The Match Out: ASX rises after a tough week, Audinate (AD8) hits 9-month high, Have a great weekend!

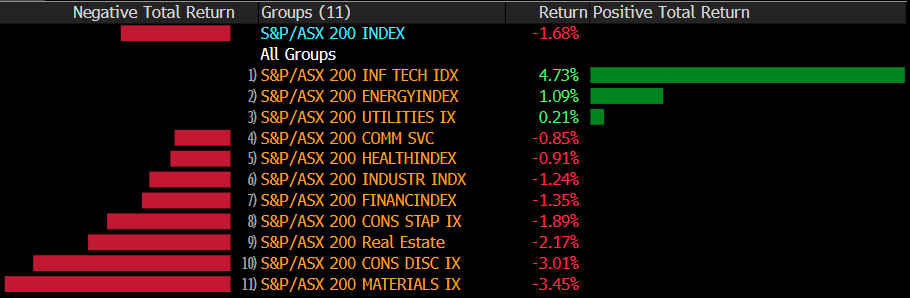

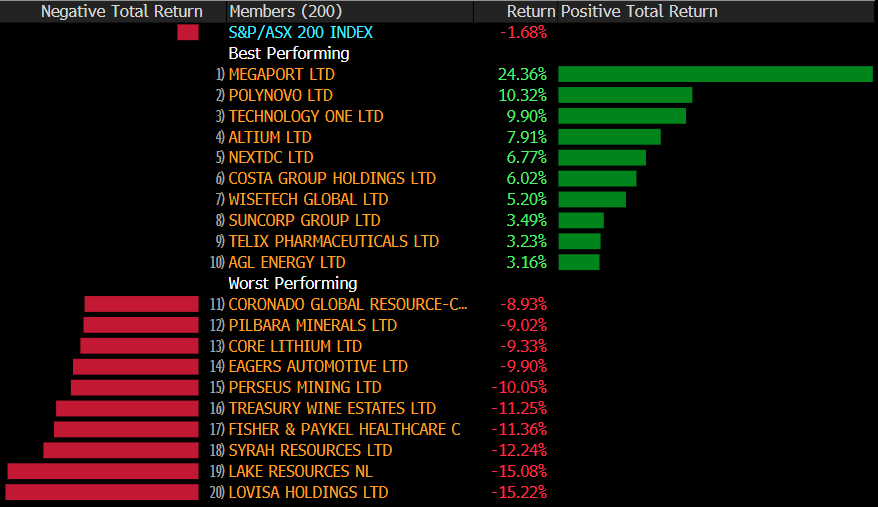

A quiet end to a busy week for markets with competing factors creating some big divergence across sectors. For the week, the ASX 200 fell by -1.68% while the Small Cap Index was off by -2.86% - smalls still can’t take a trick! These moves however underplay the variance across sectors with IT up +4.7% contrasted by the Materials sector which fell 3.45%.

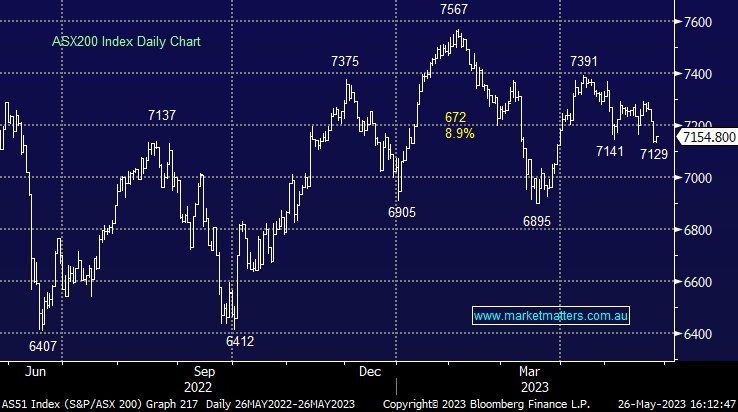

- The ASX 200 finished up +16pts/ +0.23% at 7154

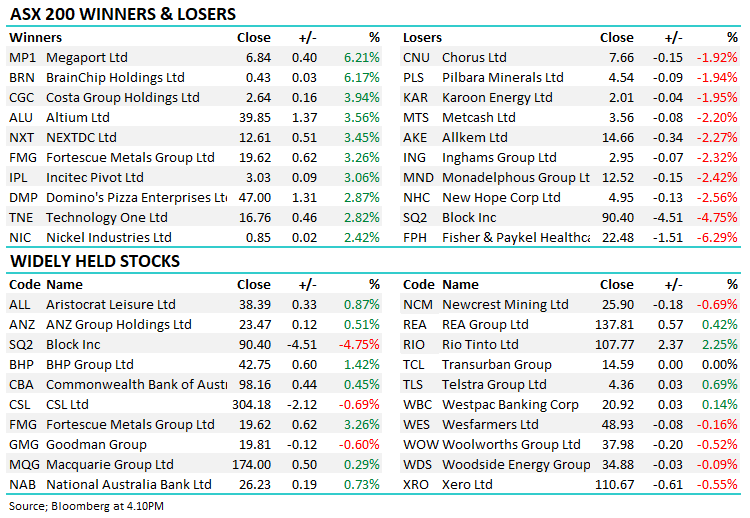

- The IT sector was best on ground (+1.55%) while Materials (+0.93%) & Consumer Discretionary (+0.46%) were also up.

- Healthcare (-0.76%) and Real-Estate (-0.69%) the weakest links.

- While we’ve been positioned well for what’s played out this FY to date, driving strong outperformance in our Flagship Growth Portfolio, the week past has been more challenging, with some reversion of recent performance playing out.

- We’ve continued to fade individual stock moves, today trimming James Hardie (ASX: JHX) while averaging a recent purchase in Sandfire (ASX: SFR) that’s underwater.

- It will be interesting to see how long the tech sector tolerates rising bonds yields, with the US 2-year yield having added 0.7% this month alone up from 3.8% to 4.5%) as aggressive rate cuts are being priced out of the market.

- We highlighted this likely action ahead of time, however for now at least, the tech stocks are focussing more on better earnings from AI-related companies – at some point (we think soon) tech will again fret over higher yields – so we’re more inclined sellers of tech than buyers.

- Audinate (ASX: AD8) +8.01% hit 9-month highs today after Jefferies initiated with a buy, talking up the opportunity in the AV space with expectations of 25%+ revenue growth. We are long and bullish.

- Respiratory device company Fisher & Paykel Healthcare (ASX: FPH) -6.29% struggled on a weak FY23 result as costs squeezed margins. Guidance was also weak but margins are expected to return to long term levels in the next 3-4 years.

- Latitude Financial (ASX: LFS) -3.47% fell after making a $53m provision for remediation costs from a recent cyber-attack with costs expected to grow with regulation and legals.

- Humm (ASX: HUM) -8.24% said they have been ordered to stop bringing on new BNPL customers following an ASIC enforcement which brings the business to a standstill.

- AGL Energy (ASX: AGL) +0.33% which is held in the Income Portfolio hit new 52 week highs, and is pushing up against its highest level in 2 years. The market has now turned more bullish on AGL, with Macquarie the latest to upgrade, with a 12 month PT of $9.61 while JP Morgan and Barrenjoey both think it’s worth more than $10.

- Metcash (ASX: MTS) -2.2% on the other hand has had a tough period making new 52-week lows. We think MTS is oversold and around $3.60 is solid buying. Concern they are losing market share to Aldi and a general sell-off in retailers to blame.

- Altium (ASX: ALU) +3.56% broke out of its trading range today and looks bullish – a stock we sold recently after holding it for nearly 2 years.

- Evans & JP Morgan are saying the dip in Treasury Wine Estates (ASX: TWE) is a buying opportunity. They were flat today.

- Iron Ore was ~2% higher in Asia supporting Fortescue (FMG) +3.21%, BHP +1.35% & RIO +2.2%%

- Gold was down overnight before tracking up US$6 in Asia, settled $US1948 at our close.

- Asian stocks were up, Japan +0.36%, China +0.31% while Hong Kong was closed.

- US Futures are flat

ASX 200 Chart

Sectors This Week

Stocks This Week

Broker Moves

- Treasury Wine Raised to Positive at Evans & Partners Pty Ltd

- 29Metals Raised to Neutral at Jarden Securities

- Ingenia Cut to Underweight at Jarden Securities; PT A$4.70

- Treasury Wine Cut to Hold at Morgans Financial Limited

- Treasury Wine Raised to Overweight at JPMorgan; PT A$14

- Costa Raised to Accumulate at CLSA; PT A$2.90

Major Movers Today

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

10 stocks mentioned