Buckle up: This market is throwing up amazing companies at amazing prices

Investors are well aware that equity markets have commenced 2022 with severe volatility and big price declines. Russia’s brutal invasion of Ukraine and economic sanctions have exacerbated supply disruptions of many important economic inputs, such as energy and food. As if this was not enough, China – the world’s second-largest economy – has effected new lockdowns of large cities as the highly-contagious variant of Covid spreads domestically.

Of course, this all comes at a time when inflation is already high in many large economies. In recent weeks, the Federal Reserve hiked interest rates for the first time since 2018. Stagflation – in the form of high inflation (driven by supply disruptions) but with weak economic growth (driven by monetary tightening) – is now a likely scenario.

Investors, naturally, are nervous. But those with existing holdings should stay invested. Long-term equity returns never come in a straight line. It’s also important to remember that price falls are not all bad news and can actually reduce investment risk.

And for those with cash on the sidelines, today represents a rare opportunity: some of the world’s most amazing businesses are now trading at amazing prices.

Don’t fear drawdowns

The extent of many stock price drawdowns in the past few months has surprised many. But volatility, such as we’ve witnessed recently, is always a part of the investment journey. In his excellent book, The Psychology of Money, author Morgan Housel points out the following:

“Volatility is the price of admission. The prize inside is superior long-term returns.”

Housel is reminding investors that, in order to capture the wonderful long-term returns that equities do indeed offer, we need to endure periods of volatility – as uncomfortable as they are at the time.

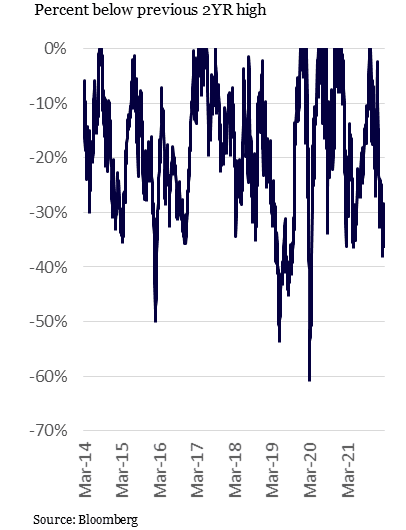

Tesla – Drawdowns

In fact, the discomfort required to generate great long-term returns is probably much higher than most realise. Consider what the investment journey of owning the highest-performing stock of the last decade (Tesla) must have felt like. Surely it was heavenly bliss owning a stock that delivered an average return of more than 60% every year for the last decade.

It was anything but.

“It never is. And it never will be. On the way to making serious money, you spend a lot of time losing serious money,” Housel says.

Owning Tesla over the last decade was a financial living nightmare. On more than a dozen occasions, the stock was down more than 30% from its prior two-year highs; and it fell at least 50% three times.

A paradox of investing

Indeed, price falls can actually make investments less risky. A paradox of investing is that, all else being equal, lower stock prices mean they are now less risky, not more. In the fog of economic war and price volatility, it is easy to forget that stock prices are nothing more than numbers that represent what investors expect for underlying business fundamentals, including revenue sustainability and growth, future profit margins, capital intensity and business capital costs.

When a stock price falls, its new lower level implies that investors now expect relatively lower future revenues, earnings and cash flows. But if the underlying business fundamentals have not changed, all this says is the probability of future ‘outperformance’ and an upward stock price rerating has increased.

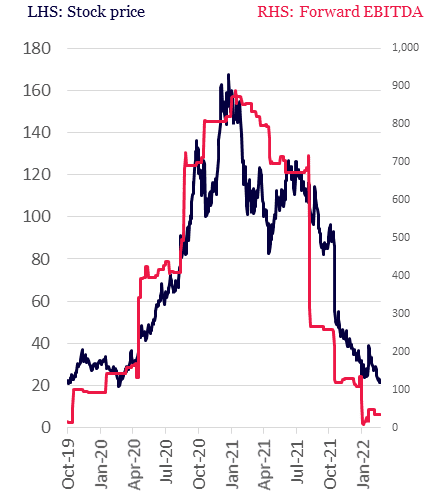

Some of the large stock price declines in recent months do relate to an erosion of business fundamentals that seem absolutely fair. Take Peloton Interactive, maker of the popular at-home spin bike and interactive online classes. The business boomed during the covid lockdowns of 2020 sending the company’s earnings forecasts through the roof. The stock price naturally followed.

Since then, however, it has become clear that the market overestimated the sustainability of Peloton’s covid-related growth. As investors downgraded forward earnings expectations, the stock price of Peloton fell. This is logical.

Peloton Interactive

But not all stock price declines have followed the same logic, of late.

Long-term winners have been oversold

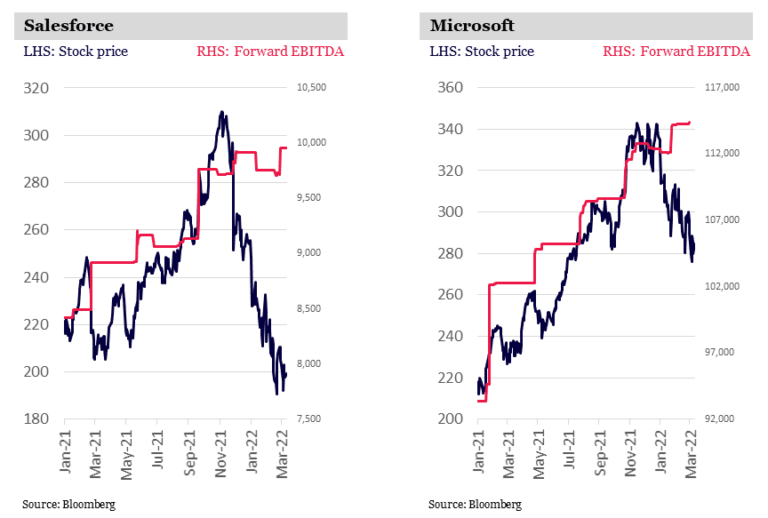

Stock prices of some of the world’s highest-quality businesses have also sold off materially. For businesses like Salesforce, the global leader in enterprise customer relationship management, and Microsoft, future earnings expectations have actually increased recently. And yet, their stock prices have been falling.

Said another way, these long-term winning businesses have recently become a lot cheaper. That is, less risky. This perhaps explains why Amazon announced a new US$10 billion stock buy back in recent weeks: its board no doubt views its current stock price as materially undervalued.

And it’s not just the long-term winners in tech that have been oversold. We have observed this dynamic play out in the alternative asset management leaders, as well as the long-term winners in certain luxury segments.

A long-term game

As Russia continues to attack Ukraine, risks of more widespread geopolitical conflict increase, as we look down the barrel of a period of stagflation, and as stock prices continue to fall, investors can be forgiven for feeling anxious.

But long-term investing requires investing for a long time. Through periods of prices high and low.

Today, the stock prices of many of the world’s best businesses have been oversold. For investors with cash to deploy, these represent highly attractive long-term investment opportunities.

Through this volatile period, Montaka’s portfolio has remained largely unchanged. The drawdowns have been uncomfortable, as they always are. But understanding these as part of the natural journey to strong long-term compounding gives peace of mind to stay the course. And today, the upside potential of Montaka’s portfolio is the highest it’s ever been, in our view.

Note: Montaka is invested in Salesforce and Microsoft.

Compound your wealth over the long-term

Montaka Global Investments provides investors with the opportunity to compound wealth over the long term through disciplined global investment strategies and a sophisticated approach to risk management. Get in touch with us through the 'CONTACT' button below.

5 topics