Setting and understanding investment goals

Why invest

The simple answer to the fundamental question of why we invest is of course to make money. Perhaps to build personal wealth, or perhaps to build a nest egg for the next generation. For other investors, the starting point is more about capital preservation and the protection of capital that has been carefully accumulated over time.

However, high-level answers such as these don’t specifically help us in planning or moving forward. To understand or establish our level of satisfaction with any outcome, we need to understand what we were aiming for.

No doubt every investor will have different goals, but at least broadly speaking, people tend to invest their capital in the hope that in the future it is worth (adjusted for inflation) at least as much as it was on day one.

In addition, most investors hope to generate a return above and beyond the cost of inflation, generally at a rate that surpasses their personal cost of living.

What do we measure against

We are often asked how the Collins St Value Fund has performed relative to the broader stock market, yet to be perfectly blunt we don’t care.

While we have won best performing awards throughout our journey, most recently in 2020, that won’t always be the case. We are okay with that because our true goals are of our own making, and unrelated to the fortunes of other investors.

We're not concerned about how "the market" has performed, how "momentum trading" has performed relative to ‘fundamental investing’, nor does it matter to us if ‘Growth’ is outperforming ‘Value’. Sure, all these topics make for interesting conversation, but the only factor that investors should consider is whether or not they have achieved a satisfactory return for their efforts measured in absolute terms.

We are ‘value investors’, and our focus is on identifying the most attractive businesses in the equity markets, but we hold no animus to other approaches or asset classes. In fact, we suspect that many of the perceived differences (especially within the scope of investments made based on fundamental analysis) between approaches and assets are imagined.

As distinct from speculators, most investors are just looking to buy an asset worth $1 for $0.50.

Nevertheless, over the last few months we have seen a lot of interest in the fortunes of growth investing relative to value investing.

Before we get into the details and discuss the differences between approaches, I would note that we don’t make a clear distinction between styles. Each approach has different considerations, and different goals, but where ‘value investing’ ends and ‘growth investing’ begins is a matter of consideration for the ages.

In any case, our view is that comparing different investment philosophies is akin to comparing cricket with AFL. Sure, both are popular Australian pastimes, but just because cricket teams may deliver a score higher than your average AFL match, does not make it a better sport or pastime. Just as a run in cricket is not comparable to a goal in football, so too investment philosophies seek to fulfill different desires.

The spectrum of fundamental investing

As previously suggested, there is no clear distinction between where value investing ends and growth investing begins. Instead, most investors find themselves somewhere along the spectrum.

That being said, there are certain economic drivers that will affect certain types of businesses differently to others.

Low interest rates “new world”

Low interest rates drive asset prices higher for two reasons.

Firstly, given no other alternatives to keep up with inflation and personal cost of living increases, people tend to put money in riskier assets in an effort to maintain the value of their capital over time. Be it gold, cryptocurrency, art, or collectables, given that the alternative cash options are offering a low or no return, the perceived risk becomes acceptable.

This is speculation for sure, and any gains are made due to someone being prepared to pay more tomorrow than was paid yesterday. But history shows that as cash and bonds become less attractive, speculative assets and alternative zero-coupon assets (like gold) appreciate.

Secondly, as interest rates fall, the cost of capital falls with it. As a result, the discount rate on future earnings is reduced and cash flows in the years to come are ascribed more value than they would have been had interest rates been higher.

These two factors tend to see companies with large future earnings profiles benefit the most. Specifically, companies without current earnings, but the expectation of strong future earnings tend to see their fortunes leveraged to interest rates and the cost of capital. This is because the type of businesses without substantial assets or current earnings are likely to be valued on the basis of its future prospects.

Therefore, many growth stocks are highly sensitive to interest rates for both reasons:

- Speculation and hype draws interest to ‘exciting’ opportunities and new technology when alternative (boring) investments offer lower returns, and

- Future cash flows are highly sensitive to the cost of capital.

The correlation between interest rates and growth stocks can be illustrated by comparing 10-year (US) government treasuries and a major US based growth managed fund Ark Innovation EFT (US: ARKK).

As the following graph highlights, as treasury yields fall, growth and speculative investments performed exceptionally well. However, as US rates begin to increase the impact on many of the prospective and growth businesses has been significant.

Though the graph above is too subtle to see the true impact of recent interest rate increases, since US yields increased above 1.25% in February the ARKK fund has fallen by over 20%.

Locally companies like buy-now-pay-later leader Afterpay have seen their fortunes rise in a world of low interest rates. So much so that at its peak APT had a larger market cap than Woolworths, Wesfarmers, Telstra, Woodside Petroleum and Brambles, despite not having yet made a profit.

This is not to suggest that established businesses are not impacted by cheap money, they are. The key difference is that stable companies are not an exciting place to speculate - their earnings are too predictable. Additionally, established companies tend to be valued on the basis of their assets and ongoing business and not predominantly on the basis of their future expectations.

Our experience

As is to be expected, in an environment of increasingly cheaper capital, companies leveraged to future earnings, and speculative opportunities have outperformed investments in established businesses.

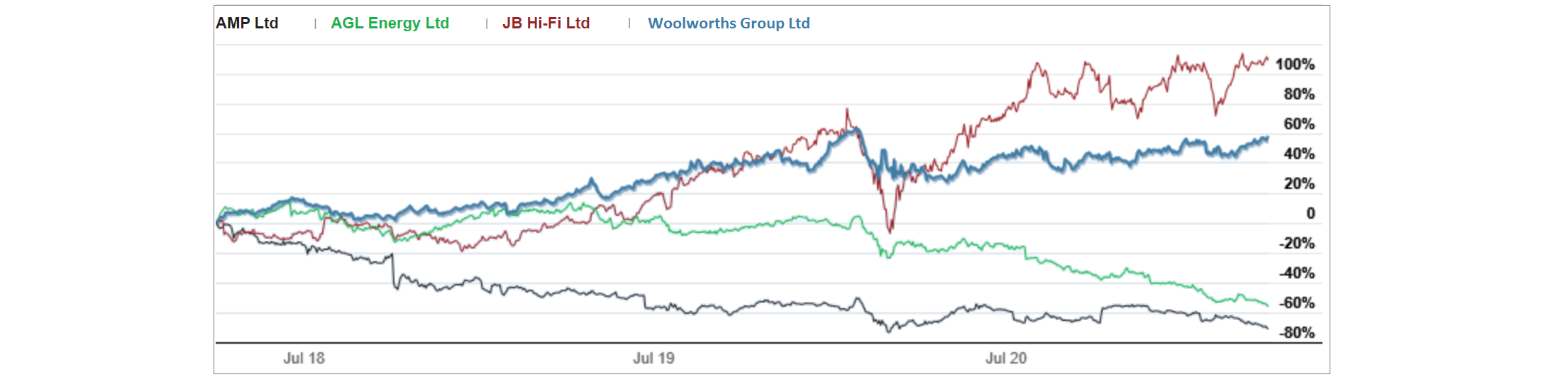

Nevertheless, not all established businesses are the same, and not all value investors will achieve the same results.

There have been some exceptionally performing established companies over the last few years (think JBH and WOW) and there have been poorer performing companies as well (think AGL and AMP). So too there have been strong performing funds as well as some weaker ones.

We have been fortunate at Collins St Value Fund.

We are not bound by arbitrary restraints as our mandate allows us to invest with conviction and take concentrated positions. In being mandated to only invest in our favourite ideas, our returns have been very pleasing.

It hasn't happened by accident. Our view is that there is always an opportunity to uncover a wonderful business trading at too great a discount to its intrinsic value if investors are prepared to be a little patient and search a little harder than the average investor.

Our challenge, as it is for all investors, is to remain steadfast to our ideals and avoid becoming caught up in the latest and greatest alternative investment.

We endeavour to remain focused on our goals. Be satisfied in achieving them and avoid risking them in an effort to chase ideas we don’t understand.

This is not because you can’t make money from all sectors and investment types, but because it’s ideas that you don’t fully understand, and the ideas that you misunderstand that turn into profit traps.

On that note, we’ve found ourselves making some significant purchases recently – watch this space for future wires where we outline our thesis behind some recent activity within the Collins St Value Fund, including two heavily oversold consumer discretionary companies and a special situation ‘take over arbitrage’ opportunity playing out in the market at the moment!

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

5 stocks mentioned