The Match Out: 9-month high for the ASX, 5 consecutive positive sessions, Sandfire announced 2Q update

It was a case of rinse & repeat for the ASX today with early sold-off then seeing support kicking in before midday to take the index to a new 9-month high. Despite the strength in the index, the banks failed to join the rally, certainly surprising to see such a strong move without the Financial sector contributing, likely on the back of a sector-wide downgrade coming through from Macquarie yesterday. It was the Materials sector continuing to see buying that dragged the index to within 2% of all-time highs today while Real Estate and Tech were also key pillars of strength.

- The ASX 200 finished up +33pts/ +0.44% at 7490

- The Real Estate sector was best on ground (+1.82%) while Tech (+1.32%) & Materials (1.26%) were the other sectors trading more than 1% better today

- The laggards included Financials (-0.25%), Industrials (-0.25%) & Healthcare (-0.23%)

- Premier Investments (ASX: PMV) +3.64%, a broker upgrade saw the retailer press higher today. Morgan Stanley making Premier their number 1 pick in the emerging retailer’s space based on their international growth story and strong balance sheet.

- Sandfire (ASX: SFR) +0.8%, a choppy session post their 2Q production update. We discuss this below.

- Lithium stocks rallied after UBS upgraded near-term price forecasts across the board. The begrudging upgrade came with the broker admitting the lithium market will likely remain in deficit for the medium term keeping prices higher for longer. Mineral Resources (ASX: MIN) was the best performer of the big caps, up 5.28%.

- Myer (ASX: MYR) +5.29%, announced their best half-year trading update in more than a decade with sales up ~25% driven by in-store revenue. First-half profit is expected to nearly double on last year, though the company remains cautious on the consumer.

- Zip Co (ASX: Z1P) -15.57%, gave up early gains despite a strong update. 2Q revenue was up 12% year on year thanks to growth in Australia & NZ while the company was cash EBITDA positive in both November and December. Shares did their dash yesterday, jumping 22.79% on the Sezzle (ASX: SZL) update.

- Iron Ore was closed in China today for Luna New Year

- Asian stocks were largely closed as well. Japan’s Nikkei rallied 1.53%.

- US Futures are trading around flat at the time of writing.

ASX200 Chart

Sandfire Resources (ASX: SFR) $6.30

SFR +0.8%: the copper miner put out a reasonable set of 2Q production numbers today helping to support the stock. Copper production came in at 20kt for the quarter, almost 30% below 1Q23, however, they remain on track to hit guidance of 82-91kt for the full year given more than half of that is in the bank already. Zinc production was flat while Lead and Gold fell, though guidance was maintained again. Costs were the main concern at $US1.77/lb, above guidance of around $US1.74/lb, though the second quarter is a seasonally lower period of production which lifts average costs. MM recently trimmed our position in Sandfire, though we still remain long across 2 portfolios.

Sandfire Resources

Broker Moves

- Mesoblast (ASX: MSB) Raised to Buy at Jefferies; PT A$1.30

- Neuren (ASX: NEU) Cut to Hold at Jefferies; PT A$7.40

- Nanosonics (ASX: NAN) Cut to Market-Weight at Wilsons; PT A$5

- REA Group (ASX: REA) Cut to Neutral at Evans & Partners Pty Ltd; PT A$140

- Hotel Property Investments Ltd (ASX: HPI) Cut to Neutral at JPMorgan

- Stockland (ASX: SGP) Cut to Underweight at JPMorgan; PT A$3.90

- Centuria Industrial (ASX: CIP) Cut to Neutral at JPMorgan; PT A$3.50

- National Storage (ASX: NSR) Raised to Overweight at JPMorgan; PT A$2.60

- KMD Brands (ASX: KMD) Cut to Equal-Weight at Morgan Stanley; PT A$1.05

- Accent Group (ASX: AX1) Cut to Equal-Weight at Morgan Stanley; PT A$1.95

- Premier Investments (ASX: PMV) Raised to Overweight at Morgan Stanley

- IGO (ASX: IGO) Raised to Buy at UBS

- Mineral Resources (ASX: MIN) Raised to Buy at UBS

- Pilbara Minerals (ASX: PLS) Raised to Neutral at UBS

- Sims (ASX: SGM) Rated New Outperform at RBC; PT A$17

- Cleanaway (ASX: CWY) Rated New Outperform at RBC; PT A$3.25

- CSR (ASX: CSR) Cut to Neutral at Credit Suisse; PT A$5.40

- Adbri (ASX: ABC) Cut to Underperform at Credit Suisse; PT A$1.50

- Boral (ASX: BLD) Raised to Outperform at Credit Suisse; PT A$3.90

- GWA Group (ASX: GWA) Cut to Underperform at Credit Suisse; PT A$2

- Ansell (ASX: ANN) Cut to Neutral at Macquarie; PT A$29.20

- Warehouse NZ Cut to Neutral at Macquarie; PT NZ$2.40

- City Chic (ASX: CCX) Cut to Underweight at Jarden Securities

- Platinum Asset (ASX: PTM) Cut to Underweight at JPMorgan; PT A$1.80

- ARB (ASX: ARB) Cut to Equal-Weight at Morgan Stanley; PT A$31

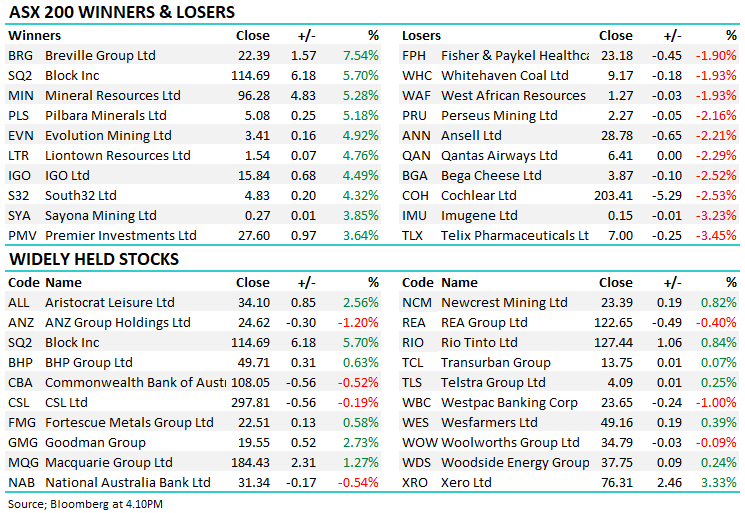

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

28 stocks mentioned