How the brokers' top reporting season stocks stacked up

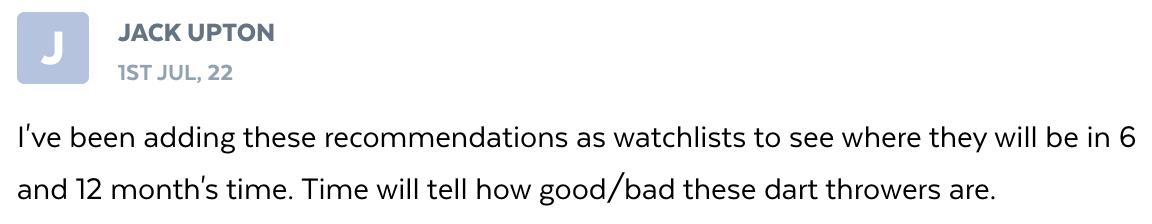

In June, I penned a piece on the stocks Macquarie analysts declared to be "recession-proof". That piece was read by more than 30,000 of you. But it also attracted some serious debate in the comments. Of all the things readers sent in (and thank you for doing so), this is the one that stood out the most:

This comment - and others like it - gave us in the newsroom an idea. What if we could track the brokers' top conviction picks this reporting season and see if they can actually outperform the market?

This wire is the culmination of five weeks' worth of planning, research, number-crunching, and analysis. In fact, this piece is so big that we're going to split it into two parts.

The first part, written by yours truly, will focus on the have's (that is, what the brokers actually picked). The second part, written by my colleague Chris Conway, will focus on the have not's (that is, companies that performed extremely well but did not get any love from the brokers in our data set). You're welcome.

Before the good oil, the disclaimers

First, this is an experiment for us here at Livewire. I've not been around these traps all that long but, as far as I know, this has never been done in this way. Naturally, this will mean we can make improvements to this idea.

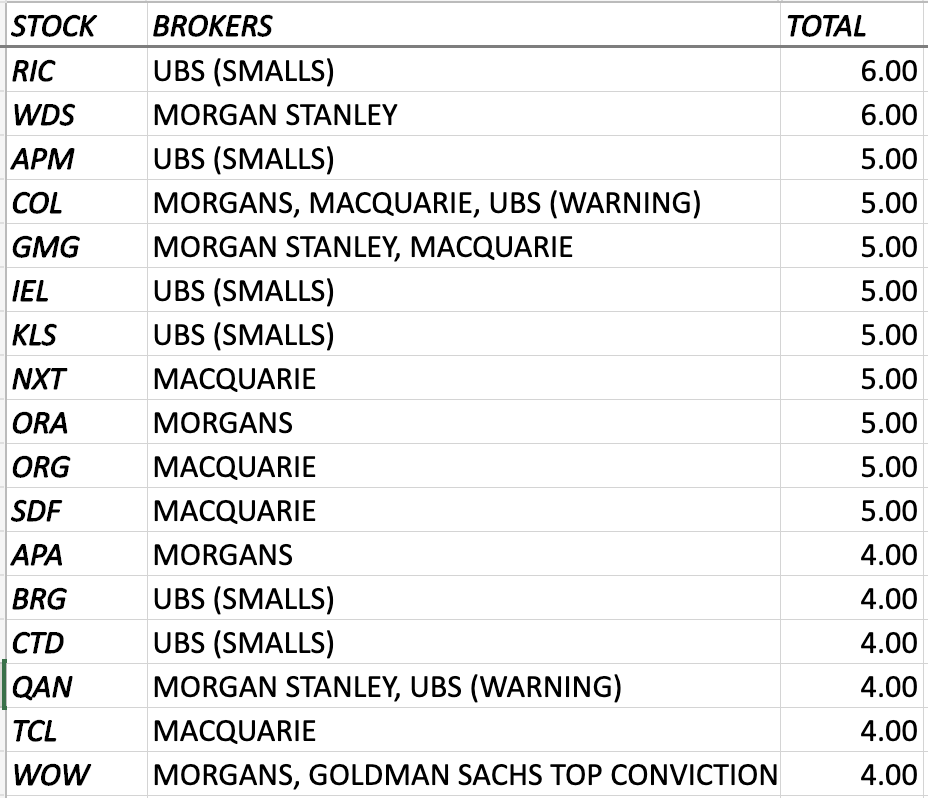

Second, we were only able to get ahold of four brokers' pre-earnings season calls. We are sure that all the major research houses reveal their highest conviction picks before August, and some even take it down to the sector-specific level. One of the reports we'll feature only tackled small caps. All this is to say that we couldn't get around to everybody so this list is by no means exhaustive.

Third, not all companies that were a top reporting season pick report in August. They are not covered in this wire.

A quick word on metrics

Our system is based on the binary number system. One (1) point is scored for a beat or an in-line result. Zero (0) is assigned to any company that misses the mark.

The 1 and 0 metrics will work for five of the six criteria:

- Share price reaction (day of)

- EPS beat/miss

- Revenue beat/miss

- Profit beat/miss

- Dividend hike/cut

While we're at it, we've only chosen to measure same-day share price reaction for ease of compilation and analysis.

The last metric is the most nuanced of all of them - outlook statements. We tossed up whether any outlook statement deserved a point, or if outlook statements needed concrete and numerical guidance to earn the point. In the end, we decided on the former. Mostly because we're optimists and that, frankly, any outlook in the pandemic era deserves some acknowledgment.

And now, the results

The 100 club: Two stocks achieved a perfect score

If we learned anything in this process, it was that broker crowding doesn't always bode well for reporting season. 28 stocks made our original list, and the average among those on our system was 64%. This implies that 64% of companies, tipped by the brokers as a top conviction pick, actually improved their efforts across the board.

Of greater interest, only two achieved a perfect score. And both were nominated as a top conviction pick by different brokers.

0 for 0: Corporate resilience on show

Economists often point to leading and lagging data indicators alike as reasons for why they think a slowdown is on the horizon. Some have gone further to suggest there is a recession on the way, and others yet have even been willing to put a timeline on when that downturn will come to fruition.

But if a recession is the buzzword on economists' minds, then it certainly has not hit corporates to the same degree. Not a single company scored zero on our metrics. While no report was perfect, it shows that each company was able to demonstrate some level of resilience or improvement even in these challenging times.

As an example of that, 79% of the companies on our dashboard provided outlook statements. 79% of the same list (though not necessarily the same names) increased or equalled their previous dividend payout in FY21. While there is every reason to be sceptical that the increased payouts may have something to do with the falls in share prices we've seen this year, it also does show that corporate boards are sticking or trying to find new ways to reward shareholders even in this tough environment.

Tough crowd: Investors react poorly to results that don't raise the bar

One of the things that immediately stood out when we'd finally filled in the last of the results was the poor reactions to reports on the day of their release. In fact, only 25% of companies who reported on their respective days registered a positive end-of-day performance in the share price following the release of their earnings.

For the companies that did see a notable increase in share price following their reports, there was a consistent theme of those same firms beating their last year's effort across the board. Put another way, the companies that scored a "1" in this column also scored highly across all the other metrics. If you like, perfectionism was well-rewarded and any whiff of disappointment was looked upon with a reason to sell.

| STOCK | ASX CODE | TOTAL SCORE | BROKER(S) |

| Ansell | ASX: ANN | 2/6 | Morgans |

| Goodman Group | ASX: GMG | 6/6 | Morgan Stanley, Macquarie |

| IDP Education | ASX: IEL | 5/6 | UBS |

| Kelsian | ASX: KLS | 6/6 | UBS |

| Newcrest Mining | ASX: NCM | 5/6 | Macquarie |

| Qantas | ASX: QAN | 4/6 | Morgan Stanley* |

| QBE Insurance | ASX: QBE | 5/6 | Morgan Stanley |

| Ridley Corporation | ASX: RIC | 6/6 | UBS |

| Woodside Energy | ASX: WDS | 6/6 | Morgan Stanley |

*Interestingly, UBS actually flagged Qantas as a warning stock as one of a slew of companies that could be impacted long-term by increased costs.

But if you thought the crowd was tough...

One thing our new managing editor Chris Conway immediately pointed out to me once reporting season was in full swing was how many downgrades there were flooding our inbox. Why were they not made before reports had come through?

This question gave us a new idea - how many downgrades will we see in this post-reporting season cycle? And in turn, will those downgrades perhaps come too little too late?

Take for example Computershare (ASX: CPU). Computershare was highlighted as a top company to fend off rising interest rates. It has a steady revenue stream from repeat customers - or so we thought. While global revenues looked good, this part of the outlook spooked the market:

Transaction-based revenues in corporate actions and employee share plans trading were impacted by market volatility in the second half, and the expected recoveries in bankruptcy and class actions have yet to come through.

Following the disappointing share price performance, brokers cooled off their enthusiasm for the company with CLSA double-downgrading the stock.

Our quick math revealed there were 184 downgrades over the month of August across the gamut of brokers (including ones that were not on our list). Among the highlights:

- ResMed ASX: RMD was downgraded by five brokers post-earnings, including a slew of neutral ratings at JPMorgan and Citi

- Bendigo and Adelaide Bank ASX: BEN copped five downgrades post-earnings, and all but one of them (to the best of our knowledge) were downgrades to a sell rating.

- Appen ASX: APX copped two more downgrades post-earnings, taking its score to 0 buys and 5 sells (including data from FNArena). Ouch.

What happens now?

If our data has proven anything, it's that companies are looking good at the top line when it comes to releasing concrete outlook statements and increasing dividend payouts. But look under the surface and you'll see that those top headlines easily show more than a few cracks. For instance, while nearly 80% of companies increased revenues year-on-year, only a smidge over 50% actually increased profits. Costs are biting, rates are rising, and making greater profits in a tougher market environment is quickly becoming the defining challenge of our time.

Stay tuned for part two of this collection where Chris will be taking you through a slew of results that the brokers missed. These are the companies that the experts missed, and will make some revealing reading.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed-income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

2 topics

13 stocks mentioned

1 contributor mentioned