Charts and caffeine: The Federal Reserve hikes rates by 75 basis points - and doesn't rule out more

Welcome to a historic edition of Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

At 4am this morning, history was made. For the first time since the Paul Volcker era (1994), the Federal Reserve raised its key interest rate range by 75 basis points. The range now sits between 1.5% and 1.75%.

Chair Jerome Powell said he doesn't expect these huge moves to be common - but he also said hikes are not stopping anytime soon.

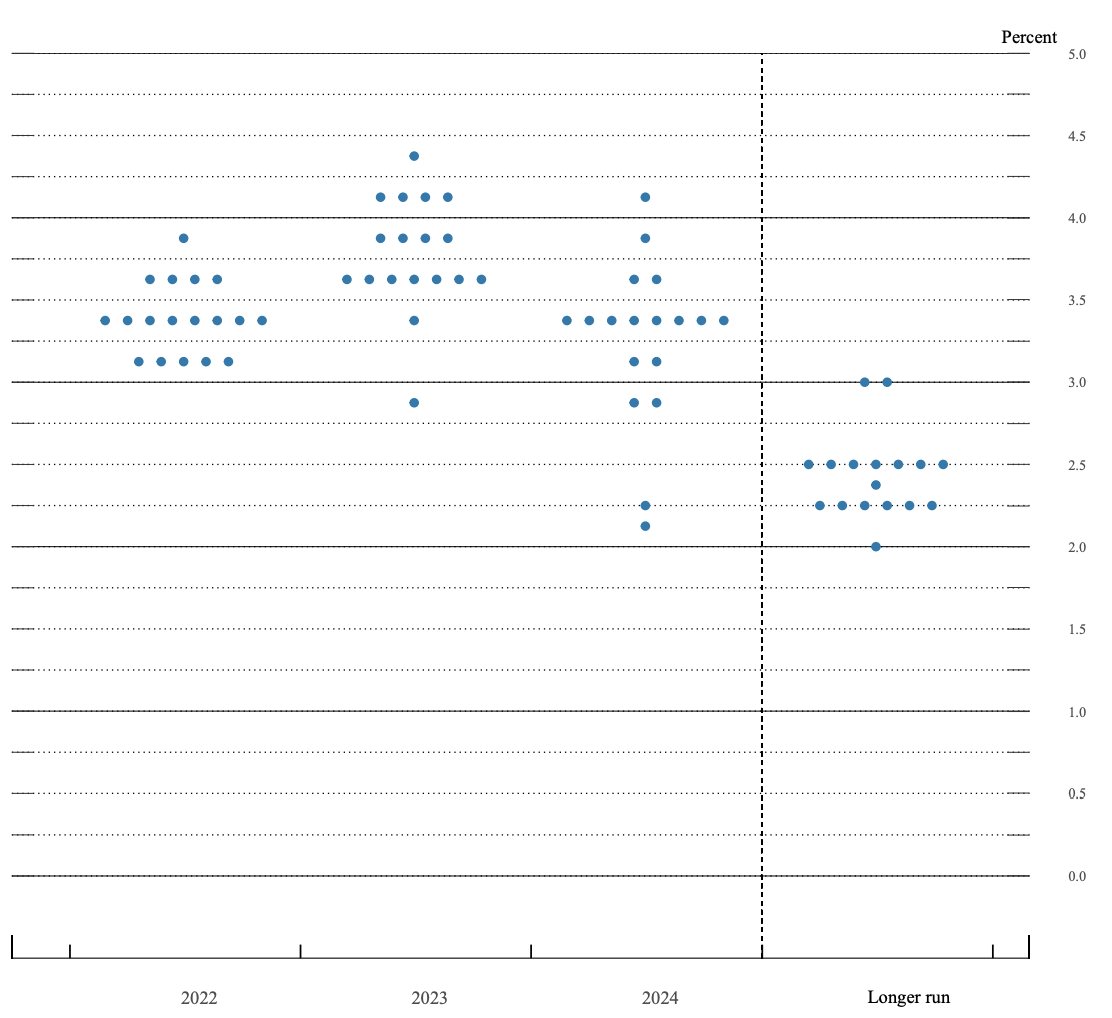

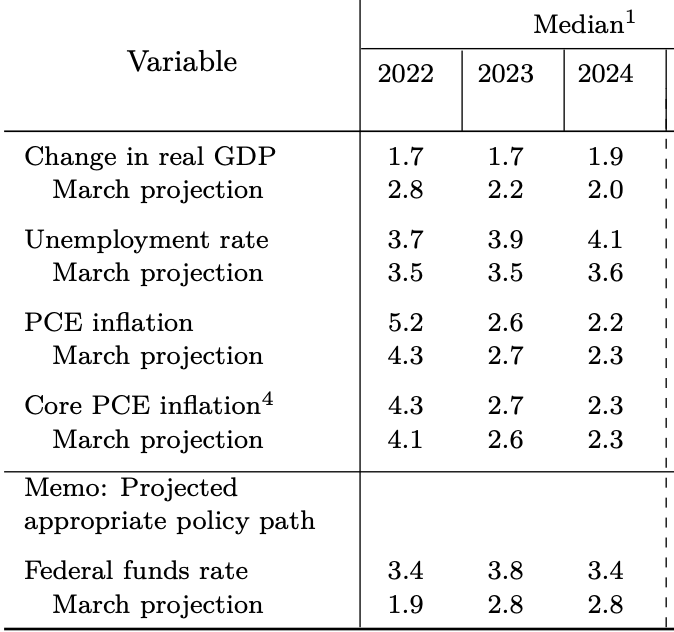

This meeting was also vital in that it showcased the Fed's economic projections as well as calls from the top brass for where they believe the interest rate will be at the end of the year.

If you treat the midpoint of these projections (the "dot plot" as it's called) as gospel, the Fed’s benchmark rate will end the year at 3.4% before rising to 3.8% at the end of 2023.

Perhaps most importantly, the projections for GDP growth, unemployment, and inflation have changed dramatically.

Expect these projections and those terminal rate forecasts to bounce around quite significantly over the next few months. After all, the Fed is (still) looking for the "compelling" evidence it needs to see that inflation is coming down.

One last thing - another 75 basis point hike is not off the table for the next meeting in six weeks.

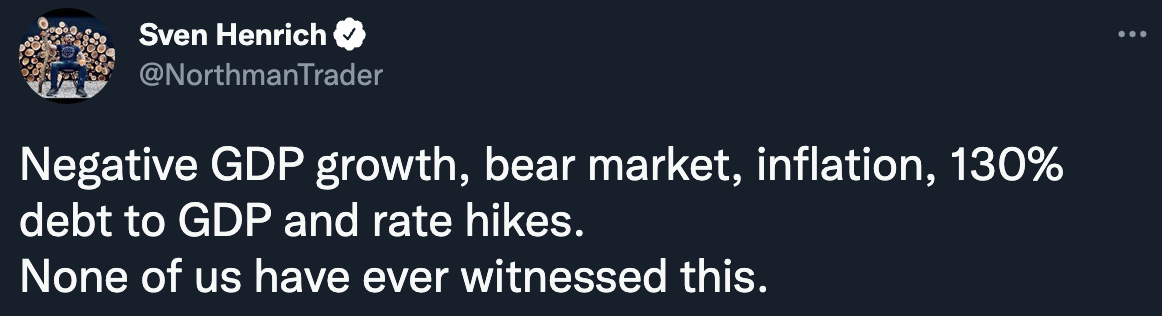

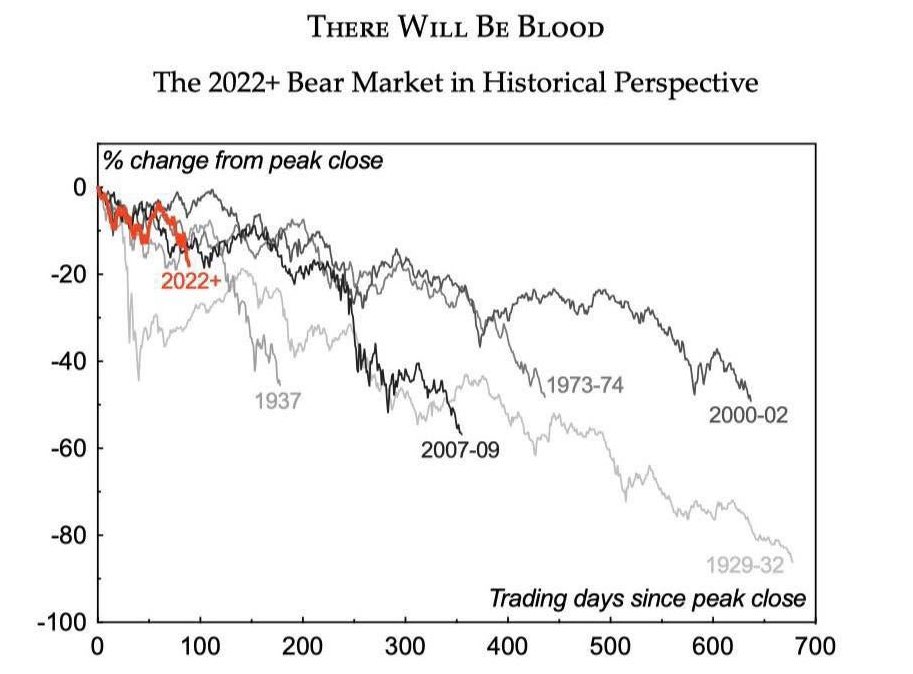

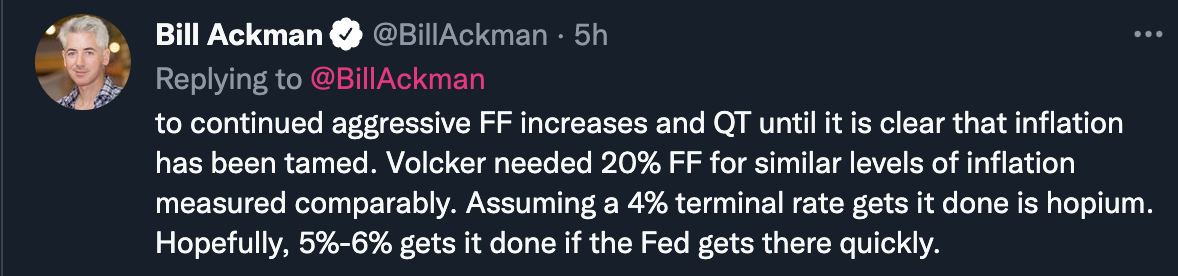

That makes this tweet even more pertinent - we are in unchartered waters by all expectations.

On a related note, the European Central Bank called its own "ad hoc" (translation: emergency) meeting yesterday. The conference attempted to deal with a concept called "anti-fragmentation". Following its scheduled meeting last week, the ECB failed to deliver any new measures to support highly indebted nations in the bloc. Since then, markets have been testing the ECB's resolve, and yesterday, the governing council said they would "accelerate" the creation of a new tool to fight the said problem. That's where those details ended.

MARKETS WRAP

- S&P 500 - 3,790 (+1.46%)

- NASDAQ - 11,099 (+2.5%)

- CBOE VIX - 29.62 (-9.39%)

- US 2YR - 3.218%

- US 10YR - 3.315%

- USD INDEX - 104.82

THE CHART

THE STAT(S)

70 bps: The five-day rise in US 2-year yields is the most since the American summer of 1982. (Source: JP Morgan/WSJ)

When some pundits say "the market is doing the Fed's work for them", this is what they mean. The sell-off in US Treasuries across the curve (but particularly at the short maturity end) has been absolutely astonishing. With that in mind, here are two more cool stats with the same theme.

- The US 2-year yield is now at the highest in 14.5 years

- The US 10-year yield is at the highest in 11 years

- You can (as of writing) earn a better yield from investing in a 5-year note than in a 10-year or 30-year bond.

Hooley Dooley doesn't do it justice.

THE QUOTE

The usual rule is, if you are worried about how your moves are going to affect financial markets, you move gingerly ... You worry about the risk of breaking something. In this case, it’s worth breaking something. We are at a very critical point where it looks like their credibility is starting to erode.

Today's quote comes from Barclays economist Jonathan Millar - his team was the first in the market to argue a 75bp hike would be the base case for this morning's rates decision. He also used the note to shut down any worries about a looming recession that could be caused by hiking too fast.

THE TWEET(S)

STOCKS TO WATCH

So now that markets are in free fall, I thought I'd take a look at the state of the consumer. Barrenjoey put out a recent note on the ASX retail sector due to what it calls a looming margin and earnings crimp. Here are the words of analyst Tom Kierath:

Cost of living pressures are set to bite hard such that spend on discretionary retail will slow, especially in the electrical/furniture categories where spending is most above trend. We make significant earnings cuts to discretionary retailers under our coverage.

And then, there's this little addendum that got my attention.

We can’t think of a time in the past 15 years when the consumer macro-outlook has looked more challenging ... we struggle to see opportunities to become more constructive until earnings forecasts reflect reality.

As a result, the team now sees the most risk for JB HI-Fi (ASX:JBH) and Kogan (ASX:KGN). In contrast, they see Metcash (ASX:MTS) as a buying opportunity with overweight ratings on Universal Store (ASX:UNI), Lovisa (ASX:LOV), Adairs (ASX:ADH) and Dusk (ASX:DSK).

PREVIEW TO BANK OF ENGLAND

As quickly as the market turned a 50bp hike bet into a 75bp hike bet, all eyes will now turn to the Bank of England.

The market is expecting another 25 basis point hike from the Bank of England, which would lift the benchmark Official Bank Rate (OBR) to 1.25% from the current 1% rate. Analysts and traders think that if the BoE opts for 25 this time, then 50 is likely to follow at the next meeting.

The fun part for the Bank of England is two-fold: 1) the committee releases its vote tally and in recent meetings, the split has been 5-4. It will be interesting to see if this eventuates again. 2) The Bank must also now contend with soaring inflation, a contraction in economic growth, and most importantly, a weaker British Pound in the face of a Federal Reserve pulling absolutely no punches.

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

7 stocks mentioned