Charts and caffeine: Goldman Sachs reinstates buy on BHP despite iron ore headwinds

Welcome to another edition of Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of expert editors. Let's get you caught up on the overnight session.

MARKETS WRAP

- S&P 500 - 4,177 (+1.84%)

- NASDAQ - 12,893 (+2.75%)

US markets went for a run overnight but at the company level, earnings continued to reflect macro strains. Microsoft (NAS:MSFT) cut sales and earnings guidance for the current quarter, citing the impact of a stronger US dollar.

In contrast, Hewlett Packard (NYSE:HPQ) shares slumped after missing the street's estimates for earnings and revenue. I wonder if this will boost Carl Icahn's case for a merger with Xerox? For a primer, see here.

Finally, Hormel Foods (NYSE:HRL) recorded a double-digit boost to earnings but did flag that the price of your turkey could be going up because of - get this - bird flu.

Not the turkeys!

- FTSE 100 - 7,533 (-0.98%)

- STOXX 600 - 441 (+0.57%)

Note light trading volumes in the UK because of the Queen's Jubilee Bank Holiday.

- USD Index - 101.77 (-0.71%)

- Treasury yields unch

- Gold - US$1,872/oz (+1.29%)

- WTI Crude - US$117.44/bbl (+1.87%)

Oil prices rose overnight despite OPEC+ agreeing to increase the size of its supply hikes by about 50%. However - infrastructure constraints are still a big problem for the cartel. Countries that have been unable to raise production will still be allocated the higher quota. That could mean that the actual supply boosts are smaller than the official figure.

THE CALENDAR

The labour force report hits tonight in the United States and as always, it'll be very closely watched. The tight labour market is a known story all over the world. Analysts are expecting the unemployment rate to tick down to 3.5% after 325,000 more jobs are created.

The big story will be in the average hourly earnings and in the hiring fatigue. Job openings fell by nearly half a million in April, narrowing the historically large gap between vacant positions and available workers but only slightly. But let this stat sink in for a second.

There are still nearly two jobs for every American who wants one.

Average hourly earnings are tipped to come in around 0.4% higher for the month, but we'll see how true that come 10:30pm Sydney time.

STOCK TO WATCH

Our stock of the day is BHP (ASX: BHP), and it's all thanks to this note from Goldman Sachs:

We reinstate BHP with a Buy rating post the completed oil merger on attractive valuation & free cash flow, and upside from copper growth.

The thesis is long (17 pages for one stock, to be precise) but here is the essential gist of it. Just because it's demerged its oil assets doesn't mean it can't maintain its share price premium and competitive advantage. These are the reasons the team gave:

- Ongoing superior iron ore margins and operating performance

- High returning copper growth/strong position in seaborne coal

- Lower iron ore replacement and decarbonisation CAPEX.

- Higher exposure to lower operating jurisdictions such as Australia and Canada

This view seems to be in some contrast to Macquarie (ASX: MQG) who believes that time is running out for iron ore. Analysts at that broker wouldn’t be surprised to see prices moving higher again in the near term as market focus shifts back to rapidly drawing inventories and underperforming supply. But as always, it comes down to China - no or less stimulus means fewer projects and less iron ore. For its part, ANZ's (ASX: ANZ) commodities guru Daniel Hynes argues the iron ore price may have now found a floor but that upside is probably limited.

Even if iron ore does correct dramatically, the Big Three have had a comparatively good run against the rest of the market.

THE QUOTE(S)

Two contrasting quotes from the same firm - namely Jamie Dimon and Marko Kolanovic of JP Morgan (the latter was featured in a recent piece on this website!)

At a conference in New York, the CEO of one of the most important banks on Wall Street warned investors that an economic "hurricane" is coming.

You know, I said there’s storm clouds but I’m going to change it … it’s a hurricane. That hurricane is right out there down the road coming our way

He went on to add that he does not know if the recession will be a minor or major one, but he did say that investors should brace themselves for what could come. I can only wonder what Michael Feroli (Chief US economist) must be thinking after hearing that. Having said this, he is on the record saying a recession is likely next year.

Then, there's the view of equity market bull Marko Kolanovic, who wrote this in his note:

The market already absorbed and priced in the change in monetary policy and significant tightening of financial conditions as inflation peaked or is peaking now.

Has it? The S&P 500 is down nearly 15% year-to-date without the Federal Reserve actually beginning its tightening process. I wonder where those gains will come from when the Fed starts (i.e. right now).

THE CHART

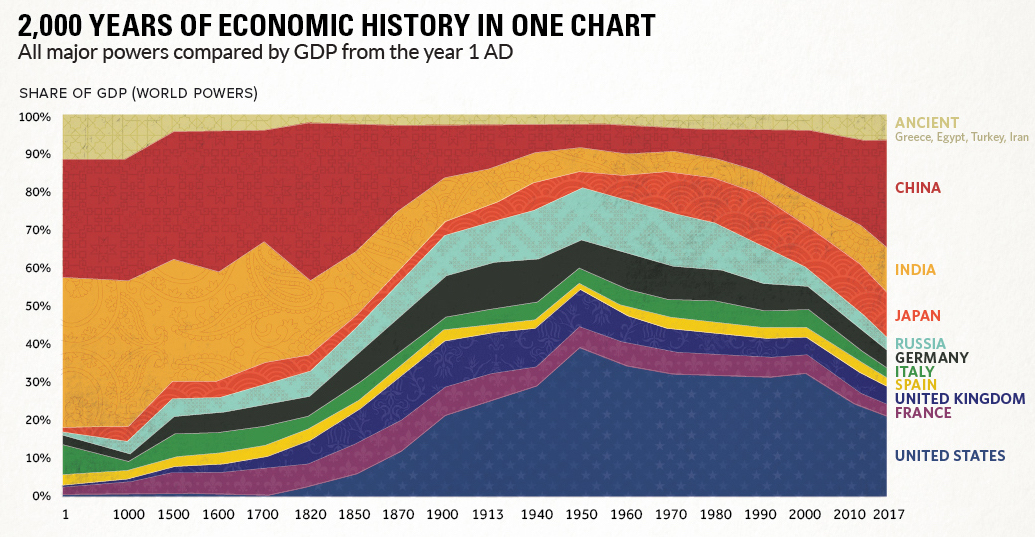

Today, I thought we'd break from our regular routine of market or macro-sensitive projections and show you this really colourful history of global economic power.

I'm drawn to two things about this particular chart - the peak in American power was actually a lot earlier than I thought (around the 1950s) and look at that comeback from China. It was slow for a while but when it returned, it came back in a big way.

Note, that this chart was originally published in a research letter by Michael Cembalest of JP Morgan, and this particular rendition is an update based on the most recent data and projections from the IMF. The only part I'm not a fan of is that gap between 1 AD and 1000 AD (and again between 1000 AD and 1500 AD). Then again, I suppose there's only so much space on a website's page.

THE TWEET

I've taken this one from Catherine Rampell of The Washington Post because it highlights how much voters depend on government to solve the issues they are most facing.

THE BEST READS IN BUSINESS NEWS

Billionaire’s Activist Victory Jolts Boardrooms Across Australia (Bloomberg): You know Mike Cannon-Brookes' ability to destroy a demerger proposal is big when it hits the Bloomberg website as the daily big take. Angus Whitley takes a look at what that all means for investors.

Canva’s falling value highlights venture capital’s big worry (AFR): I found it interesting to hear Matt Comyn of CBA saying that the funding environment for VC firms is currently as difficult as it’s been since the GFC. I wonder how those books will look long after the free money flows away. (Glenn Freeman)

Pride For Sale (WaPo): Although this article is from 2019, I thought it'd leave you something to take away with for the weekend. As it's now June (and therefore, Pride month), I found this piece to be timely again. Business hopping on the coattails of important occasions to make a social-friendly dollar isn't anything new. But is it right?

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

4 topics

4 stocks mentioned

1 contributor mentioned