It’s not too early to consider inflation protection

This month we consider whether it is premature to start thinking about inflation protection. The H1 2020 pandemic-led recession has almost certainly secured a low inflation outlook for the next year. However, with the potential for central banks to peg policy rates near zero and craft an inflation overshoot beyond that, there is an increasing risk we will see inflation expectations rising further through 2021, with material implications for valuations both across different assets and within sectors.

It’s not the time to be panic-buying inflation hedges, which can be relatively expensive when inflation is low. Instead, we discuss how adding some moderate inflation protection to portfolios is relatively uncomplicated and could ultimately improve risk-adjusted returns over the next few years as inflation resurfaces.

But first…from an asset allocation stand-point

Data over recent weeks, including a strong pick-up in consumer spending and housing activity globally, suggest the world economy is bouncing out of the pandemic-led global recession that dominated the first half of this year. Traditional leading indicators of activity, as well as high-frequency mobility data (driving directions, restaurant bookings and the like), also point to an almost certain sharp rebound in Q3 growth for most economies.

Beyond a Q3 bounce, uncertainty over the shape of the world’s recovery remains elevated. Some loss of momentum through the later months of this year seems likely, consistent with our central case for a moderate stop-start U-shaped (rather than V-shaped) recovery ahead. Economic activity is expected to remain well below pre-virus levels until late 2021 at the earliest.

Still, the past month has seen a number of the risks we highlighted at the start of June receding, if only partly. In particular, many governments have been extending fiscal support (easing fears of a fiscal cliff), the US and China have re-affirmed their phase-one trade deal, and the worrying second wave of the virus through the US southern states looks to be increasingly under control. Further, as the initial rebound in activity unfolds, and the risk of a return to severe mobility restrictions here and overseas ebbs, recent equity reporting seasons in the US, Europe, non-Japan Asia and Australia have delivered earnings outlooks that are stabilising (and edging higher in the US).

For economies and financial markets, the next few months will be increasingly impacted by the path of the pandemic, developments surrounding a potential vaccine, geo-political tensions, and November’s US presidential election. On balance, unprecedented stimulus, an emerging capex pick-up, and progress in containing the virus still suggest the world is on track for a synchronised moderate growth recovery into 2021.

Despite challenging valuations in equity markets, we remain favourably disposed to our currently modest risk-on asset allocation. While there is an excess of valuation risk in some parts of the world’s equity markets (particularly US technology), and government bond yields look equally expensive under almost all scenarios other than a renewed recession, we believe other assets display value. These include domestic and UK equities, credit markets, and alternatives, particularly private equity and debt strategies with undeployed capital. Real assets, such as unlisted infrastructure and property, are also attractive and offer the additional benefit of being defensive through periods when inflation rises.

The near-term inflation outlook remains (very) low

COVID-19 has crushed the near-term inflation outlook. The next couple of months may see a short-term bounce in global inflation, as energy prices pick up and some activities get back to normal after the severe mobility restrictions that dominated April and May. But most major economies have delivered history-making declines in Q2 growth, confirming much of the world was in a deep recession in the first half of this year. Australia will be no different when it releases Q2 growth data in the first week of September.

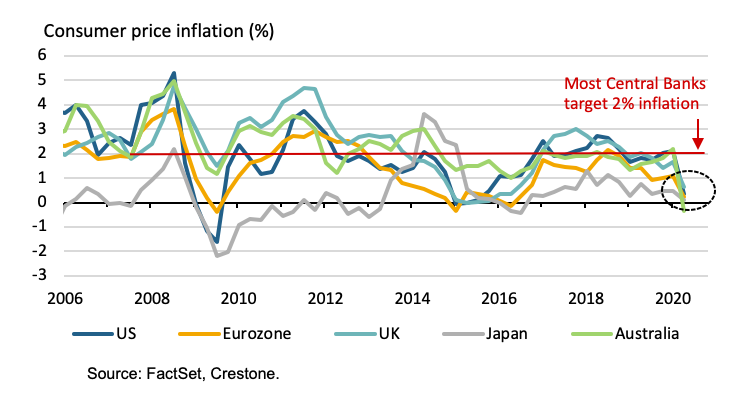

Even with an almost certain rebound in Q3, it seems unlikely we will revisit pre-COVID levels of activity before late 2021. Why does this matter? With most economies operating well below their potential, with huge swathes of spare capacity and underemployed workers, it’s hard to see how inflation is going to average anywhere near most central banks’ inflation targets for at least a year. As shown in the chart below, inflation is less than 1% in the major developed economies, far short of the 2% target for most central banks.

Inflation is less than 1% in the major developed

economies

With the shape of the world’s recovery post-virus still uncertain, governments here and overseas remain focused on providing support (particularly shovel-ready infrastructure projects and payments in lieu of work) to triage economies through the pandemic and minimise damaging long-term unemployment. This is very costly for government budgets. But low inflation gives central banks the ammunition they need to keep buying bonds, forcing interest rates to historic lows, and easing governments’ financing burden of this debt.

For now, low inflation and low rates will most likely continue to support equity market valuations, which on some metrics appear to have already factored in a couple of years of rebounding growth. Along with elevated US electoral and geo-political uncertainty, this would typically see us leaning on bonds for safety in portfolios. But with yields so low, this defensive ballast is increasingly being sourced from other assets, such as unlisted real assets where yields remain relatively attractive (see the July edition of CIO Monthly-The case for real assets where we discuss their inflation protection characteristics).

A medium-term inflation renaissance seems likely

But looking beyond the near term, an inflation renaissance seems increasingly likely. And this has the potential to meaningfully impact the outlook for economies and markets. Some of the catalysts have their foundation in good old-fashioned economic theory. Others are more a product of the chaotic and ever-changing global economy we live in.

1) Massive monetary and fiscal stimulus—even the non-monetarist can appreciate the concept that "inflation is always and everywhere a monetary phenomenon", as penned by Milton Friedman in 1970. While despised by advocates of the not-so-new ‘modern monetary theory’, that implies governments can spend endlessly, free from debt or inflation consequence, the most prescient inflation risk comes from the unprecedented stimulus being afforded by both fiscal and monetary policy makers globally. Near-zero interest rate settings in most developed economies are underpinning a quite significant pick-up in the money supply. While appropriate policy for the times (and largely filling a demand vacuum), the challenge will be withdrawing this before higher inflation becomes entrenched in expectations.

2) Demand pressures as economies bounce back in 2021—short-term goods shortages as economies recover in 2021 and 2022, and the reversal of some recent government initiatives to support workers (think free childcare in Australia), could also trigger inflationary forces earlier than many anticipate.

3) Rising supply-chain costs—in the medium term, the need for corporates to wind back the ‘just-in-time’ inventory juggernaut, to diversify supply chains across countries and ensure multiple sources for supply, is also likely to add additional costs that may eventually tilt up prices. The latest UBS Evidence Lab CFO survey finds 77% of US CFOs have been, or are planning to, shift some production out of China.

4) The end of globalisation—in recent decades, accelerating globalisation, which according to the Bank for International Settlements (BIS) has been cutting global inflation by 1% per year, is now firmly in reverse, courtesy of sustained geo-political tensions (as well as China’s transition from industrial to consumer dominance). World trade has now been slowing for half a decade, China’s wages are no longer falling relative to those in the US and, according to data from the World Trade Organization, import restrictions have leapt from 4% of global imports to over 10% in just the past three years.

Of course, there are ongoing forces that could work to mitigate some or all of the rise in inflation. These would include a resurgence in investment and productivity, particularly if this includes ongoing and significant increases in factory automation. Failure to secure an adequate treatment for COVID-19, leaving the world in a sub-trend growth malaise, would also minimise the risk of inflation picking up any time soon.

But if 2021 sees COVID-19 largely contained, and activity picks up moderately as we expect, inflation expectations will more likely start to lift, even if actual inflation stays low for a time. This will warm the hearts of central bankers globally, reassuring them their policy is working. Of course, after years of under-achieving, it’s almost certain they will want to see inflation trending well above 2% before reaching for the rate-tightening lever, as implied by the US Federal Reserve (Fed) in its policy review in late August. Near-zero policy rates are likely in play until at least 2022. Inflation is also a happy bedfellow for governments needing to reduce their debt quickly.

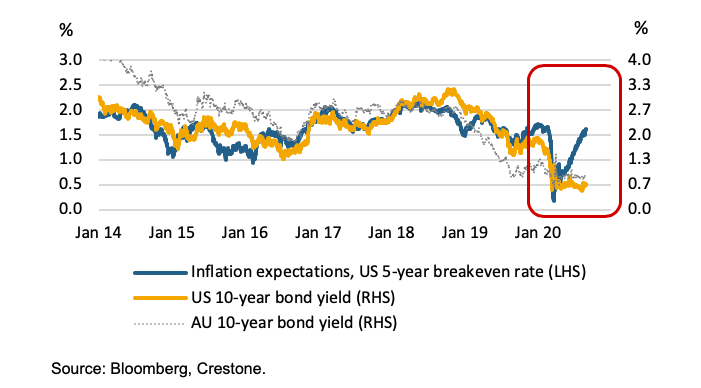

As the chart below shows, inflation expectations in the US have already rebounded post their pandemic-led collapse earlier this year. Bond yields are yet to respond. But it is precisely that reluctance of central banks to stymie inflation that will likely underpin a further rise in inflation expectations and a gradual rise in long-term bond yields. Even a moderate rebound in inflation will have to be factored into bond market pricing. A steeper yield curve will also help central banks signal to the market higher policy rates are ahead.

Inflation expectations and 10-year bond yields

How best to access inflation protection?

Inflation is likely to remain very low over the coming year, both at a headline and an underlying level, before drifting higher through 2021. Even then, it is likely to be only mild and below pre-pandemic levels as economies struggle to regather lost levels of activity and reverse elevated unemployment rates.

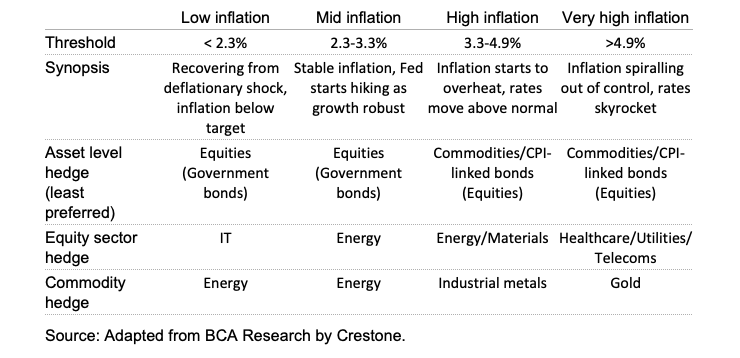

However, the desire of central banks to drive up inflation over the coming couple of years almost demands we consider inflation protection now or in the near future. And while BCA correctly notes that some inflation hedges “are costly to hold when inflation is at lower ranges”, its 2019 research highlighted that there are many relatively low-cost hedges which we believe warrant a moderate allocation to portfolios now, with the potential to increase these and other hedges should inflation begin to rise further through 2021.

Periods of rising inflation (US markets 1973-2019)

Inflation hedges…what’s on the menu?

Equities—as shown in the table above (from BCA Research), equities can be one of the best performing assets as inflation starts to rise (while bonds underperform). In periods of low inflation, equities typically enjoy multiple expansion and then, as inflation starts to rise (and multiples correct), they benefit from stronger earnings growth. Tech has done well when inflation is low (reflecting the impact of discounted cash flows), while stocks exposed to energy and materials perform better as inflation rises. While all equities underperform during high inflation, defensive sectors (such as healthcare and utilities) have, in the past, provided the best capital preservation.

Real assets—the table above does not

highlight real assets due to data limitations. However, in its analysis, BCA

Research showed that “direct real estate is a good inflation hedge”. As we

highlighted recently in July’s Core Offerings, we believe unlisted real

assets (property and infrastructure) not only provide a defensive ballast to

portfolios at a lower relative cost than sovereign bonds, their typically contracted

inflation-linked returns can provide significant inflation

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

2 topics

1 contributor mentioned