Charts and caffeine: Where the special dividends and buybacks may be found

Welcome to another edition of Charts and Caffeine - our daily markets wrap featuring the best charts and reads from across Livewire's team of expert editors. Let's get you caught up on the overnight session.

MARKETS WRAP

- S&P 500 - 4,161 (+0.95%)

- NASDAQ - 12,712 (+0.89%)

- CBOE VIX - 24.85 (-2.87%)

Target shares slumped for the second time in three weeks after downgrading its profit forecast (again), blaming bloated inventories (again).

- FTSE 100 - 7,599 (-0.12%)

- STOXX 600 - 442.88 (-0.28%)

- USD INDEX - 102.33

- US 10YR - 2.977%

- GOLD - US$1855/oz

- WTI CRUDE - US$120/bbl

THE CALENDAR

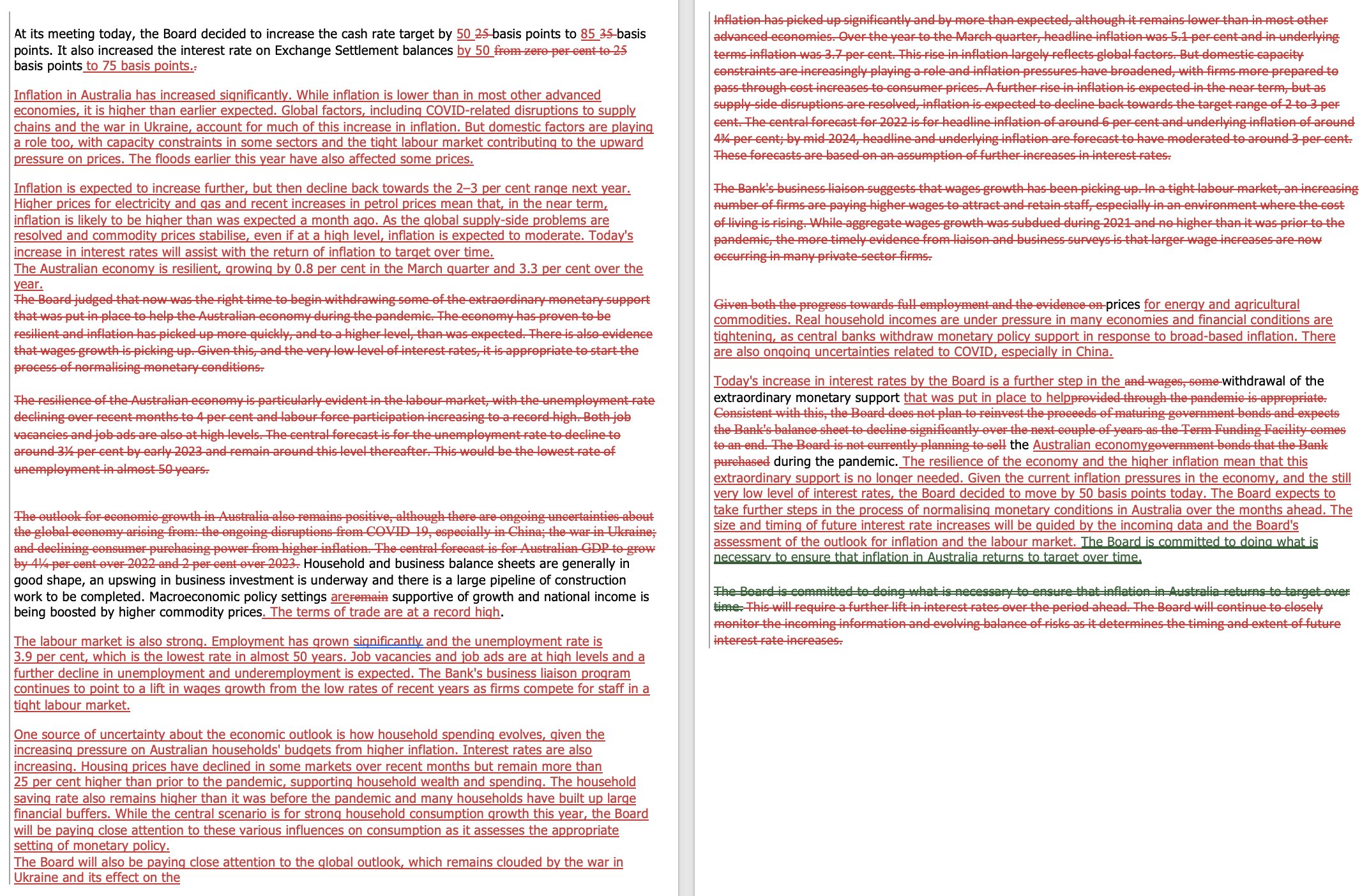

The last time the RBA hiked rates by this much, Killing Heidi was the top of the ARIA Charts. But their 50 basis point move sank the mood of an already dour equity market while thrilling Australian dollar traders at the same time (if only briefly). Of the major economists who were polled, only one had a 0.5% hike in the pool (Goldman Sachs' Andrew Boak) while two of the Big Four had 0.4% increases coming into today's announcement.

To me, this picture tells the whole story.

Next stop for the macro nerds: the June ECB meeting tomorrow. Buckle up, kids. It's going to be absolutely thrilling.

STOCKS TO WATCH

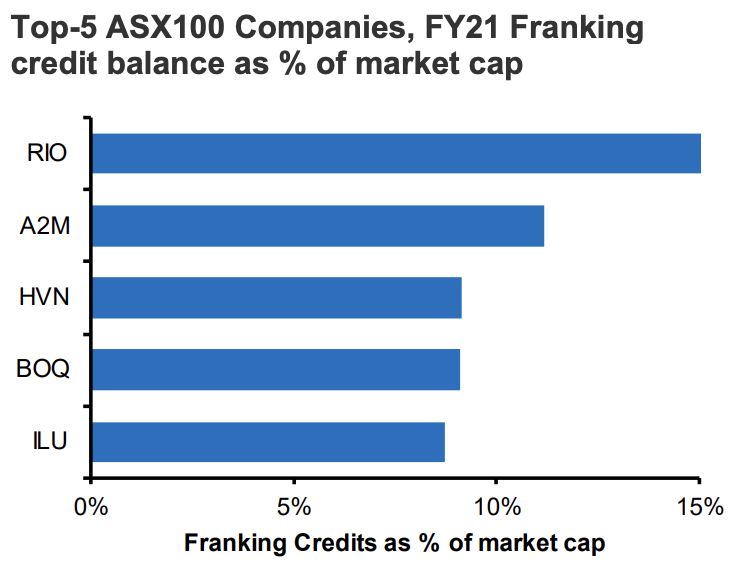

It's June which means it's time for two things in Australia - winter and tax time. While both matter to everyone, the latter is a particularly important subject for those who own high dividend-yielding stocks. Luckily, Macquarie's done the work for you through its in-house research system. Even better, it's compiled a list of companies that it thinks are likely to commence capital returns to shareholders.

On the franking credits side, the five ASX 100 companies with the highest balances are mentioned below - Rio Tinto (ASX:RIO), A2 Milk (ASX:A2M), Harvey Norman (ASX:HVN), Bank of Queensland (ASX:BOQ) and Iluka Resources (ASX:ILU).

As the analysts note, companies' ability to distribute franking credits through buybacks or special dividends would be amazing! However, it's also largely dependent on how much extra cash is on the balance sheet or indeed, potential divestments on the horizon.

So if you're a dividend investor, where could the extra payouts come from? Allow us to enlighten you.

Excluding the capacity for other investments or divestments, Macquarie has identified seven potential companies that could be distributing extra cash back to you. Of note, six of them are outside the ASX 100.

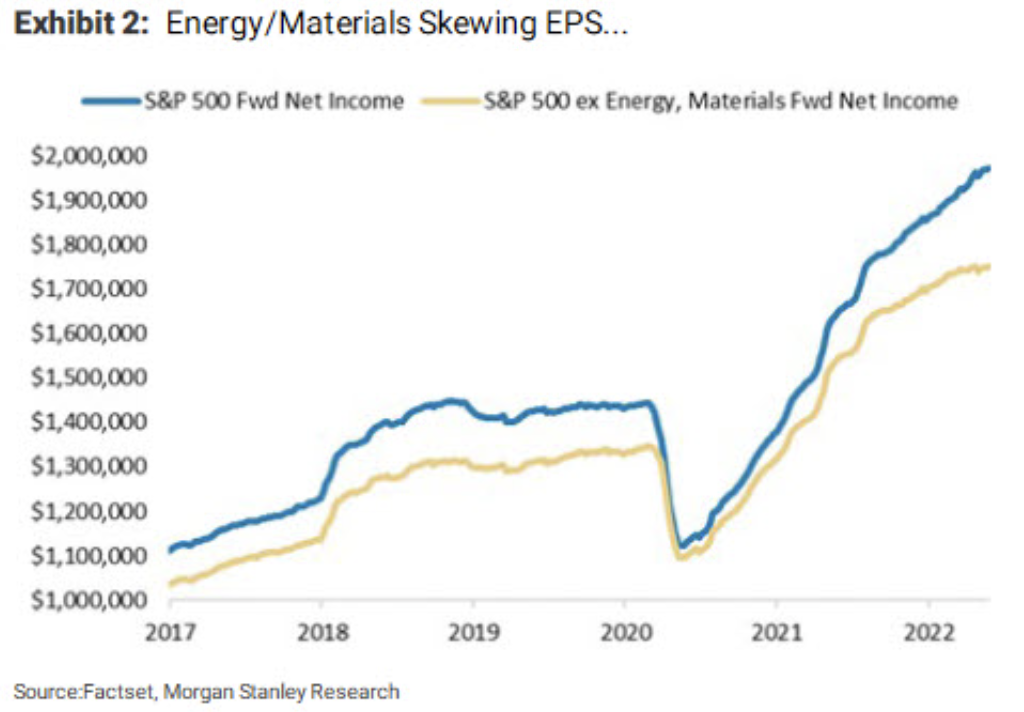

Beach Energy (ASX:BPT) and Woodside Energy (ASX:WDS) - In both cases, the company has a strong balance sheet right now (no prizes for guessing why). However, the snag (especially for BPT) is that management has indicated it may pursue M&A or capital management in the next 12-24 months. If they do, kiss that special payout goodbye. WDS' major M&A project has already been finalised.

Either way, its earnings are humongous - so much so that they are skewing EPS forecasts in the states.

McMillan Shakespeare (ASX:MMS) - Current conditions and business strategy support the potential for capital management

Premier Investments (ASX:PMV) and Super Retail Group (ASX:SUL) - A possibility given the strong landscape for retail sector revenues but the decision will be constrained by any decisions to hold capital for further growth or M&A. In the case of SUL, there may also be an issue around inventories.

Seven West Media (ASX:SWM) and Southern Cross Media (ASX:SXL) - Two compatriots in the media space but two very different reasons. SWM has a high franking credit balance and may want to offload some of that. For SXL, it raised too much equity in early 2020 - so it may just choose to return that money back to shareholders if it feels it doesn't need the spare cash.

THE CHART

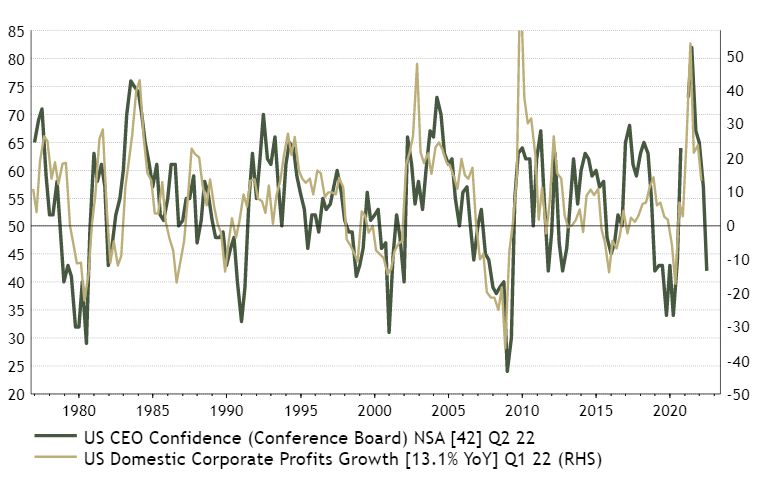

This particular chart comes to us from London-based Ian Harnett (ex-UBS, but running his own shop for many years). He argues the bigger risk for company share prices is no longer valuations but earnings downgrades.

To prove the point, he noted the confidence of CEOs based on the latest survey stateside. While there have been outliers on occasion, the two tend to move together - and the correlation at the very far right of this chart is amazing.

Extra reading: If you enjoyed this chart, then you'll enjoy this piece featuring the views of Patrick Hodgens from Firetrail Investments on why shorting earnings downgrades is a good idea.

THE STAT

1999: The last time Amazon did a stock split

Yes, you weren't seeing things. Amazon is officially a three-digit stock price again for the first time since 1999. A reminder that stock splits don’t alter the value of a company or impact the worth of shareholders’ investments - but the last time it did do that, the dot-com bubble followed very quickly after.

Be careful what you wish for.

THE INFOGRAPHIC

Little known fact - one of the inspirations for this market note is the Morning Brew newsletter. One thing they definitely do better than I would ever do are infographics - and this one is too good to resist not putting in. Sure, the price stays the same but the company has to remain afloat somehow!

BEST READS IN BUSINESS NEWS

Four lessons from an energy crisis we could have avoided (AFR): This is the electricity crisis Australia didn’t have to have, writes APA Group CEO Rob Wheals. He says soaring prices are only the conclusion of what's been a decade-long disaster.

Patrick Poke): When investors see red across their portfolios, the emotions this can trigger often lead to poor decisions (I know I've been through that). In light of that, Patrick's written a guide to navigating stormy markets. (And yes. it is that Patrick Poke.)

Get the wrap

We hope you are enjoying Livewire's newest series - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

5 topics

13 stocks mentioned

1 contributor mentioned