Charts of the Week - Weather, demand, and demographics affect markets in Europe, Asia, and beyond

.png)

- Has Europe stockpiled enough natural gas to counter Putin's plans to cripple its industry?

- Did Powell's testimony alter the market's outlook on future rate hikes?

- Will China's prudent growth target dampen the region's sentiment?

- What is the potential extent of the housing market crash predicted by two separate models in Sweden?

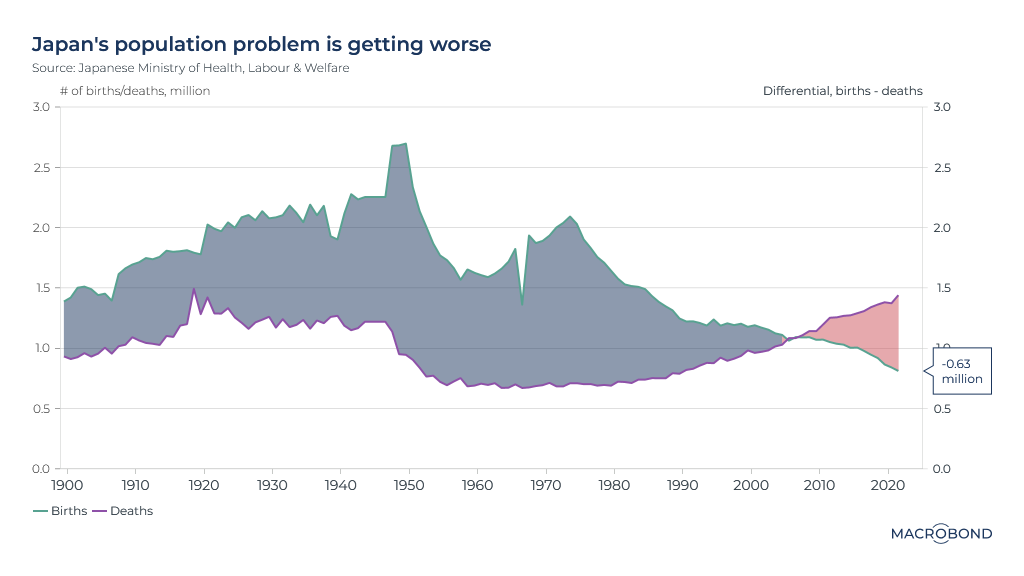

- With deaths exceeding births at an alarming rate, is Japan's demographic time bomb ticking closer to detonation?

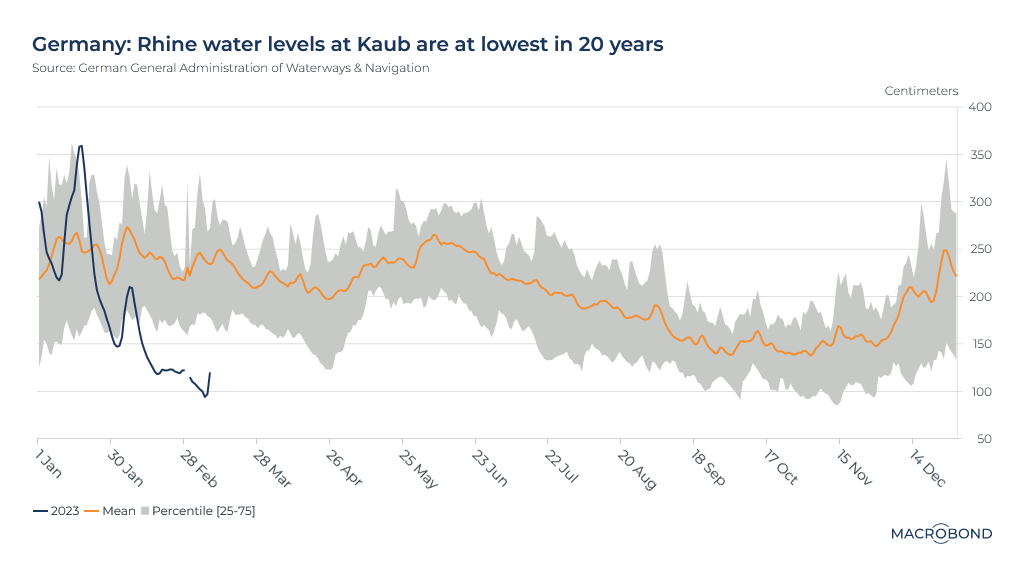

- Lastly, how will the low water levels in the Rhine River impact the German economy and European trade?

All of these questions and more are examined in this week's Charts of the Week.

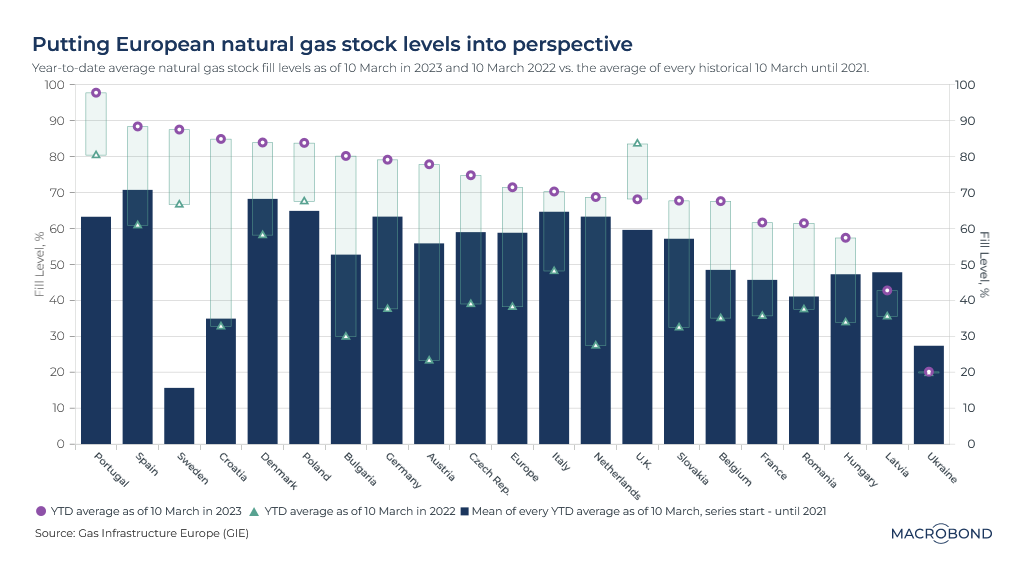

Warm weather stops Putin's plan to disrupt European economy with energy cutoffs

Had Putin consulted the weather forecast before invading Ukraine, he might have been better prepared. His strategy of disrupting the European economy by cutting off its energy supply has been thwarted by unseasonably warm weather and strong winds, which have reduced demand and allowed time to secure alternative sources and increase storage capacity.

However, the situation remains precarious. While the chart shows that the Year-To-Date Average Fill Level % is relatively positive compared to previous years, prices are still twice as high as they were before the conflict, and demand from Asia is increasing. Furthermore, the reopening of China's economy will intensify competition for scarce resources. As evidence of Europe's growing uncompetitiveness, companies such as BASF have closed plants.

Will the weather be as forgiving in the future?

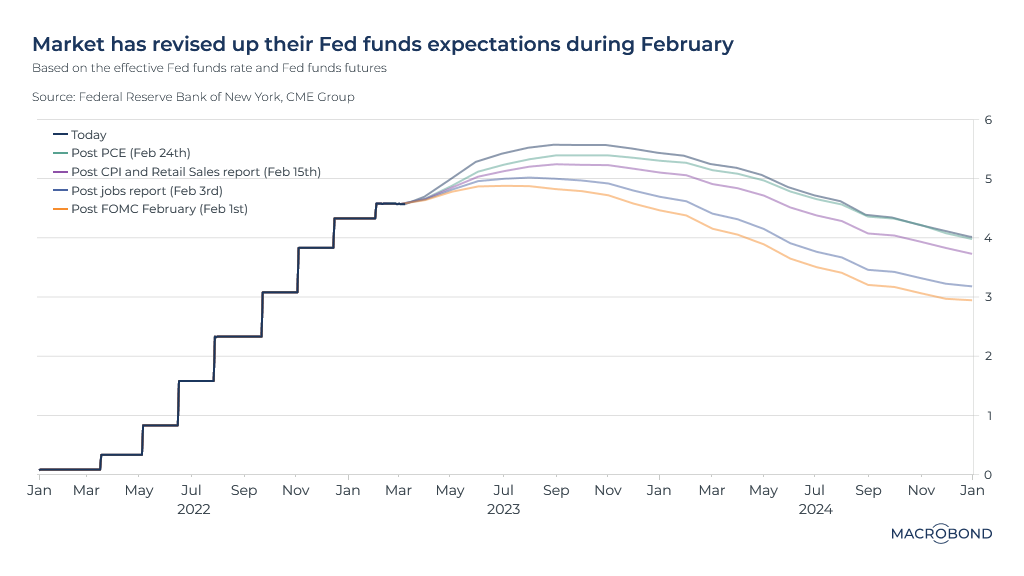

Fed chair testimony triggers market correction amid hawkish signals

The recent "good news is bad news" macro story is still unfolding, as Jerome Powell's recent testimony to Congress caused markets to fall sharply. The hope that the recent tightening was coming to an end seemed misplaced, as Powell made it clear that he was prepared to speed up if the steady stream of strong data refused to dry up.

Until recently, federal funds futures were pricing in a rate of around 3% for the start of 2025. However, the continued momentum in the labour market, surging retail sales, and strong CPI and PCE prints released in February seem to be forcing the Fed's hand. As a result, markets are now more hawkish, with a 30% increase in the terminal rate already priced in.

China's modest 5% growth target disappoints investors and hits commodities

As China emerged from its lockdown period, markets had risen strongly in anticipation of its economic resurgence and the pivotal role it could play in driving growth across the region. However, the recent announcement of a modest 5% growth target, the lowest in over 30 years, underwhelmed investors. As a result, commodities were particularly hard hit as demand forecasts were reassessed. With so much riding on China's success, can we hope that they plan to surprise on the upside this year?

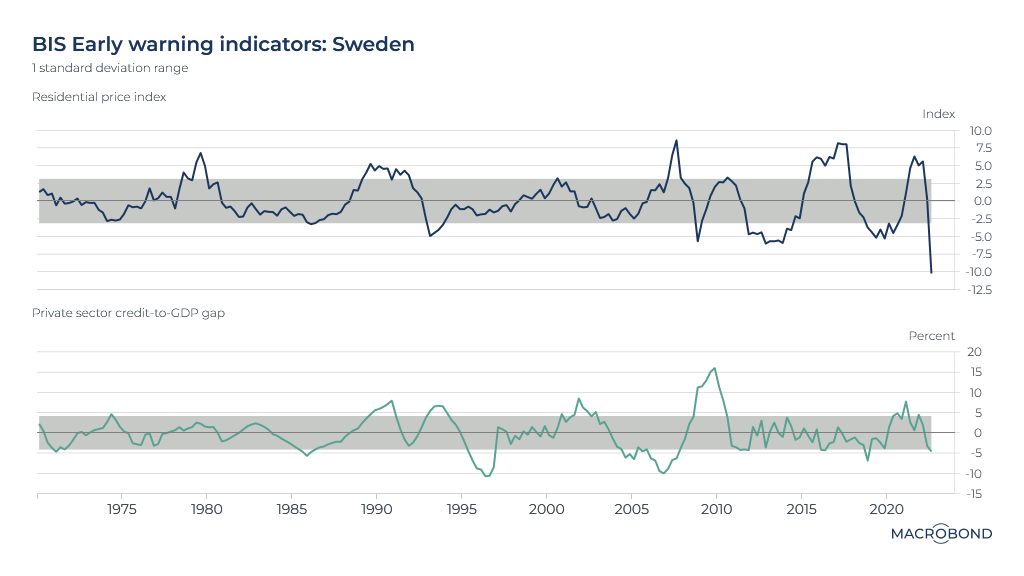

Early warning indicator flashes red for Sweden's banking system: Risk of housing market crash

The Bank for International Settlements (BIS) defines "Early Warning Indicators" (EWI) of banking crises as deviations of credit and asset prices from long-term trends.

Currently, for Sweden, one of these indicators is flashing red.

In the chart above, we have replicated the BIS calculations using the Hodrick-Prescott filter on the credit-to-GDP and property prices series. To highlight deviations from the long-term trend, we show a +1/-1 standard deviation band.

Stefan Ingves, who served as the Riksbank's governor from 2006 to 2022, repeatedly warned about the build-up in mortgage debt. Due to the high levels of household debt and significant proportion of floating rate mortgages, he likened the Riksbank's job as rate-setter to "sitting on top of a volcano." It appears that his warnings were prescient.

Although the overall private sector credit remains within the standard deviation band, the upper chart shows evidence of a potential housing market crash. There is a record negative gap to the long-term trend, even surpassing 1992's bloodbath.

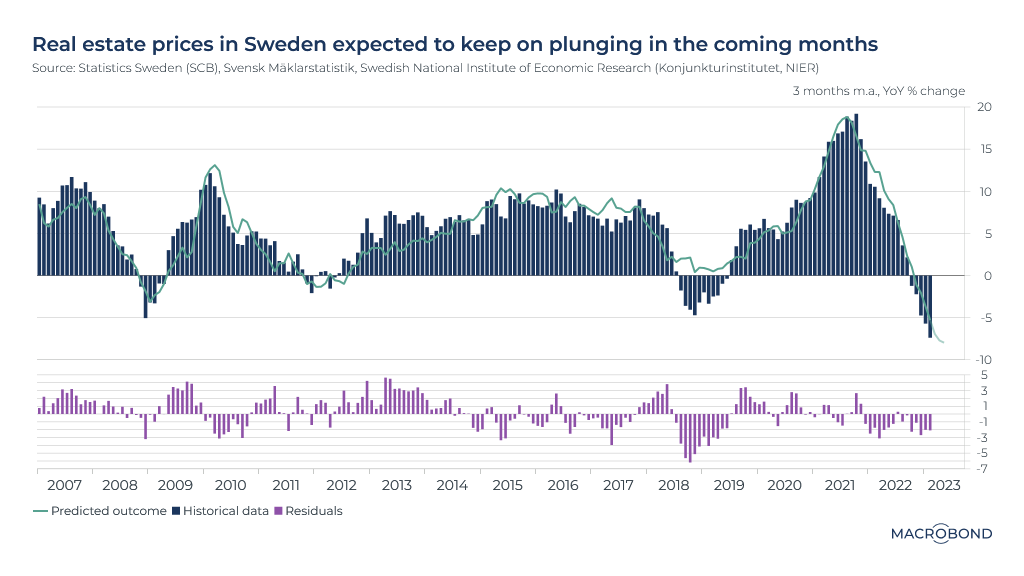

Regression model predicts further plunge in Swedish real estate prices amid high sensitivity to rates

Continuing on the topic of the Swedish housing market, we have developed a regression model to nowcast short-term changes in real estate prices. Our model utilises several data series as inputs, such as a consumer survey for major purchases within the next 12 months, unemployment, housing inflation, the K/T coefficient (i.e. purchase price / assessed value ratio), and lending rates for housing to households.

The results of our model are clear: real estate prices are expected to continue to decline in the coming months, reaching levels not seen in the past 20 years.

Additionally, our model highlights the high sensitivity of Swedish housing prices to interest rates, as evidenced by the negative coefficient of -3.8 in the regression model. This sensitivity can be attributed to high levels of household debt and the extensive use of variable or short-term fixed-rate mortgages.

Japan's demographic time bomb nears detonation as births fall short of deaths

The demographic time bomb that has been ticking in Japan since the end of the economic boom in the 1980s appears to be getting closer to detonation. Last year, there were over 600,000 more deaths than births, and in eight years' time, it's expected that the number of women of childbearing age will dwindle to a point where population decline cannot be reversed. As a result, Prime Minister Kishida Fumio has stated that Japan has been brought "to the brink of not being able to maintain a functioning society."

Low water levels in Rhine River pose challenges for German economy and European trade

The Rhine River plays a vital role in the German economy, acting as a primary conduit that connects its industries to key North European ports such as Rotterdam and Amsterdam, as well as the Black Sea. The water level of the Rhine is crucial, as low levels require cargo ships to operate with reduced loads, leading to increased shipping costs for German businesses. In addition, bottlenecks can arise, resulting in delays and additional expenses.

Paradoxically, the mild weather that contributed to reducing energy demand and prices has had negative repercussions for the Rhine.

As shown in the chart above, the water level is presently one of the lowest it has been in the last two decades, causing another headache for both the German economy and Europe as a whole.

4 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)