Don't let the noise drown out the facts

Alpha Fund Managers

April was a volatile month indeed – or so you would think if you have been following the news. While sensationalised reporting generates readership, a comprehensive assessment of the data often doesn’t support the narrative.

To illustrate the point, there have been countless articles for a number of years predicting the imminent rout of the Australian housing market and yet until very recently there has been a continued upward trend in prices.

A few cities are deflating year-on-year after running hard including Sydney (-3.37%), Perth (-2.31%) and Darwin (-7.67%) but the other major cities have booked annual gains. Hobart is up 12.68%!

The reality is with an RBA rate of 1.5%, stable employment and large migrant net flows and a high level of equity ownership the chances of a major collapse is extremely low if not improbable.

Another recurring story is that global equities are 'overvalued' and that with rising interest rates, led by the USA, there is a greater risk of significant drawdowns.

Again the linkage appears logical and is correct - but omits a number of other contributing factors which offset this thesis such as:

- The effects of global synchronised growth,

- Massive global infrastructure spending - particularly in Asia,

- Economic stimulus of large QE (quantitative easing) programs in Japan and the EU,

- Historical high earnings of US corporates, and

- The benefit of tax cuts passed by the Trump administration.

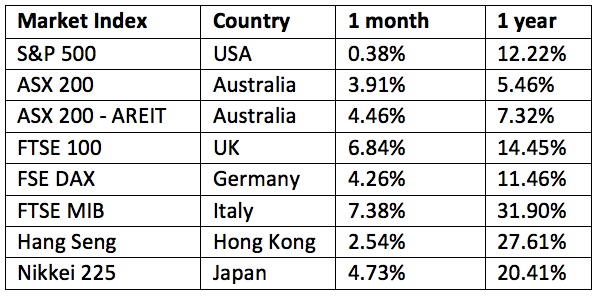

What has been the result of all these tailwinds on the market?

The answer is very positive as shown by the consistency of global equity returns in the table below.

Source: Morningstar

Equities are clearly in a bull market but what about fixed interest?

Most of the talking heads pontificate the Federal Open Market Committee (FOMC) minutes and try to predict how many rate rises will occur in 2018 – will it be two or perhaps four? While this is interesting and topical it isn’t a big driver of markets at this point given the moderate pace of change.

If the Federal Reserve (FED) raised rates in the US by a large degree outside of what the market predicted and priced in already then that would be a different story. Given the proverbial green shoots are now starting to flower in many places, the FED will be remiss to raise rapidly without inflation ramping up, which over the last decade has been consistently low to the surprise of many economists and market participants alike.

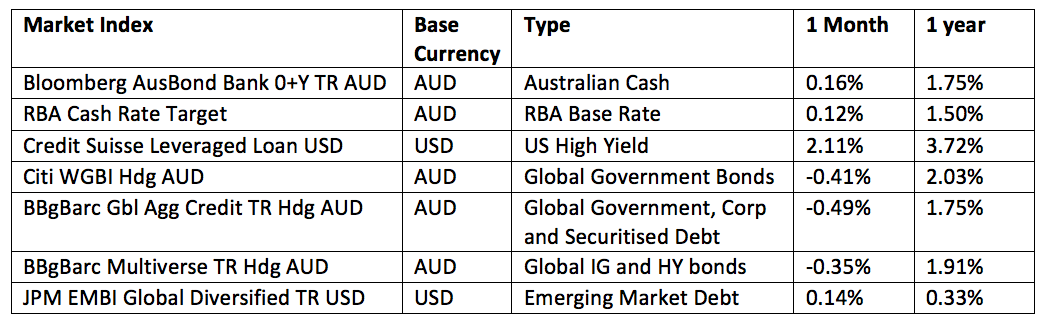

The table below highlights the general return profile for global and domestic fixed income. Not only are the returns low but on a real return basis they are barely keeping up with inflation, if at all.

Given this dynamic, I don’t see the threat of a meaningful switch from equities into bonds in the immediate future regardless of the rate rise cycle in place. Fixed income has historically been a great diversifier from an asset allocation perspective and still is within one's portfolio, but it will be less of an offset to equity risk vis-a-vis historical correlation given that yields remain low or even negative in some cases.

Source: Morningstar

Source: Morningstar

There will always be risks in markets, and volatility may indeed rise from the historic lows we have enjoyed for a number of years. Yet with active and professional management, proper portfolio diversification across asset classes, and a steady hand, over the longer-term one will be rewarded with asset growth and income to offset the risk of investing their hard earned savings.

Market sentiment will rise and fall over the economic cycle, and news headlines will at times be both overly negative or optimistic. But the reality is often more opaque so one needs to look past the headlines, obtain a balanced view and stay the course to enable their investment objectives to be met.

While not a perpetual bear - or bull - on markets, I believe the current convergence of positive market forces will continue to provide superior returns in risk assets over the near-term, while fixed income will also benefit from rising rates as it translates into higher yields.

Best to make hay while the sun is shining!

5 topics

Julien is a portfolio manager at Alpha Fund Managers responsible for portfolio construction and strategy selection across eight funds. In prior roles Julien was an analyst at GE Capital and Deloitte, a corporate banker at CBA and spent five years...

Julien is a portfolio manager at Alpha Fund Managers responsible for portfolio construction and strategy selection across eight funds. In prior roles Julien was an analyst at GE Capital and Deloitte, a corporate banker at CBA and spent five years...