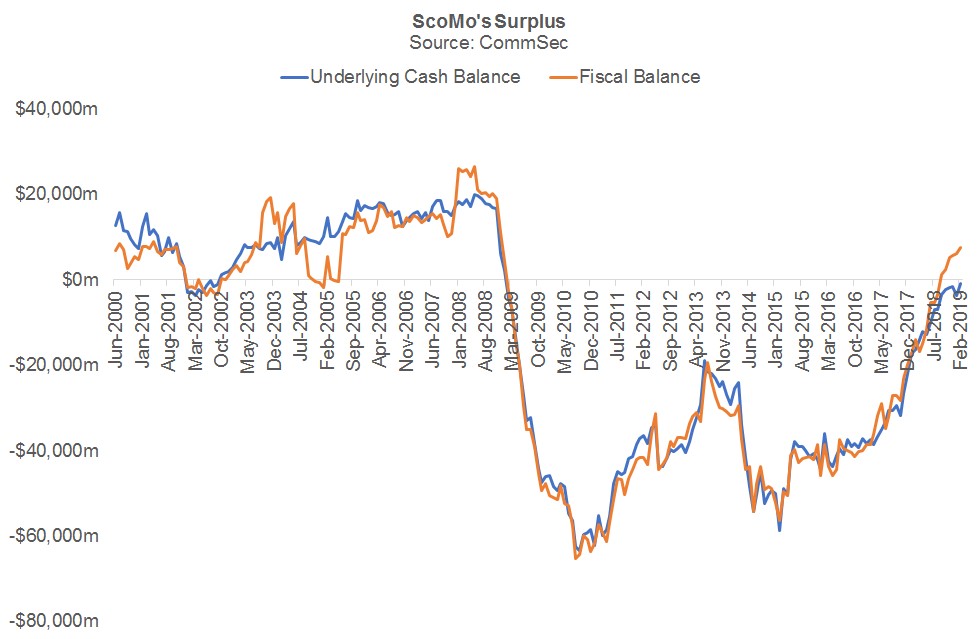

The Federal Budget is Already in Surplus!!

Today I show how ScoMo has already delivered a $7bn plus budget surplus on a number of the key measures years in advance of what rating agencies and analysts (save yours truly) expected, which is the best budget outcome since 2008. I then present the evidence I used to demolish an economic doomsayer---who reckons we are heading towards an "economic Armageddon" that will force house prices down 40%---during a televised debate hosted by Peter Switzer. I conclude with our analysis of the RMBS market, which shows that big house price falls have massively increased risks in recently issued RMBS deals that investors have been blindly buying, resulting in some holding many assets that are underwater (or have negative equity). Read the column by clicking here or AFR subs can click here. Excerpt enclosed:

During the week I demolished one such doomsayer, a News Ltd columnist called John Adams, on a televised debate hosted by the imitable Peter Switzer. Adams argued that Australia’s elevated private debt levels mean that we are destined to experience an “economic Armageddon” that will force house prices down 40 per cent in a manner similar to what the Irish endured during the GFC.

Yet he was completely flummoxed when I asked him to explain what factors will necessitate the deleveraging that precipitates this apocalypse.

Adams and other economic extremists I have debated (including Steve Keen back in 2008) ignore the essential question of debt serviceability and the interaction between the level of debt and incomes and interest rates. (They also conveniently overlook the fact that Australia's net government debt to GDP ratio is extremely low.)

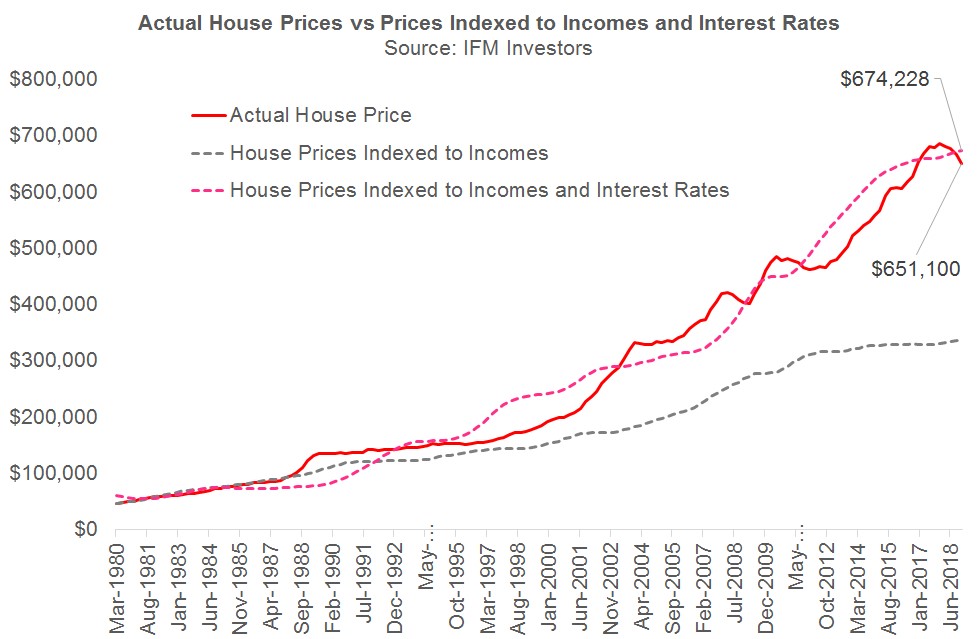

Whereas the average home loan rate between 1980 and 1995 was staggeringly high at 12.7 per cent, it has fallen 45 per cent to average 7 per cent since that time. (It is currently 5.4 per cent at the headline level, or 4.7 per cent on a discounted basis.)

The structural decline in the price of money as a consequence of the advent of low inflation in the early 1990s has allowed the economy to safely service much higher debt burdens. This is why despite the sharp increase in the household debt-to-income ratio, which in 2013 this column forecast would reach record highs, the 9.1 per cent share of income accounted for by interest repayments is not materially different to the 8.2 per cent average that has held over the last 40 years.

If adversity looms and the RBA wants to alleviate borrowers’ debt servicing burdens, it can slash the cash rate to zero, which the RBA’s research suggests would push house prices back up by more than 30 per cent.

The critical influence of incomes and interest rates is also highlighted in Dr Alex Joiner’s research. Joiner shows that if you index the median house price in 1980 to the change in household incomes and borrowing costs between 1980 and 2018, you can explain 100 per cent of the ensuing appreciation as a function of the expansion in purchasing power. Indeed, if you think the RBA’s cash rate is going to remain at 1.5 per cent forever, current house prices are theoretically 3 per cent cheap.

If, on the other hand, you believe the cash rate will normalise to between 2.5 and 3.5 per cent, Joiner’s modelling implies that Aussie house prices remain overvalued by between 3 and 13 per cent.

This does not mean I am a housing bull. After calling the boom in prices between 2013 and 2017, I was the only mainstream analyst to predict a 10 per cent fall in dwelling values in early 2017. And I upgraded that forecast in early 2018 to a 10 to 15 per cent decline after it became clear Labor would likely win the election and eliminate negative gearing while hiking capital gains tax by 50 per cent.

While I am watching the fat tails of the distribution, my central case remains that the US economy will continue to power global growth, which will ensure that the current housing correction is orderly and results in the most important unwinding of Australian financial imbalances in decades.

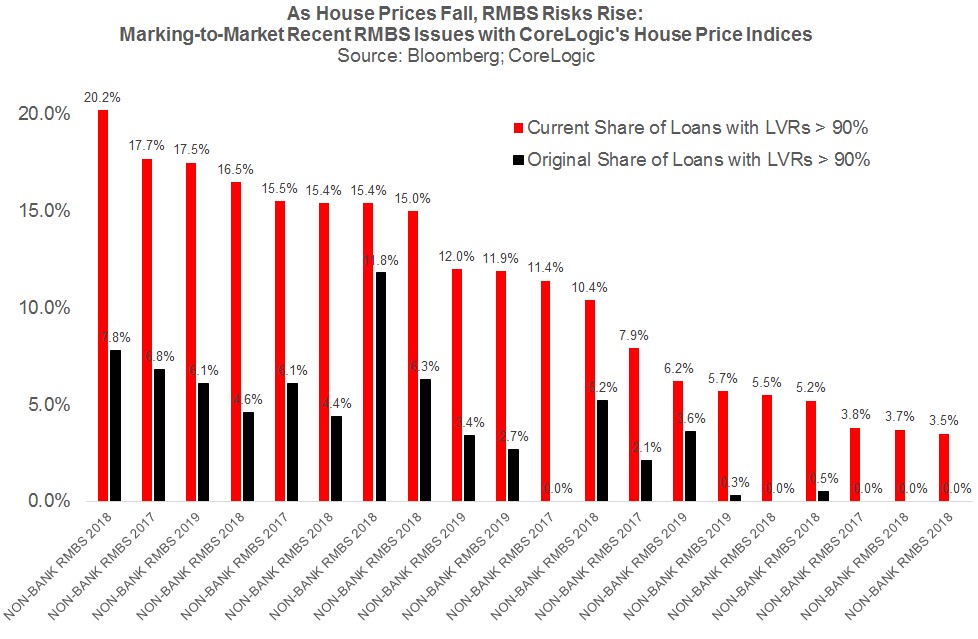

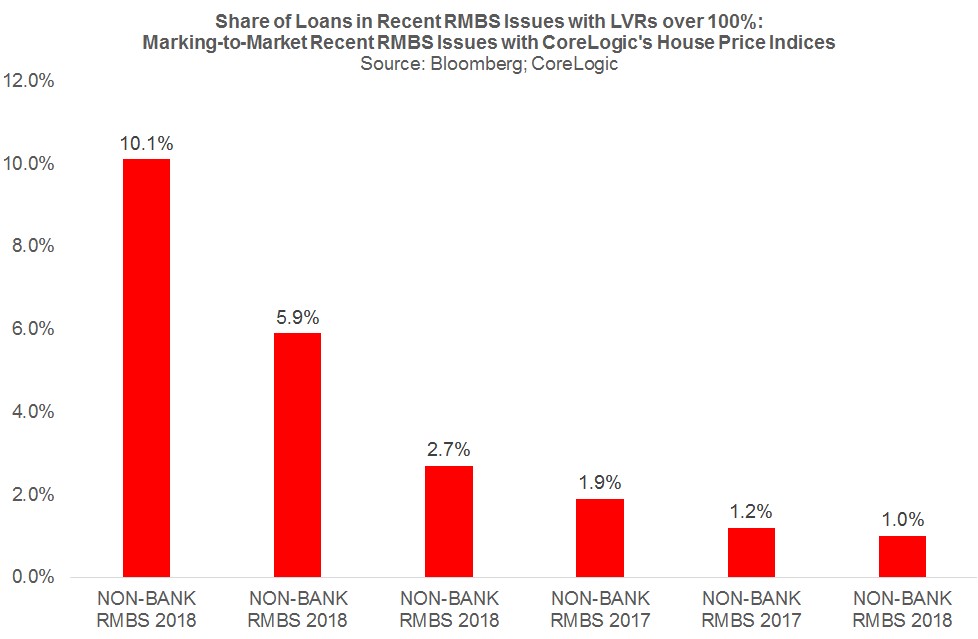

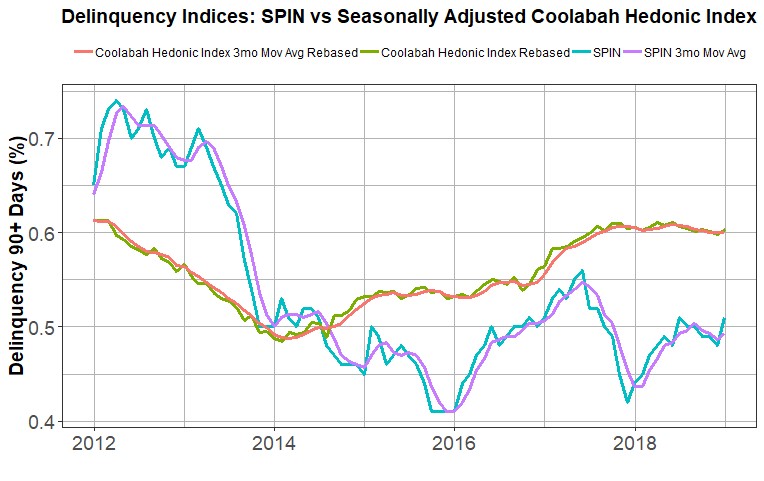

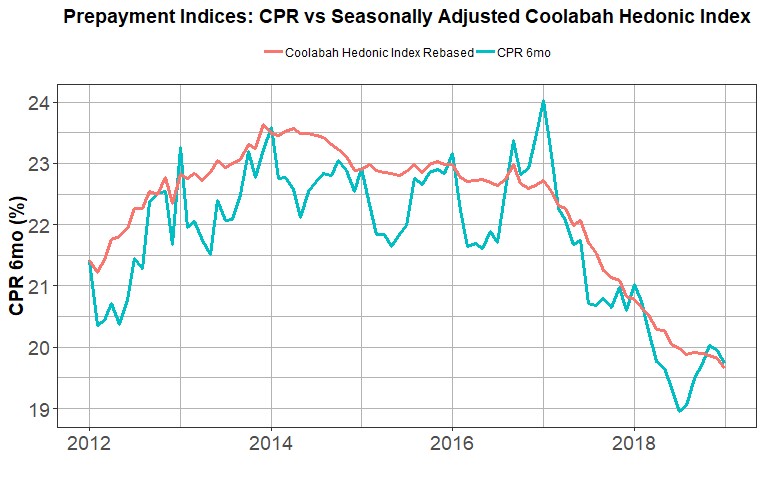

Although this risk reduction is positive for bank creditors, it is demonstrably negative for other asset-classes, like recently issued residential mortgage-backed securities (RMBS) where the only thing protecting the investment is the value of the homes underpinning the loans.

Bank creditors get the benefit of government guaranteed deposits, access to emergency RBA liquidity facilities, a balance-sheet with extremely seasoned assets that have been originated over decades with modest loan-to-value ratios, and world-beating equity capital ratios that continue to rise.

This is why investors are falling over themselves to buy the major banks’ senior bonds and presumably what attracted them to securities like Macquarie’s latest hybrid (ASX: MQGPD), which listed on Thursday at $102.69, or 2.7% per cent above its par price.

6 topics