Media Worth Consuming – January 2022

Top 5 Articles

15% of S&P 500 companies have a price to sales ratio over 10, more than double the peak in 2000.

A study found that fund manager experience correlates with better performance, but a CFA qualification is a negative.

The World Bank warns that around 60% of low-income countries could need to restructure their sovereign debts.

QE has created the problems that Thomas Hoenig predicted it would when he voted against it as a Fed Governor in 2010 and 2011.

The forgotten history of humans having two periods of sleep at night.

Chart of the month – A bear market without a recession?

The selloff in risk assets this month was predictable in its occurrence, but the timing is always the unpredictable part. US equities had been expensive by almost every metric on a historical basis, with the outliers being earnings yield and dividend yield relative to ten year bonds. A move upwards in bond yields made it difficult to see any reason for equities to remain as expensive as they were.

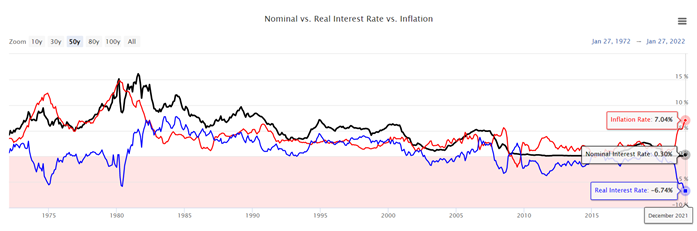

It is also understandable why asset prices had reached such high levels. The graph below from Longtermtrends.net shows the massive negative real returns on cash that investors have been facing recently. Negative real returns have been in place most of the time since 2009, which is an awfully long time to gradually boil the proverbial frog. Central banks have been deliberately punishing investors in cash and investment grade bonds, hoping that by forcing them out of these asset classes they would invest in other sectors, kicking off the wealth effect.

Source: Longtermtrends.net

Whilst the impact of higher asset prices on consumer spending is debateable (lower returns on low risk assets dampens spending by retirees) the impact on asset prices has been clear. Investors bullied out of lower risk assets have forced up the prices of higher risk assets, with sub-investment grade bonds, equities, real estate and infrastructure obvious beneficiaries. However, over time these sorts of shifts move from regular assets to speculative assets, as the future returns on regular assets are forced down by higher starting prices.

As first this trend tends to be seen in growth stocks, in both the IPO and venture capital segments, starting with companies that are generating decent revenues but with strong prospects for rapid growth. After a while, recently established business with little more than an idea and a slide deck are allocated large slabs of capital. Eventually it is “assets” with no business case like cryptocurrencies and NFTs that attract money as the speculative frenzy takes over. Without negative real interest rates and quantitative easing, these speculative (and arguably Ponzi) endeavours would have remained niche collectables largely ignored by mainstream financial markets.

Now that short and long term interest rates are rising, as well as electronic money printing being slowed or reversed, asset prices are being revalued. Normally, the prospect of a recession accompanies a slump in asset prices with the 2007-2009 period being a helpful guide. However, this time the starting point and trigger is somewhat different from historical examples.

Developed economies are generally in very good health with low unemployment and having had a solid bump in consumer savings from enormous fiscal stimulus and lockdown restricted spending. The corporate sector as whole is also cashed up, though there is a significant segment that is either (i) unprofitable and dependent upon future capital raisings or (ii) breakeven and dependent upon rolling over high debt levels. Fiscal stimulus and budget deficits will reduce, but austerity remains a dirty word by the majority who fail to realise it is an inevitable reckoning when governments overspend.

Those focussed on interpreting central bank mutterings have realised that overnight rates will increase faster and sooner than expected, and quantitative easing will stop sooner than expected. What I haven’t heard yet is a central bank committing to positive real interest rates. This indicates that whilst central banks are responding to the political pressure to do something about inflation, they aren’t fully committed to normalising monetary policy.

Pulling all this together, I see fiscal and monetary policy being stimulatory, but less than it has recently been. Consumers are likely to keep increasing their spending though business investment will slow somewhat as the cost of capital pushes up. There’s also plenty of economic activity that has been held back due to government restrictions and people being cautious, so there will be a natural reversal of that. A situation where very long duration debt, equities and other higher risk assets fall by 20% or more whilst developed economies continue to grow seems quite plausible. It would also be a reversal of the last 18 months when economies have suffered whilst asset prices rose.

Here’s the long list of the most interesting and under the radar articles I came across this month.

Finance

The sell-off started with the most over-hyped stocks but is now hitting the mega-caps. Jeremy Grantham sees asset prices as a “superbubble” now deflating. 2021 was a record year for US IPO issuance but investors have suffered miserable returns on them. UK consumers are facing a future of soaring CPI, tax increases and interest rate increases.

Chinese local governments are selling land to their off-balance sheet entities as developers struggle to remain solvent. China’s largest developer saw its stock price and bonds slump after a failed convertible bond deal, but was later able to get a $501 million issue away. An Evergrande restructuring plan has collapsed after Oaktree appointed a receiver to a key asset. Evergrande has been ordered to demolish 39 luxury apartment buildings after the permit was “obtained illegally”. China’s Minsheng Bank had the worst performance of 155 global bank stocks last year with its high risk lending to developers attracting short sellers.

The start-up that helps whistleblowers take their claims to regulators and the public. Wonderland’s crypto tokens, that offer an 83,687% annual interest rate, slumped 32% after one of its founders was exposed as a seasoned scammer. Three basic points for why Cryptocurrencies are a waste of resources. Imagine there’s no crypto, it’s easy if you try.

Politics & Culture

Republican Senators reportedly threatened to support impeachment of Trump if he pardoned Assange or Snowden. In a bizarre turn of events, Democrats used the “racist” filibuster to block sanctions being put on Russia. US stimulus cheques were sent to prisoners, including some serving life sentences. The US government’s $800 billion job protection stimulus mostly went to business owners not employees. After five years, Puerto Rico is set to exit bankruptcy but questions remain over its ability to service reduced debt levels and whether politicians can deliver budget surpluses.

Amazon is being sued by a convicted murderer for discrimination after the company rejected his job application when they discovered his criminal record. Tesla has dropped a law firm after the firm refused to fire a lawyer who had brought down a solid penalty on Tesla when working for the SEC. Ivy League colleges are accused of forming an illegal cartel to restrict the financial aid given to students from poorer families.

Olympic athletes have been warned not to eat meat outside of the Olympic village due to potential contamination with performance enhancing drugs. Athletes are also being warned to use burner phones to limit the potential of being spied upon. China has threatened athletes with punishment if they breach local laws restricting free speech.

Police raided the offices of the most prominent pro-democracy newspaper in Hong Kong over sedition charges. Hong Kong’s pet hamster cull is a new low in Covid authoritarianism. Chinese censors are completely rewriting the endings of major films such as Fight Club and Shawshank Redemption. The Chinese government is telling citizens to boycott KFC after a promotion saw one customer buy 106 meals to collect a full set of toys. The Israeli police implanted spyware on the phones of political opponents and journalists.

The controversial argument against land acknowledgements. Hollywood’s woke turn is likely to end up in a massive class action lawsuit. Thomas Sowell refuted the arguments of Black Lives Matter decades before they were made. BLM riots were far more violent and costly than the January 6 riot. Reuters fired a data scientist for exposing its factual errors and bias favouring BLM. A Swedish warship had been praised for four out of its five navigators being women, but in November it sank due to disastrous navigation errors.

Economics & Work

Pennsylvania is considering capping the pay of nurses in a wrongheaded attempt to reduce contract nursing. Robots are increasingly taking repetitive work from humans at a cost less than the minimum wage. US employment has grown less than the congressional budget office forecast, despite more stimulus than forecast being thrown at it. With inflation spiking politicians are considering price controls, a “solution” that has a long history of failing.

Americans continue to leave high tax states for low tax states. When taxes are increased there’s less pie for everyone to share. Global minimum tax agreements enable governments to waste more money. The IRS reminded Americans to pay taxes on stolen property and drug deals. The IMF never seems to learn that its bailouts make things worse. Turkey has blown through its reserves in a futile attempt to defend its currency.

Miscellaneous

After a winter where renewable generation fell short and power prices spiked, parts of Europe are turning back to nuclear power but Germany is closing nuclear power plants. Private equity firms are lining up to bid for coal mines. Global average temperatures continue to trend higher. The turnaround in the ozone layer provides lessons for other environmental problems. Setting up a honeybee hive can cause problems for plants and native bees. How ethanol replaced lead in fuel 80 years later than it should have. The volcanic explosion in Tonga was bigger than a nuclear blast.

The Washington Post gave its harshest ranking to wildly overstated claims about children suffering with Covid by a US Supreme Court Judge. With more evidence showing that a previous Covid infection offers better protection than vaccines, mandatory vaccine policies that ignore previous infection are on shaky ground. Sweden’s less restrictive approach to Covid has delivered better outcomes. Hong Kong’s covid zero strategy is madness with citizens paying a hefty price. Fifty examples of absurd Covid restrictions.

A UK government study found that mask wearing in schools provides statistically insignificant health benefits and that it impedes students from learning. A long list of reasons why face masks are more than an inconvenience. A Chinese woman was locked in with her blind date for four days after the city imposed a Covid lockdown.

A team of Slovakian engineers has received approval for a car that quickly converts into a plane capable up flying up to 18,000 feet all whilst running on regular automotive fuel. The physical and economic limitations of skyscrapers. What’s the greatest statistic in American sports? 9 tips to become a better listener.

Why most play-to-earn games are pyramid schemes. A smash and grab robbery in Florida netted $1.5 million in designer handbags. A cruise ship changed its itinerary to avoid Miami after a US arrest warrant was issued for it over $1.2 million in unpaid fuel bills. The decades of problems that preceded the Miami tower collapse. Charting the biological advantages men have in sports. A tiny portion of Greenlanders have a genetic variation that avoids many of the negative consequences from eating sugar. For $10 a month, Taco Bell customers can get one taco every day.

4 topics