Chart of the Week: Commodities at a tipping point

First of all, it’s worth acknowledging something that may seem peculiar. I look at commodities at the asset class level. And so I should! — I run an asset allocation research service, and asset classes are basically my “stocks“.

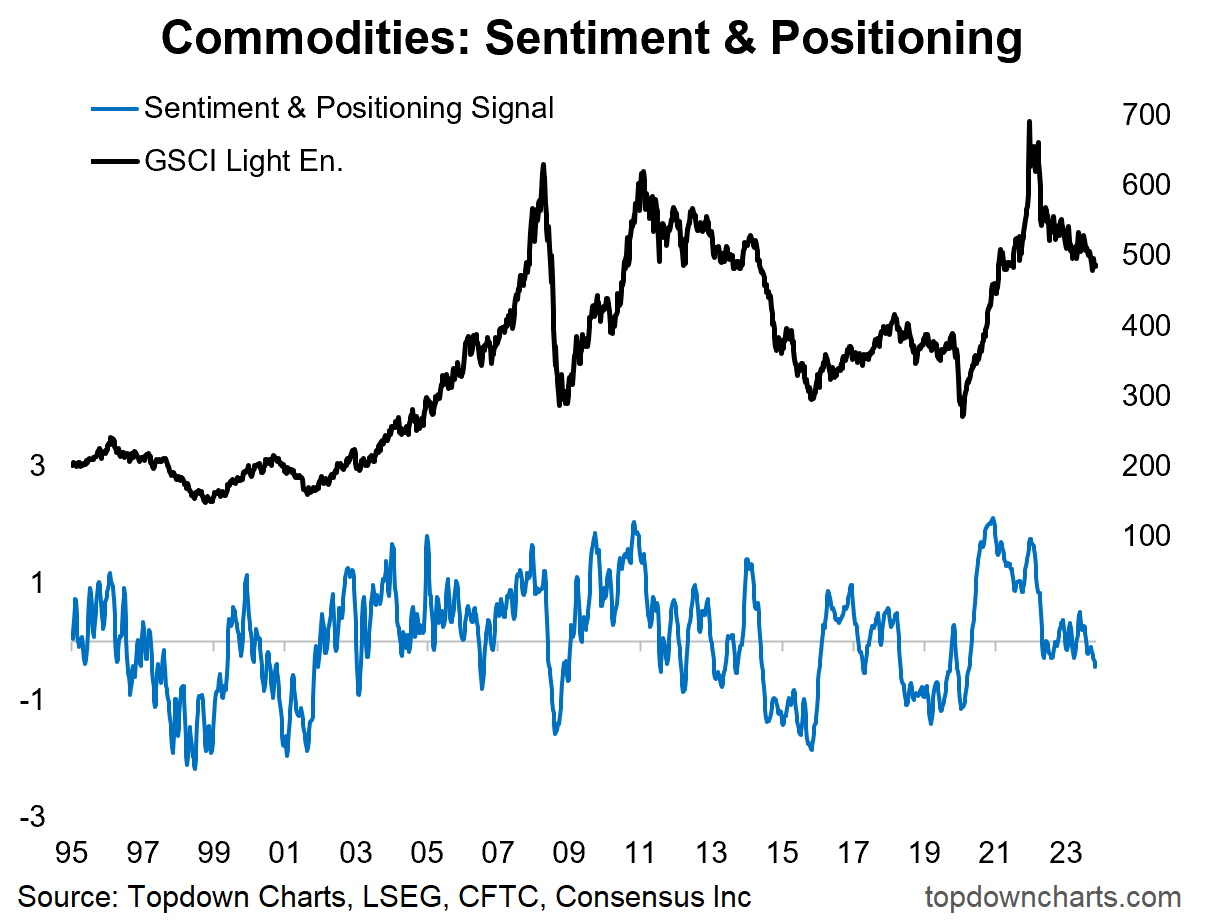

In that respect, the chart below should make a little more sense… what we are looking at is the price for “commodities“ in the black line (in this case it is the GSCI Light Energy Index — which is a broad diversified commodity index).

The blue line is a sentiment-positioning composite signal, which is 50% sentiment (Consensus Inc.) and 50% speculative futures positioning (CFTC CoT data). Both standardized for signal alignment.

Now onto the main part — why is this interesting?

Since the cyclical bear market in commodities took hold, the index has come down to a major longer-term support level, and sentiment/positioning have reset from crowded consensus bullish to now just south of neutral.

We’re basically at a tipping point between capitulation vs reacceleration.

Capitulation = the steady cyclical bear breaks support, sentiment and positioning collapse, final violent phase of the commodity bear market ensues.

Reacceleration = a new higher floor is established, the existing reset in sentiment/positioning proves enough, and upside is unlocked (this scenario would probably need a rebound in global growth).

I’m open minded on either outcome, but I would note given that short-term trend and momentum are downward sloping, the burden of proof is on the bulls.

Ultimately though I think the swing factor is going to be what happens with the global growth pulse. 2023 saw significant slowing as soft data caught down to recessionary leading indicators, and hard data (especially global trade and manufacturing) slowed considerably.

This brings us back to my macro-edge-risks framework — at one edge is recession and deflation, at the other edge is reacceleration and inflation resurgence. I believe we will see this play out in real time in charts like the below. So aside from being a useful information point in itself for gauging the risk/return outlook for commodities as an asset class, it’s also going to be a key barometer and indicator of the global macro risk outlook.

Key point: Commodities are at a tipping point, keep close watch on this chart!

5 topics