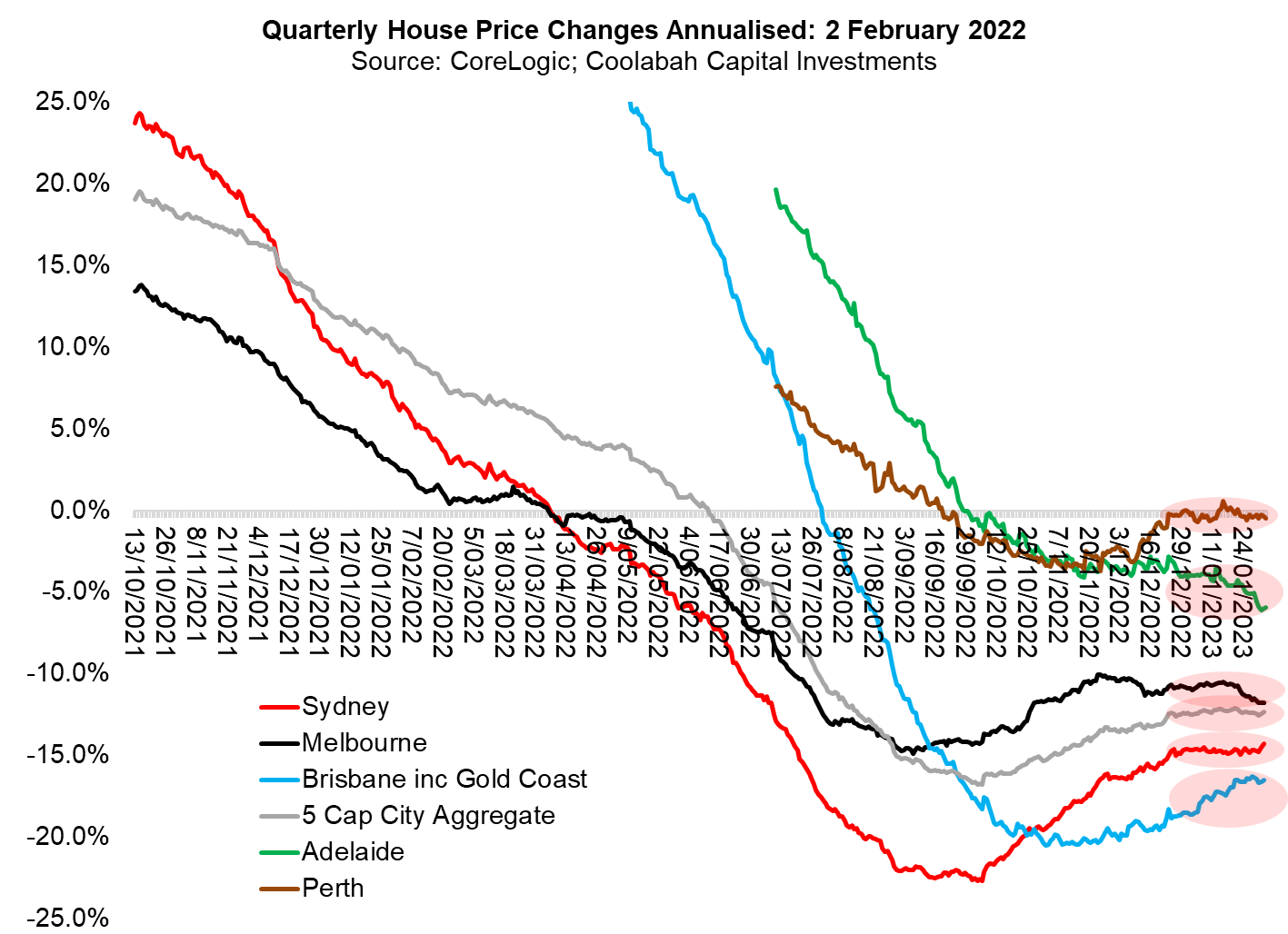

Over the last three months, the annualised pace of these house price falls has been fairly stable at somewhere between 12% and 17%, which is something we have been keen to underscore since late last year. There is no evidence currently that the great Aussie house price crash is bottoming-out or slowing, as many have been keen to suggest. And with 1-in-4 home loans switching from fixed to floating this year, which will result in their interest rates soaring from circa 2% to 6% (exacerbated by additional RBA rate hikes in February and March), this housing pain is set to continue for many months to come.

Across the five biggest capital cities, home values have been melting at a 12.3% annual pace over the last quarter (see chart below). The worst performing market has been Brisbane, where prices have been plunging at a record 16.5% annual rate followed by Sydney (14.3%) and Melbourne (11.8%).

Remarkably, when it started hiking in May last year, the RBA was forecasting that an increase in its cash rate from 0.1% to at least 2.5% would precipitate little change in house prices using the same Saunders/Tulip model that we were refining back in 2021. As prices immediately started sliding quickly in May 2022, it was forced to downgrade this view to a much more pessimistic (and record) 11% draw-down a few months later. We have previously argued that the RBA would be eventually forced to once again dump this assumption and embrace our even more negative central case of a 15-25% loss, which now seems likely to be Martin Place's modal expectation...

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers.

3 topics