Can you trust the Weatherman?

Meteorologist. The only job where you can be wrong every day and still keep your job. Willard Scott

Meteorologists or weather people are inherently not trusted. They are extremely public figures that people rely on to make decisions every day about how the coming day/ week will prevail. It can be a tough gig. However similar to the analogy of weather people, as fund managers sometimes it can be challenging getting caught in the day to day weather patterns of the market. It is always best to zoom out and take a longer term view. Hence we took note last month when the Bureau of Meteorology (not sure if we’re still allowed to call it the BOM) officially declared La Niña over with Australia (and the world) now on watch for El Niño conditions. This could be a material longer term change.

First of all, what is a La Niña and El Niño? The layman’s view is that El Niño and La Niña are opposite phases of a naturally occurring global climate cycle that effects weather patterns and hence climate globally. El Niño happens when the Pacific Ocean heats to a temperature higher than normal which can cause variability in rain patterns generally meaning drier conditions (although not guaranteed in all locations). La Niña on the other hand refers to the Pacific Ocean getting cooler than normal, almost causing the opposite effects, i.e., more rain and flooding in some areas.

In Australia specifically El Niño has seen warmer conditions across the country including drier conditions in the east and in southern Australia, increasing the risk of bushfires and droughts and reduced rainfall up north. La Niña in Australia has generally been associated with cooler temperatures across most of the country and wetter conditions across northern and eastern Australia, think the recent Queensland floods. If you are asking yourself where’d my 40 degree summer’s go? The answer is we have seen 3 La Niña years in a row, only the fourth time this has occurred since 1900. 2022 was also regarded as the wettest year for Sydney on record. In North America El Niños are usually associated with wet and stormy conditions in southern states of the US but warmer and drier conditions in the northern part of the country. La Niña however generally sees drier and warmer conditions in the south and wetter and more cooler conditions in the north. Hurricanes across the Atlantic are also a key feature of La Niña periods.

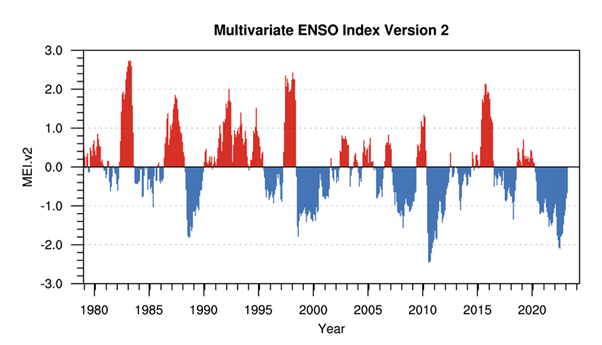

Although there is some debate whether we were truly in La Niña/ El Niño for some of these years the general pattern for the past 40 years is presented in the graph below with blue indicating La Niña and red indicating El Niño periods.

Source: (VIEW LINK)

Specifically for the past 15 years the following patterns have been observed:

- La Niña 2020 to 2022

- El Niño 2018 to 2019

- La Niña 2016 to 2018

- El Niño 2014 to 2016

- La Niña 2010 to 2012

- El Niño 2009 to 2010

- La Niña 2007 to 2009

Apart from deciding whether to continue carrying around an umbrella why is this an important observation and can it impact earnings and hence stock returns? We have summarised some company impacts below.

Insurance

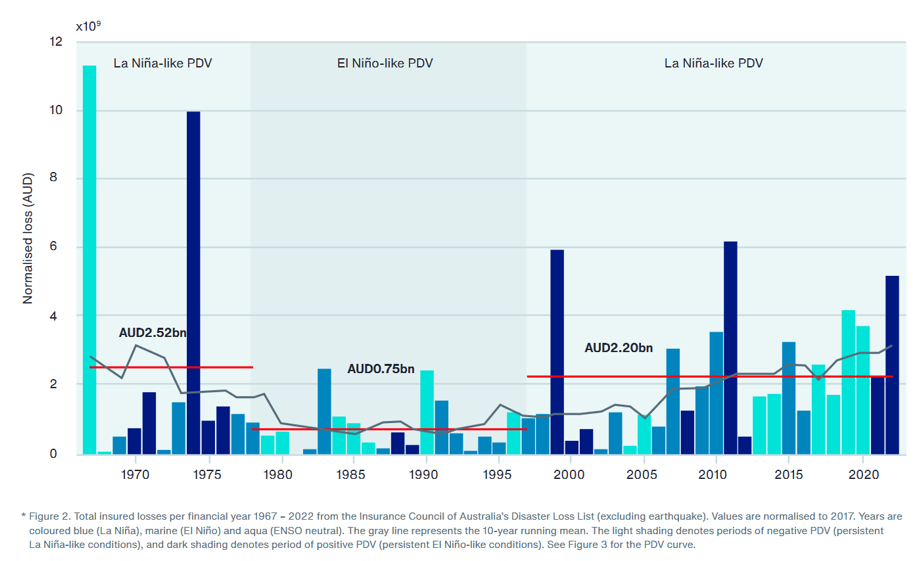

We start with what we see as the most obvious beneficiary of an end to La Niña in insurers. Insurance Broker and Risk consultant Aon in partnership with Climalab recently presented a report titled Say Goodbye to the Big Wet and Excessive Losses. Within the report was the following graph showing insured disaster losses across Australia for the past 50 years. It simplistically shows La Niña = higher weather losses vs El Niño periods.

Source: Aon Report, Say Goodbye to the Big Wet and Excessive Losses

The recent La Niña period has led to consecutive years of flooding across the east of Australia. Aon specifically argues that “all previous triple dip La Niña’s have been a precursor to a flip in the Pacific Decadal Variability (PDV). I.e., a switch to an El Niño dominated period that has “persisted for at least a decade”.

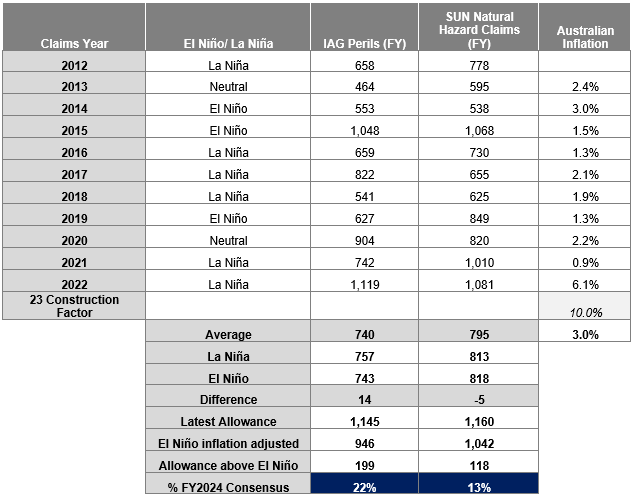

We consider the past 10 years of data across the insurers and note that although there have been recent periods that are classified as neutral or El Niño years, the dominant conditions have been that of La Niña.

QBE

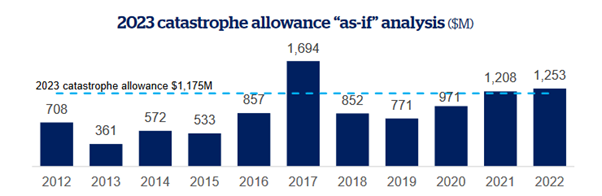

QBE differs to Suncorp (SUN) and IAG Australia (IAG) in that it is a truly global insurance company with approximately only 25% of premiums written in the Australia Pacific region and the rest of the business split fairly evenly between North America and the rest of the world (International). Since 2017 QBE has been positioning for growth and turning around underperforming businesses. This has been somewhat accelerated by the commencement of CEO Andrew Horton in September 2021. One of the measures to improve returns and reduce volatility has been to raise the level of catastrophe (“Cat”) provisioning from USD685m in 2021, to USD962m in CY2022 and now USD1,175m. The provision vs claims of the past 10 years is presented in the graph below.

Source: QBE CY2022 Results Presentation

We have tabled this below to demonstrate the variability in claims across El Niño and La Niña years and what that might mean for overall claims going forward.

Source: Chester Asset Management with data from QBE Annual Results reports

As is evident in the table above La Niña has brought with it material damage from weather events. The 3 years most significantly impacted being 2017, 2021 and 2022.

- 2017 included damages from the impacts of Hurricanes Harvey, Irma Maria, as well as California Wildfires

- 2021 included Winter Storm Uri and Hurricane Ida

- 2022 included Hurricane Ian and the French storms

The table above suggests to us potential for a catastrophe claims beat should ‘normal’ (if there is such a thing) El Niño conditions prevail.

Suncorp and IAG

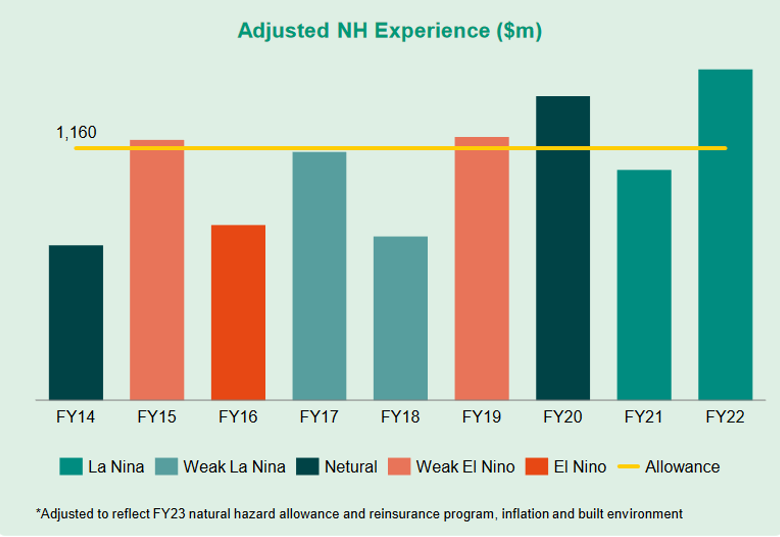

Suncorp (SUN), if their bank sale achieves ACCC approval, is set to become a pure play insurer. SUN has ~16% market share (28% motor and 22% home) across Australia with brands such as AAMI and GIO. IAG has traditionally been regarded as the premium insurance name in Australia with historically strong performance from brands such as NRMA, CGU, RACV (JV), SGIO, etc. and ~20% market share. Both IAG and SUN have been materially impacted by Cat claims in recent years from the severe flood events. SUN’s claims from FY2014 to FY2022 are evident in the graph below.

Source: Suncorp Presentation, FY2022

For comparison to QBE, we have prepared a similar table however the results don’t highlight much difference in claims between El Niño and La Niña years for the Australian insurers since 2012. In FY2015 in particular (El Niño year) there were elevated claims associated with storm events in Brisbane (November 2014) and NSW (April 2015). We also believe that El Niño conditions bring with them increased risk of bushfires.

Source: Chester Asset Management with data from IAG and SUN Annual Results reports

As highlighted above the dominant weather pattern over the past 15 years has been La Niña and hence despite there not being obvious evidence in the table of variances between El Niño and La Niña years, the work by Aon and Climalab supports reduced peril/ natural hazard claims for both insurers should we enter a period dominated by El Niño.

Agribusiness

Apart from Insurance, the Agribusiness subsector is the most impacted by weather conditions. We have tabled some of the potential impacts to select ASX Agribusiness names below.

Source: Chester Asset Management, various sources

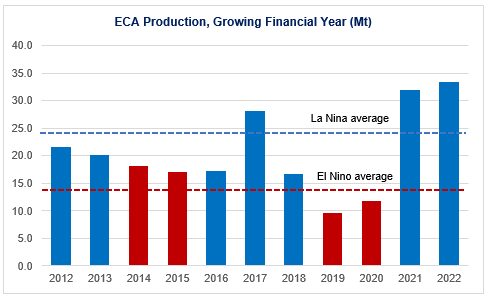

In relation to Graincorp, East Coast Australia (ECA) production[1] is presented in the chart below.

Source(s): Chester Asset Management, Graincorp, ABARES

It is worth pointing out that the FY23 winter crop is currently forecast at 28.9Mt (vs 10 year average of 20.9Mt) and the ECA summer (sorghum) crop is estimated at 2.5Mt taking the total forecast to 31.4Mt. I.e., another strong year benefiting from La Niña rainfall. Should we enter a period of El Niño however the data suggests production materially below that of La Niña years.

Construction and Development

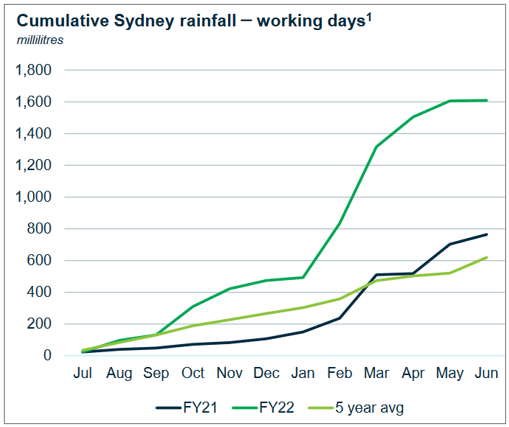

The FY2022 and now FY2023 rain and flooding events across eastern Australia has been extremely challenging for a host of industrials, namely construction and development companies. As noted above 2022 for Sydney was the wettest on record and the 2022 financial year saw almost 3 times the average rainfall of the previous 5 years.

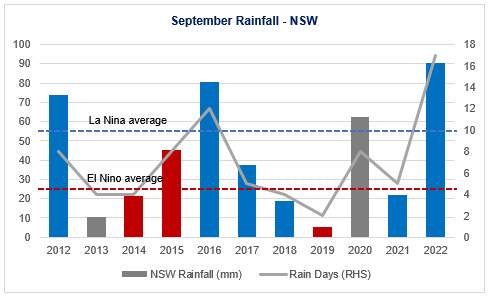

Below for reference we have tabled the rainfall experienced in NSW in September for the past 10 years. We have used this as a guide to the degree of variability between El Niño and La Niña years.

Source: Chester Asset Management, Bureau of Meteorology

I.e., in the graph above La Niña years are ~30% above the 10 year average rainfall figure and El Niño years ~40% below. A sample of industrial companies we note that have recently been impacted by the weather are tabled below.

Mining and Utilities

We have seen a host of miners impacted by wet weather in the past few months. Tabled below are a recent subset, on the east coast. These operators obviously stand to benefit from drier conditions.

We also note that El Niño drier conditions are combated with increased energy (air-conditioner) use so an El Niño dominant period could lead to volume growth and electricity price benefits for the likes of AGL and Origin Energy. 2019, the last El Nino period in particular brought with it a spike in electricity prices with the March Quarter in Victoria averaging ~AUD200/MWh.

Closing

So, the question really comes down to can you trust the Weatherman? Because if you can, and we are set up for an El Niño dominated decade there could be some material benefactors within the insurance, industrial and mining sectors and conversely some areas of risk to be mindful of in Ag. Bring on long hot summers.

1 topic

27 stocks mentioned