Gross profits soar 48% as this company continues on its path to global domination

A few years ago, this retailer boasted a presence in 13 countries. Now, they are expanding into more than 30. In fact, in the first half of the year, this S&P/ASX 300 company opened more stores than it did in the entirety of the 2022 financial year.

Momentum like that is hard to come by, particularly in this kind of macro environment, and even more so for a discretionary retailer. I assume that's why investors have been throwing their cash at Lovisa (ASX: LOV) in recent years, with the jewellery retailer's share price soaring 185% over the last five (and more than 50% over the past 12 months).

It makes cents (literally). After all, in Lovisa's latest first-half result, management reported that revenues soared 44.8%, net profits after tax (NPAT) increased by 31.9% and earnings per share (EPS) rose 31.6% to 44.3 cents per share.

But can this kind of growth be sustained? And can Lovisa continue on its path to global domination? Monash Investors' Shane Fitzgerald certainly thinks so.

In this wire, Fitzgerald shares why Lovisa isn't your average retailer, taking you through Lovisa's latest first-half result. Despite ongoing concerns of a weakening consumer, you'll find out why Fitzgerald believes Lovisa can continue to deliver incredibly strong revenue growth not just this year, but for many years to come.

Note: This interview took place on 23 February 2023. Lovisa reported on February 22.

Lovisa H1 Key Results

- Revenue up 44.8% compared to H122 to $315.5 million

- Gross profit up 48.4% compared to H122 to $253.2 million

- Gross Margin of 80.3%, benefiting from price increases in the second half of FY22 and a strong focus on optimising gross margins

- EBITDA up 27.1% compared to H122 to $103.9 million

- NPAT up 31.9% compared to H122 to $47.7 million

- Net cash of $24 million at the half-year end

- EPS up 31.6% to 44.3 cents per share

- Dividend of 38.0 cents per share

- 715 stores at the end of the half-year

- Global rollout accelerated, with 86 net new stores

opened for the period, with seven new markets opened and a presence in over 30 countries

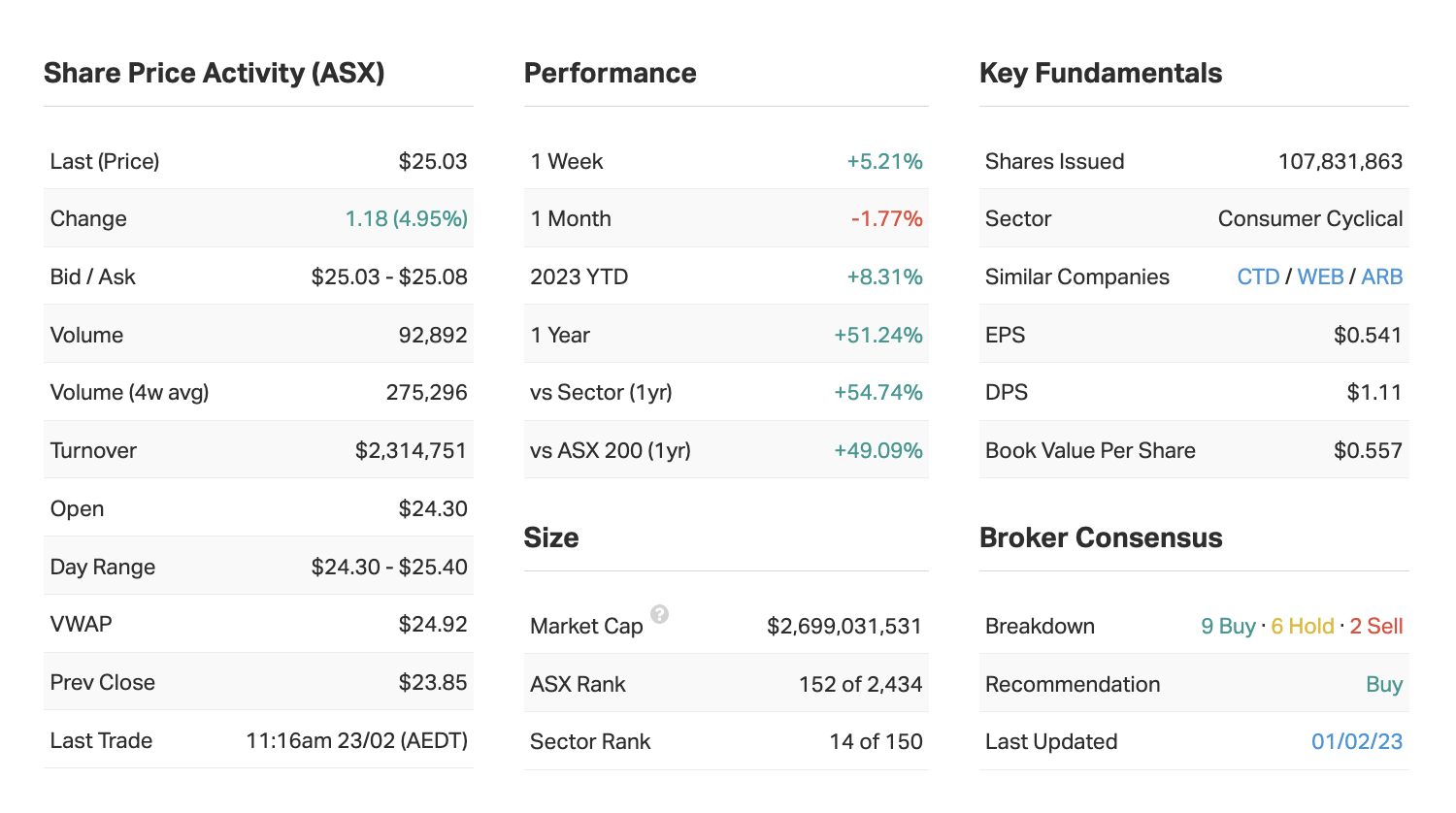

Key company data for LOV

Lovisa recently placed in the top 10 across the following metrics, according to MarketMeter: Climate risk management (1), Culture and conduct (1), Effectiveness of board (1), Remuneration policy (2), Supply chain risk management (2), Credibility (5), Leadership depth (5), Operational management (5), Capital management (4), Earnings quality (6), Investment desirability (5), Value (3), Growth prospects (3), Sustainable competitive advantage (3). For more information on MarketMeter, please click here.

1. In one sentence, what was the key takeaway from this result?

The key takeaway was the increased momentum in the store rollout program that the company is enacting around the globe.

To expand on that further, about two to two and half years ago, Lovisa was opening stores in 13 countries. It's now over 30. Lovisa is hiring staff in Taiwan, for example, and that's not even on the list yet, and I'm sure there are other countries that Lovisa is looking at expanding into as well.

In the first half, it opened up more stores than it did in the entirety of the year before. And that momentum is just going to accelerate from here because it is operating today in about 40% more countries than it was a year ago.

So what is the investment case for Lovisa? It has always been and continues to be, the store rollout program and that gazumps anything else that is going on in the business.

2. What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

It was weird. It was up 2% and then it was down 3%, and then it was up 2% and down 3% again. So it was flipping and flopping all over the place. So it was an odd reaction to the result. It's up a strong 5% today so I think the market reaction is pretty good.

The result comes against a backdrop of the market looking at retailers and thinking "Jeez, I'm not sure about retailers, because the consumer is getting weaker and weaker." But I think Lovisa powers through all those macro concerns because of its rollout program.

I expected it to rally stronger than it already has because of the momentum that is in the business. All the broker notes I saw said that the store rollout program was way ahead of what they were forecasting and it's going to go even faster from where we are now. So I think there's still plenty left in the share price. It is trading on a fairly high PE multiple of 27 times two-year forward earnings, so it has to grow into that multiple, but it's certainly achieving that at this point in time.

3. Were there any major surprises in this result that you think investors should be aware of?

One was that gross margins expanded up to over 80%. That is a really, really strong number and close to a historical high for the business. And Lovisa can probably hold that given the price increases it put through are still working their way through the business. So I think that that was a key positive in it.

The other thing that was a positive was the cost containment in the business was really good. I think the market, however, was a bit surprised by the size of the long-term incentive for the CEO that it booked for the period - it was $15 million. And Lovisa is flagging that there will be a similar number in the second half.

But what that implies is that next year, the long-term incentive will be a much smaller number, because we know what these long-term incentives are and Lovisa will have largely expensed most of the potential long-term incentives by then. The other side of that is that means that Lovisa is tracking towards the upper end of the long-term incentive program the CEO has, which is EBITDA numbers ahead of where the market is at the moment.

4. Would you buy, hold or sell Lovisa on the back of these results?

Rating: BUY

We are long the stock and very happy to be so. This is a stock that is just going to grind higher over a couple of years, because right now Lovisa has 715 stores, and it has opened another 30 stores since the period end. Just to put that in context, Lovisa opened 86 in the first half, and it has opened up another 20 or 30 stores since then. So that's what I mean by this rollout program accelerating.

So what's the endgame here? Well, in Australia, Lovisa has 160-odd stores and a population of 25 million. America has a population of 330 million and it has 155 stores in the country. Is it finished in America? Not even close.

A company that is similar to Lovisa is Claire's. And Claire's is not the same as it sells a wide range of woman’s accessories, for example, makeup, scarves and handbags etc. But it has around 2800 stores around the world and it doesn't operate in as many countries as Lovisa does. So, we're seeing 750-odd stores as we speak, that number is going to grow to thousands as time rolls on, and that's just going to deliver really strong earnings growth for a very long time.

5. What’s your outlook on Lovisa and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

We like Lovisa because it can deliver on the expectations we have. Purely from the store rollout program, it will deliver very strong growth and we're in the early days of that rollout program playing through. This is the same story we saw in JB Hi-Fi (ASX: JBH) back in the 90s. And the same thing we saw with Domino's (ASX: DMP) and Harvey Norman (ASX: HVN). You have to go back to ancient history for examples of when these companies did the same thing, but that's what we're expecting to see.

Our outlook for the broader retail sector is pretty negative because it is facing tough comps with the reopening trade that occurred in the last 12 months or so. And also because everyone can see that the consumer is under pressure thanks to mortgage rates and the rest of it.

So generally speaking, we would expect like-for-like sales growth across the retail sector to be pretty weak. And in that sort of environment, it's very hard for a general retailer to do well. But Lovisa is not a general retailer.

6. From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 3.5

We would probably say it's around a 3.5-type number. It's there or thereabouts. Within the market, you can find exceptional companies doing exceptional things. And that's what we're all about trying to identify.

I am a little bit cautious because the macro is still unclear, but we do think we've seen the peak of inflation and I don't think we are going to see large interest rate rises from here. I think most of the hard work has already been done. The markets already corrected to the higher inflation and interest rate structure that we're now in. Those things aren't going to get worse from here.

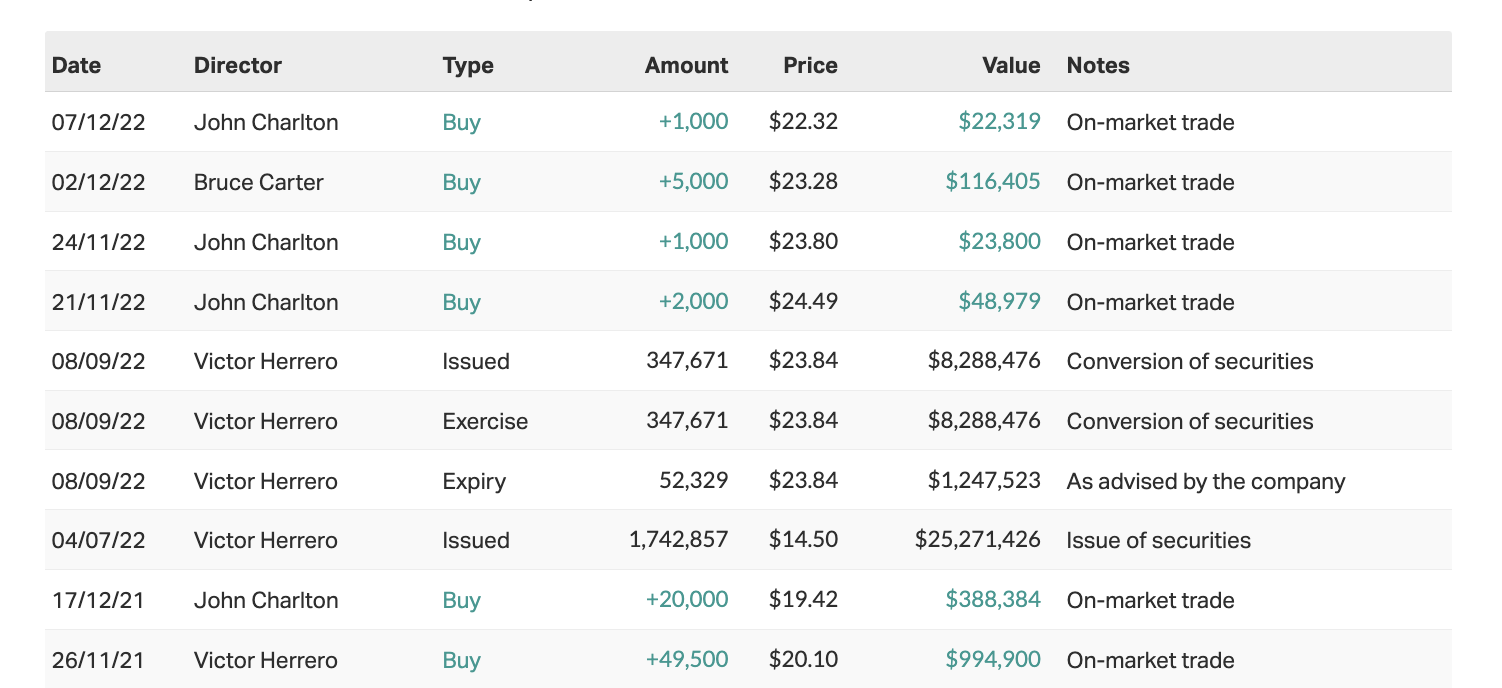

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

4 stocks mentioned

1 contributor mentioned