How to choose an international fund manager

Step 1: Categorise

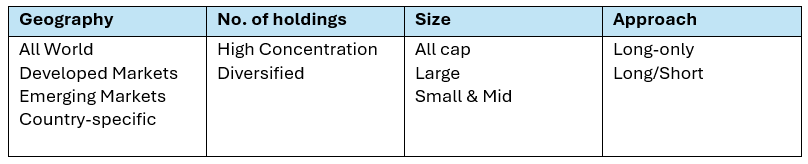

You have a lot more choice when you open your investable universe to the entire world. To keep this article simple and practical, I’ll provide you with a starting point, rather than a comprehensive categorisation framework.

Repeating the concepts from our first article on Australian Equities managers, the goal here is to fairly compare and contrast the investable universe. No point comparing a small-cap manager with a large-cap manager, or a developed markets manager, with an emerging markets specialist.

Outside the scope of this article:

- quantitative/systematic funds

- geared strategies

- special situations funds

- sector or thesis-specific funds

Step 2: Allocating

Long-only, all-cap, all-world managers have a tough time beating the MSCI All-World Index, in AUD terms.

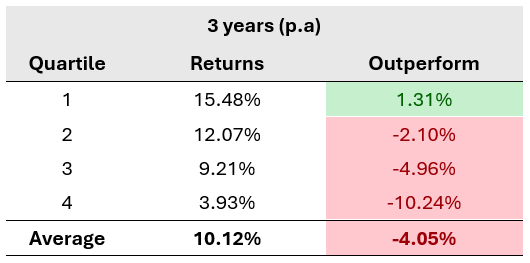

Out of 264 active funds in the universe (FEAnalytics ACS Global - Equity) with 3-year numbers, only 46 beat the index over that same period (MSCI World ex Australia), or about 17% of managers. The average outperformance of that cohort was +2.05% pa ahead of the benchmark.

The remaining 234 managers underperformed the benchmark by -5.26% pa, on average.

Does this mean using active managers for International Equities is pointless? No. I’m just pointing out that it's difficult. And you should be focused on strategies that are likely to outperform.

Without going into the trash-talking business, here are a few ideas that might help you out in selecting International Equity managers:

High-conviction strategies make a lot of sense to me.

With a universe of c. 1500 companies, with various legal, cultural, and societal regulations and norms – it’s unreasonable to think a single company or team is going to be across all that and consistently know how to best exploit it. (If you think you’re going to be able to do it from your study in Kew… you’re delusional.)

I like managers who can find something they are good at and apply it to the largest possible opportunity set.

Quality helps.

Look, I’m a sucker for high-quality businesses. My biggest investment (Seneca) is a founder-owned, led and operated, reoccurring revenue business, in a sector supported by structural tailwinds for Pete’s sake!

Managers have had a lot of historical success avoiding ‘drama’ (for lack of a better word) in Global equities. I suspect this has worked for several reasons but not least, it’d be difficult to get across the intricacies of sniffing out a value opportunity (distinct from a value trap) from the other side of the world. That sort of investing in my experience, requires specific knowledge of the unique situation – something that’s difficult to ascertain from the financials when you’re quant screening on Factset.

Worrying about 1-year (or less) returns is pointless.

Of the top 20 managers over 3 years, only 2 are in the top 20 over the last 6 months (and given we’ve had both in our Seneca Global Equity SMA since its inception shows that I might know what I’m talking about… occasionally.)

Similarly, the top 3 funds over the past 3 months rank 244th, 126th and 237th respectively, over 3 years.

Step 3: Building a portfolio

We make regular changes to our Global Equity portfolio. It’s arguably where our Investment Committee (IC) has the most responsibility and longest levers.

There are lots of potential decision points. I’ll outline a handful here for you to consider.

- Should we hedge our currency exposure?

- How much should we have invested in Developed Markets vs Emerging Markets (as well as other geographic/regional-specific decisions)

- Should we be overweight/underweight small and mid-cap companies? In which regions?

- What should be our style bias in the current macro climate? Are value or growth managers likely to outperform in the forward period?

I don’t see much point in me (or any other talking head) outlining our IC’s current views. What matters and adds value is the compound, incremental value a high-quality investment process adds over time – these views could change at IC next week.

I would say some general rules to live by are:

- Have some exposure to broad-based, high-quality industrial companies – even if that’s represented by only a handful of companies in a high-conviction fund. Or just buy an index fund that’s linked to something like the MSCI All Cap, All World Index.

- Don’t neglect emerging and Asian equity markets. While you’ve been paying attention to the “Magnificent 7”, the Japanese stock market is up 34% over the last 12 months.

- Get some exposure to global small and mid-cap companies. Done well, they can add a lot of value in my experience.

- Unlike Australian long/short (which I wrote about last week in my newsletter, you can sign up at senecafs.com.au/subscribe), Global long/short has delivered for investors. We think including some exposure in your Global Equities allocation is worthwhile.

The same “common mistakes” and data requirements I wrote about in this piece on selecting Australian fund managers apply again here.

And if you want us to make all these sorts of decisions for you every month, feel free to reach out to me directly.

5 topics