Small and mid-caps shine. Here are Macquarie’s top picks

According to a recent research note from Macquarie, small and mid-cap companies have delivered one of their strongest reporting seasons in years.

With domestic cyclicals powering ahead and a string of key names outperforming expectations, the August 2025 reporting season has highlighted where investors might want to focus next.

Sector snapshot – domestic cyclicals strongest strategy group

Domestic cyclicals came out on top, emerging as the strongest strategy group, outperforming with net beats or in-line results of 89%. These results were well ahead of Growth (69%), Global Cyclicals (66%), and Defensives (55%).

Across industrials, 43% of companies beat consensus, and with just 22% missing, results reflected strong underlying momentum.

However, beneath these headline beats, Macquarie noted that:

“FY26 EPS saw downgrades (34%) exceeding upgrades (17%)”, as companies cited cost pressures, softer consumer demand, and macro uncertainty.

Macquarie’s top picks post reporting season

From this mix of results, Macquarie rolled out its top post-season picks – stocks that combine growth potential, margin resilience, and solid balance sheets.

Top picks: ARB, AUB, BRG, FLT, IDX, MGH, NEU, NWH, PNI, PXA, SLC, SDR and UNI.

Recommendation changes also followed the results season. NRW Holdings (ASX: NWH) was upgraded, while Bravura Solutions (ASX: BVS), Codan (ASX: CDA), and Lovisa (ASX: LOV) were downgraded.

SPOTLIGHT ON SELECT NAMES

ARB Corporation (ASX: ARB); Outperform - $44.90 TP

Sales growth was in line with consensus and grew +5% year-on-year, strong export momentum +16% year-on-year and a near-term special dividend. US expansion with the increase in equity ownership from 40% to 50% and ORW acquired 4WP. Macquarie also noted:

“Combined with ORW's existing 11 sites, this expanded the ORW/4WP network to 53 stores, representing the largest 4WD accessory retailer in the US.”

With US OEM contracts and e-commerce expansion in play, Macquarie sees further upside in FY26.

Fundie view

Donny Buchanan of Lakehouse Capital, however, sees a very different story for ARB.

"ARB Corporation, admired for its strong brand and proven management, faces challenges from a tough macroeconomic environment and global tariff uncertainties. Manufacturing cost pressures from a strong Thai Baht and softer sales in some core vehicles in Australia (55% of revenue) add further headwinds."

Elsewhere, Joe McCarthy of Elston Asset Management flags ARB as a HOLD, citing concerns around ARB's US expansion in a price-sensitive market, whereas Ben Rundle of Hayborough Investment Partners rates ARB as a BUY. You can check out their theses on the recent episode of Buy Hold Sell below;

AUB Group (ASX: AUB); Outperform - $37.40 TP

According to Macquarie, the insurance broking and underwriting group continues to compound earnings via acquisitions and organic growth. Underlying PBT rose +12.8%, while group EBIT margin expanded +100bps year-on-year. Boosted by a +9.3% average increase in commission and fee income per client, increased interest income, and continued network optimisation.

Bizcover was a standout, with EBIT margins jumping to 45.8% (+380bps year-on-year) as product enhancements and insurer panel strength drove growth.

NZ Broking margins of 34.4% (-210bps) reflect investment for share gains, while International/Tysers lifted GWP to £340m from £110m. Macquarie noted that AUB remains firmly on track to achieve its medium-term EBIT targets.

Fundie view

Recently, James Nguyen of Tyndall AM highlighted AUB as a tactical addition during portfolio rebalancing.

He attributed the stock-specific opportunity, alongside selective positioning, as a key driver of the Tyndall Australian Small Companies Fund's strong ~15% gain in August, outperforming its benchmark by more than 600 basis points.

Breville (ASX: BRG); Outperform - $39.20 TP

Macquarie's report highlighted Breville's revenue growth +10% in FY25 across all regions (EMEA +12%, Americas +11.5%, APAC +10.7%), led by Coffee, with new distribution in CHina, the Middle East, and South Korea.

Gross margins were 36.6% and EBIT rose +10.2%, although FY26 will face tariff headwinds before recovery in FY27-28 as manufacturing shifts outside China.

Macquarie noted BRG's strong balance sheet and unleveraged position provide flexibility to weather tariff headwinds while continuing to invest in growth.

Fundie view

In the August reporting season, we spoke to James Nguyen of Tyndall Asset Management about BRG. Nguyen rates BRG as a BUY, stating:

"Breville is a material holding for us, which we initiated post the Trump-induced Liberation Day sell-off. This is a multi-year structural growth story, and the short-term volatility at that time has provided a great opportunity for active managers."

Nguyen did highlight potential risks in the coming year as the company mitigates tariff impacts, with doubts that they'll be able to continue their historical earnings growth in FY26.

Flight Centre (ASX: FLT); Outperform - $16.55 TP

Macquaried noted that FY25 was volatile, with FLT's adjusted PBT finishing ~10% below pcp, impacted by losses in Asia (-$22m), Middle East tensions, and weaker US leisure bookings. Still, underlying growth was evident. Leisure TTV grew 7%, Corporate TTV rose 2% and ex-Asia corporate profit climbed 6%, supported by Productive Ops with TTV per FTE up +13% over two years.

Looking ahead, Macquarie highlights improving momentum into FY26, with record July corporate TTV, stronger Leisure enquiry, and expectations for Asia to deliver a ~$20m profit swing.

Macquarie sees a flat 1H but stronger 2H, supported by cost benefits and cyclical recovery.

It's worth noting that short interest in FLT has recently doubled to 10.6% (from 5.4%), making it onf ot the top 10 shorted names on the ASX200. Short sellers are betting further weakness lies ahead in its UK and US travel segments — a contrarian signal that, if FLT delivers on its recovery, could set the stage for sharp upside.

Integral Diagnostic (ASX: IDX); Outperform - $3.40 TP

According to Macquarie, FY25 results for IDX were in line, with revenue up +6.7% (Australia +7.3%, NZ +1.4%), aided by MBS indexation and a shift to higher fee modalities.

Macquarie forecasts several tailwinds: MRI deregulation from 1-Jul-25 (42 licenses), the $264m National Lung Cancer program, and expanded bulk billing. Macquarie also expects margin gains from the CAJ merger, lifting synergy targets to $14m and forecasting +140bps in FY26E and +50bps in FY27E.

Fundie view

Marc Whittaker of IML described IDX's reporting season results as a "little soft", citing cost pressures:

"It’s a good quality company, it’s a short-term hiccup. It’s very hard when you’re looking at companies to look at half by half because often you get movements within a financial year – what you see in the first half doesn’t replicate in the second half. The margin management for that business should be a lot better in the second half".

MAAS Group (ASX: MGH); Outperform - $5.10 TP

MGH's FY25 adjusted EBITDA of $219m was in line with guidance, up +2% and boosted by $14m in capital recycling, according to Macquarie.

Macquarie highlighted the revenue jump for Construction Materials +37% to $493m, now 47% of group earnings, with margins steady at 22.4%, while capital recycling delivered $108m in proceeds.

Looking into FY26, Macquarie expects Construction Materials growth to be led by quarry volumes linked to infrastructure and renewable energy projects, while concrete volumes remain soft.

Fundie view

In a recent interview with Michael Steele from Yarra Capital Management, he named MGH as his 'sleeper stock' and said this:

“They’ll benefit from a cyclical recovery and market share expansion in renewables and residential. Hidden value in the property portfolio, founder-led, and significant upside.”

Neuren Pharmaceuticals (ASX: NEU); Outperform -$21.20 TP

Macquarie reported 1H25 royalties from Acadia's DAYBUE reached A$28.3m (up from A$24.3m in 1H24), in line with forecasts but ~6% below consensus. Total income beat expectations (+25% vs MRE, +32% vs VA) on higher interest and FX gains, lifting NPAT above estimates.

Guidance for FY25 commercial revenue was maintained at A$62–67m, consistent with Macquarie’s A$64m forecast.

Looking ahead, Macquarie notes key catalysts including the US Phase 3 PMS trial (~160 children) and EMA approval in 1Q26, which could unlock more royalities and milestone payments, prompting Macquarie to raise PMS contribution to 30% and de-risk ROW valuation from 50% to 75%.

Tom Wickenden, an Investment Strategist from Betashares, had this to say about NEU:

"NEU was one of the worst performing stocks on the ASX last financial year. This time, its August half year report was a standout. Neuren delivered record profit, increasing 88% YoY, driven by surging royalties for its signature drug, Daybue, with US sales almost doubling and further global expansion."

Fundie view

On an episode of Buy Hold Sell from the end of June, Henry Jennings from Marcus Today, noted NEU as his pick for an innovative and exciting stock for the next 12 months heading into FY26. Jennings chose NEU as his stock pick:

"They've got one treatment out there, which they've licensed to a US company called Acadia, and they've got milestone payments. They've got upfront payments. They get a royalty stream. They've got $360 million in cash. It's capitalised at 1.5, 1.6 billion. It is quite volatile. They do have a new drug coming, NNZ-2591, which they've got trials, results coming later this year, which could be a game changer for them again."

NRW Holdings (ASX: NWH); Outperform - $4.45 TP

Macquarie upgraded NWH to Outperform following its acquisition of Fredon at 5.2x earnings, adding a fourth pillar (EMIT) and exposure to energy transition and digital markets.

Fredon brings a $1b work-in-hand, $3.6b pipeline, and ~$2b in tenders submitted, with Macquarie forecasting ~$840m in FY26 revenue and a step-up into FY27 as integration benefits flow.

FY26 guidance of >$3.4bn revenue and $218-228m UEBITA is seen by Macquarie as conservative, underpinned by an order book of $6.1bn. Active tenders worth $5.6bn also offer upside, with margins expected to expand toward historical averages.

Fundie view

At the end of July, on an episode of Buy Hold Sell, Peter Gardner from Plato Investment Management and Hugh Dive from Atlas Funds Management had their own conflicting thoughts on NWH.

Gardner rated NWH as a BUY:

"It's a buy for us as well. It's a mining service company, which is obviously variable. It's one of those more cyclical companies that you've got to be wary of. But a lot of its customers are large customers that are doing more investment. It's got a pretty good order book at the moment, so we think its earnings are pretty solid for the next few years."

However, Dive rated NWH as a SELL:

"On the reverse, sell. Mining services and contracting companies are not the place to look for consistent dividend yields. Unfortunately, I've owned other companies like that in the past and generally you've been surprised very heavily on the downside where something just comes out of left field and have to get new contracts every couple of years. It's just a little bit too volatile for my taste."

Pinnacle Investment Management (ASX: PNI); Outperform - $25.33 TP

FY25 saw net inflows surge +$23.1bn (vs + $9.9bn in FY24), underpinned by Life Cycle, which reached profitability in 2H25 with $15.4bn FUM — the fastest start for any PNI affiliate, according to Macquarie.

Reported margins of 36% were weighed by platform costs, though underlying margins were closer to 44%. With $463.5m in cash and ongoing affiliate expansion, Macquarie sees PNI well-positioned for growth.

According to Rudi Filapek-Vandyck, Pinnacle continues to sit firmly among the market’s quality compounders with performances solid enough to continue supporting share prices.

Fundie view

In the same Buy Hold Sell episode linked above under ARB, Ben Rundle rates PNI as a BUY, referencing the strength of their distribution network, driving talent towards the business.

Pexa Group (ASX: PXA); Outperform - $17.30 TP

Macquarie notes that FY25 Operating EBITDA of $133m came in 4% below consensus, with margins pressured by cyber investment ahead of pricing reviews.

UK operations gained credibility with FCA approval and NatWest onboarding, lifting share assumptions to ~30%.

Macquarie expects a digital divestment as a positive catalyst, with platform leverage and UK growth driving margin recovery from FY28+.

Fundie view

Emanuel Datt of Datt Capital, in the recent interview with Livewire linked above under ARB (You're fire! 6 ASX stocks to fire, 6 to hire small-cap edition), Datt explained how they have recently increased their position in PXA.

"We recently increased our position, due to the combination of stronger management discipline, prudent capital stewardship and imminent UK expansion optionality as catalysts for a re-rate over the medium-term."

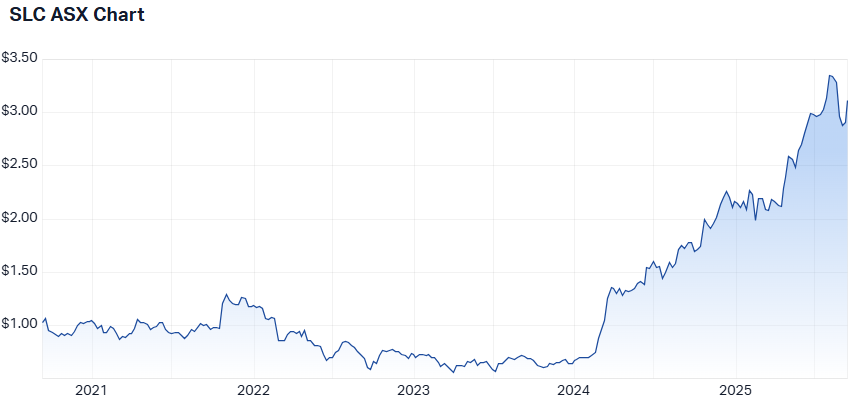

Superloop (ASX: SLC); Outperform - $3.60 TP

According to Macquarie, SLC's FY25 results showed Consumer weakness, with net adds down –11k, though FY26 trading suggests ~+135k annualised adds. Macquarie stays cautious on NBN pricing pressures but highlights long-term growth, aided by ASX200 inclusion (~4% tailwind).

Macquarie points to upside in Smart Communities (+42k lots under construction) and stabilising Business NBN ARPU, while Origin’s strong customer growth should keep Wholesale earnings supportive into FY26.

Fundie view

Last week, I spoke with James Barker from Ellerston Capital, who drew attention to challenger telcos chipping away at the incumbents. Regarding SLC, he said:

"Over FY25, total NBN connections were roughly flat, but underneath that about 682,000 users migrated from lower-speed plans to high-speed (100Mbps and above) plans. Aussie Broadband and Superloop were big winners in this shift – they significantly grew their subscriber bases at the top end of town."

SiteMinder (ASX: SDR); Outperform - $8.11 TP

FY25 ARR rose to $273m (+27%), de-risking FY26 revenue of ~$282m, Macquarie highlighted. The Smart Platform added $4m in 2H and is expected to deliver $20–25m in FY26, with assumptions for SDP lifted on partner growth.

SDR has re-rated from ~4x to ~6x EV/Sales, but Macquarie sees further upside as momentum builds toward 30%+ revenue growth. FY25 results showed revenue +19% to $224m, UEBITDA of $14m, and first positive UFCF of $4.7m.

Fundie view

Two weeks ago, I spoke to Luke Laretive from Seneca Financial Solutions, who recently invested in SDR:

"We bought it at the end of July. A growing, reoccurring revenue software business that the market had fallen out of love with on weak cash flow. We ran it to ground as we usually do, figured out that revenue growth was likely to be re-accelerating and there was potential for upside surprise on cashflow. It reported $14.3m EBITDA on Wednesday, stock traded up as much as 31% on the day."

Universal Store (ASX: UNI); Outperform - $10.20 TP

Macquarie sees strong FY26 momentum, with Perfect Stranger sales up +25.5% and Universal +13%, though growth is expected to moderate to +7.3%. Management plans 12 new stores, while margins rose to 61.1% on higher private label penetration and should expand further.

A solid balance sheet with $17.2m net cash and strong cash conversion underpins growth, with private label seen as a key moat.

Fundie view

Last week, we spoke to Joel Fleming from Yarra Capital Management, who highlighted UNI as having a strong growth profile, with "selling a good product at the right price in the right place" as a driver for UNI's success in the consumer space.

.jpg)

Additionally, in the following write-up, my colleague Vishal Teckchandani dives into both Bell Potter and Macquarie's take on earnings season and how they believe investors should position themselves ahead.

5 topics

16 stocks mentioned

11 contributors mentioned