Cashed up small cap looks to make amends

Laser guidance manufacturer Electro Optic Systems (EOS) had an incredible run in 2019, with the share price appreciating four-fold. But contract and delivery delays on the back of COVID restrictions have meant that expectations have missed their mark with investors so far this year.

But with the short term traders moving on to greener pastures and the price down around nearly 30% this year, Henry Jennings from Marcus Today reckons it might be time to reconsider the company.

I spoke with Henry following the EOS result on Monday to hear the latest about the company. He tells us why it's a unique opportunity in the Australia market, why next year should see a significant improvement in the bottom line, and he shares what he'd need to see for him to re-enter the stock.

How long have you held EOS?

I have held EOS on and off for the last couple of years. I last held it back in June and sold out at $6.40 before the capital raise. So, I have been out of it for a little while, but looking very interestedly from the sidelines, as it is a stock that has piqued my interest before. It fills a void in the Australian market as a defence contractor with good exposure to not only terrestrial defence, but also now moving into the space race. That is always important for diversity.

So, you are considering re-adding that to your portfolio?

I am, but it all depends on the price of the stock. The stock price fell on Monday, down around 11% on those results. I am very much interested in adding to that position in the portfolio and it is starting to get into my target range. Getting very interested at these levels.

Why were you attracted to the company in the first place?

One of the big reasons is that there are not too many ways you can get exposure to defence in this country. On the ASX you have got Austal (ASB) making ships for the Australian and US navies, but there are very few ways to get exposure to defence.

EOS is one way to get exposure though. They have laser-guided weapons systems and drone systems. Now they are moving into space technology and communications, which is appealing.

Given that governments around the world are spending more money on defence, I think it is a good thematic over the next 10 years. We have seen the Australian Government increase their spending to $270 billion over the next 10 years, but it is not an easy thematic to play in this country. A lot of defence contractors, like British Aerospace Systems, are located overseas. EOS is a home-grown success story and has been very good at penetrating overseas markets, especially in the Middle East and the US. It is a great success story, and it's a good way to get exposure to that growing defence sector.

Could you outline some of the key points of the result? Why do you think the market has reacted negatively?

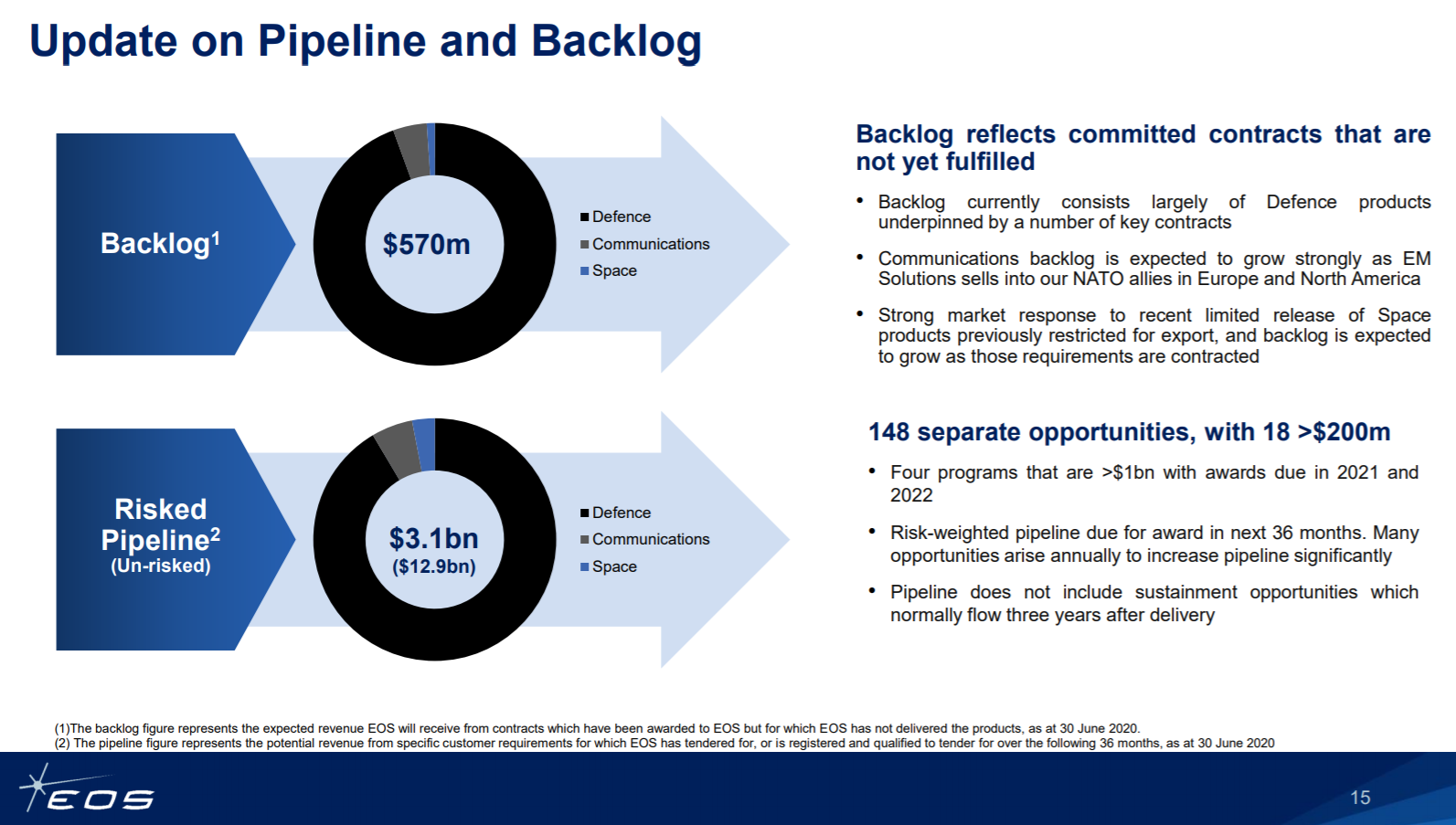

Revenue growth was good, $75 million compared to $57.4 million last year. The issue has been the deferral of some contracts. They talk about the ‘risked pipeline’ of contracts which is around $3.1 billion. That is all very well and good, but if they just keep getting pushed out because of COVID, then that revenue and those contracts do not come to fruition.

Click to enlarge

Source: Company Presentation

Source: Company PresentationUnderlying EBIT was a loss of $15.1. Last year, they made a profit of $9.1 million. So, a little bit disappointing there, but it is due to the deferral of contracts, which has been the key story. COVID has taken its toll there.

They have a lot of cash now. They raised money recently, they raised at $4.75 for institutions. Luckily for retail shareholders, they got stock at $4.40. They have now got cash of around $128 million. The balance sheet gives them some flexibility there, but it is all about those forward orders.

The disappointing thing was that we heard back in July that the Australian Government was looking at 251 remote weapons stations. I think the market was getting itself in a bit of a lather about more news and an actual dollar value on that contract. And the tick of approval from the government. But we didn't get that on Monday. So, maybe that is why we've seen some disappointment.

I guess one of the problems with defence contractors is that they operate in sensitive areas. It takes time to get things over the line. There's no question they've got the technology and they've got the manufacturing capability, but it is just taking time.

I think investors have just got a little impatient short term, and I'm happy to watch and wait and try and benefit from that by picking up some cheap stock, maybe around $5.00 to $5.20, if it does pull back. Given that we saw that capital raise at $4.75 with institutions, there are potentially some institutions that are ‘stale-bulls’. They may be happy to move on and put their money to work elsewhere.

It appears they have built a bunch of products and it's ready to go, but their customers are not taking delivery. Does that leave the company in a situation where it could make up those lost profits in the next financial year if those orders come through?

Yes,I think it is largely a timing thing. They have put forecasts out for guidance of between $20 to $30 million. So, it is a big guidance range for EBIT. Prior guidance was $27 million. So maybe that has spooked the market, but what they have not seen is cancellations of contracts, just deferment. So, stock in the weapons systems is building up, ready to go, ready to be delivered. But it is difficult to deliver at the moment for some countries due to lockdowns and travel restrictions.

The pipeline looks strong and this government contract they could get from the Australian Government for 251 remote systems won't have any impact on their manufacturing capability either.

So, they should have plenty of scope to be able to do that. It is a timing issue more than anything else at the moment. Those contracts not being cancelled, just deferred. But it is clearly having a short-term impact on revenue and profit.

How did the results compare with your expectations and the expectations of the broader market?

The market was hoping perhaps to get a little bit more clarification on those deferred projects. It was a little bit disappointing, given the world is opening, that we have seen no real clarification on that yet. So, I think there was some disappointment there.

There was also disappointment that there was no clarification about the potential contract with the Australian Government. I think that is weighing on the stock. Maybe a few short-term traders are getting out and moving on.

Were there any surprises?

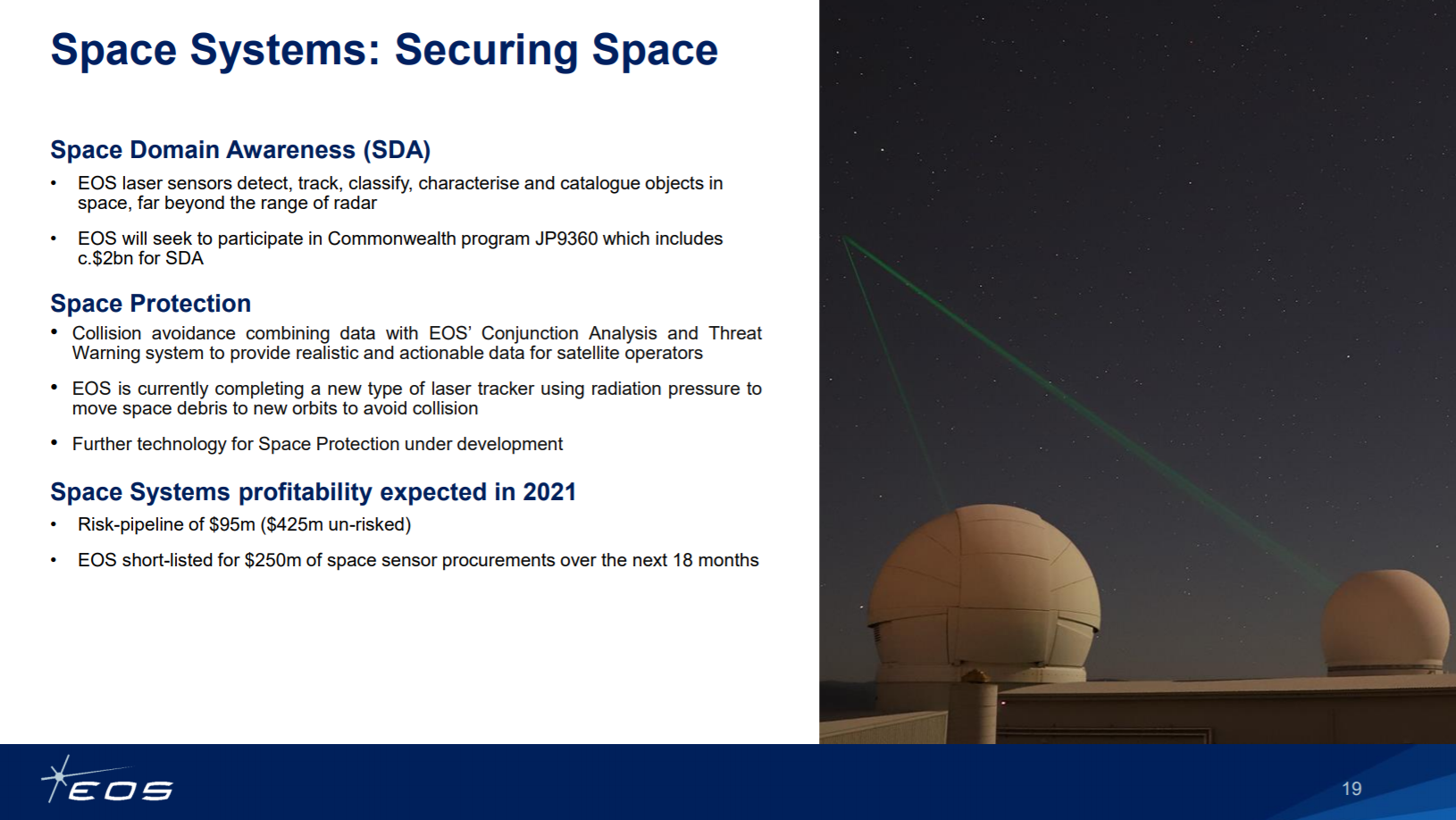

The one thing that did surprise me a little bit is there was a great focus on the space side of things. But when you looked at the revenue coming out of space, it was negligible. I think around $0.7 million. That was down a bit from last year. Admittedly, space is a new business, and they have made some acquisitions to build that business. It is clearly taking some time to get some traction, but that was one of the reasons people got excited earlier this year. Especially when you had the US talking about the new Space Force, the new frontier of the Cold War, cybersecurity, etc.

Click to enlarge

Source: Company Presentation

Source: Company PresentationHas your position changed following the results and why or why not?

Not really. This is quite a volatile stock and it does sort of have some big swings. It is very much a sentiment-based stock. We have seen a big fall today due to a few stale balls and a bit of disappointment on those contracts.

I am looking to accumulate on the back foot with this one. Then once the good news starts to come through again and economies and defence contracts start to reopen, then we should see this one back in the winner's circle.

So yes, waiting and seeing, and hoping to get them at a better price than they were a couple of days ago.

Want more earnings season Q&As like this?

Hit like so we know that you want more of this type of content.

Throughout August, my colleagues Bella Kidman, James Marlay, Glenn Freeman and Vishal Teckchandani will also publish similar Q&As on Livewire readers' most-tipped big caps and small caps. Hit FOLLOW on our profiles to be notified when these wires are published.

1 topic

2 stocks mentioned

4 contributors mentioned