Lights out for the energy sector?

In the electricity sector, new technologies and policies aimed at reducing carbon emissions introduce the risk that existing assets may be rendered redundant. This paper reviews the stranded asset risk for the listed players AGL and Origin Energy.

A plan to reduce emissions

Australia’s commitment under the Paris Agreement (COP21) is to reduce carbon emissions to 26 – 28% below 2005 levels by 2030. In addition to the emissions at the end point, it appears that an emissions budget is another variable that must be managed over the transition period.

In 2005, Australia’s CO2-e emissions were approximately 600Mt with approximately one-third coming from the electricity sector. While these levels have since fallen — current emissions are 554Mt based on the December 2017 estimate — electricity generation still accounts for roughly one-third of emissions.

As it stands, Australia needs to reduce annual emissions from an FY17 level of 554Mt to a range of 432 – 444Mt (down 20 to 22%), as well as reduce cumulative emissions over the transition period by an average of 66 – 71Mt p.a. The existence of this emissions budget during the transition means that policy action needs to be front-end loaded or the future cuts will need to be significantly higher.

Assessing the risk of stranded assets

Assessing the risk of stranded assets requires significant assumptions regarding the policy settings needed to achieve the agreed reductions. Variables include the:

- amount of reduction targeted

- timeframe in which this is sought

- means by which it will be achieved. For instance, will the government seek an equal reduction across all sectors of the economy or will it be more targeted in its approach and seek to eliminate emissions from specific areas, either on the grounds of cost efficiency or labour market impacts.

The current policy settings do not appear to be targeting any one sector as bearing a heavier burden of emissions reduction than any other. Moreover, the recently abandoned National Energy Guarantee included an emissions reduction target for the generation sector of 26 – 28% by 2030. Although it was ultimately abandoned due to Liberal party in-fighting, it has been widely reported that this policy had achieved bipartisan support.

In making an assessment of likely stranded assets, I will rely on these policy settings.

In regards to the electricity sector, it is also pertinent to consider the market structure. Currently, electricity markets are essentially state-based, with limited capacity to transport electricity between states. I will assume that this remains the case and that there is no further expansion of interconnector capacity.

Therefore, I will assume the electricity sector in each state needs to reduce its carbon emissions by 20 – 22% as determined above.

New South Wales

A review of NSW’s generation plant highlights that more than 95% of carbon emissions come from five power stations.

Table 1 Top five carbon-emitting power stations in NSW

Source: Nikko AM estimates based on AEMO disclosures of the capacity of plants

The scheduled closure of Liddell removes an estimated 14% of NSW emissions from the electricity sector (although this will be partially reduced by the need for gas-fired generation to strengthen the renewable generation that replaces it). Vales Point will turn 50 in 2029 and for this reason, we expect it will be the next plant likely to shut, although I note its new owner believes it has life beyond this. We estimate that the closure of these two plants would see NSW reduce its emissions from the electricity sector by the necessary 28%, albeit with some offsetting emissions from a gas-fired firming plant.

The key downside risk beyond this is the adoption of Labor’s target of having 50% of electricity coming from renewables by 2030. In our view, this would likely see the early closure of Origin Energy’s Eraring coal-fired plant. Should Eraring close in 2029, rather than the scheduled 2032, we estimate Origin’s valuation would be reduced by 2.3%.

Victoria

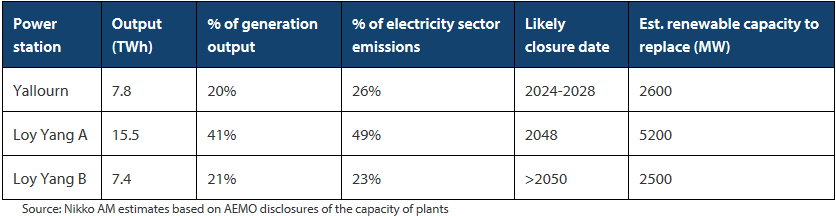

Similarly, in Victoria the vast majority of carbon emissions in the electricity generation sector can be attributed to the three coal power plants:

Table 2 Top five carbon emitting power stations in Victoria

Source: Nikko AM estimates based on AEMO disclosures of the capacity of plants

We estimate that the closure of Yallourn will largely achieve the current targeted emissions reduction. This is the oldest plant and also the plant with the highest emissions intensity.

In regards to the Labor Party’s target of 50% of electricity coming from renewable generation by 2030, it is apparent that AGL’s Loy Yang A plant has some risk of early redundancy. One or two of Loy Yang A’s four units may be closed to accommodate increased renewables. By our estimates, the valuation impact under this scenarios is -5% to -10%.

Conclusion

For the listed players in the electricity sector, the risk of stranded assets appears to be low based on recent policy settings. Origin may see Eraring close a few years earlier than planned and AGL may need to close part of Loy Yang A around 2030. In our view, the valuation implications of the emissions reduction targets are immaterial for Origin Energy (c2%) and modest for AGL (5 – 10%). Notably, the complexity of the system, the physical need for synchronous generation and the lumpy nature of existing thermal generation complicate the management of this transition to clean generation as well as the ability to draw definitive conclusions. That said, while the above assessment is extremely simplistic relative to the complexity of these issues, it does provide some insight into the valuation impacts. Moreover, the valuation impacts are well within the typical range of uncertainty.

It is worth noting that further potential downside exists for AGL should its remaining thermal generation assets be rendered redundant by advances in technology ahead of their planned closure dates.

Assuming base-load thermal generation is displaced entirely by 2030, AGL’s valuation falls by a total 35% from the base case valuation.

Further insights

For additional analysis and views from the Australian equity team, please visit our website

1 topic

2 stocks mentioned