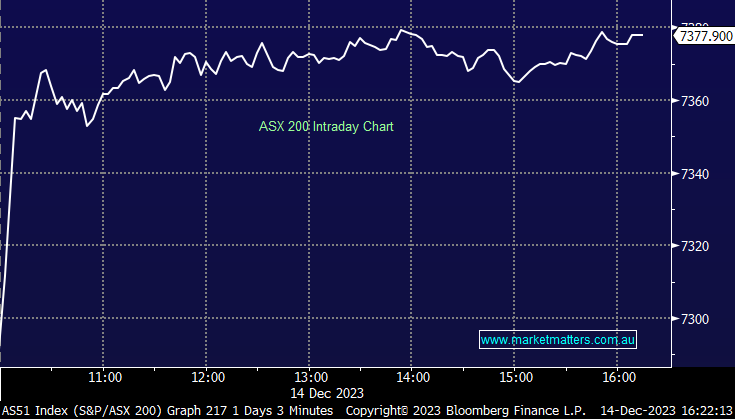

The Match Out: A great day to be an equity investor with the ASX up 1.65%

The market opened with a bang this morning, up ~100pts and held onto the gains for the day after the US Federal Reserve left interest rates on hold and pivoted towards rate cuts in 2024 – huge news, arguably as good as it gets for equities, the perfect backdrop for a blow-off high into 2024. The rate-sensitive sectors did best, but it was a day in the sun for nearly all ASX stocks with 85% of the ASX200 finishing higher.

- The ASX 200 finished up +120pts/+1.65% at 7377.

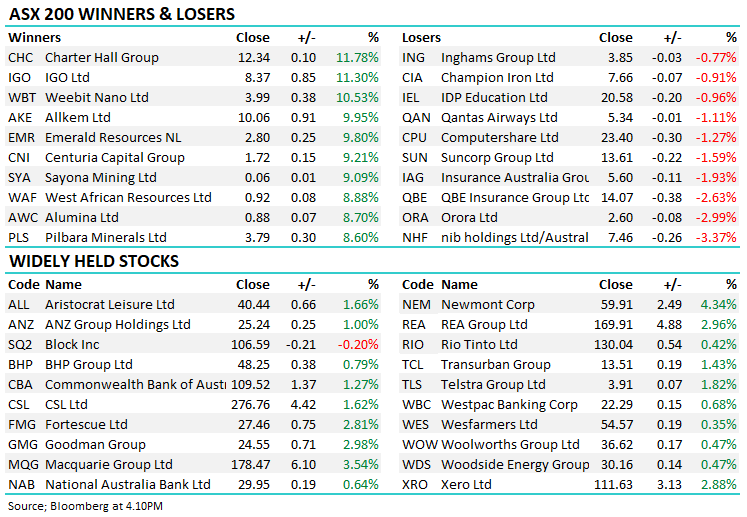

- The Property sector was best on ground (+4.01%) while Tech (+2.90%), Materials (+2.35%) and Telcos (+2.21%) also stood out.

- The worst sector, Staples, still managed a +0.63% gain

- Australian bond yields followed their US counterparts lower, Aussie 3-years down 0.19% to 3.74% as more rate cuts get priced into the local market.

- Interest Rate Futures are now pricing ~1.5% worth of cuts in the US in 2024 & 0.58% here in Australia. If that proves correct, the RBA cash rate will be 3.77% this time next year.

- While we doubt that will actually happen to the extent it’s being priced, the move in global bond yields in the past 6-weeks, and specifically the last 24 hours, will show up in lower mortgage rates soon.

- Equities love lower interest rates, as long as the economy doesn’t fall apart in the process, and that is exactly what the Fed alluded to overnight, growth remaining solid with inflation being tamed, rates could soon be cut.

- Gold stocks were a standout as the precious metal enjoyed a big drop in the $US, Gold +$US42 overnight and edged higher during our time zone today.

- Northern Star (ASX: NST) +8.12%, Evolution Mining (ASX: EVN) +3.93% and Silver Lake Resources (ASX: SLR) +4.5 %

- Property stocks also stood tall, our holdings here helped to underpin outperformance vs a strong market, Dexus (ASX: DXS) +5.73%, Centuria Capital (ASX: CNI) +9.21% rallied nicely, a stock that is very heavily influenced by interest rates due to their hedging position, Goodman Group (GMG) +2.98%, while the more conservative National Storage (ASX: NSR) +0.84% built on recent gains – it looks like the market has been caught short the property sector.

- Lithiums enjoyed the risk on vibe, Pilbara (ASX: PLS) +8.60% while our position in Mineral Resources (ASX: MIN) +6.32% rallied nicely.

- In the smaller caps we own, Audinate (ASX: AD8) +3.63% hit an all-time high at $16.31, Regal Partners (ASX: RPL) +6.07% while Pexa (ASX: PXA), which will benefit from higher property volumes added 3.77%.

- On the flip side, Insurance stocks were the key lags as lower interest rates are a negative headwind for earnings, ASX: QBE Insurance (QBE) -2.63% the proxy here.

- Metcash (ASX: MTS) -3.07% traded ex-dividend for 11c and fell by the same amount.

- Wesfarmers (ASX: WES) +0.35% lagged on a UBS downgrade to Hold

- Orora (ASX: ORA) -2.99% provided a trading update and fell – more on this below

- Iron Ore was marginally higher in Asia, adding +0.15%, Fortescue (ASX: FMG) once again hitting all-time highs.

- Gold was slightly higher in Asia following last night’s rally, up $US50/oz since 5.30AM.

- Asian stocks were mixed – Nikkie lagging with a -0.60% fall, Hang Seng adding +1.11% and China +0.3%.

- US Futures are all higher – S&P500 futures +0.4% and Nasdaq futures +0.6%.

ASX 200 Index - Intraday

ASX 200 Index - Daily

Orora (ORA) $2.60

ORA -2.99%: One of the rare stocks that didn’t participate in today's rally after they released some updated guidance that included their recent acquisition of Saverglass. While group EBIT is expected to be higher in FY24, they said that the specific Saverglass earnings are broadly inline with how they saw things up until June, but put some caveats around that which implies a greater level of uncertainty. Specifically, it seemed like they watered down their confidence in a near-term rebound, talking about the potential for prolonged customer destocking or softness in consumer demand continuing for longer than they originally expected. While not a negative update per se, there was a belief in the market that they were talking down the SG earnings during the acquisition process, providing a better opportunity for higher revisions post the purchase, but for now, that hasn’t happened.

Broker Moves

- Wesfarmers Cut to Neutral at UBS; PT A$55

- Monash IVF Rated New Accumulate at Ord Minnett; PT A$1.40

- SRG Global Ltd Rated New Buy at Ord Minnett

- Mirvac Group Cut to Equal-Weight at Morgan Stanley; PT A$2.30

- Downer EDI Rated New Neutral at Barrenjoey; PT A$4.60

- HUB24 Rated New Hold at Moelis & Company; PT A$36.88

Major Movers Today

Enjoy the night

The Market Matters Team

1 topic

16 stocks mentioned