Getting the best of both worlds

Whether it’s value and growth, or income and total returns, the ‘best of both worlds’ was on offer from the three fund managers presenting in the morning session of day two at the Pinnacle Investment Summit.

This second day of the summit saw presentations from three Australian equity managers; Blake Henricks, Portfolio Manager at Firetrail Investments; Dr Don Hamson, Chief Investment Officer at Plato Investment Management; and Michael Bell, Joint Chief Investment Officer at Solaris Investment Management.

In the first presentation, Blake Henricks told us how beliefs were being tested, but the markets’ focus on the short term allows them to capitalise on opportunities in both the ‘value’ and the ‘growth’ segments of the market.

In the second presentation, Dr Don Hamson explained why dividends still remain an attractive source of income, despite the cuts from well known dividend payers such as the banks and Telstra. Investors hunting for income need to look outside the box, and he shares some of the unexpected places he’s been finding great income.

Finally, Michael Bell asked the question on almost every investor’s mind: can stock prices be justified? He shared three reasons that growth stocks can support a higher valuation, and why he’s skewed the portfolio more towards growth than value. However, he also warned that not all growth stocks are created equal, and some well known Aussie growth stocks could pose risks. He then shared some growth and value stocks that do pass muster.

The case for investing in value-growth

In today’s markets, investor’s beliefs are being tested, said Blake Henricks from Firetrail Investments. It’s difficult to see what the future may hold, but one thing that can be relied upon is that markets will be affected by a short-term focus. However, this creates opportunities for those who can look past the short term, ignore labels like ‘value’ and ‘growth’, and focus on what really matters.

Both ‘value’ and ‘growth’ stocks are susceptible to this short-term focus, as investors overreact and extrapolate recent events out into the far future. Focus on paying the right price for a company – good investments come down to the price paid.

2 opportunities: 1 growth and 1 value

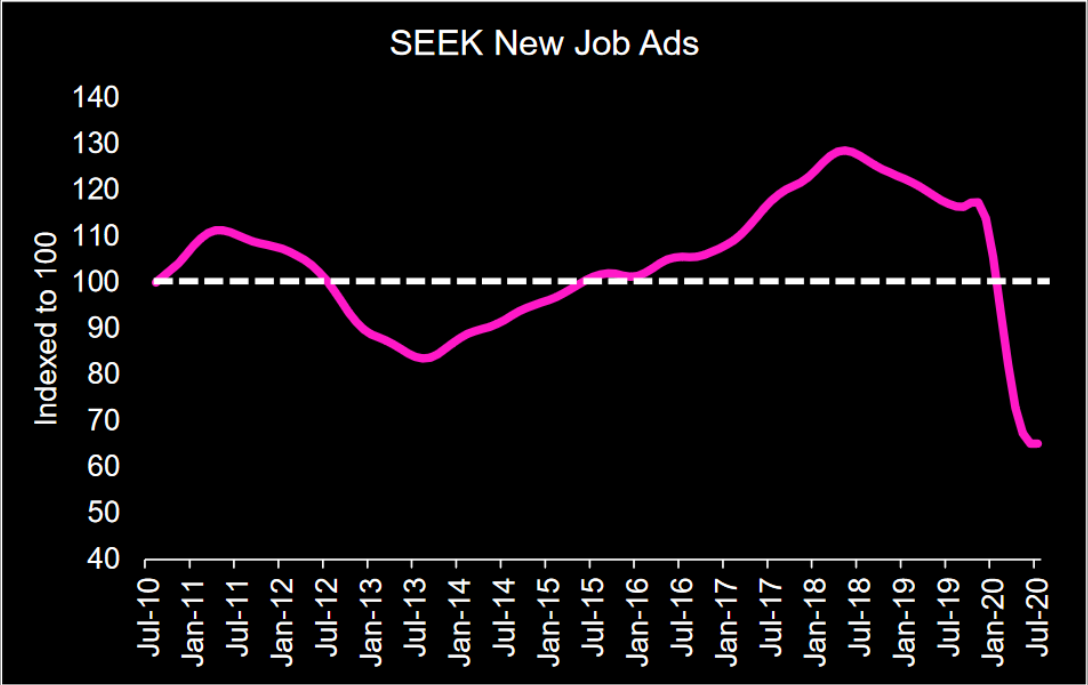

Seek is well known as the leader in Australian job ads, but the company also has market leading positions in China and South East Asia. Seek has recently been de-rated due to a drop in job advertisements. But this drop is just a cyclical change, and the market is too focused on the short term.

Sources: LHS Charts, SEEK, Firetrail Interpretation.

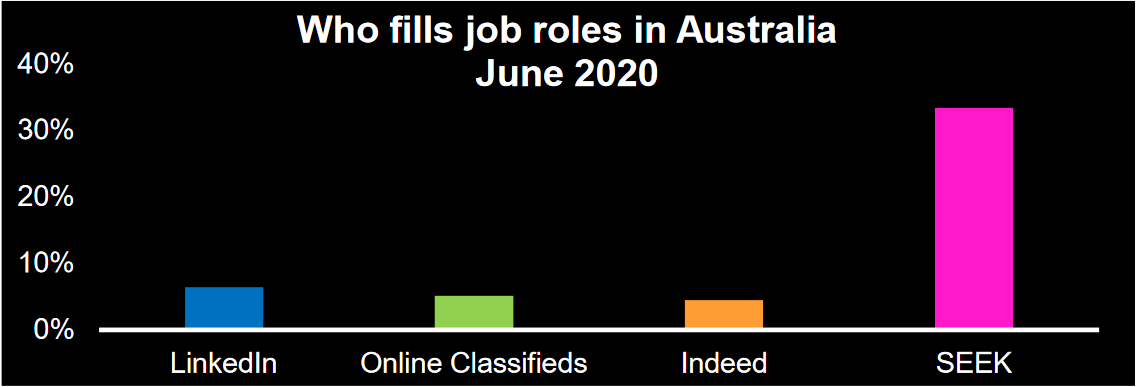

What really matters is who fills the jobs in Australia. Overwhelmingly, that is Seek.

Source: LHS, Firetrail.

Despite being the dominant player in the industry, Henricks said that just a fraction of the cost of filling a role comes from the Seek ad. For a typical $62,000 p.a. role, the recruiter’s commission would be around $9,300, but the Seek ad would cost just $64.

“We believe there’s a major opportunity to close that value gap”

Seek looks attractive on the valuation front too, with an EV/Sales ratio significantly lower than other ASX technology stocks such as Xero, Afterpay and Wisetech. Henricks says Seek offers material valuation upside versus other fast-growing businesses.

On the ‘value’ side of the ledger, Henricks said Firetrail is attracted to Lendlease. Lendlease is an integrated real estate developer and manager, with leading positions in Australia and overseas. The opportunity comes by way of the market’s focus on the engineering sector, which “has been a disaster”. After losing more than a billion dollars, Lendlease has since sold the majority of the division, which was small relative to the rest of the company.

What matters for LLC is that it is the leader in global development of residential, office, and mixed developments. The company has grown its pipeline from $40b to more than $100b since 2014.

Source: Lendlease

Lendlease is also increasingly moving towards an investment management model, which produces high-quality, recurring revenue streams. Today Assets Under Management (AUM) are less than $40b, but Firetrail sees potential for AUM of $100b.

“Not only are earnings going to grow, but it’s growing in higher quality areas.”

Like Seek, Lendlease was de-rated on short term concerns. It has strong businesses with massive growth potential, and the valuation provides a lot of upside.

How to deliver consistent high income for retirees

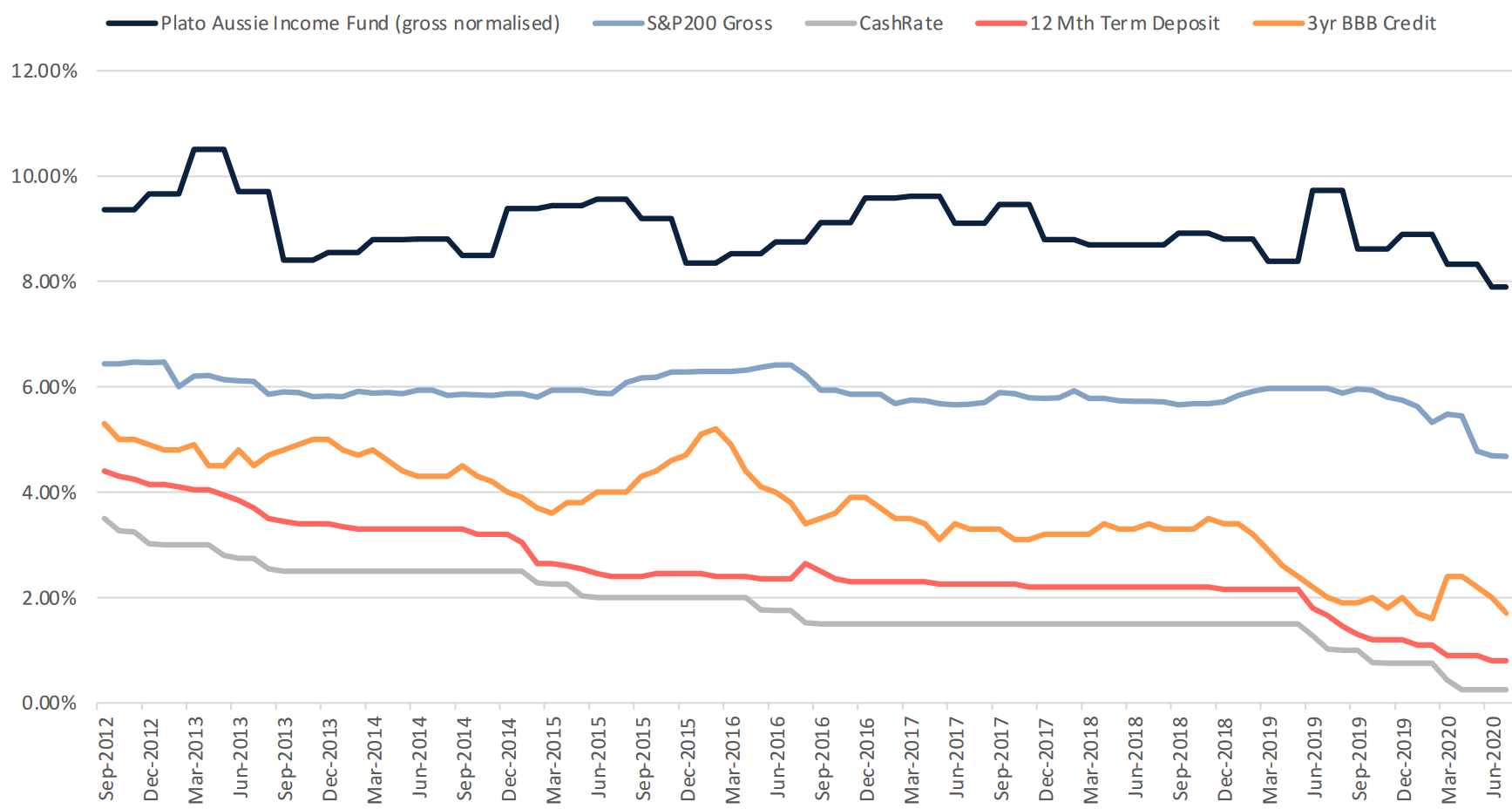

Many people are saying that dividends are dying, but Dr Don Hamson from Plato Investment Management assured us they remain well and truly alive. On the other hand, cash rates aren’t so healthy. He believes investors should expect cash rates of 0.25% for at least two or three years.

It's not just cash; other asset classes have been dragged down by low rates too.

Yields on all asset classes are falling

Source: Plato, RBA, Bloomberg Plato income normalized to exclude impact of large buybacks in 2018/19

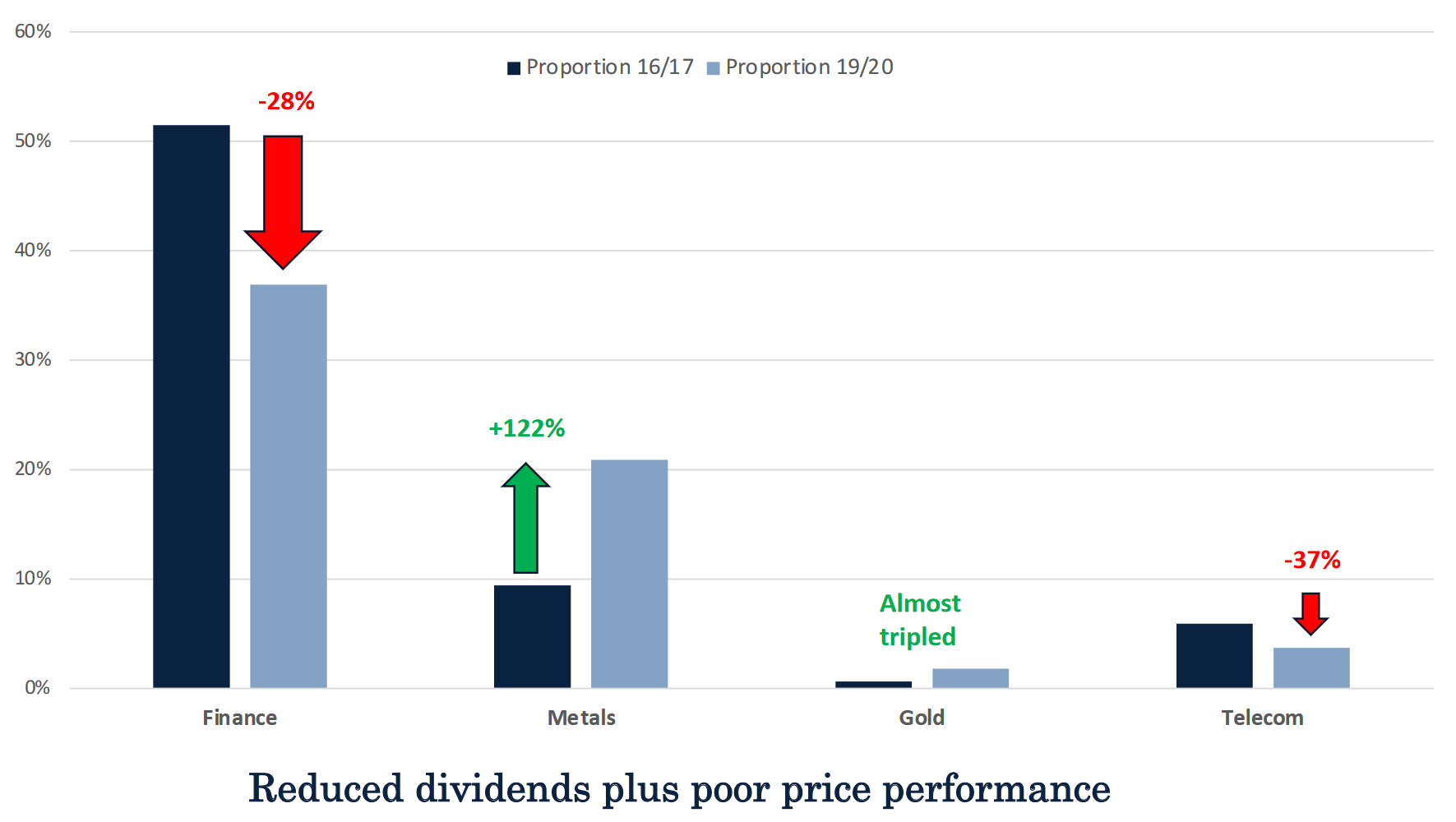

So while dividends have fallen somewhat, in a relative sense, Hamson believes they still look very attractive. But traditional income stocks are not the best place to look. The big 4 banks and Telstra – have really struggled in recent years.

“Telstra and the banks have continued to underperform in price terms, but they’ve also cut their dividends”

Telstra has cut its dividend so much that it’s no longer in the top six dividend payers in the market.

Proportion of dividends FY19/20 versus FY16/17

On the other hand, Rio Tinto, BHP, and Fortescue Metals Group (FMG) have more than doubled their income over the last few years. Hamson says that normally they’d expect a stock on a gross yield of 14% would be a dividend trap, but that doesn’t appear to be the case with FMG. Rio and BHP also offer yields of eight percent and six and a half percent respectively.

He believes that iron ore miners could be ‘the new banks’ for income on the Australian market.

The banks, meanwhile, are struggling from reduced earnings, and an APRA directive to limit payout ratios to 50%. Commbank slashed its final dividend, while Bendigo and Westpac cancelled or deferred dividends.

In conditions like this, it’s more important than ever to be on the lookout for dividend traps. He pointed to Crown, Flight Centre, Lovisa, and Scentre Group, among others, as potential dividend traps.

“If it’s trading on a 15% yield and the share price is falling, the market is trying to tell you something.”

These valuations make no sense at all! Or do they?

Michael Bell from Solaris Asset Management said that when meeting with clients, the biggest topic on their minds was valuations. Can growth stock valuations continue to rise? And will value stocks ever recover?

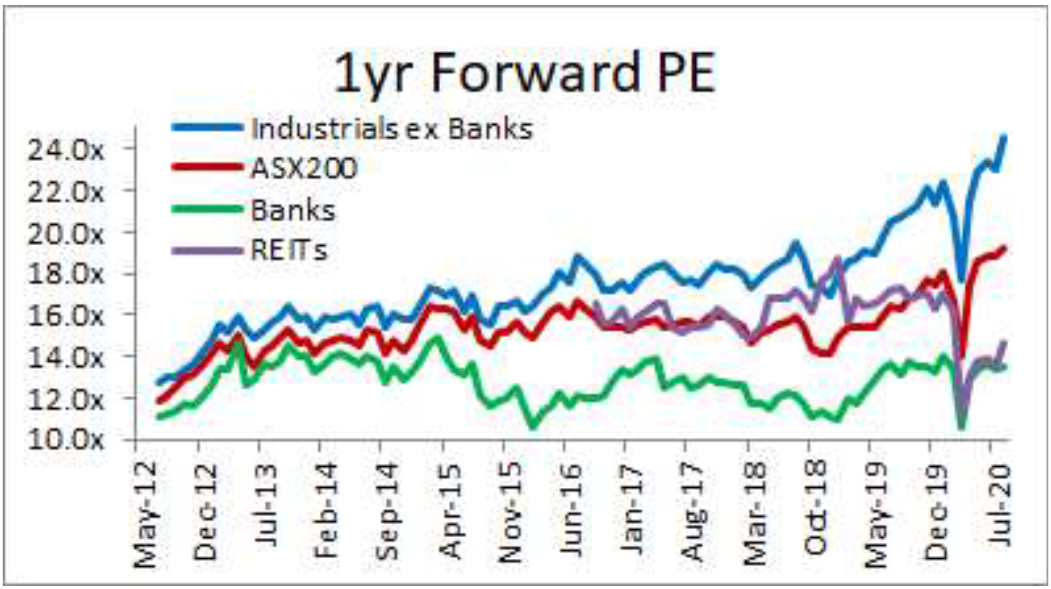

How do we justify this performance? Interest rates have fallen from 3.8% 7 years ago, to 0.9% today – growth has outperformed value on the back of this.

Growth has materially outperformed value

Multiples across the market are elevated

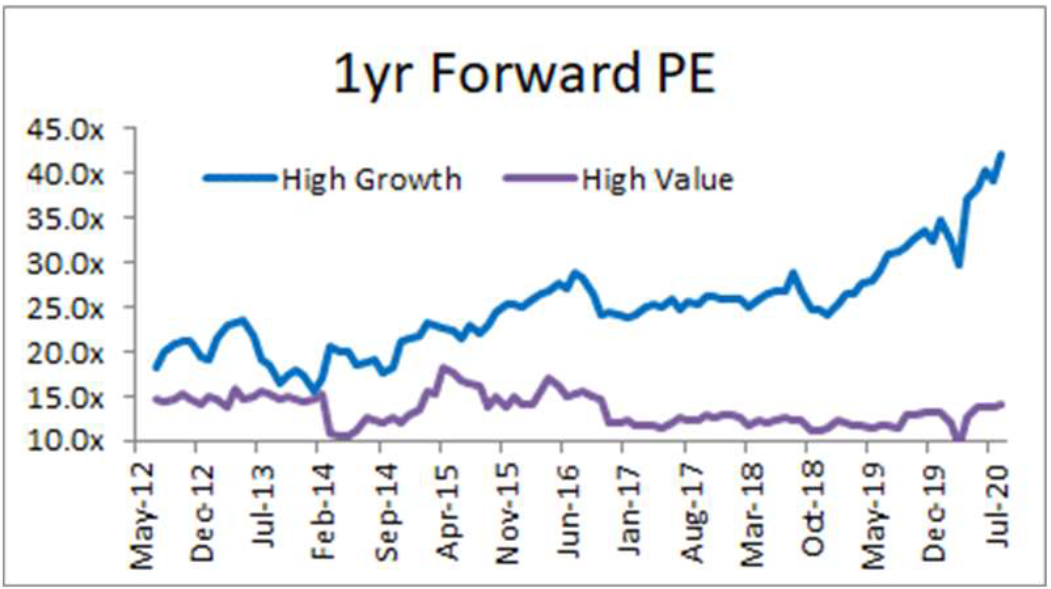

The split between value and growth has grown

Bell says that Industrials ex banks are the most expensive they’ve been in his career – even more expensive than during the tech bubble. It’s also the biggest dispersion between growth and value he’s ever seen.

Even the founders and CEOs have been selling stock!

But are the prices justified?

There are three key reasons that high growth stocks are seeing such high valuations, according to Bell.

- Sensitivity to changes in interest rates

- Rise of tech disruption

- Scarcity of growth

When fund managers such as Solaris are valuing a company, they use a method called ‘discounted cash flow’. This involves forecasting the future returns of the company, and ‘discounting’ them based on how far in the future they’re expected to occur – as the old saying goes; a bird in the hand is worth two in the bush.

Because a greater percentage of a growth company’s valuation comes from cash flows further out in the future, they’re more sensitive to changes in the rate at which they’re ‘discounted’.

When interest rates fall, so do risk-free rates, which are a key input to the discount rate. Hence, lower interest rates equal higher valuations of growth companies.

Bell does urge some caution with this line of thinking though, asking whether we are “getting a little carried away”. While interest rate expectations have moved in the last 12 months, growth stocks have rallied significantly.

Tech disruption is another source of high prices. Companies like Google, Facebook, and Amazon can build huge, powerful network effects, and capture value from all around the globe with relatively small additional investment. Companies with this kind of size, scale, and economics were far less common in earlier ages.

Finally, a lack of attractive growth stocks on the ASX means limited supply and high demand. As any economics 101 book could tell you, this naturally results in elevated prices.

Growth risks

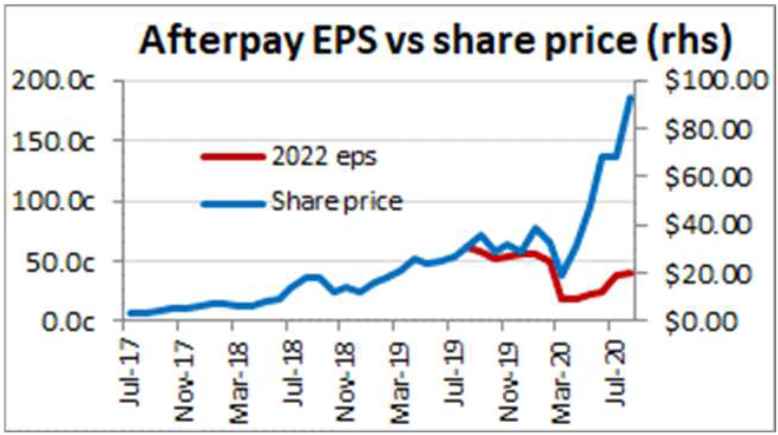

Afterpay has exciting, market leading technology and a huge addressable market. Not to mention being an obvious beneficiary of a boom in online shopping. However, with numerous competitors entering the market, including Zip, Sezzle, Splitit, Lay Buy, and Paypal, it faces an increasingly difficult environment. Couple that with a lack of barriers to entry, and a share price that’s rallied much faster than earnings expectations, Bell sees Afterpay as a risky bet.

Xero, likewise, has outstanding technology and operates in an attractive industry. The company faces significant risks from COVID, as small and medium enterprises, the segment in which it specialises, are suffering from shutdowns and the associated recession. Despite earnings downgrades, the stock has rallied in recent years.

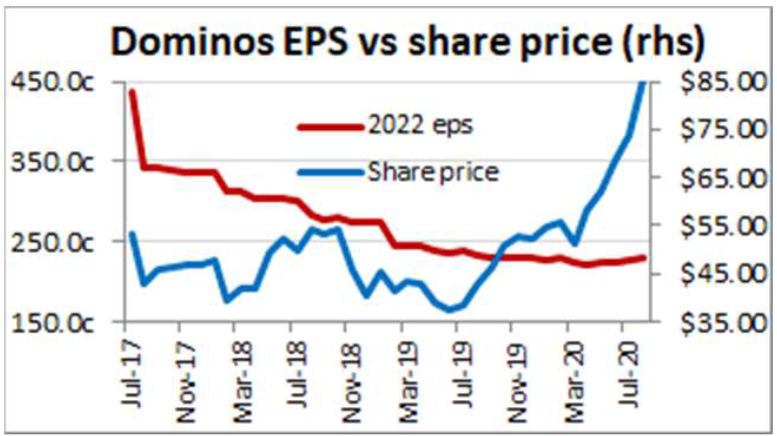

Despite being close to saturation point in Australia, Dominos still maintains a solid pace of expansion from its international business. Regardless, it’s had consistent earnings downgrades over time. Following the recent share price rally, it’s now trading on more than 40x earnings.

Growth opportunities

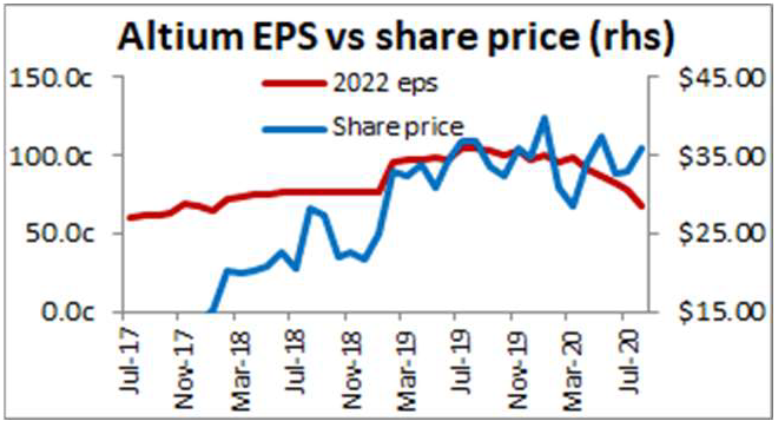

Altium is a more attractive growth business, according to Bell. The company is a leader in computer assisted design (CAD) for printed circuit boards. The quality of revenue streams is improving, as the company moves to a cloud/software-as-a-service model. The company has conservative accounting practices, and is highly profitable.

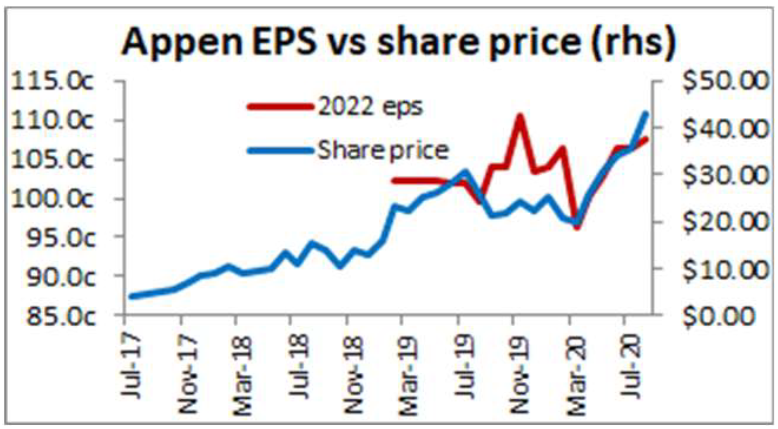

While Appen’s share price has rallied notably this year, so have earnings expectations. The company provides artificial intelligence training data, which is in high demand as the technology is taking off. Appen is largely unaffected by COVID, and like Altium, is highly profitable. 33 times earnings might not look cheap, but in today’s market, with Appen’s growth, Bell believes it’s justified.

Value opportunities

While growth might get all the attention, value stocks also play an important role in portfolios. If and when the dispersion between value and growth reverses, you don’t want to be caught holding nothing but growth.

With the iron ore and gold mining sectors both booming, demand for explosives should be solid in the years ahead. Market leader, Orica, is driving technological innovation to make it easier for mining companies to remove ‘overburden’ (the junk material on top of the deposit) more easily. Bell sees high single digit earnings growth at Orica over the next three years, and you can pick it up for an undemanding price.

Scentre Group has seen its price to earnings multiple dive in recent years, which has been accelerated by COVID shutdowns. But while some weaker retailers may not survive this recession, demand for shop fronts in high quality locations is not ready to die just yet. Scentre Group is the highest quality retail REIT in Australian and New Zealand, with the best locations, the best shopping centres, and the best retailers. It’s now trading at less than half of its (already discounted) asset value, and carries plenty of liquidity on the balance sheet.

Finally, another beneficiary of the boom in iron ore has been Aurizon. It offers stable, predictable earnings that are tied to ore volumes moved, not prices. With a solid yield and a reasonable price, Bell sees a place for it in the ‘value’ segment of the portfolio.

Wrapping it all up

Whether you’re a growth investor, a value investor, or an income investor, there was something on offer in this session for all investors. If you’re a Sophisticated or Professional Investor, you can sign up to watch tomorrow’s session on global equities here. It features Jacob Mitchell from Antipodes, Tim Samway from Hyperion, and Andrew Parsons from Resolution Capital. For retail investors, follow Glenn Freeman to get his wrap on the session once it’s over.

Like this wire? Let us know by hitting the 'like' button to the left. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

1 topic

15 stocks mentioned

5 contributors mentioned