Goldman Sachs upgrades two, downgrades two ASX miners ahead of quarterly earnings

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,590 (-0.63%)

- NASDAQ - 10,791 (-1.24%)

- CBOE VIX - 33.80

- USD INDEX - 113.25

- US 10YR - 3.939%

- FTSE 100 - 6,885 (-1.06%)

- STOXX 600 - 387.96 (-0.55%)

- UK 10YR - 4.475%

- GOLD - US$1666/oz

- WTI CRUDE - US$88.56/bbl

- DALIAN IRON ORE - US$97.35/T

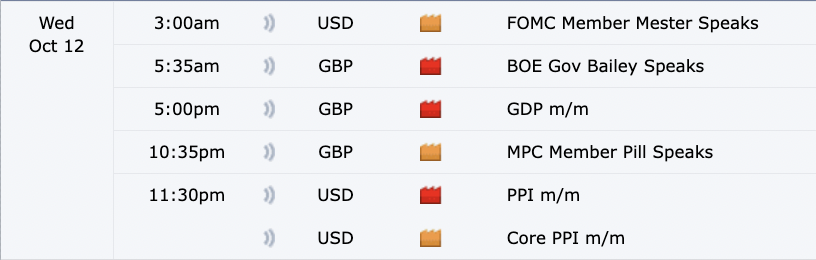

THE CALENDAR

Before we go on, two quick notes about the surveys released yesterday from Westpac and the NAB caught my eye. First, consumer sentiment is still depressing. But it could have been a lot worse.

- Consumer Sentiment falls 0.9% to 83.7, near historic lows.

- RBA’s smaller-than-expected 25bp rate rise averted a much bigger fall.

- Sentiment amongst those surveyed post-RBA was up 14.7% vs pre-RBA.

In total contrast, the NAB business survey showed something very different. Business conditions (trading, profitability, employment) actually rose last month to +25 (read: insanely positive). Confidence, in contrast, pared back to a +5 reading in a broad-based fall.

It's a big one! It's US PPI and UK GDP tonight. All the details are in Monday's report. We also get a couple of central bank speakers as well so there are lots to chew on.

STOCKS TO WATCH

It's earnings season again! No, not ASX earnings season and not even US earnings season (though that does kick off this Friday with the big banks). It's actually ASX miners' quarterly reporting season this month. Ahead of the barrage of numbers, Goldman Sachs' Australian equity team has made four changes to the 17 materials stocks it covers - including a new "buy" rated stock making it eight altogether.

But if you'd like a clue as to which stocks are getting the downgrade treatment, all you have to read is the first line of their note:

The GS commodity team has downgraded aluminium and nickel price forecasts on the back of revising European demand lower for 2H22 and 1Q23. We continue to think the next two to three quarters will be a tough period for base metals and steel as European and global demand continues to weaken and the US Dollar continues to strengthen.

So you may be surprised then that Alumina (ASX: AWC) has actually been upgraded to a neutral (from sell, mind you). But given it's on a cheap valuation and it's fallen a long way, it's looking more attractive than it did before.

The other upgrade is for Deterra Royalties (ASX: DRR), which is now a buy. Given its fantastic dividend yield and low industry OPEX and CAPEX, the analysts have seen it fit to award the company its new rating. DRR joins BHP (ASX: BHP) and RIO (ASX: RIO) in the iron ore buy club. Fortescue Metals (ASX: FMG) remains the lone sell.

But the downgrades are where it gets interesting. Following a projected 40% fall in EBITDA and execution risks at a key copper mine, Sandfire Resources (ASX: SFR) is now a sell.

Finally, South32 (ASX: S32) has been downgraded to neutral for the reasons mentioned above. But a share buyback and attractive dividend yield could mean this rating may not stay here for long.

THE CHARTS

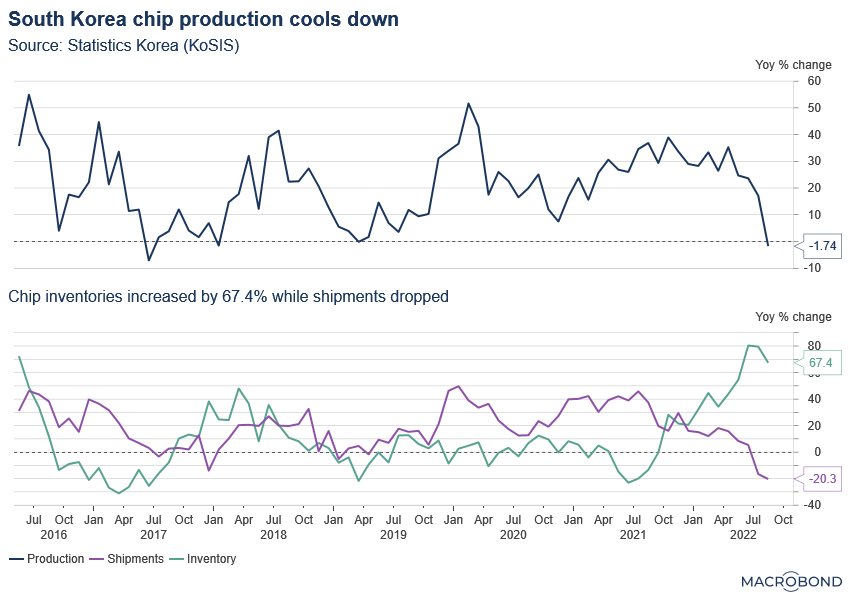

Our charts today are dedicated to that never-dormant subject - semiconductors and the chip shortage in general. This week, Macrobond Financial put out two charts that are directly related to each other, showcasing just how rough that trade has been despite the rationale making a lot of sense.

First, let's take a look at a chart that takes a look at chip production. The old supply and demand quandary, if you will.

It’s not just the US chip sector that is struggling (although it seems to be only Joe Biden stepping in to protect the US industry by ending reconciliation). The chart above shows how South Korean semiconductor production is slowing. Domestic inventories of chips have increased significantly since the end of last year, while shipments have declined. That could well indicate bad news for the global tech sector.

But don't take my word for it - just watch the market reaction instead.

This data is from the collection of semiconductor-linked stocks which trade in the US. Conclusion? It's not been a fun year, led by such companies as Nvidia. With central banks continuing to hike and tech companies announcing hiring freezes, there might be more pain to come. It's truly the trade that is knocking your SOX off.

THE QUOTE

"The Nobel Prize committee has rightly recognised three economists — Ben Bernanke, Douglas Diamond, and Philip Dybvig — for their research on a topic crucial to human prosperity. If only regulators would do a better job of putting their insights into practice."

I have no knowledge of who the candidates were for the Prize, but that's pretty high praise from Bloomberg's opinion board that the award was gifted to the right people. Maybe it's because they nabbed an interview with Diamond straight after the announcement. Either way, I can't really fault that last line. But that's just my opinion.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

7 stocks mentioned

1 contributor mentioned